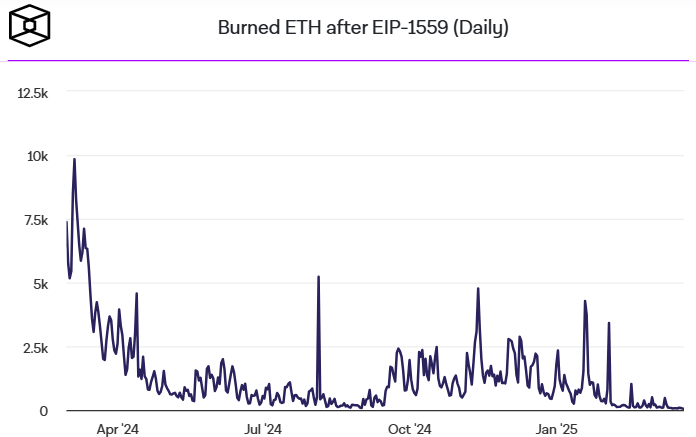

While many fundamental issues in cryptocurrencies have been addressed, few anticipated the current bleak market conditions. The SEC is nearing the conclusion of its cases against cryptocurrencies, but risk appetite has plummeted to levels reminiscent of the worst days. Ethereum’s burning metric is signaling alarms. What is happening here?

Ethereum’s Merge transitioned to a PoS mechanism, initiating a reduction in supply. However, this trend appears to have reversed with Dencun. As the ultrasound Money narrative that previously boosted Ether demand flips, we are witnessing another historical milestone today.

The amount of burned ETH hit an all-time low over the weekend. This decline, confirming price weakness, indicates a serious contraction in network demand. The EIP-1559 change allows ETH to be burned for paying essential transaction fees, aiming to reduce inflationary pressure and witness deflationary days during periods of high network activity.

License.

License.Read Entire Article

Screenshot generated in real time with SneakPeek Suite

BitRss World Crypto News | Market BitRss | Short Urls

Design By New Web | ScriptNet