The global cryptocurrency market plunged into chaos late Saturday, June 21, after U.S.

President Donald Trump confirmed a series of airstrikes on Iranian nuclear sites. The military action immediately triggered a sharp sell-off, sending Bitcoin (BTC) to a low of $100,945 before rebounding slightly.

Within hours, over $40 billion in market capitalization evaporated across the crypto space, highlighting investor sensitivity to geopolitical risk.

Bitcoin Price Reacts to U.S. Military Strike

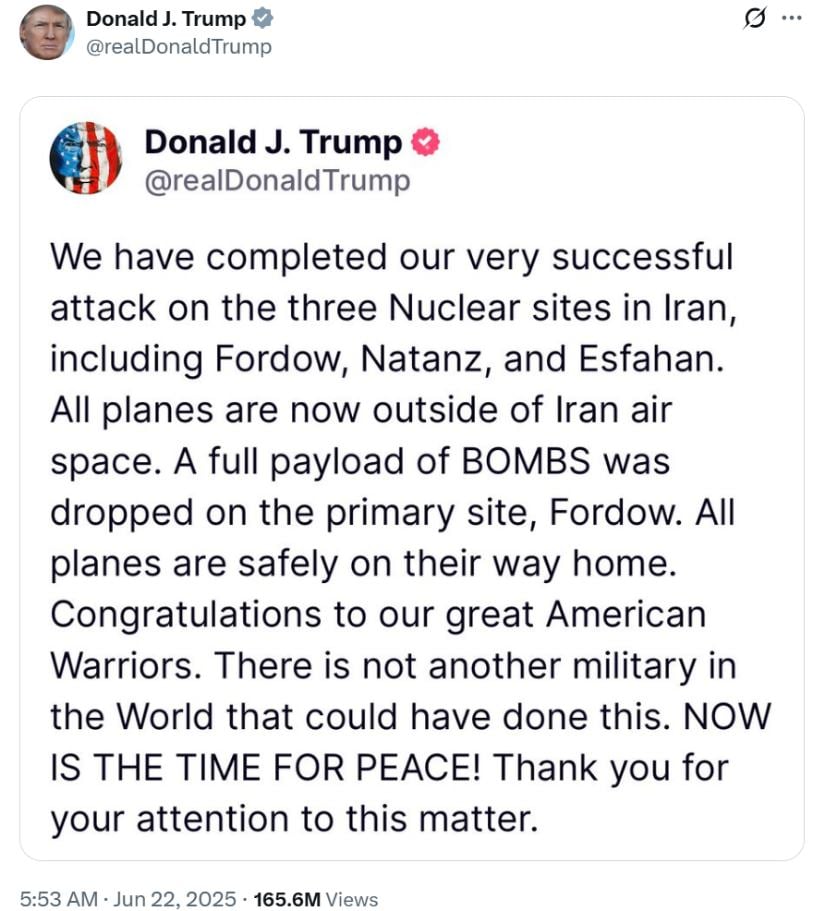

The dramatic turn of events unfolded when President Trump took to Truth Social at 7:50 p.m. EST, stating, “We have completed our very successful attack on the three Nuclear sites in Iran, including Fordow, Natanz, and Esfahan. Congratulations to our great American Warriors.” His announcement was swiftly followed by a 2% drop in Bitcoin’s price, hitting a session low of just under $101K.

Bitcoin (BTC) was trading at around $100,533.27, down 2.95% in the last 24 hours at press time. Source: Bitcoin Liquid Index (BLX) via Brave New Coin

Although BTC later recovered to around $102,350 by 9 p.m., the damage was done. Ethereum (ETH) and other major altcoins also suffered steep declines, with ETH dropping 6.7% within the same window. Traders described the move as a classic “panic sell,” sparked by fears of broader conflict in the Middle East.

Crypto Market Sentiment: Uncertainty and Escalation Fears

Market experts warn that this may just be the beginning. “The crypto market is extremely vulnerable to global flashpoints, especially when there’s potential for escalation,” said a senior analyst from CoinGape. “We’re now in a wait-and-watch phase, but if Iran retaliates or tensions spread, crypto markets could face another brutal leg down.”

President Donald Trump announced on X that U.S. forces struck three Iranian nuclear sites—Fordow, Natanz, and Esfahan—and confirmed that air fighters remain deployed. Source: Donald J. Trump via X

Reports suggest that the attacks were strategically planned to minimize civilian casualties, but the Iranian government has signaled possible retaliation. Concerns are mounting that a broader conflict involving global powers like Russia or China could follow, adding more pressure to risk assets, including cryptocurrencies.

Bitcoin Support Levels and What Comes Next

Technical analysts are keeping a close eye on the next critical support zone between $92K and $94K. According to popular crypto trader @CredibleCrypto, Bitcoin has tagged a key support level, which could trigger a short-term bounce. “If BTC loses the $102K zone again, we could revisit $98K or even see a flush toward $94K,” he noted on X.

Range lows have been tested, suggesting a potential triple bottom formation; if support holds, a reversal is likely, with the next target zone between $94k and $98k if broken. Source: CrediBULL Crypto on TradingView

While some see this as a buying opportunity, others caution against making hasty moves amid ongoing geopolitical tensions. The overall Fear & Greed Index has shifted sharply toward “fear,” suggesting bearish momentum may persist until more clarity emerges.

Altcoins See Sharper Losses Amid Broad Sell-Off

The damage wasn’t limited to Bitcoin. Ethereum, Solana, and some high-cap alts were hit with steeper declines, with most falling more than 5% within the past 24 hours. Such coins are more risk-sensitive, and experts caution they may experience further losses in case of ongoing global uncertainty.

XRP price broke the $2 support level and was trading around $1.93, down 8.58% in the past 24 hours at press time. Source: XRP Liquid Index (XRPLX) via Brave New Coin

The general sentiment in the market has gone defensive, with investors pulling out liquidity and moving into safer assets or remaining in cash positions. This drop underscores that even decentralized assets are not exempt from macro events.

Trump Leaves Door Open for More Strikes

Adding to the uncertainty, President Trump declined to confirm whether further military action is off the table. In a late-night speech, he said, “If Iran chooses conflict over peace, we are prepared.” This ambiguity is keeping both traditional and crypto markets on edge.

Donald Trump delivered a White House speech boasting of his attack on Iran, threatening further strikes and demanding that Iran make peace or face greater attacks. Source: Ben Norton via X

“There’s still a real threat of escalation,” said political analyst Seymour Hersh, who predicted earlier that an airstrike could occur over the weekend. “And while traditional markets are closed, crypto trades 24/7—it becomes the first line of market reaction.”

Crypto Outlook: A High-Risk Path Forward

With over $40 billion wiped from the market in just three hours, investors are grappling with a tough question: Is this a temporary shakeout, or the start of a more extended downturn?

The near-term outlook remains volatile. Any signs of diplomatic resolution may revive risk appetite and bring buyers back into the market. Conversely, if geopolitical tensions intensify, crypto could face a prolonged correction.

As the world watches for Iran’s next move, the crypto market will likely remain on edge, with every update from Washington or Tehran potentially triggering another wave of volatility. For now, Bitcoin’s $100K support is under threat—and the global crypto community is bracing for impact.