The highly anticipated moment has arrived for Circle. The fintech powerhouse behind the ubiquitous USDC stablecoin has officially priced its Initial Public Offering (IPO) at $31 per share on the NYSE, marking a pivotal step for a major crypto-native company entering traditional public markets. While Circle initially aimed to raise $624 million through a 24 million share offering at a target valuation of $6.7 billion, the final $31 price reflects the intense investor demand that reshaped its public debut. This is arguably the highest-profile crypto-related IPO since Coinbase ($COIN) in 2021.

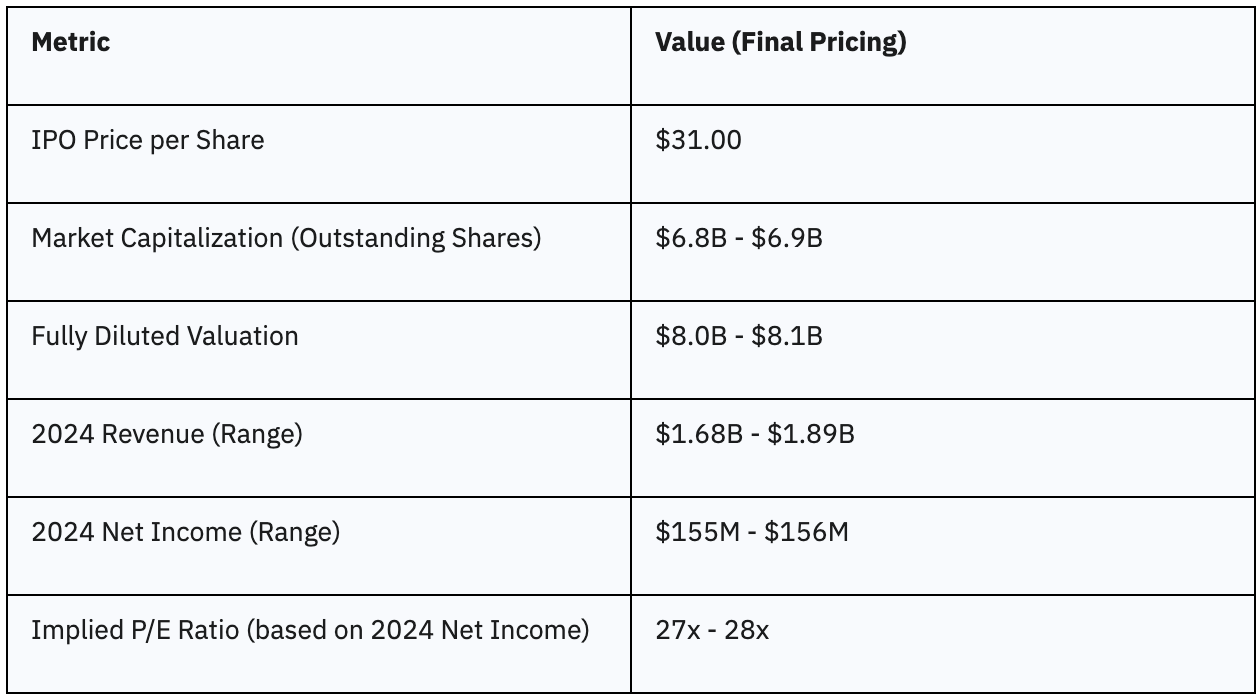

Circle (CRCL) IPO Key Statistics (as of June 5, 2025):

- Final Circle IPO Listing Price: $31.00 per share

- Initial Market Valuation (at IPO Price): Approximately $6.9 billion

- Fully Diluted Valuation (at IPO Price): Approximately $8.1 billion

- Total Shares Offered in IPO: 34 million shares of Class A common stock

- Shares offered by Circle: 14.8 million

- Shares offered by selling stockholders: 19.2 million

- IPO Oversubscription Rate: Reportedly over 25x oversubscribed

- Notable Institutional Interest: ARK Invest and BlackRock reportedly interested in acquiring approximately 10% of the shares offered.

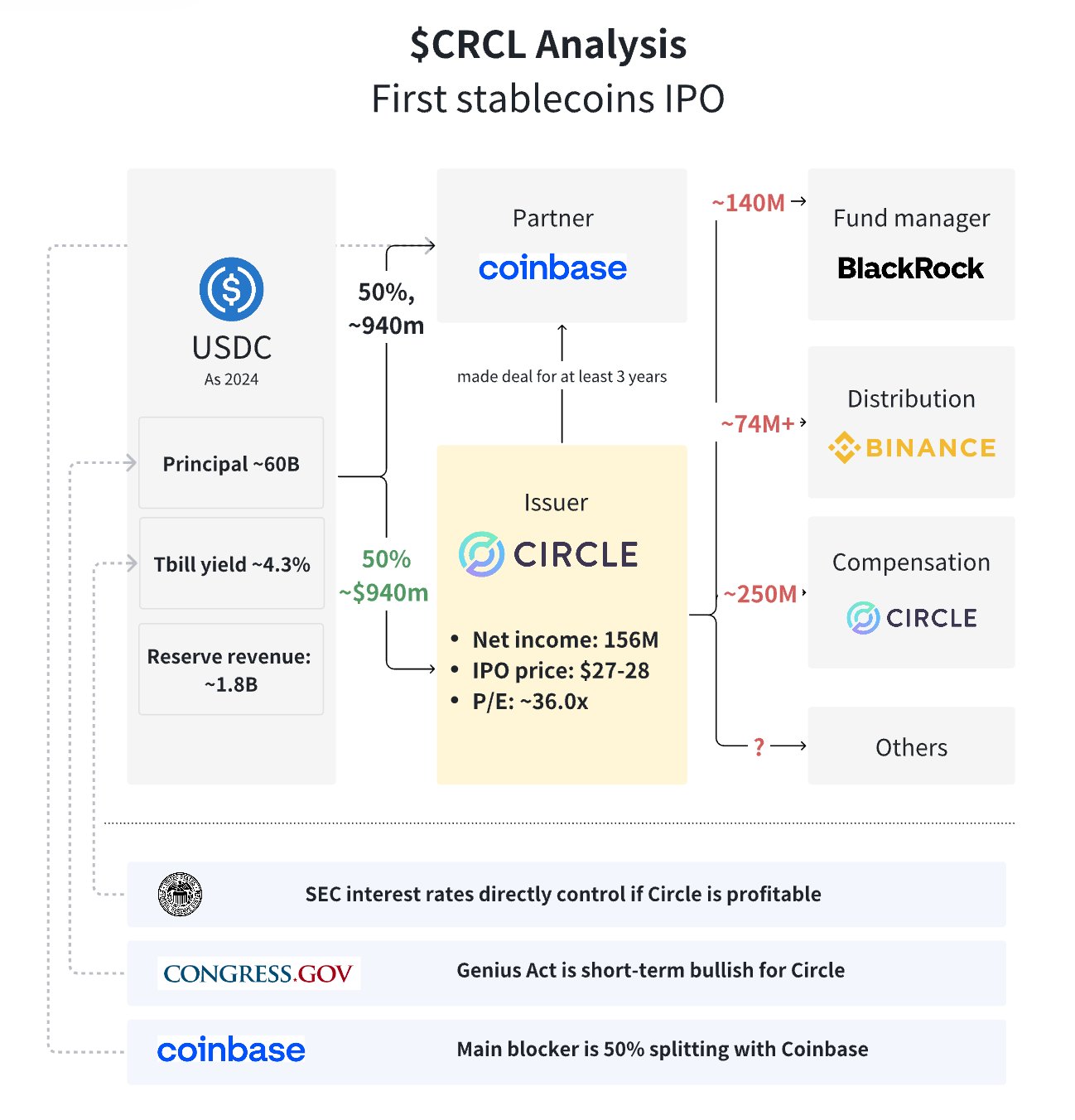

Underlying Business Metrics (as per recent analysis, primarily 2024 data):

- USDC Circulation (Principal Reserves): Approximately $60 billion

- Yield on Treasury Bill Reserves: Around 4.3%

- Estimated Reserve Revenue: Approximately $1.8 billion

- Net Income (as per analysis linked to initial IPO range): ~$156 million

- Price-to-Earnings (P/E) Ratio (based on initial $27-$28 IPO range analysis): ~36.0x

Source: rui

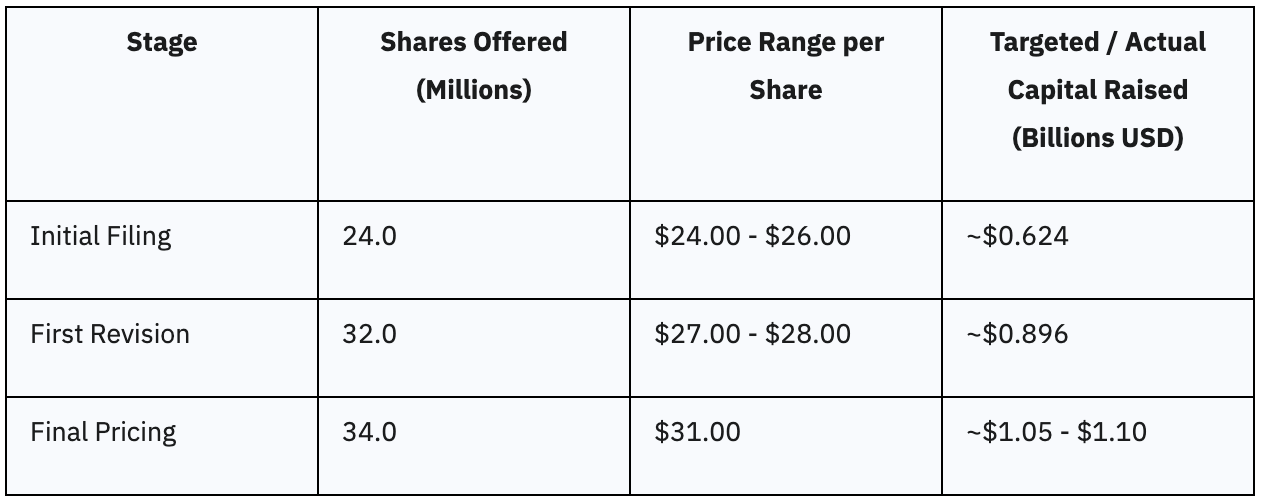

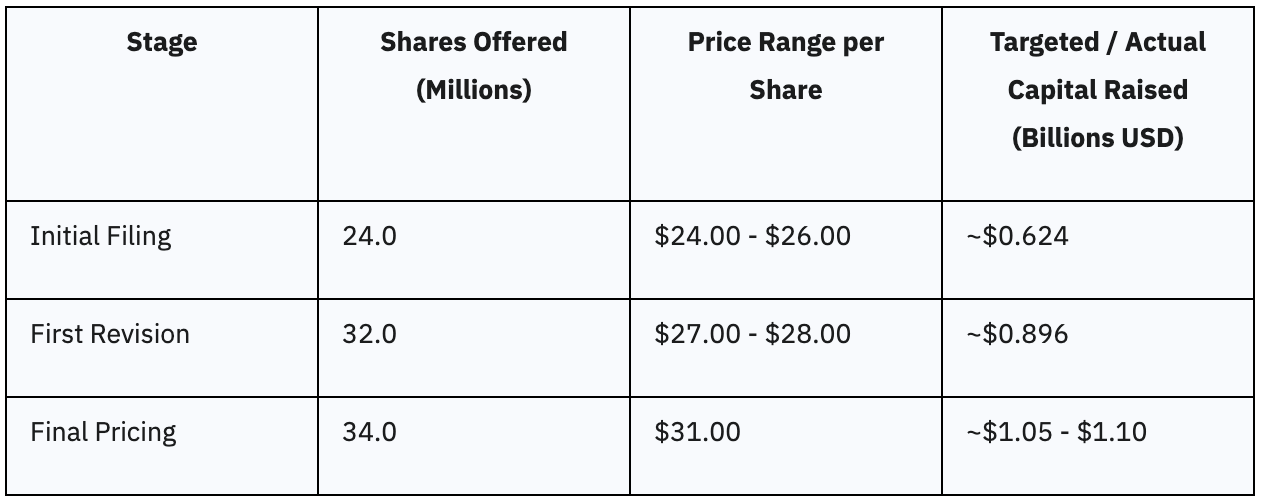

Circle’s IPO Journey: From Initial Expectations to Upsized Reality

Circle Internet Group’s path to its public debut was characterized by a series of upward revisions, demonstrating strong market validation at each stage. The company’s strategy appeared to be one of measured re-entry into the public market, particularly given its prior unsuccessful attempt to go public via a SPAC merger in 2021. This cautious approach allowed Circle and its underwriters to accurately gauge investor appetite, enabling the price to be driven upward by genuine market demand rather than an aggressive initial valuation.

Initial Circle IPO Price Range and Shares Offered

Circle initially launched its IPO with a plan to offer 24 million shares of its Class A common stock, setting an expected price range of $24.00 to $26.00 per share. This initial offering was projected to raise approximately $624 million. At the midpoint of this range, $25.00 per share, the company’s market capitalization was estimated at nearly $6 billion, with a fully diluted valuation potentially reaching about $6.7 billion when accounting for stock options and restricted share units. Even at this initial, more conservative valuation, the substantial multi-billion dollar figure underscored Circle’s established position and perceived value within the burgeoning digital asset ecosystem.

Revised Price Range and Upsized Offering

Following an exceptionally strong reception, Circle swiftly revised its offering terms. The company increased the number of shares to 32 million and adjusted the price range upward to $24.00 to $26.00 per share. This revised plan aimed to raise up to $896 million.

Reports indicated that investor orders for shares exceeded the available quantity by over 25 times, demonstrating an exceptionally high level of interest and confidence in the offering. This rapid upward revision, explicitly linked to such significant oversubscription, served as a powerful market validation of Circle’s business model and future prospects.

This overwhelming demand provided the company and its underwriters with the leverage to push for a significantly higher valuation, indicating a strong pull from the investor community rather than a mere push from the issuer. This dynamic suggested that a broad base of investors, beyond just a few anchor institutions, were eager to participate.

Final Pricing and Total Capital Raised

On June 4, 2025, Circle announced the definitive pricing of its upsized IPO at $31.00 per share. This final offering consisted of 34 million shares of Class A common stock, allowing Circle to successfully raise between $1.05 billion and $1.1 billion. Of these shares, Circle itself offered 14.8 million, while selling stockholders offered 19.2 million.

Additionally, Circle granted underwriters a 30-day option to purchase up to an additional 5.1 million shares to cover over-allotments. The ultimate pricing at $31, surpassing even the revised range, signified a highly successful IPO execution. This outcome reflected strong market acceptance for Circle’s business model and its strategic positioning within the evolving digital finance landscape.

The ability to increase the offering size multiple times and still price above expectations indicated deep investor confidence and successful book-building by the lead underwriters, including J.P. Morgan, Citigroup, and Goldman Sachs.

The following table summarizes the evolution of Circle’s IPO pricing and offering:

Table 1: Circle IPO Pricing & Offering Evolution

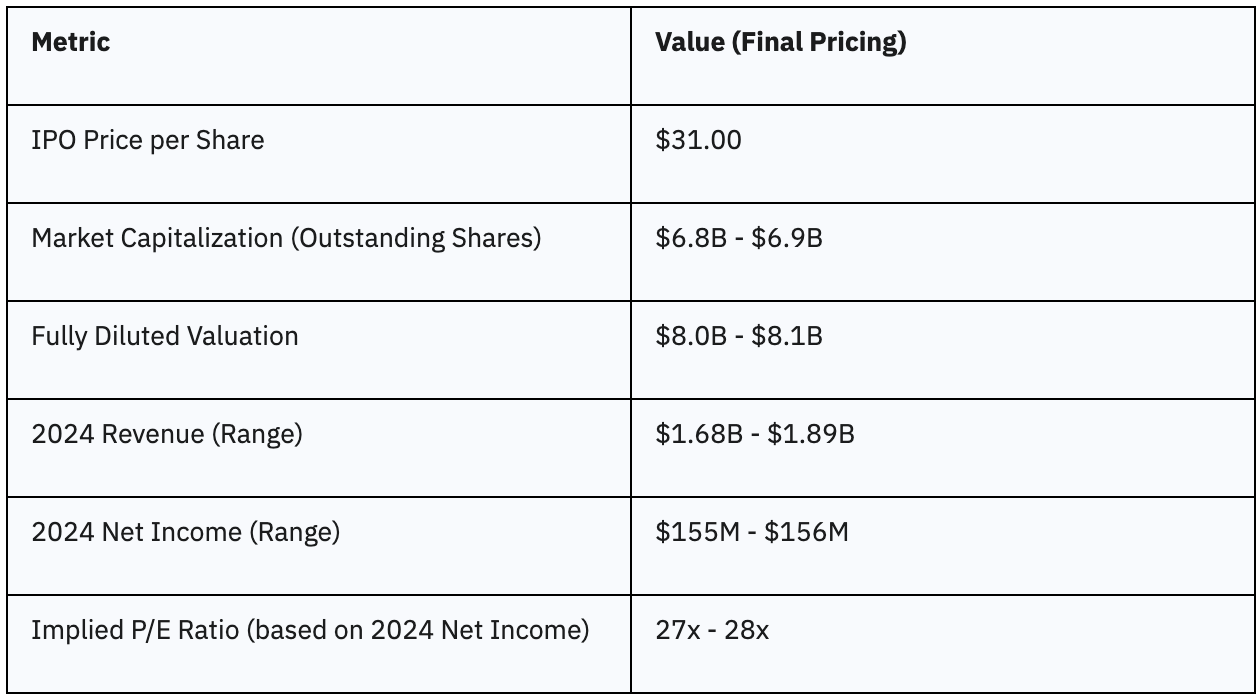

Circle IPO Valuation Analysis: Understanding the $31 Price Point

The final pricing of Circle’s IPO at $31.00 per share provides a clear benchmark for its market valuation, offering insights into how the market perceives its current standing and future potential.

Market Capitalization and Fully Diluted Valuation at $31

At the final IPO price of $31.00 per share, Circle’s market capitalization, based on its outstanding shares (reported as over 220 million or 222 million), is estimated to be approximately $6.8 billion to $6.9 billion.

However, on a fully diluted basis, which includes employee stock options, restricted share units, and warrants, the company’s valuation is significantly higher, estimated at approximately $8.0 billion to $8.1 billion.

For investors, understanding both the market capitalization (based on currently outstanding shares) and the fully diluted valuation is crucial. The higher fully diluted figure provides a more comprehensive view of the company’s potential future share count and the potential impact of dilution on per-share metrics, offering a more realistic assessment of the total value investors are paying for.

Analysis of Circle’s Financials (Revenue, Net Income, Profitability)

Circle reported revenues ranging from $1.68 billion to $1.89 billion in 2024. Its net income for 2024 was reported between $155 million and $156 million. For comparison, in 2023, the company generated $1.45 billion in revenue and a higher net income of $268 million.

Circle also reported $779 million in operating income in 2024 and $215.92 million in EBITDA over the last twelve months, indicating strong operational efficiency. In Q1 2025, Circle saw a 55% jump in reserve income to nearly $558 million, although this was offset by a 68% surge in distribution and transaction costs.

A critical observation for investors is the decrease in net income from 2023 to 2024, despite an increase in revenue. This suggests that while Circle is successfully expanding its top line, its cost of operations, particularly distribution and transaction costs as highlighted in Q1 2025, are growing at a faster rate, impacting overall profitability and margin sustainability. This trend warrants careful monitoring by investors to assess whether the company can improve its operational efficiency and profitability going forward.

Implied Valuation Multiples and Industry Context

Based on its 2024 net profit, Circle’s IPO pricing implies a P/E ratio of approximately 27-28. However, financial analysts note this valuation is “not particularly cheap.” This holds true for a young, uncertain market. Especially, if interest rates stay high or investor enthusiasm for crypto wanes post-IPO.

Thus, a P/E multiple of 27-28 suggests the market assigns a significant premium. This reflects Circle’s future growth prospects. This includes its potential to gain more of the regulated stablecoin market. It also anticipates expanding its financial services.

Essentially, investors are betting heavily on the company. They expect it to execute its growth strategy. They also anticipate improved profitability. Therefore, any deviation from these high expectations could pressure the stock downwards. Indeed, the stock is priced for perfection.

The following table offers a concise comparison of Circle’s key financial and valuation metrics at its IPO pricing.

Table 2: Circle Valuation Metrics (Initial vs. Final)

Implications for CRCL Investors: Opportunities and Risks

For investors considering CRCL, the IPO’s success and the company’s strategic positioning present a unique blend of opportunities and risks that warrant careful consideration.

Opportunities for CRCL Investors:

-

Enhanced Credibility and Institutional Adoption: Listing on the NYSE boosts Circle’s credibility. This comes from strict regulatory compliance and transparency. Such “legitimacy” attracts risk-averse institutions. This includes traditional banks and governments. It positions Circle as a “financial utility layer of the internet.” This increased trust can expand USDC’s market reach.

-

Potential for Market Share Gains: Circle strongly emphasizes regulatory compliance. They also focus on transparent reserve management for USDC. This directly challenges Tether’s opaque methods. This difference attracts institutional clients. It could grow USDC’s market share from 27% to 40% as regulatory clarity emerges.

-

Access to Deeper Capital Markets: The IPO raised over $1 billion. This provides substantial capital for new product development. It also funds global expansion and enhanced compliance infrastructure. Strategic acquisitions are possible too. This capital infusion accelerates Circle’s growth ambitions. It also strengthens their competitive advantage.

Risks for CRCL Investors:

-

High Valuation Concerns and Profitability Outlook: Circle’s valuation appears stretched to some analysts. Its fully diluted valuation reached $8.1 billion. The P/E ratio is 27-28. Net income dropped from $268 million in 2023 to $155-$156 million in 2024. This happened despite revenue growth. It raises questions about profitability margins and cost management.

-

Business Model Concentration on USDC: Circle’s revenue almost entirely relies on USDC. This focus creates significant risk. If USDC loses market share, is delisted, or faces trust issues, the company is vulnerable. Diversification options are limited.

-

Persistent Regulatory Uncertainty: Despite positive legislative signals, U.S. stablecoin regulations are still evolving. Unforeseen strict rules could heavily impact Circle’s operations. This includes reclassifying stablecoins.

-

Volatility of the Broader Cryptocurrency Market: Circle’s business links to overall crypto market health. This is true even for a stablecoin issuer. Downturns in volatile cryptocurrencies can affect stablecoin demand. Consequently, Circle’s transaction volumes and revenue may suffer.

Circle IPO Lock-up Period:

While the specific lock-up period for Circle’s IPO was not explicitly detailed in publicly available materials, IPOs typically have a 90-180 day lock-up. A notable point is that 19.2 million of the 34 million shares offered were from existing “selling stockholders,” meaning a substantial portion of insider shares were already liquidated. Investors should seek further clarity on any remaining lock-up restrictions to understand future supply dynamics.