HYPE is holding above key support after a $35M institutional buy and major buybacks, with traders eyeing a breakout toward the $38.50 zone.

After a $35 million buy-in from Nasdaq-listed EyEnovia and one of the protocol’s biggest buyback days ever, momentum around Hyperliquid is building fast.

Hyperliquid’s current price is $35.42, up 5.03% in the last 24 hours. Source: Brave New Coin

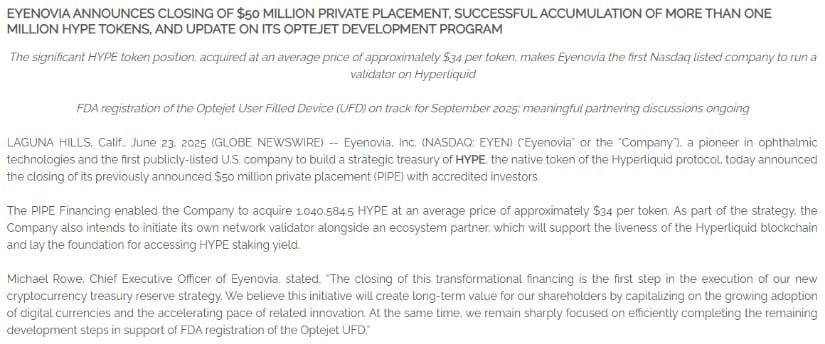

EyEnovia Just Bought $35M Worth of HYPE

In a bold move that signals growing confidence in Hyperliquid, a publicly listed biotech firm, EyEnovia has purchased over 1 million HYPE tokens at an average price of $34. The buy-in was part of a $50 million private placement, making EyEnovia the first Nasdaq-listed company to take a direct position in HYPE.

EyEnovia becomes the first Nasdaq-listed firm to invest in HYPE, signaling growing institutional confidence. Source: Hyperliquid News via X

EyEnovia plans to launch a validator on Hyperliquid and build ecosystem infrastructure around the network. With recent momentum from buybacks and price strength, this kind of corporate involvement could mark a new phase of utility-driven demand for HYPE.

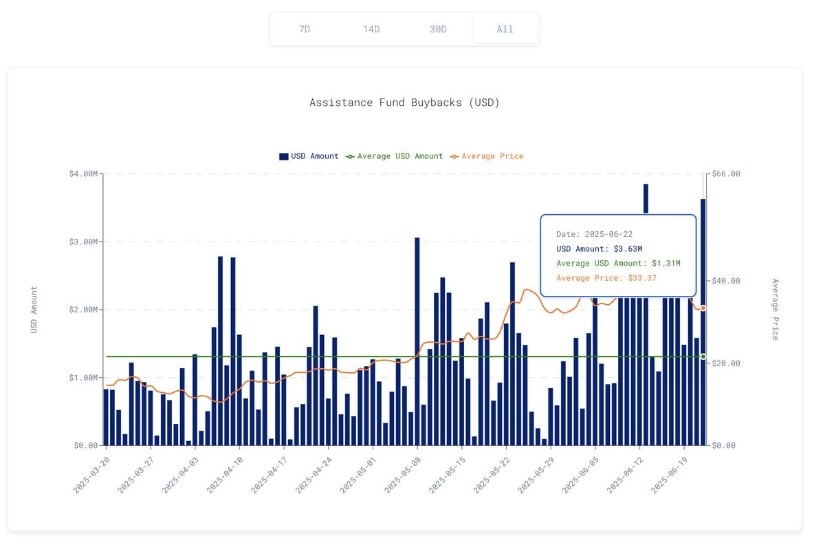

Hyperliquid Sees One of Its Biggest Buyback Days

EyEnovia’s $35 million HYPE allocation made headlines, and Hyperliquid followed up with another major show of strength. Analyst Tobias Reisner reported that the protocol executed $3.63 million in HYPE buybacks in a single day, one of the largest on record. The activity was driven by its Assistance Fund.

Hyperliquid executes $3.63M in daily HYPE buybacks. Source: Tobias Reisner via X

The buybacks occurred at an average price of $32.77, slightly below EyEnovia’s $34 entry, reinforcing the view that institutional and on-chain support is converging. When you see this level of aggressive repurchasing paired with recent ecosystem expansion, it suggests HYPE is building a strong base for now.

HYPE is Getting Support from Key Technical Level

Coming off the back of major institutional buy-ins and historic buyback activity, HYPE is now defending a critical technical level around $35, the same zone that marked its previous all-time high. According to nech_n_, the price has been consolidating along this former resistance-turned-support, and has already shown signs of a bounce. This area is significant not just psychologically, but structurally, with recent price action forming a series of higher lows above it.

HYPE defends key $35 support zone, forming higher lows and signaling sustained bullish momentum. Source: nech_n_ via X

Momentum remains tilted upward for now, especially as the price holds above that $34 to $35 band. The current move lines up with the broader “higher for longer” sentiment floating through Hyperliquid’s ecosystem. As long as HYPE stays above this level with volume support, it keeps the short-term bullish bias intact.

Hyperliquid Technical Analysis

Following other long-term signs of strength, HYPE is now showing signs of short-term strength as well. As seen in ChartJesus’ chart, price is hovering near a local support band, where buyers have previously stepped in. There’s a visible consolidation just above that zone, and the chart outlines a possible move back into the $36.80 to $37.40 range. A clean break above that could open up a path toward the next resistance zone around $38.50 to $39.

HYPE consolidates above local support with eyes on a breakout toward $38.50 to $39.00. Source: ChartJesus via X

This zone also acted as resistance during previous price pauses, making it an important area to watch from a momentum perspective. Structurally, the trend still leans bullish in the short term, with higher lows forming around the $33.80 and $34.50 zones, and no major breakdowns below key levels.

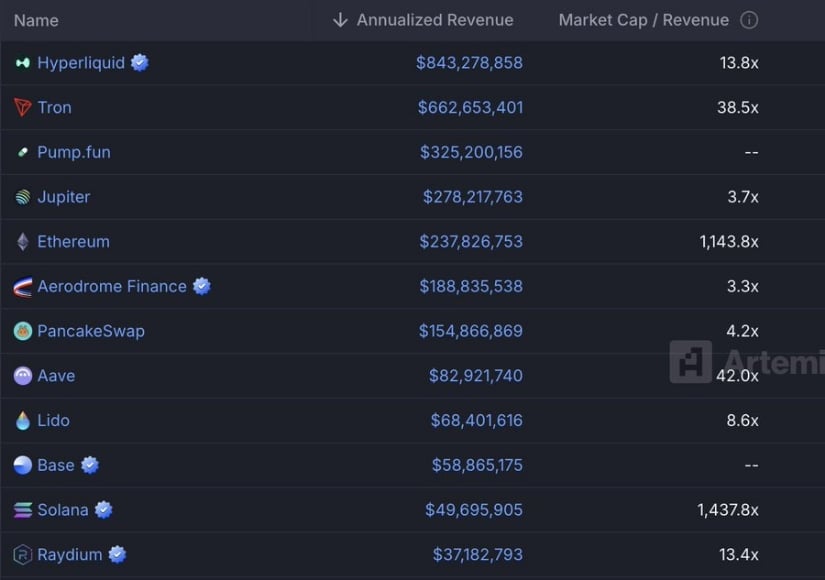

Hyperliquid Remains Undervalued

While the market keeps speculating on Layer 1 narratives, Hyperliquid is quietly pulling ahead in actual performance. According to new data from GemsGun, Hyperliquid is generating over $843 million in annualized revenue, more than Ethereum, Tron, and Solana. Yet, unlike Solana, which trades at an eye-watering 1,437x market cap-to-revenue ratio, Hyperliquid sits at just 13.8x.

Hyperliquid leads top L1s in revenue with $843M. Source: GemsGun via X

Hyperliquid, on the other hand, leads in fees and still hasn’t been fully priced in as a top L1. With revenue metrics this strong and buyback support already active, HYPE might be laying the groundwork for a broader recovery.

Final Thoughts

HYPE is holding its ground strong. The consolidation along the $34 to $35 zone, which was once a hard ceiling, is now acting as support, showing the significant shift in sentiment. With higher lows continuing to form and price respecting key trend structures, participants are starting to treat this as more than just a short-term bounce. If the $36.80 to $37.40 range breaks cleanly, the path toward $38.50 and beyond could come into play quickly.

![Maker [MKR] holders adjust their positions – Will the support at $1,300 hold? Maker [MKR] holders adjust their positions – Will the support at $1,300 hold?](https://i2.wp.com/ambcrypto.com/wp-content/uploads/2025/03/MKR-1000x600.webp?w=380&resize=380,220&ssl=1)