The crypto ETF market came alive on Thursday as both the Bitcoin (BTC) and Ether (ETH) spot funds delivered impressive performances, marking the second-largest daily inflows since their inception.

The 12 US spot Bitcoin exchange-traded funds, which debuted in January 2024, saw an inflow of $1.17 billion as their underlying asset hit a peak of $113,800 when markets closed on July 10. Bitcoin continues to surge in price, rising by 6% in less than 24 hours to set an all-time high at $118,403.

The spot Ethereum ETFs also had a record-setting day, witnessing their second-highest inflow day to date. This was marked by ETH’s run to $3,000 following weeks of positive momentum for the largest cryptocurrency after Bitcoin.

Spot Bitcoin ETFs See $1.17 Billion In Net Inflows, Second-Largest Since Debut

According to data from Farside Investors, BlackRock’s iShares Bitcoin Trust (IBIT) topped the daily inflow chart with $448 million, followed by Fidelity Wise Origin Bitcoin ETF (FBTC) with $324 million, and Ark 21Shares Bitcoin ETF (ARKB) at $268.7 million. This is the sixth consecutive day of gains for the funds that provide investors with exposure to the flagship cryptocurrency’s spot market performance.

There were smaller contributions from Bitwise’s BITB with $77.2 million, Grayscale’s Bitcoin Mini Trust (BTC) with $81.9 million, and $15.2 million from VanEck’s HODL. Only the Grayscale Bitcoin Trust ETF (GBTC) experienced outflows yesterday, which amounted to $40.1 million. The total trading volume for the day was $51.3 billion, driving net assets under the ETFs to a record $139.39 billion.

The $1.17 billion daily inflow is only topped by the $1.37 billion recorded for the spot Bitcoin ETFs on November 7, the day Donald Trump was declared the winner of the 2024 US Presidential race.

Spot Ethereum ETFs Amass $380 Million in Daily Inflows, Led by BlackRock’s ETHA

Meanwhile, US spot Ether ETFs trading also witnessed positive flows on Thursday, netting $383.1 million without any outflows. This also marked the second-highest net inflow for the funds since their launch in July 2024.

Unsurprisingly, BlackRock’s iShares Ethereum ETF (ETHA) dominated the influx, registering $300 million in net inflows. This was the fund’s highest daily inflow on record. Fidelity’s FETH came in a distant second with $37.3 million, followed by Garyscale’s Ethereum Mini Trust (ETH) with $20.7 million, and the Grayscale Ethereum Trust (ETHE) at $18.9 million.

Trading volumes shattered the previous records at $5.1 billion, and net assets under management for the spot Ethereum ETFs rose to $11.84 billion.

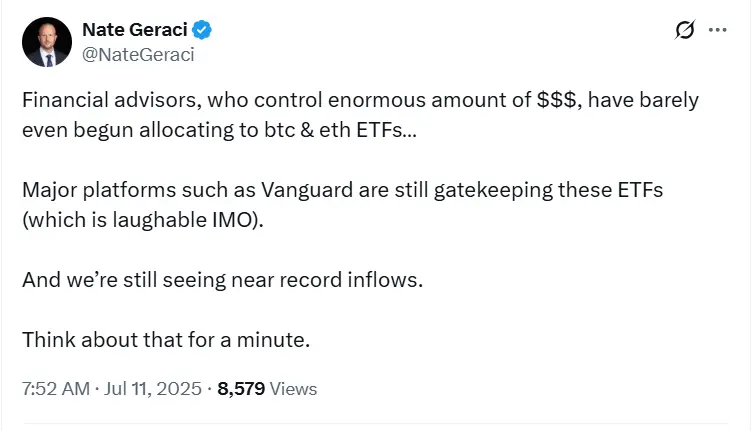

Nate Geraci, president of NovaDius Wealth Management, took a shot at traditional financial advisors in an X post, saying that despite controlling enormous amounts of wealth, they have barely even begun allocating to Bitcoin and Ether ETFs, which continue to see near-record inflows. He called asset management giant Vanguard’s decision to gatekeep the instruments from customers “laughable”.

Also Read: Ether Follows Bitcoin’s $118K ATH By Rallying To $3,000 Amid Corporate Treasury Announcements

Bitcoin and Ether ETF Demand is Outweighing the Cryptos’ Daily Supply

Both the Bitcoin and Ether spot ETFs are absorbing the net issuance of their underlying crypto.

According to data sourced by Ultra Sound Money, the 24-hour net issuance of Ether stood at 2,045 ETH, worth approximately $6.20 million. This figure far exceeds Thursday’s net inflow into the spot Ethereum ETFs, which stood at $383.1 million, equivalent to 126,636 coins. Currently, there are 120.89 million ETH in circulation.

Similarly, yesterday, 450 BTC worth $53.40 million were mined, but the inflow into the Bitcoin ETFs was worth 11,550 BTC, far outweighing the supply. A recent report by Galaxy Research showed that US Bitcoin ETFs and Michael Saylor’s firm, Strategy, have collectively accumulated $28.22 billion in BTC, which is four times the miners’ net issuance of $7.85 billion during the same period.

Potential Fed Rate Cuts and US Crypto Policies Expected to Drive Demand for Bitcoin and Ether via ETFs

Presto Research analyst Min Jung noted that while potential US tariff risks continue to loom over the market, positive catalysts like the expectation of an interest rate cut by the Federal Reserve and increased institutional appetite for digital assets will continue to drive growth in the crypto space. He believes that demand for Bitcoin and Ether spot ETFs could remain “robust” in the medium term, especially as the assets’ role in diversified portfolios evolves.

Investors are also closely watching recent regulatory developments, such as the upcoming GENIUS stablecoin act and the removal of a key IRS crypto broker tax rule. LVRG Research director Nick Ruck said the developments surrounding these events have fueled institutional demand for major cryptocurrencies as costly barriers and legal complications are being removed from traditional financial systems.

At the time of writing, Bitcoin (BTC) is trading at $118,372, up 6.56% in the last 24 hours. Meanwhile, Ether (ETH) is changing hands at $3,007, up 8.29% since yesterday.