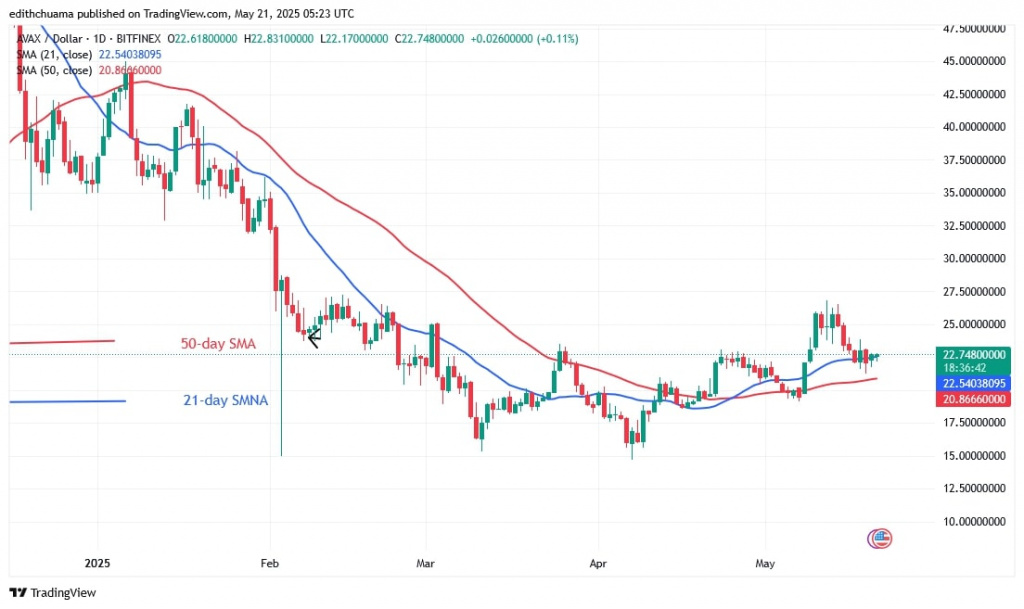

Avalanche (AVAX) has continued its uptrend after retracing above the 21-day SMA.

Avalanche price long-term analysis: bullish

The cryptocurrency was pushed back after hitting a high of $26.82. The altcoin has pulled back above the moving average line. Since May 17, AVAX has been trading above the 21-day SMA support but below the resistance at $26.

The altcoin began its upward movement today. A breakout above the $26 mark will catapult the altcoin to a high of $35. However, the price of the cryptocurrency is rising steadily and remains above the 21-day SMA.

AVAX will come under renewed selling pressure if the bears break the 21-day SMA support. The altcoin will fall below the moving average lines and hit a low of $20.

In the meantime, the price of the altcoin continues to fluctuate above the 21-day SMA support. AVAX is currently worth $22.52.

Analysis of the Avalanche indicator

On May 12, the cryptocurrency was pushed back as shown by a long candlestick wick pointing to the $26 barrier. The decline has paused above the 21-day SMA support as the altcoin begins a range-bound rise above the current support. AVAX will be forced to execute a bound move as it is confined between the moving average lines on the 4-hour chart.

Technical Indicators:

Key Resistance Levels – $60 and $70

Key Support Levels – $30 and $20

What is the next direction for Avalanche?

AVAX is bearish below the moving average lines but has started to meander sideways below these lines.

AVAX is trading above the $21 support but below the moving average lines and resistance at $24. Doji candlesticks have emerged above the $22 support, causing the altcoin to fluctuate in a range.

Coinidol.com reported on May 12 that AVAX was at a minor retracement above the moving average lines. The altcoin’s bullish rise could continue if it retraced above the $23 level.

Disclaimer. This analysis and forecast are the personal opinions of the author. They are not a recommendation to buy or sell cryptocurrency and should not be viewed as an endorsement by CoinIdol.com. Readers should do their research before investing in funds.