Zima Red gives readers the weekly pulse on the biggest news around NFTs. Join our community and take the journey with us by subscribing here:

Hey everyone! Here’s what we got for you this week:

News

-

Snapchat eyes NFT integration

-

Huobi on what lies ahead for NFTs

-

Magic Eden’s new gaming venture arm

-

PROOF acquires Divergence

-

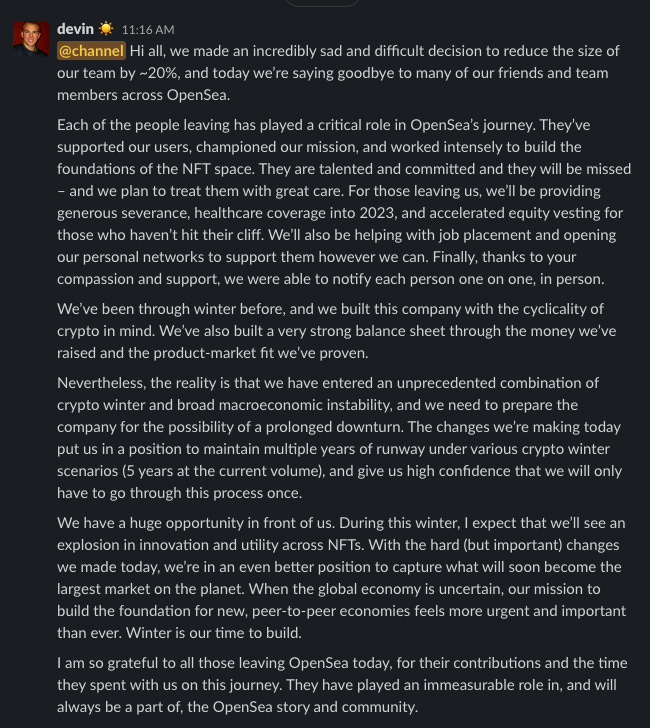

OpenSea lays off 20% of its workforce

Market

Collectibles

Gaming

Virtual Worlds

+ The Zima Red Podcast

The integration would allow artists to show off their NFTs as AR filters. In the trial run, artists will mint NFTs on another platform before importing them into Snapchat as Lenses. Snap does not plan to take any money from the artist but rather give them a way to monetize their art.

Huobi Research, the research arm of the crypto exchange Huobi, released a report exploring the possible impacts of three big moves in the NFT space.

-

Uniswap and OpenSea’s acquisition of Genie and Gem, respectively

-

eBay’s acquisition of KnownOrigin

-

Shopify’s New NFT Storefront

Uniswap Acquires Genie – why Uniswap wants an NFT platform

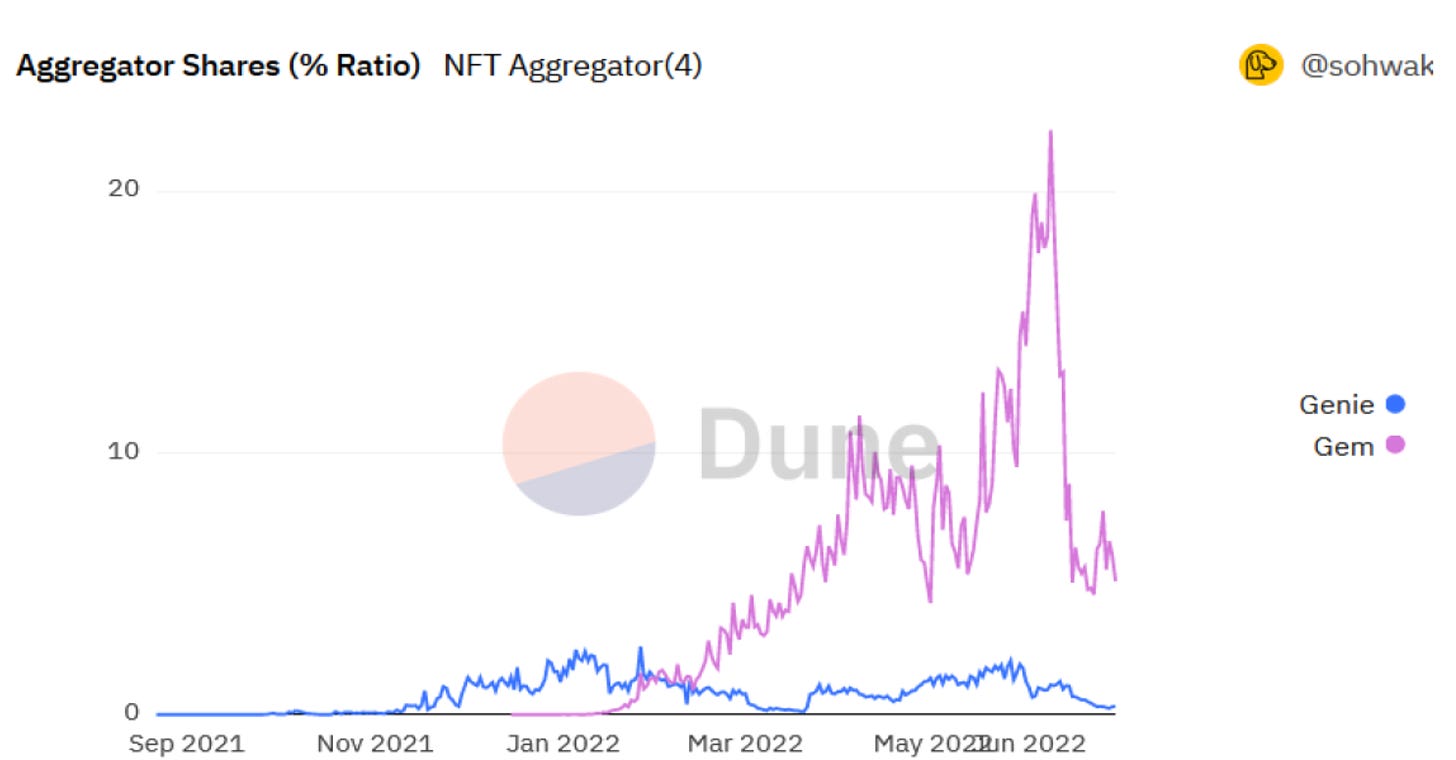

Genie is an NFT market aggregator. Uniswap will integrate Genie into its web app and begin cross-selling NFT products to its 170,000 monthly active users beginning this fall. With this userbase and reputation, Uniswap could be a strong competitor to OpenSea. However, OpenSea’s new acquisition, Gem, is beating Genie in every way possible

Compatibility is 👑

As more NFT marketplaces emerge, the need for aggregators will grow exponentially. The metrics bear out just how important it is for market aggregators to attain compatibility with new marketplaces as soon as possible

Gem became compatible with LooksRare just 10 days after the latter’s launch, while Genie took months. Despite its first mover advantage, Genie was overtaken by Gem as the leading NFT market aggregator in February due to its incompatibility with Looks Rare.

Payment flexibility will become the norm

Most NFT marketplaces today only take ETH as payment. Uniswap is expected to accept any cryptocurrency as payment, even allowing NFTs to be priced in several types of tokens at the same time. Gem already accepts all ERC-20 tokens as payment.

Solving the liquidity problem

Liquidity is one of the biggest problems facing the NFT market as each trade requires a unique buyer. This problem can be resolved with NFT liquidity pools by allowing users to trade directly with a liquidity pool without the need to find an actual buyer. Uniswap is already experimenting with NFT liquidity pools via Unisocks.

Competition benefits consumers

Competition amongst NFT marketplaces concerns functionality, stability, and transaction fees. The competition will force marketplaces to keep fees low while at the same time offering robust platforms with high functionality – or risk death by abandonment.

E-commerce 🤝 NFT integration

eBay acquired KnownOrigin – an NFT marketplace with few users or volume.

Why?

Ebay has the users and volume – just not the platform or know-how.

The acquisition will bring NFTs to eBay’s 150M+ active users.

The first market eBay will reportedly tackle is digital trading cards. eBay has a very large userbase of card traders.

Shopify’s GM shop

Shopify built an in-house storefront platform targeting existing NFT projects. This could help many projects unlock the second phase of value creation – becoming lifestyle brands.

So, what lies ahead for NFTs?

-

More traditional -commerce platforms integrating NFTs into their stores

-

The demand for NFT market aggregators will grow

-

OpenSea and Uniswap have positioned themselves as leading NFT trading platforms

-

Competition between marketplaces will lead to more benefits for NFT traders

Magic Ventures plans to use the fund to make strategic Investments and onboard developers. The company hired Tony Zhao – formally of Tencent – to lead its gaming investments.

Zhao said that the fund’s investments are “purely strategic in nature”

“We’re not thinking about returns – never have and never will”

Zhao and Magic Ventures want to help Magic Eden cement itself as the go-to platform for NFT game developers.

PROOF announced that it has acqui-hired a web3 engineering team called Divergence. The team previously worked on PROOF’s smart contracts as well as other projects like PREMINT and Admit One.

Before deciding to join PROOF, Divergence was planning to raise money and continue independently. The team reportedly had an “A-List slate of investors” lined up – including PROOF founder Kevin Rose via his firm, True Ventures.

The OpenSea daily volume continues to stick in the range of $10-$20M. NFT interest via Google trends is about flat near the lows. NFTs are trading a bit lower, but that is likely due to the short-term rally in ETH/USD.

-

Punks are doing great (scroll down for more)

-

OtherDeeds is still flat at around 2.85 ETH despite the Otherside game demo going live

-

STEPN shoeboxes are performing well in the short term

-

Generative art project Faktura is performing very well

-

Notable collectors ledger, Tyler Hobbs, XCOPY, and Punk6529 all minted/bought one

-

Their fund owns ~1000 NFTs with some very high-priced collectibles

The legal docs are open, but it still isn’t clear if Vincent Van Dough’s Starry Night NFT fund is technically part of 3AC or if it is separate. If it’s separate, then it could be okay, but if it’s not, then it will probably be liquidated like the rest of 3AC.

What impact could this have on the market?

Ape floor – 94 ETH

Punks floor – 83.75 ETH

The CryptoPunks floor is closing the gap on Bored Ape Yacht Club. The Punks floor has nearly doubled in the span of the last few months. Sentiment surrounding the project on CT is really high, and we are even seeing holders of other blue chips sell to buy more Punks.

The run-up can largely be attributed to Noah Davis leaving Christie’s to take over as CryptoPunk’s Brand lead.

Pudgy Penguin holders can now license their NFTs to be made into toys. Not all NFTs will be selected, however. This baked-in monetization scheme for holders is something to watch. Pudgy Penguins did not elude to their selection criteria other than it is dependent on if they feel it fits the product line best.

Andreesen Horowitz partner Arianna Simpson spoke with Venture Beat about the intersection of web3 and gaming.

Here are the takeaways:

-

a16z believes gaming will be a huge catalyst capable of bringing millions of people into the web3 space

-

Many of the best businesses were built in a bear market

-

NFT criticisms are often unfounded

“This is the obvious answer. I can’t think of anything else. It just makes so much sense. This solves so many problems.”

– One gaming industry veteran on web3 according to a16z

Despite the market bloodbath, Animoca managed to avoid taking a down round – they raised at a higher valuation ($5.9B) than they had before the crash.

Although the round is at a slightly higher valuation compared to its last, $5.9B vs. $5B, it is significantly smaller. They previously raised $359M and $139M in separate raises. The financing will go towards new acquisitions, investments, and “popular intellectual properties.”

Otherside opened up its first trip live game demo on July 16th. People who participated were generally pretty impressed.

Otherside also dropped its lite paper – read it here

The Sandbox has partnered with Playboy to create a Playboy MetaMansion social game inside The Sandbox. The game will feature special NFTs and experiences.

Andrew spoke with one of the web3 space’s greatest minds, @0xfoobar

Foobar is a polymath involved with all aspects of web3 building, investing, learning, and teaching – we discuss it all in this episode, and you can’t miss it!