pcess609/iStock via Getty Images

By Benedict Buckley, CFA, Dimitry Dayen CFA & Mary Jane McQuillen

Capitalizing When the Market Swoons

Market Overview

The second quarter of 2025 was a historic one given the elevated market volatility, with political factors thrust to the fore of both economics and investing with an intensity we have not seen in a long time. Despite the push to enact new tariff structures and subsequent trade discussions, a growth slowdown, consumer sentiment deterioration, and intensifying geopolitical conflicts, U.S. equities rose significantly. The benchmark Russell 3000 Index advanced 11.0%.

We are happy to report that, in a challenging environment ultimately defined by a major rally, the Strategy outperformed the benchmark during the quarter. This represents a significant stabilization in performance following several disappointing quarters.

Outperformance was driven by stock selection in financials, communication services, materials, industrials and consumer discretionary sectors. Allocation away from the energy sector also helped. Health care and information technology ((IT)) were notable detractors.

Stocks fell to begin the quarter after President Trump unveiled wide-ranging reciprocal tariffs on April 2, with the S&P 500 Index plunging 10% by April 7, but recovered most of their losses by month end as a delay in the tariff implementation, a handful of bilateral trade deals and a softened tone from President Trump on both China and Federal Reserve policy improved the outlook. The trade picture continued to brighten in May and June as the U.S. and China reached a preliminary trade deal and energy market fallout from a 12-day war in the Middle East seemed to have been avoided; major indexes finished the quarter at all-time highs.

The Strategy’s defensive positioning entering the quarter drove outperformance in April given significant downside volatility. We observed significant declines across many sectors, even for stocks not particularly economically sensitive or exposed to tariffs. At the same time, some of the more defensive names in the portfolio held up well or even rallied through the volatile period.

This selloff produced attractive opportunities in high-quality long-term compounders that are also levered to rising markets. We used these conditions to tilt the portfolio away from more defensive names where valuation has become less palatable in favor of attractive faster growers such as Netflix (NFLX), Palo Alto Networks (PANW) and PTC (PTC) — all new positions in the quarter. These changes contributed to outperformance in May as the S&P 500 and Russell 3000 both staged a 6.3% rally.

Lower-quality stocks led the market higher in June, which did not favor our investment style of pursuing high-quality compounders with attractive fundamentals, strong balance sheets and strong management teams. We continued to take advantage of dislocations to add to existing attractive investments and to initiate position in names we view as long-term winners.

Key financials contributors for the quarter included JPMorgan Chase (JPM), Bank of America (BAC) and Morgan Stanley (MS), all of which were helped by disciplined execution, resilient consumer spending and credit, reduced tariff fears and signs of increasing capital markets activity. The largest banks are increasingly seeing benefits of scale, benefiting JPMorgan Chase and Bank of America in particular.

In communication services, companies showing the ability to evade macro pressures dominated. Netflix is accelerating revenues with broadening price hikes, while its new ad technology, which gives advertisers new ways to buy ads and target viewers, supports a further jump in ad revenue to come. We believe this company has a long growth runway driven by pricing and subscriber growth. We initiated our position in recognition of the growing competitive advantage created by Netflix’s scale of content spend and the significant positive utility its customers derive from the service. It is highly penetrated in its core (English-speaking) markets, but it has ample room to grow pricing given its very high value proposition on a cost-per-hour-viewed basis. Non-English language content spend and AI-enabled dubbing can unlock international audiences where Netflix has significant room to grow subscribers.

Also in communication services, Chewy (CHWY), a pure play e-commerce company focusing on pet products that we bought late in 2024, returned to customer growth and capturing share in pet spending. Disney (DIS), meanwhile, showed strong earnings improvements across its streaming, legacy entertainment and parks divisions and announced a new theme park in Abu Dhabi, the seventh Disney resort globally. We added to our position during macro-induced recession fears in the quarter.

Detractors were concentrated in the struggling health care sector. We exited our position in UnitedHealth Group (UNH), which saw a renewed selloff in May following a first-quarter earnings miss and guidance reduction as the company announced even further cost pressure and the exit of the managed care company’s CEO Andrew Witty. We also sold out of detractor BioMarin Pharmaceutical (BMRN), a biotech company whose main growth driver — Voxzogo, a once-daily injection for children with achondroplasia (a form of dwarfism) — will face significant competition from a new once-weekly competitor. Cooper Companies (COO), meanwhile, lowered its full-year guidance citing weak demand in its contact lenses and fertility markets, which weighed on performance. We continue to own Cooper Companies as the negative update is mostly reflected in the share price, in our view.

Portfolio Positioning

A key tenet of the Strategy’s approach is that we look to source most of our risk from stock-specific rather than macro factors. As such, while there remains uncertainty in the economy as it relates to the consumer, interest rates and tariffs, we believe the portfolio is appropriately positioned with a predicted beta close to 1. We are overweight IT, industrials and materials and continue to not own stocks in the traditional energy sector.

The quarter saw elevated turnover, which was a function of high volatility and the resulting opportunities. Rounding out our buys of Palo Alto Networks, an enterprise cybersecurity solutions provider poised to benefit from agentic AI as well as continued cyber threats, and PTC, a leading player in industrial software applications that should benefit as industrial activity recovers and tariff uncertainty fades, we also added Monday.com (MNDY) and Analog Devices (ADI).

Monday.com is a leading cloud-based work management software company gaining share in small and medium-size businesses and mid-market companies in fragmented industries. Analog Devices makes high-performance analog, mixed-signal and digital signal processing technologies for industrial, automotive, consumer and communications end markets — which we believe are at the bottom of the analog semi cycle.

Amid a shifting competitive landscape in IT we exited Salesforce (CRM), whose core growth is slowing as competition ramps up in its customer relationship management software market, while its agentic AI opportunity has yet to be fully proven and may take longer to materialize. Competition, in particular from Chinese players, was also behind our sale of semiconductor capital equipment company Lam Research (LRCX), while we also completed our exit of Dell (DELL), having already sold most of it in November 2024 following the election given our awareness then of tariff concerns, to which Dell is meaningfully exposed. Concerned that advancements in AI-driven image generation may erode Adobe’s (ADBE) moat over time, we exited our stub position.

Outlook

While the U.S. economy faces several open questions, we are still not seeing a recession as the base case. Along with interest rates and the One Big Beautiful Bill Act, how the consumer reacts to macro pressures will be a key driver of the economy for the rest of the year.

In the longer term, we continue to be constructive on U.S. equities. The U.S. market enjoys structural advantages such as innovation, favorable demographics, energy resilience and strong capital markets. These factors should continue to drive corporate earnings growth. Against this backdrop, we remain focused on owning a concentrated portfolio of high-quality companies with strong fundamentals, sustainability drivers that reinforce the fundamentals, low debt leverage and solid management teams that we believe can outperform over the business cycle.

Portfolio Highlights

The ClearBridge Sustainability Leaders Strategy outperformed its Russell 3000 Index benchmark in the second quarter. On an absolute basis, the Strategy had gains in seven of 10 sectors in which it was invested (out of 11 sectors total). The main contributors were the IT, industrials and communication services sectors, while the health care sector was the main detractor.

On a relative basis, overall stock selection and sector allocation were positive. In particular, stock selection in financials, communication services and materials sectors and a lack of energy holdings contributed to relative results. Conversely, stock selection in the health care and IT sectors, a health care overweight and a communication services underweight detracted.

On an individual stock basis, Broadcom (AVGO), Walt Disney, Microsoft (MSFT), Trane Technologies (TT) and Booking Holdings (BKNG) were the largest contributors to relative performance. The main detractors from relative returns were positions in UnitedHealth Group, Nvidia (NVDA), Cooper Companies, American Water Works (AWK) and Danaher (DHR).

In addition to portfolio activity discussed above, in the quarter we added Linde (LIN) in the materials sector and UL Solutions (ULS) in the industrials sector. We exited Enphase Energy (ENPH) in the IT sector, Hartford Insurance (HIG) in the financials sector, and Nike (NKE) and LKQ (LKQ) in the consumer discretionary sector.

ESG Highlights: Climate Strategy is Business Strategy

For almost 40 years ClearBridge has been incorporating climate risks and opportunities into our fundamental investment strategy. As climate has become more and more relevant in our portfolios, we have taken steps to enhance our process and ensure material climate metrics are appropriately captured.

Company engagements are a key pillar in ClearBridge’s climate strategy as we seek to understand and manage company-specific climate-related risks and opportunities. ClearBridge engagements on environmental, social and governance (ESG) topics generally have two overlapping objectives:

1. Research: Gaining a better understanding of ESG issues that could impact our investment thesis

2. Impact: Encouraging specific changes at the company to better align its operations with sustainability best practices

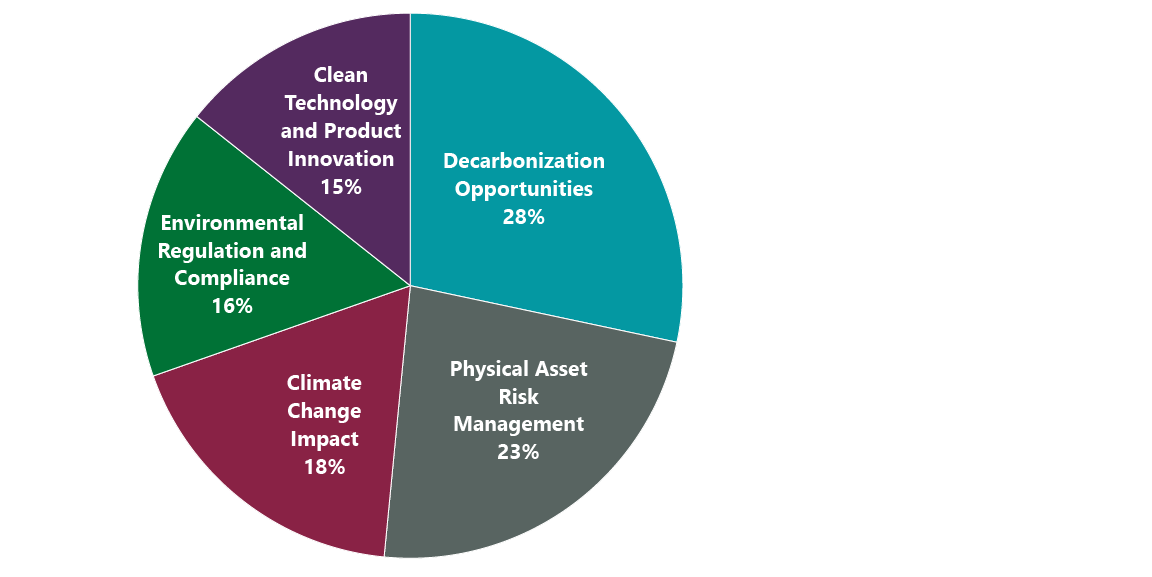

Across these two objectives, our engagements span many different climate-related topics (Exhibit 1), with engagements primarily focused on higher-emitting sectors.

ClearBridge’s model for ESG integration, which includes ESG discussions as part of fundamental company research led by our investment teams, allows climate-related engagements to be thoughtful and well-rounded discussions on climate topics. As the following examples show, our analysts and portfolio managers cover very different topics in discussions with companies in very different sectors while still focusing both on companies’ climate strategies and the connection of these strategies to the companies’ business case.

Exhibit 1: Top Environmental Factors Engaged Upon in 2024

As of Dec. 31, 2024. Source: ClearBridge Investments.

Amazon.com (AMZN): A Fully Integrated Approach to Climate

In September 2024, ClearBridge joined Amazon for a group discussion with the company’s ESG and Energy Sustainability teams as part of Climate Week to discuss Amazon’s environmental strategy. Amazon went into the many components of its company-wide initiative to achieve net zero by 2040. Each business unit — grocery, studios, AWS — has dedicated sustainability leads, with a team led by Head of Energy and Sustainable Operations Chris Roe ensuring carbon goals are embedded in annual plans and reviewed by leadership. In setting its strategy, Amazon focuses on metrics specific to different business units like carbon per dollar of gross merchandise value (GMV) in retail and per unit of compute in AWS. Amazon has also launched a $2 billion fund to accelerate decarbonization technologies into commercial products.

Cost and carbon are highly correlated in Amazon’s climate strategy as retail operations get more efficient. Major challenges include reducing Scope 1 emissions from middle-mile logistics, where diesel trucks remain a bottleneck. However, progress is evident in last-mile delivery: 680 million packages were delivered by EVs in the previous year. Efficiency gains in packaging have also led to a 40% reduction in packaging waste over nine years.

Internally, Amazon uses climate risk models to anticipate energy usage and drive real estate design. Factors in the models include generative AI’s future energy needs, growth of Amazon’s fleet, locations of logistics facilities and water availability for different sites.

While ClearBridge encourages emissions reduction targets aligned with the Science-Based Targets initiative (SBTi), Amazon appears to have a responsible approach of setting internal science-based targets per business unit, although these are not formally verified by the SBTi. Amazon does, however, work with both SBTi and academics to align with International Energy Agency pathways. The company avoids offsets for interim targets, reserving removals like direct air capture for residual emissions — which are expected to be mostly Scope 3 by 2040.

This discussion provided us with a better understanding of Amazon’s climate strategy and we remain positive about its climate efforts. Our biggest takeaway was how well resourced and data driven Amazon’s climate efforts are from an organizational standpoint, driving down the cost/carbon impact per dollar of value with the value metrics being defined at a segment level: e.g., carbon footprint per unit of compute for AWS or per dollar of GMV in Retail.

Microsoft: Powering AI Responsibly

In November 2024, ClearBridge held a call with Microsoft’s sustainability investor liaison to discuss shareholder concerns on energy efficiency, as with the huge growth of AI has come a massive demand in energy as well. We discussed Microsoft’s AI energy needs and its goals to become carbon negative. Microsoft reconfirmed its commitment to achieving its climate goals with its recently announced power purchase agreement for nuclear power with Constellation Energy (CEG), which involves restarting Three Mile Island. Microsoft clarified it won’t own or operate this facility, but will be a customer of Constellation, with which Microsoft has maintained strong supplier conduct statements. When asked about safety concerns, Microsoft explained the reactor slated to be restarted was functioning safely and effectively for decades before being turned off for economic reasons in 2018. This represents a significant part of Microsoft’s commitment to nuclear power. The company sees this agreement as part of achieving its 2030 and 2050 carbon emissions targets (for net negative emissions).

As it relates to renewables, Microsoft continues to encounter the issue of intermittency (as do peers). It is conducting research on power battery storage and other mechanisms to solve this issue and includes deals for wind and solar in its portfolio approach to its power generation needs.

We were encouraged to hear Microsoft is still committed to bringing carbon emissions back down as energy needs increase. Since this engagement, Microsoft has also announced many agreements to purchase offsets, as the energy efficiency of AI, particularly in data centers, is still a challenge. We continue to see Microsoft’s climate strategy as leading among peers and will continue to engage with the company on this topic.

Benedict Buckley, CFA, Portfolio Manager

Dimitry Dayen CFA, Portfolio Manager

Mary Jane McQuillen, Head of ESG, Portfolio Manager

|

Past performance is no guarantee of future results. Copyright © 2025 ClearBridge Investments. All opinions and data included in this commentary are as of the publication date and are subject to change. The opinions and views expressed herein are of the author and may differ from other portfolio managers or the firm as a whole, and are not intended to be a forecast of future events, a guarantee of future results or investment advice. This information should not be used as the sole basis to make any investment decision. The statistics have been obtained from sources believed to be reliable, but the accuracy and completeness of this information cannot be guaranteed. Neither ClearBridge Investments, LLC nor its information providers are responsible for any damages or losses arising from any use of this information. Source: London Stock Exchange Group plc and its group undertakings (collectively, the “LSE Group”). © LSE Group 2025. FTSE Russell is a trading name of certain of the LSE Group companies. “Russell®” is a trade mark of the relevant LSE Group companies and is/are used by any other LSE Group company under license. All rights in the FTSE Russell indexes or data vest in the relevant LSE Group company which owns the index or the data. Neither LSE Group nor its licensors accept any liability for any errors or omissions in the indexes or data and no party may rely on any indexes or data contained in this communication. No further distribution of data from the LSE Group is permitted without the relevant LSE Group company’s express written consent. The LSE Group does not promote, sponsor or endorse the content of this communication. Performance source: Internal. Benchmark source: Standard & Poor’s. |