GameStop (GME), the iconic video game retailer and meme stock legend, has stunned both Wall Street and the crypto world with a blockbuster announcement: a $513 million investment in Bitcoin.

On May 28, 2025, GameStop revealed it had acquired 4,710 Bitcoins, marking its first major foray into digital assets and signaling a bold new direction for the company’s treasury strategy.

The move comes as GameStop faces mounting pressure in its core business, with physical game sales declining and digital competition intensifying. But CEO Ryan Cohen isn’t backing down — instead, he’s taking a page from Strategy’s (MSTR) playbook, betting big on Bitcoin to rejuvenate GameStop’s financial future. According to the company’s SEC filing, the purchase was funded through a $1.3 billion convertible bond offering completed in March, giving GameStop the liquidity to make such a substantial crypto play.

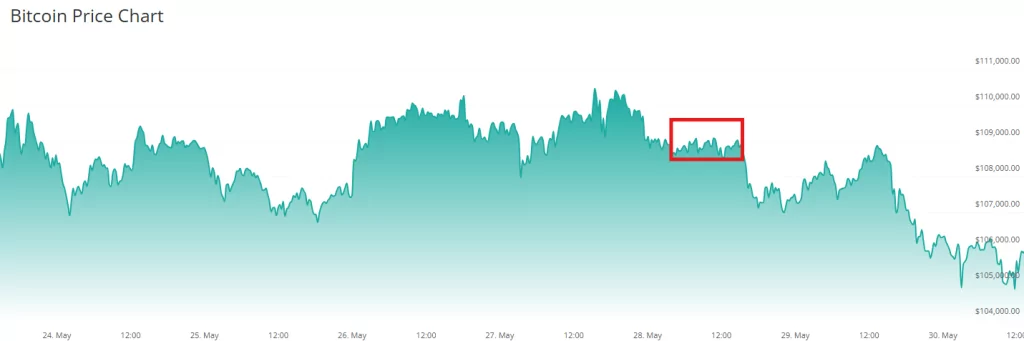

The timing couldn’t be more dramatic. Bitcoin recently soared to an all-time high of nearly $112,000 before a sharp correction brought it back to the $106,000 range. GameStop’s average purchase price was $108,950 per bitcoin, meaning the company’s investment is already riding the waves of crypto volatility.

The announcement sent GameStop’s shares on a wild ride — initially up 2.4% in pre-market trading, then plunging by 6% as investors digested the risks.

GME shares plunged by 6% after the Bitcoin purchase. Source: TradingView

GameStop’s board has also amended its investment policy, removing any upper limit on future crypto purchases. This opens the door for even more aggressive moves, with the company holding $4.78 billion in cash and marketable securities as of February 1. The strategy echoes the recent surge in corporate Bitcoin adoption, with over 50 public companies adding BTC to their balance sheets in 2025 alone.

On social media, reactions were instant and intense.

“GameStop just went full Michael Saylor. Is this the turnaround they needed—or the final meme?”, commented one of the subscribers.

Meanwhile, analysts are divided. Some see GameStop’s Bitcoin buy as a savvy hedge against inflation and a way to attract a new generation of investors. Others warn of heightened risk, especially as Bitcoin’s price remains volatile and regulatory uncertainty persists.

As of today, CoinCodex forecasts Gamestop could rise by 7.82% to $28.30 by June 30, 2025, with technical indicators currently signaling a bearish outlook.

As GameStop’s bold move reverberates through the markets, it’s also sparking a wider conversation about the future of corporate treasury management. Will other struggling retailers and legacy brands follow suit, using Bitcoin as a potential lifeline? Or will GameStop’s gamble become a cautionary tale of crypto’s unpredictable nature?

In the days following the announcement, Reddit forums and Discord channels lit up with speculation and memes, with some users even suggesting GameStop could launch its own NFT marketplace or accept Bitcoin payments for games and consoles. The company’s willingness to embrace new technology may help it forge a new identity in an era where digital assets and gaming culture increasingly intersect.

How Gamestop’s purchase of Bitcoin affected BTC’s price. Source: CoinCheckup

As GameStop embraces its new identity as a crypto pioneer, all eyes are on whether this bold bet will pay off — or if it’s just the latest twist in the meme stock saga. One thing is certain: both Wall Street and the crypto world will be watching every move.