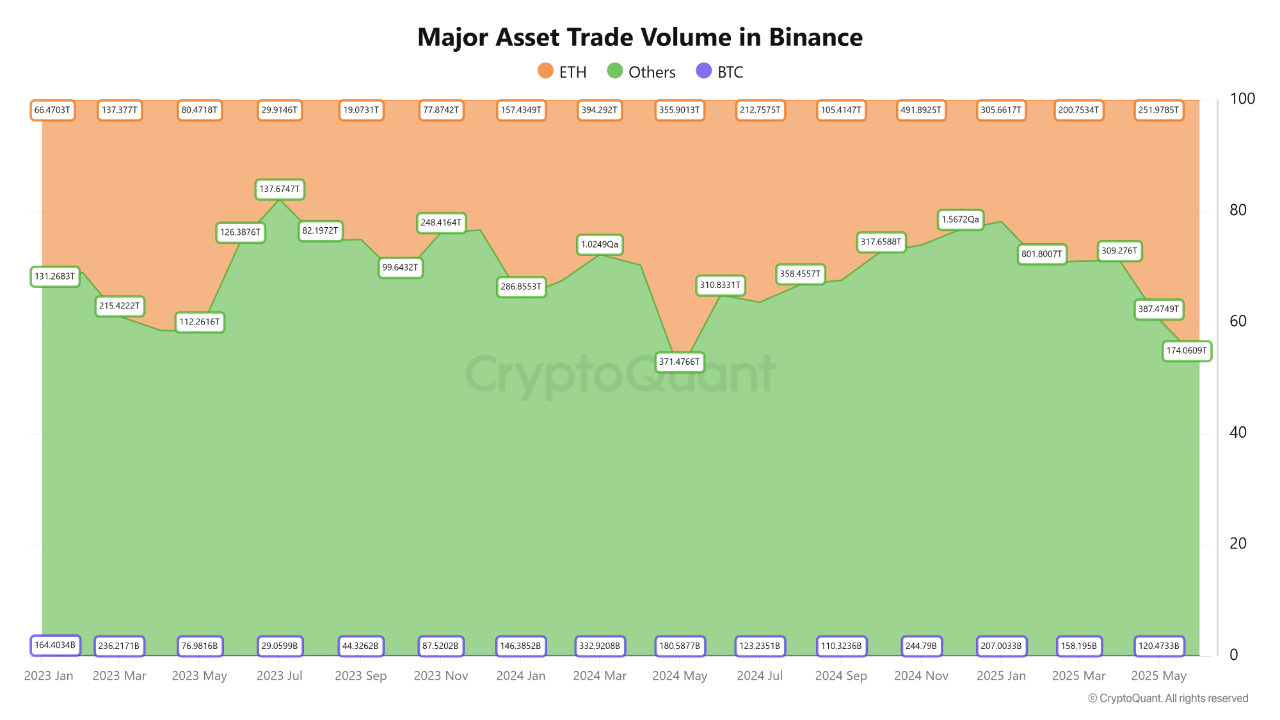

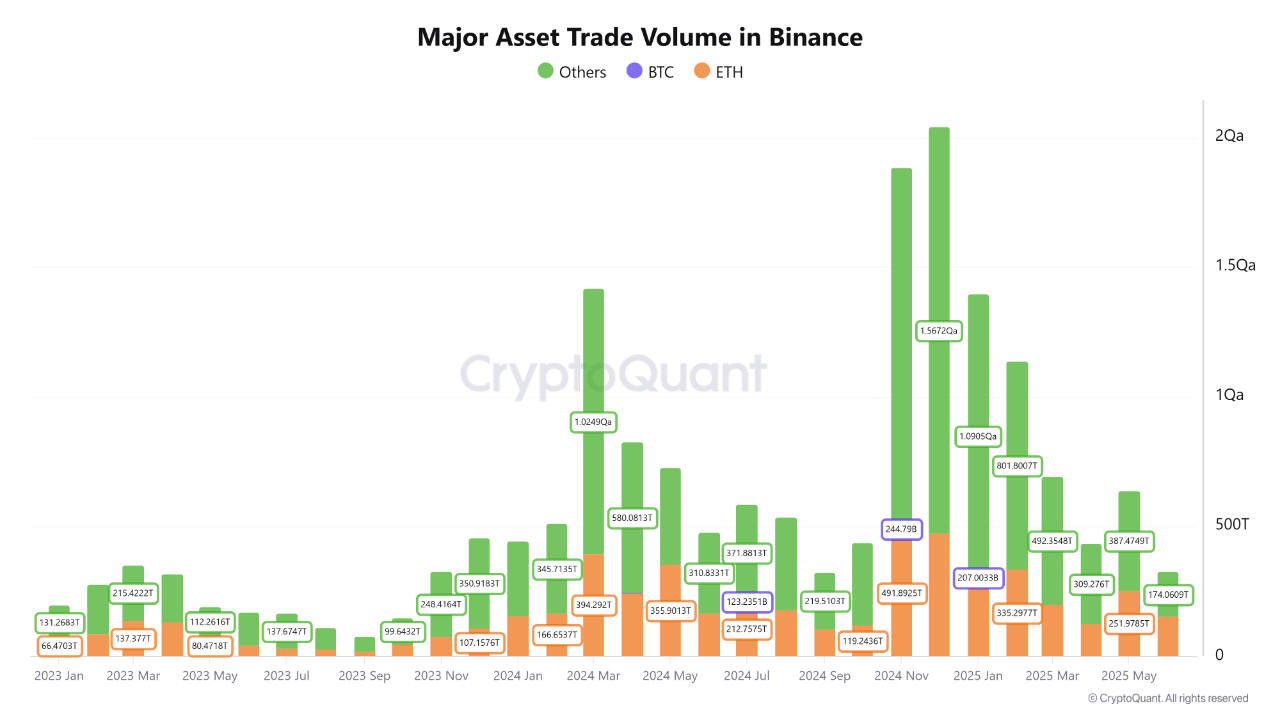

The data, covering activity from January 2023 to May 2025, highlights a significant reshaping of market dynamics on the world’s largest exchange.

Altcoin Trading Plummets While ETH Stays Steady

Between late 2024 and mid-2025, trading volume for altcoins on Binance dropped dramatically:

- Altcoin trading peaked at 1.5672Qa in November 2024, but collapsed to just 387.47T by May 2025

- Ethereum trading remained stable, ranging from 300T to 490T during the same period

- This stark contrast shows that Ethereum’s rising share of total trades is due to investors pulling capital out of riskier altcoins, not a surge of fresh ETH demand.

What’s Behind the Shift?

According to CryptoQuant, the decline in altcoin volume signals a behavioral change among investors:

- Cautious market conditions have driven capital away from speculative or unproven projects

- Liquidity previously spread across hundreds of tokens is consolidating into safer, more established assets — with ETH being the top beneficiary

- In times of increased risk or uncertainty, Ethereum’s technical resilience, DeFi leadership, and upcoming ETF prospects make it a trusted hedge within the crypto space

Ethereum: Stability Over Hype

The report emphasizes that Ethereum’s dominance is not driven by hype or explosive growth, but rather by trust and stability. ETH’s consistent performance in trading volume, especially during a period of broader altcoin retreat, reflects stronger investor confidence in its infrastructure and long-term relevance.

This trust is further reinforced by:

- Ongoing protocol upgrades

- Expansion of the Ethereum-based DeFi ecosystem

- Anticipation of regulated ETH investment vehicles like ETFs

Conclusion: A Dominance Built on Decline

Ethereum’s expanding dominance on Binance is not a victory over competition through innovation alone — it’s also a byproduct of the altcoin sector’s sharp contraction. As speculative interest fades, capital flows into ETH have solidified its role as the anchor of crypto markets, especially during more risk-averse periods.

For investors, the message is clear: in a market leaning toward caution, Ethereum stands as a pillar of relative security and consistency.