Zora – once hailed as a promising NFT infrastructure platform, has come under fire following the launch of its ZORA token airdrop. Rather than being celebrated, the event quickly drew widespread criticism due to its controversial tokenomics, unclear utility, and an execution process that many users described as poorly managed.

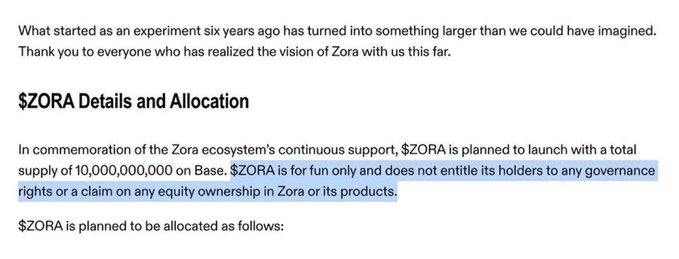

Lack of Utility, Lack of Trust in a “For Fun” Token

ZORA has been described as a token with no clearly defined benefits for holders. The project openly stated that the token carries no governance rights, no equity representation, and plays no essential role in the operation of the platform. On its official channels, Zora even emphasized that the update was a “for fun” release – a nontraditional approach designed to spark attention.

However, in an environment where users increasingly expect transparent token distribution, tangible utility, and alignment with decentralized values, Zora’s positioning has backfired. Rather than being viewed as a creative experiment, the lack of clear use cases has led many to see the ZORA token as more of a speculative asset than a meaningful contributor to the NFT ecosystem.

Source: Zora

The situation raises an important question: if the token serves no purpose, why release it in the first place? For a brand that once held a strong reputation in the NFT space, launching a token with no clear function now looks like opportunism, speculation disguised as “fun.” Users argue that if Zora had no intention of making the token useful, the least it could have done was to ensure a fair distribution. Yet, that too fell short.

Not only does ZORA lack utility, but it also debuted at a relatively high market valuation, despite offering no concrete benefits to holders. This has fueled further confusion, especially since the team and early investors control the majority of the token supply. With 65% held by insiders, ZORA’s high price, no utility, and skewed drop drew sharp Web3 backlash.

Some analysts suggest the decision was a legal grey-area move to minimize regulatory pressure. But by doing so, Zora may have hurt its reputation, just as Web3 shifts toward long-term, value-driven building.

Skewed Allocation: Zora’s Trust Problem Compared to zkSync and Scroll

Zora gave 65% of its tokens to insiders, 18.9% to the team, 20% to reserves, and 26.1% to investors. That leaves just 35% for the community, split into 10% for airdrops, 20% for community initiatives, and 5% for liquidity.

Source: Zora

This uneven distribution drew backlash, especially since ZORA was pitched as a “for fun” token with no real use. Critics argue that this launch appears to prioritize insiders rather than genuinely foster community participation, as many had hoped.

zkSync set aside just 33.3% for insiders, leaving 67% for the community, far more balanced than its peers. This includes 17.5% for airdrops and broader ecosystem initiatives managed by the nonprofit ZKsync Foundation. The vesting schedule spans four years, with a one-year cliff.

Scroll allocated 23% to the team, 17% to investors, and 10% to its foundation about 50% to insiders. The other 50% goes to the community, 35% for ecosystem incentives, 15% for airdrops distributed in planned phases.

Both zkSync and Scroll previously faced backlash for insider-friendly allocations during testnet or pre-TGE phases.

The community criticized zkSync for unclear airdrop rules that left out many longtime testnet users. Scroll also faced backlash after reports surfaced that some internal addresses received early allocation privileges.

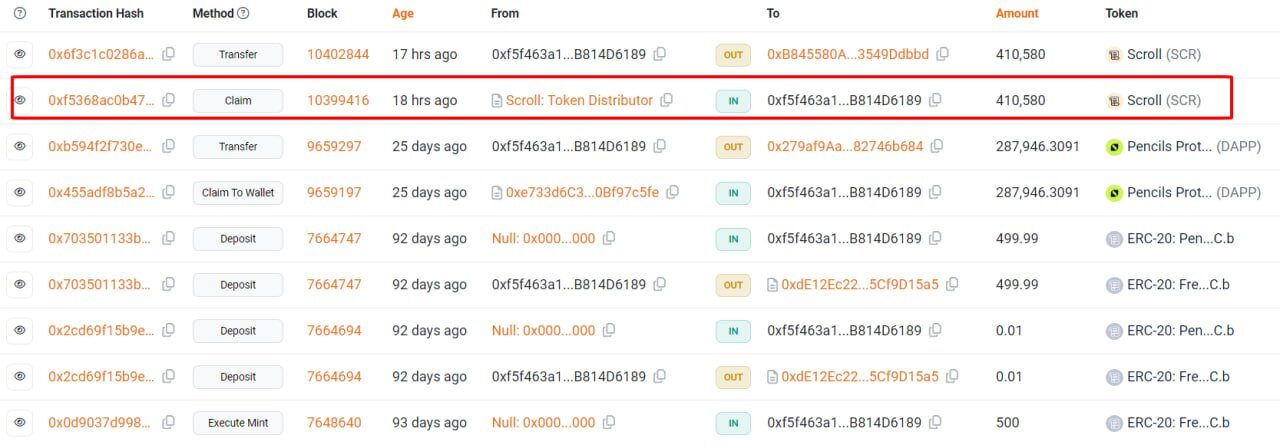

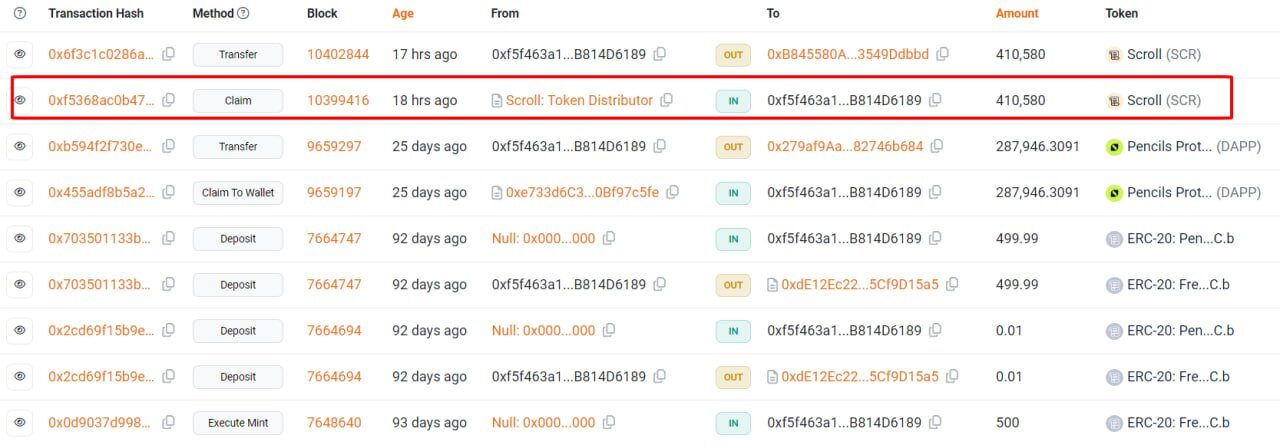

Source: Scroll Explorer

In contrast, Zora not only surpasses zkSync’s insider ratio (65% vs. 33.3%) but also departs fundamentally in value proposition. While zkSync and Scroll link tokens to governance and utility, ZORA offers none, despite higher insider allocations.

This disparity explains the wave of backlash across platforms like X and Discord. Many now see Zora as insider-led, unlike zkSync and Scroll’s community-first approach.

Across the Web3 space, it’s common to see insider allocations ranging from 20–30%. Zora’s 65% allocation led many to call it a stealth token sale, not an airdrop.

Community Backlash, On-Chain Data, and ‘Rekt’ Stories

Data shows that the price of ZORA dropped over 50% within just a few hours after listing, signaling a strong wave of sell-offs. Trading volume also plummeted – from $31 million to just $9 million within 48 hours, highlighting the dominance of short-term speculation over long-term conviction.

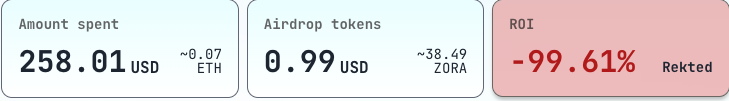

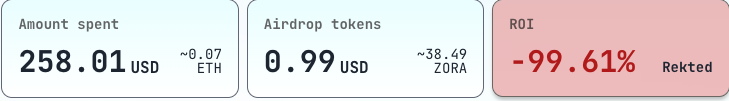

Beyond the market metrics, many users have shared their personal disappointments. One widely circulated case involved a user who spent $258 (~0.07 ETH) interacting with the platform in hopes of receiving a meaningful airdrop allocation. Instead, they received only $0.99 worth of ZORA, equivalent to just 38.49 tokens, reflecting a brutal negative ROI of 99.61%. The story quickly spread across X, stamped with the word “Rekted”, a symbol of the collective sense of betrayal echoing throughout the community.

Additionally, the community discovered that many wallets with little to no meaningful interaction with the platform still received substantial airdrop allocations. This raised suspicions of potential insider involvement or so-called “ghost allocations.”

A Dune Analytics dashboard tracking recipient wallet activity shows that some addresses received large token amounts despite having no on-chain engagement. Meanwhile, many highly active users – including industry KOLs, received minimal rewards, sometimes not even enough to cover the gas fees they had spent (with average costs exceeding $1,000).

Why ZORA is being criticized right now🤣🤣

1. ZORA non-interactive wallet address receives airdrop

– Suspected insider or team member

– (Check possible)2. Top KOLs spend about $1000+ on gas, but haven’t generated even $100 in revenue

ZORA is the…

— Naback | Korea KOL (@Naback222) April 24, 2025

While some metrics such as the number of creators and tokens minted on Zora continue to show growth, the prevailing sentiment on social media remains overwhelmingly negative. Many users argue that the airdrop created no sustainable value and instead served primarily as a liquidity exit for a small group of insiders.

Conclusion

Zora launched its airdrop as a lighthearted experiment – a “for fun” token drop meant to energize the community. Instead, it has triggered widespread backlash and damaged trust in a platform that was once considered a cornerstone of the NFT infrastructure movement.

In a market that increasingly rewards transparency, utility, and long-term vision, Zora’s approach has raised uncomfortable questions about accountability in Web3. For users and builders alike, the fallout serves as a stark reminder: in the age of decentralization, community trust is hard-won and easily lost.

Read more: Top 5 Airdrop Farming Projects on Solana (Part 2)