Bitcoin ETFs in the US recorded more than $1 billion in inflows on two straight days for the first time. On July 10, spot Bitcoin ETF products saw $1.17 billion in inflows, followed by $1.03 billion on July 11, according to Farside Investors.

These inflows brought the total for the week to $2.72 billion. The last time inflows passed $1 billion in a single day was Jan. 17, when $1.07 billion entered Bitcoin ETFs. Since their launch in January 2024, only seven trading days have recorded such large inflows.

Nate Geraci, president of NovaDius Wealth Management, confirmed in an X post that two of those days occurred in the recent 48-hour period. He added that this marked a rare moment in the spot Bitcoin ETF market since approval.

BTC Inflows Outpace Daily Bitcoin Supply

As capital moved into Bitcoin ETFs, the BTC price climbed from $112,000 on Wednesday to $118,780 on Friday, based on CoinMarketCap data. The BTC price rose 8.85 percent in seven days.

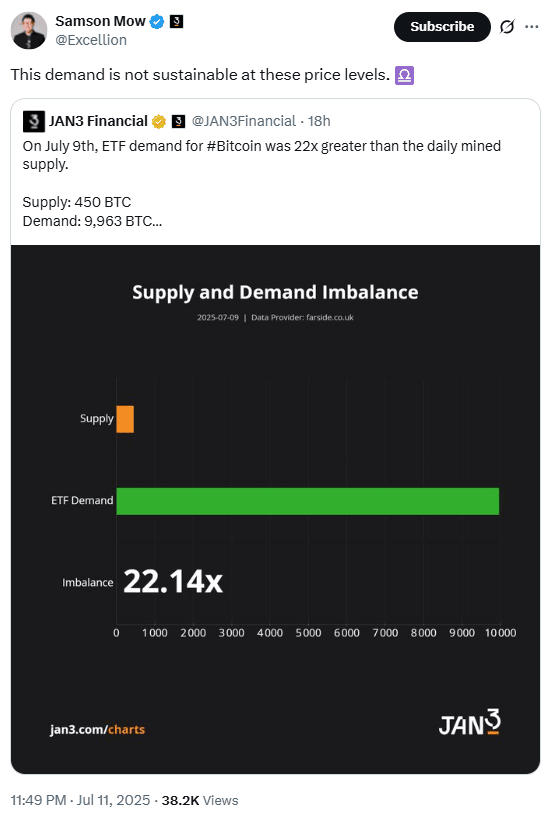

Matt Hougan, chief investment officer at Bitwise Invest, said in a Friday post that on July 10, spot Bitcoin ETF products bought around 10,000 BTC, while the Bitcoin network mined only 450 BTC that day.

The imbalance widened on Wednesday, according to Jan3, which reported that Bitcoin ETF demand was 22 times higher than the amount of BTC mined daily. Samson Mow, CEO of Jan3, commented that such demand could not continue at current BTC price levels.

BlackRock IBIT Hits $80B in ETF AUM in Record Time

The increase in BTC price and demand pushed BlackRock IBIT to cross $80 billion in ETF AUM on Thursday, July 11. Eric Balchunas, ETF analyst at Bloomberg, wrote on X that IBIT became the fastest ETF in history to reach that milestone. It took just 374 days.

BlackRock IBIT also now earns more annual revenue than BlackRock’s iShares Core S&P 500 ETF, according to the same post. This shift in revenue comes as more funds move toward Bitcoin ETFs.

Balchunas added that total ETF AUM across all spot Bitcoin ETF products passed $140 billion for the first time. He clarified that while BTC inflows contributed to the growth, the rise in BTC price accounted for most of the increase in total ETF AUM.