Hyperliquid is holding key support after a breakout, with tightening supply, rising TVL, and bullish structure pointing toward a potential move higher.

After breaking through a key resistance level near $45, Hyperliquid is now holding steady in a clean retest zone, backed by bullish tokenomics and growing institutional interest. With TVL crossing $2 billion and open interest hitting fresh highs, market participants believe this setup could lead to another bullish rally on Hyperliquid.

Hyperliquid’s Tokenomics Leading To A Supply Squeeze

There’s growing attention on Hyperliquid, and not just for price action. The real story is under the hood, where a well-designed token economy is starting to show early signs of a supply squeeze. Institutions are actively getting into HYPE, and protocols built on top of Hyperliquid are also using their revenue to accumulate it.

Meanwhile, the Hyperliquid Assistance Fund is buying HYPE around the clock, providing consistent buy pressure. What makes this setup interesting is how many mechanisms are simultaneously removing supply from circulation:

- HYPE gas is burned

- A portion of trading fees is burned

- Staking demand for HIP3 proposals and governance

- 2.1% yield staking and potential hidden rewards

- Staked for network security

- DeFi protocols are using it for yield and liquidity provision

It’s an increasingly self-reinforcing cycle. Analyst Sakrexer believes, with supply steadily draining and multiple incentives keeping tokens locked or burned, HYPE might be setting up for a major supply squeeze.

Hyperliquid Retests Support With Breakout Setup in Play

Hyperliquid just completed a textbook breakout, followed by a clean retest. Crypto analyst Buddy’s chart shows that after pushing through a multi-week resistance around the $45 zone, the price is now coming back to validate that level as support. The structure is holding so far, and the low-volume pullback suggests there’s no aggressive selling behind it, just a reset. If this level holds, the next leg higher could extend toward the previous high near $53, followed by a potential push towards $62.

Hyperliquid retests the $45 breakout zone with a low-volume pullback, setting the stage for a potential move toward $53 and $62. Source: Buddy via X

This aligns with the supply squeeze narrative already playing out beneath the surface. When tokenomics point toward tightening supply and price action confirms breakout-retest dynamics, it strengthens the overall trend. If buyers step in soon, as the retest completes, HYPE Hyperliquid price could be set for a fresh leg upward.

HYPE Hyperliquid Price Eyes $50 And Beyond

Famous crypto analyst Gianluca is calling for HYPE to break $50 imminently, with a projected consolidation phase to follow. His outlook lines up well with the recent breakout and retest highlighted by Buddy. Technically, the chart is showing a solid reclaim of previous resistance, and if the current move clears $50 with conviction, it opens the door for a higher base to form. That kind of structure would allow bulls to reload without stretching risk, especially with strong tokenomics and reduced circulating supply acting as a potential trigger.

HYPE reclaims key resistance with eyes on a clean break above $50. Source: Gianluca via X

Hyperliquid TVL Hits $2B, Strengthening Price Momentum Narrative

On-Chain analyst, Tobias Reisner, points out a key metric that Hyperliquid L1 has now crossed $2 billion in total value locked (TVL), and that’s excluding the $3 billion currently sitting on HyperCore. That’s a major milestone for Hyperliquid. This $2B is native, on-chain value within the Hyperliquid L1 environment, a strong sign of momentum not just in trading, but in protocol usage and capital commitment.

Hyperliquid L1 crosses $2B in native TVL. Source: Tobias Reisner via X

Rising TVL combined with a tightening supply structure and strong revenue flow adds real weight to Hyperliquid price prediction. These are not just speculative moves; they’re backed by fundamental metrics that point toward sustained growth potential.

HYPE Price Analysis

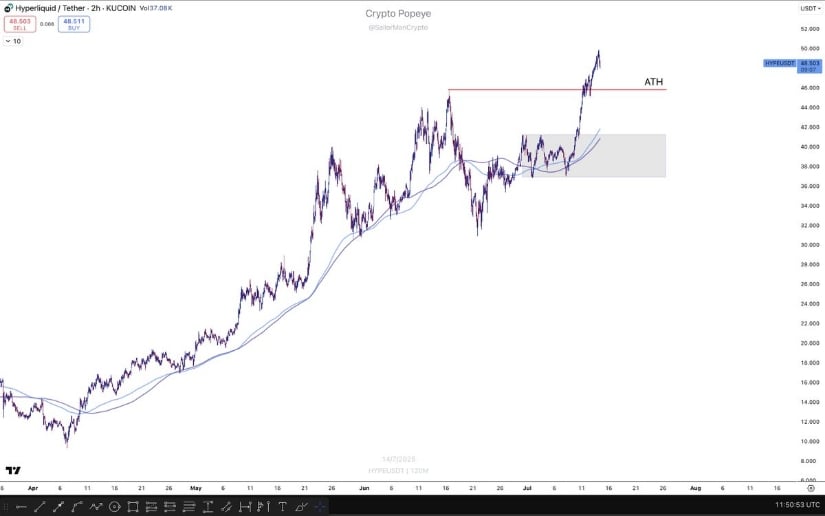

Crypto analyst Popeye points out that HYPE has officially broken above its previous all-time high on the 2H chart, a level it had respected previously. The move above the prior ATH now shifts focus to continuation within the broader uptrend structure, where the 2H trendline has consistently acted as dynamic support. If price continues to hold above the $46 to $44 zone and respects this trendline, it increases the probability of a grind higher toward the $56 to $60 region.

HYPE breaks above previous ATH on the 2H chart, with mid-term trendline support guiding potential targets toward $56 to $60. Source: Popeye via X

The key to watch now is whether HYPE continues to ride its mid-term trend support. So far, each test of that moving base has been followed by expansion. A breakdown below the $47.50 support area would be the first sign of weakness, but until then, trend continuation remains the bias.

Hyperliquid Open Interest Hits Cautious Levels

Open interest on Hyperliquid just hit another all-time high, topping $11.3 billion, marking two consecutive days of record-setting leverage activity, according to Hyperliquid Hub. This confirms surging trader participation and growing market confidence, especially following strong breakout structures and tightening tokenomics. But while elevated open interest can fuel momentum, it can also increase the chances of short-term volatility if positions become too crowded. With price action still in a strong structure and fundamentals aligned, this level of open interest is worth monitoring closely for signs of either continuation or flush.

Hyperliquid open interest hits record $11.3B, signaling strong participation but raising short-term volatility risks. Source: Hyperliquid Hub via X

Final Thoughts

HYPE is showing strong technical momentum after reclaiming the $45 zone and holding the $48 to $50 support range, with structure still pointing toward a possible move to $56 and $60. The breakout-retest pattern remains intact, and the rising trendline on the 2H chart continues to act as dynamic support. Combined with a deflationary token model, rising TVL, and record open interest, HYPE is building a case for trend continuation.