McDonald’s Today

- 52-Week Range

- $243.53

▼

$326.32

- Dividend Yield

- 2.47%

- P/E Ratio

- 25.31

- Price Target

- $321.79

McDonald’s Corp. (NYSE: MCD) stock has declined by about 8% over the past month, as analysts are not particularly impressed with the company’s latest earnings report. Same-store sales, a critical metric for companies like McDonald’s, fell by more than 2%.

The reasons for the company’s recent struggles have been tied to the popularity of GLP-1 drugs, high prices, and a general trend towards healthier eating, which is amplified by the Make America Healthy Again (MAHA) movement.

A better explanation may be that MCD stock was expensive. But today, it’s less expensive. That doesn’t mean it may not have further to fall in the short term, but as a long-term opportunity, the stock may be getting to a point where it’s offering real value.

Shrinking Waistlines Lead to Shrinking Sales

McDonald’s delivered its first quarter earnings report on May 1. Since then, the analyst forecasts on MarketBeat show six analysts have downgraded MCD stock. One of the most prominent downgrades came from Redburn Atlantic. The firm downgraded McDonald’s from a Buy to a Sell while taking its price target down to $260 from $319.

McDonald’s MarketRank™ Stock Analysis

- Overall MarketRank™

- 94th Percentile

- Analyst Rating

- Hold

- Upside/Downside

- 12.1% Upside

- Short Interest Level

- Healthy

- Dividend Strength

- Strong

- Environmental Score

- -2.39

- News Sentiment

- 0.70

- Insider Trading

- Selling Shares

- Proj. Earnings Growth

- 8.24%

See Full Analysis

The core reason is the impact of GLP-1 drugs. According to the analyst, medications such as Ozempic from Novo Nordisk A/S NYSE: NVO and Zepbound from Eli Lilly and Co. NYSE: LLY are “demand disruptors” for fast-food restaurants. That is, they reduce appetite and, therefore, are likely to impact revenue. In fact, Redburn estimates that GLP-1 drugs could cause an annual loss of around 1% ($482 million) in sales.

McDonald’s has historically been a defensive play for investors because its menu appeals to budget-conscious consumers. However, expanded insurance coverage for GLP-1 drugs, along with discount programs from the manufacturers, is making it more accessible for the lower-income consumers who are typically the core of McDonald’s business.

Sticker Shock Is Real for Core Customers

Another concern among analysts is that over the past five years, McDonald’s has increased prices by an average of 40%. That’s going to be different depending on the market. It’s also important to note that most McDonald’s are owned by franchisees who have latitude with pricing.

However, the company relies on lower-income consumers who are the most impacted by those price increases. In 2025, the gap between dining out and eating at home is lower, but it’s still tipping in favor of consumers eating at home.

Value Is Emerging for Long-Term Buyers

McDonald’s occupies a unique position because it fits with both retail stocks and consumer staples stocks. Both of those sectors have gotten battered over the last two years, but MCD stock moved higher because of its reputation as a defensive stock.

However, eventually, fundamentals catch up, and that’s more of McDonald’s issue at the moment. Yes, GLP-1 drugs are a concern, but analysts believe that the overlap between these drugs and McDonald’s core customer is overstated at the moment.

The key will be for the lower-income consumer to have confidence to start spending again. However, that may still be a couple of quarters away.

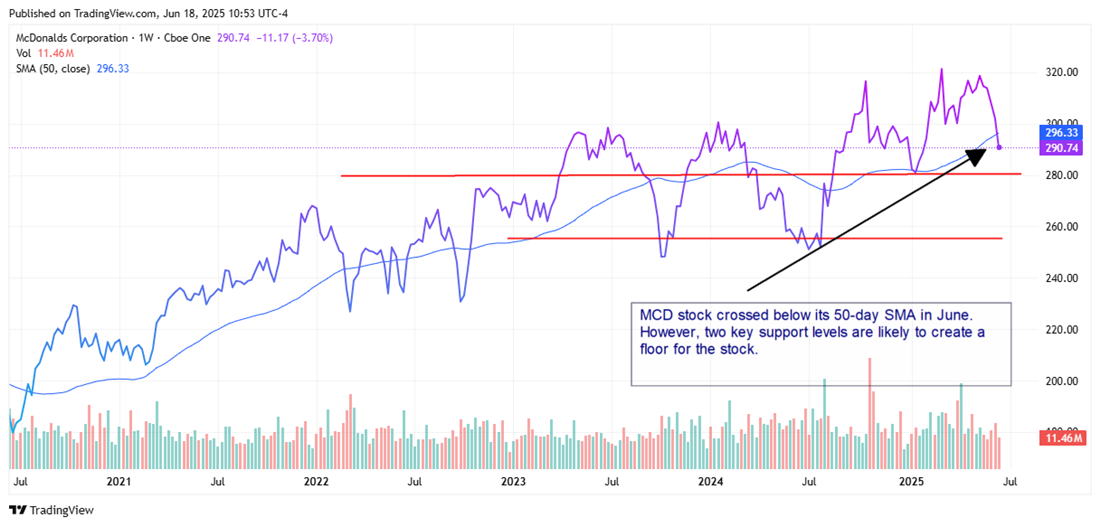

The bad news is that MCD stock may fall further. In June, it crossed under its 50-day simple moving average. With the stock just below its 50-day SMA, investors should look at a support level around $280, which was a level of support in 2023 and 2024.

If the stock breaks support at $280, the next level would be around $260. This was a level that drew strong support from buyers in 2022 and 2023.

The company’s valuation supports the idea that the stock is finding support. With a price-to-earnings (P/E) ratio of around 25x, MCD stock is starting to drift back to its historical average, maybe even a slight discount to where it’s been in the last three to five years.

Plus, the company offers a safe dividend that it has increased for 49 consecutive years. That’s more than enough reason for long-term investors to stay the course.

Before you consider McDonald’s, you’ll want to hear this.

MarketBeat keeps track of Wall Street’s top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on… and McDonald’s wasn’t on the list.

While McDonald’s currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Explore Elon Musk’s boldest ventures yet—from AI and autonomy to space colonization—and find out how investors can ride the next wave of innovation.