Galeanu Mihai

By Evan Bauman, Erica Furfaro, Aram Green, Amanda Leithe, CFA, & Margaret Vitrano

Being Patient in Momentum Growth Market

Market Overview

Despite inklings of a market broadening in the fourth quarter sparked by Donald Trump’s election victory and further interest rate cuts from the Federal Reserve, the post-election rally proved short-lived and momentum-led with relatively narrow leadership. The S&P 500 Index (SP500, SPX) advanced 2.41% in the quarter to finish 2024 up 25.02%, completing the best back-to-back years for the index since 1998. The benchmark Russell 3000 Growth Index jumped 6.83% for the quarter and 32.46% for the year, easily outdistancing all other parts of the U.S. equity market.

While small cap, value and cyclical shares were bid up in the aftermath of Trump’s win, which included a Republican sweep of Congress, growth stocks reasserted control by quarter’s end. The Russell 3000 Growth Index topped the Russell 3000 Value Index by 877 basis points for the quarter and 1,848 bps for the year while the Russell Midcap Growth Index was the best quarterly performer overall, rising 8.14%.

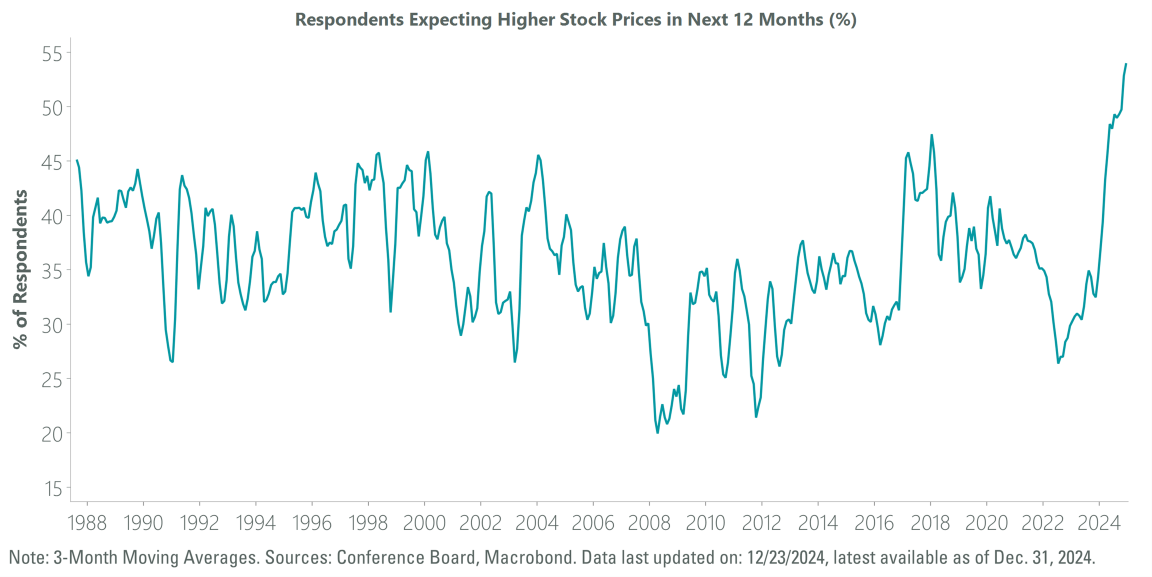

As they have done for most of the last several years, the Magnificent Seven dominated broad market returns. Nvidia (NVDA) continued to ride the momentum of its leading position as the key supplier of chips for AI applications, rising more than 170% in 2024, while Tesla (TSLA) roared back in the fourth quarter on strong financial results and the coattails of Elon Musk’s close association with the incoming Trump administration. Meanwhile, most gauges of investor sentiment, including the Investors Intelligence Bull/Bear Ratio, Citigroup’s Panic-Euphoria model, as well as current put/call ratios, show elevated levels of bullishness (Exhibit 1).

Exhibit 1: Market Optimism Elevated

The ClearBridge All Cap Growth Strategy balances its mega cap exposure with opportunities down the market cap spectrum to promote diversification, control risk and promote long-term consistency. We have always said it would be difficult to keep pace in a high-beta market when the index is up 30%. The offensive market posture and continued historical levels of market concentration for the Magnificent Seven were headwinds to our diversified approach across market capitalizations, most notably in the fourth quarter.

For the quarter, our portfolio overweight in health care, an underweight position in Tesla and a lack of exposure to some of the higher-beta growth names in the index that outperformed drove the majority of relative underperformance versus the index. Throughout 2024, we took steps to reduce our underweights to Tesla and Alphabet (GOOG,GOOGL), while continuing to maintain active weights in Amazon.com (AMZN) and Meta Platforms (META). Given another year of triple-digit price returns for Nvidia, we find the risk-reward skew in the stock to be more balanced and now have a modest underweight position in the stock relative to the index. We also prudently took profits in Broadcom (AVGO) in 2024 to use as a source of funds for new opportunities.

The Strategy’s health care holdings suffered from a combination of a clinical setback for Vertex Pharmaceuticals (VRTX) in clinical trials for its new therapeutic, suzetrigine, in the chronic pain setting; negative investor sentiment toward managed care company UnitedHealth Group; and sluggish biotechnology and pharmaceutical R&D spending negatively impacting Thermo Fisher Scientific (TMO). Despite weak recent performance, we continue to believe that health care offers durable growth trends and adds resilience to the portfolio.

Portfolio Positioning

We took advantage of that negative sentiment to establish a new position in ICON (ICLR), a leading contract research organization that handles clinical trials for biopharmaceutical companies. The CRO industry has experienced multiple compression in recent years, driven by slowing pharma and biotech spending by large clients, resulting in a meaningful dislocation in ICON’s multiple. We believe its current growth is below normal and should revert toward historical levels in the coming years. ICON is a strong player in the CRO industry demonstrating consistent share gains with a strong management team.

We also initiated a position in fast casual restaurant chain Chipotle Mexican Grill (CMG). The recent pullback in shares related to a moderation in industry-wide restaurant sales and CEO Brian Niccol’s August departure created an attractive entry point into a company with industry-leading unit economics in a still underpenetrated market. Chipotle plans to double its store footprint over time while executing initiatives to increase volume growth through technology enhancements, reduced mobile order friction and higher production during peak hours. Better throughput, technological integration and improved mix should help to drive continued margin expansion. Chipotle further diversifies the portfolio, adding to consumer discretionary where we have recently had less exposure.

We exited Biogen (BIIB), a biotechnology company developing treatments for Alzheimer’s disease and other neurological disorders. While Biogen has delivered significant advancements for the biotech sector and has been held in the portfolio for several decades, the company’s growth trajectory is now more uncertain due to a slower-than-expected launch of Alzheimer’s treatment Leqembi, with no clear catalyst for an upward inflection, which leaves the drug’s peak sales potential questionable. Additionally, patent expirations and pricing pressures in key therapeutic areas such as multiple sclerosis have further weighed on earnings potential. Biogen may also need acquisitions to stimulate growth, potentially increasing execution risk and degrading its balance sheet.

We continue to consolidate our positions within media to those with more attractive growth prospects over the next several years. We sold media conglomerate Comcast (CMCSA) as it faces greater competition and weakening pricing in its core broadband business. The growth outlook for Comcast is more challenged as competition from new entrants and dampened pricing power have impacted its connectivity business. Industry-wide saturation in broadband, coupled with a secular decline in cable TV subscribers, has diminished growth potential in its core cable business. Comcast’s ability to offset these subscriber losses through price increases is also becoming increasingly constrained.

Outlook

The Strategy and the Russell 3000 Growth Index are coming off two years of historically robust performance, with healthy double-digit price returns in both 2023 and 2024. We do not expect such strong results to continue every year and have positioned the Strategy for the inevitable periods of turbulence that are the natural course of equity markets. High expectations could pose the greatest risk to our asset class going forward as valuations of most large cap indexes are above average levels and market positioning is bullish. The selloff at year-end, triggered by the Fed’s acknowledgment that inflation remains a risk and that the scope of future rate cuts could be limited, may serve as a warning that stocks could face more headwinds than are currently priced in.

With the Magnificent Seven capping another very strong year, unless their profits increase dramatically, we see more compelling valuations among growth companies outside of that cohort. We believe our holdings in the $10 billion to $100 billion market cap range, for instance, are poised for improved results, both on a fundamental level and as macro conditions become more favorable for smaller companies. While the market broadening that began over the summer has experienced fits and starts, we believe this cycle of wider leadership is still in the early innings. The economic leadership in the Trump administration brings capital markets experience to policy making, which we believe will lead to lighter regulation and improve the environment for M&A activity, conditions particularly beneficial to companies down the market cap spectrum.

Software stocks are another area that have lagged over the last 12 months versus semiconductors but are now showing signs of modest improvement and product cycle innovation is accelerating. While we have been targeting disruptors leveraging generative AI and rapidly taking market shares in the some of the fastest-growing parts of the economy, we also see innovation occurring beyond technology-related businesses. One area we are excited about is medical devices, where portfolio holding Intuitive Surgical (ISRG) is making significant strides in providing feedback to surgeons using its robotic instruments.

We are excited about the year ahead as we believe it will provide opportunities to benefit from playing both offense and defense with our portfolio construction. This is probably the biggest upshot of taking a diversified approach across the growth market, allowing us to take advantage of market conditions while leaning on balance to promote consistency through the difficult periods.

Portfolio Highlights

The ClearBridge All Cap Growth Strategy underperformed its Russell 3000 Growth Index benchmark in the fourth quarter. On an absolute basis, the Strategy delivered positive contributions across five of the nine sectors in which it was invested (out of 11 sectors total). The primary contributors to performance were the information technology and consumer discretionary and sectors while the health care and industrials sectors were the main detractors.

Relative to the benchmark, overall stock selection contributed to performance but was offset by negative sector allocation effects. From a sector allocation perspective, overweights to health care and industrials hurt results. From a stock selection perspective, IT and real estate contributed the most to results while selection in industrials and consumer discretionary proved detrimental.

On an individual stock basis, the leading absolute contributors to performance were Broadcom, Amazon.com, Nvidia, Netflix (NFLX) and Visa (V). The primary detractors were Vertex Pharmaceuticals, Uber Technologies (UBER), UnitedHealth Group, Thermo Fisher Scientific and Freeport-McMoRan (FCX).

In addition to the transactions mentioned above, we exited positions in ETSY in the consumer discretionary sector and Seagate Technology (STX) in the IT sector.

Evan Bauman, Managing Director, Portfolio Manager

Erica Furfaro, Director, Portfolio Manager

Aram Green, Managing Director, Portfolio Manager

Amanda Leithe, CFA, Director, Portfolio Manager

Margaret Vitrano, Managing Director, Portfolio Manager

|

Past performance is no guarantee of future results. Copyright © 2024 ClearBridge Investments. All opinions and data included in this commentary are as of the publication date and are subject to change. The opinions and views expressed herein are of the author and may differ from other portfolio managers or the firm as a whole, and are not intended to be a forecast of future events, a guarantee of future results or investment advice. This information should not be used as the sole basis to make any investment decision. The statistics have been obtained from sources believed to be reliable, but the accuracy and completeness of this information cannot be guaranteed. Neither ClearBridge Investments, LLC nor its information providers are responsible for any damages or losses arising from any use of this information. Source: London Stock Exchange Group plc and its group undertakings (collectively, the “LSE Group”). © LSE Group 2025. FTSE Russell is a trading name of certain of the LSE Group companies. “Russell®” is a trade mark of the relevant LSE Group companies and is/are used by any other LSE Group company under license. All rights in the FTSE Russell indexes or data vest in the relevant LSE Group company which owns the index or the data. Neither LSE Group nor its licensors accept any liability for any errors or omissions in the indexes or data and no party may rely on any indexes or data contained in this communication. No further distribution of data from the LSE Group is permitted without the relevant LSE Group company’s express written consent. The LSE Group does not promote, sponsor or endorse the content of this communication. Performance source: Internal. Benchmark source: Standard & Poor’s. |

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.