Just 19 days ago, Bitcoin was trading around $98,000. Today, it shattered expectations by hitting a new all time high of $118,820, underscoring the accelerating shift toward viewing Bitcoin as both a store of value and a strategic asset.

BlackRock’s iShares Bitcoin Trust (IBIT) broke its ETF records last night by surpassing $80 billion in assets under management, doing so in just 374 days. That’s nearly five times faster than the previous record held by the Vanguard S&P 500 ETF (VOO), which took 1,814 days to reach the same mark.

As of today, IBIT sits at $83 billion and holds over 706,000 BTC, making it the 21st largest ETF in the US market. Two days ago, IBIT also closed at a new all time high of $63.58, reflecting a massive demand for Bitcoin.

The number of hours the average American needs to work to afford one Bitcoin. According to the latest chart by Anil Patel, it now takes 3,766 hours, nearly two full years of labor at the average US wage, to buy just 1 Bitcoin.

According to a new report from Bank of America Global Research, Bitcoin is the top performing currency of 2025, beating out 19 fiat currencies with an 18.2% gain versus the US dollar year-to-date. This puts Bitcoin ahead of traditional strong performers like the Swedish krona, Swiss franc, and Euro. The data underscores Bitcoin’s growing strength not just as a digital asset, but as a global monetary unit.

Bitcoin has also reclaimed its spot among the world’s most valuable assets, surpassing Amazon to become the 5th largest by market capitalization. With a total market cap of $2.36 trillion and a price of $118,820, bitcoin now ranks just behind tech giants like Apple, Microsoft, and NVIDIA.

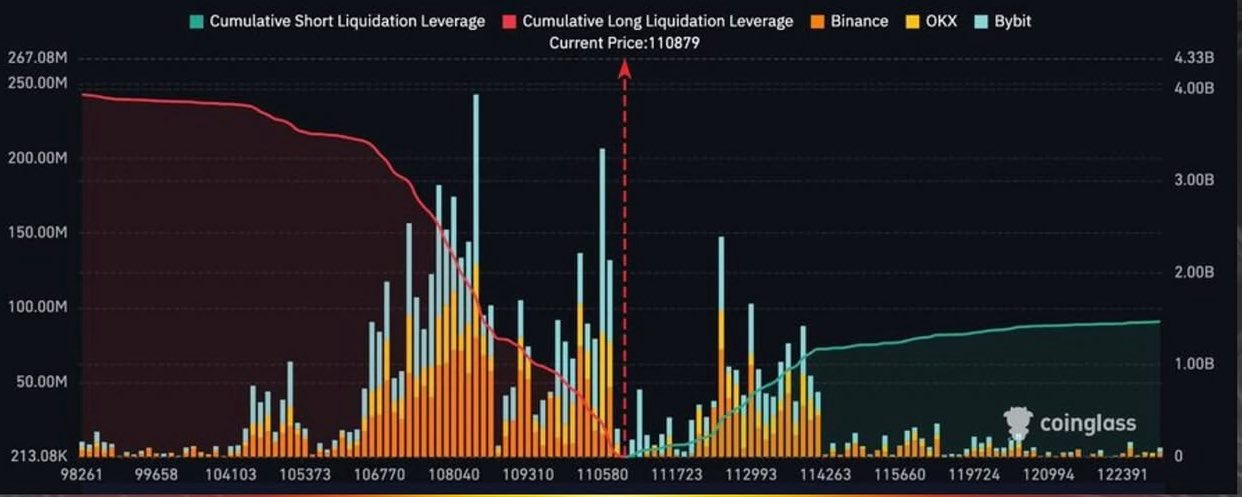

Over the past few days, more than $463 million in Bitcoin short positions have been liquidated, as price gains get even higher. According to data from Coinglass, an additional $1.5 billion in short positions are on the verge of liquidation if Bitcoin hits $120,000.