Cryptocurrency trading has grown fast over the past few years. More people are now looking for safe and easy platforms to buy, sell, and trade digital assets. With so many exchanges available, choosing the right one can be difficult. Traders want low fees, strong security, simple design, and fast transactions. Every exchange offers something different, so it’s important to compare key features before signing up.

This Phemex review will cover its trading features, fees, security, and more, helping you decide if it’s the right crypto exchange for your needs.

Phemex Exchange Review: Summary

| Founding Year | 2019 |

| Headquarters | Singapore (operating under Phemex Technology Pte. Ltd.) |

| User Base | 5 million users across 150 countries globally |

| Supported Cryptocurrencies | 470+ cryptocurrencies, including BTC, ETH, USDT, and SOL |

| Trading Products | spot trading, futures with 100x leverage, copy trading, staking, and P2P |

| Trading Fees | 0.1% maker/taker |

| Fiat Currency Support | 30+ fiat currencies like USD, EUR, BRL |

| Security Measures | Cold storage, 2FA, passkeys, anti-phishing codes, proof of reserves |

| Restricted Countries | US, UK, Canada, China, and others |

| Customer Support | 24/7 live chat, email, and Help Center; no phone support |

What Is Phemex?

Phemex is a cryptocurrency exchange based in Singapore that launched in 2019. The platform allows you to buy, sell, and trade digital currencies like Bitcoin, Ethereum, and more than 470 others. It serves more than 5 million users across 150 countries.

The exchange is known for its fast and reliable trading system. Phemex processes up to 300,000 transactions per second with minimal delays. The platform supports spot trading and futures trading with up to 100x leverage. Phemex charges low fees: 0.1% for spot trading and 0.01% to 0.06% for futures, which is quite competitive compared to other exchanges.

Phemex is a user-friendly platform with a mobile app for trading and a demo account for practicing without real money. It also offers tools like copy trading and staking options to earn a passive income. The exchange supports deposits in 30+ fiat currencies, including USD and EUR, but it’s unavailable in some regions like the US and UK due to regulations. If you are a new user, you can use our Phemex referral code FR72P8 to get a $4,800 sign-up bonus.

Pros

- Handles up to 300,000 transactions per second for fast trading

- Charges low fees, starting at just 0.1% for spot trading

- Supports over 470 cryptocurrencies and offers diverse trading opportunities

- Prioritizes security with cold storage wallets and two-factor authentication

- Provides a user-friendly mobile app for convenient on-the-go trading

- Offers a demo account to practice trading without financial risk

Cons

- Unavailable in the US and UK due to strict regulatory restrictions

- Customer support may respond slowly during high-traffic periods

- Lacks licensing in some regions, creating potential regulatory risks

Phemex Exchange Key Features

Phemex Spot Trading

Spot trading on Phemex allows users to buy and sell cryptocurrencies instantly at current market prices. Traders own the actual digital assets, like Bitcoin or Ethereum, unlike futures trading, where contracts are exchanged.

The platform supports over 470 cryptocurrencies and offers trading pairs such as BTC/USDT, ETH/USDT, and smaller altcoins. You can trade with as little as $1, making it accessible for beginners and experienced traders alike. The interface is straightforward, with real-time price charts and order types like market, limit, and conditional orders for precise trading strategies.

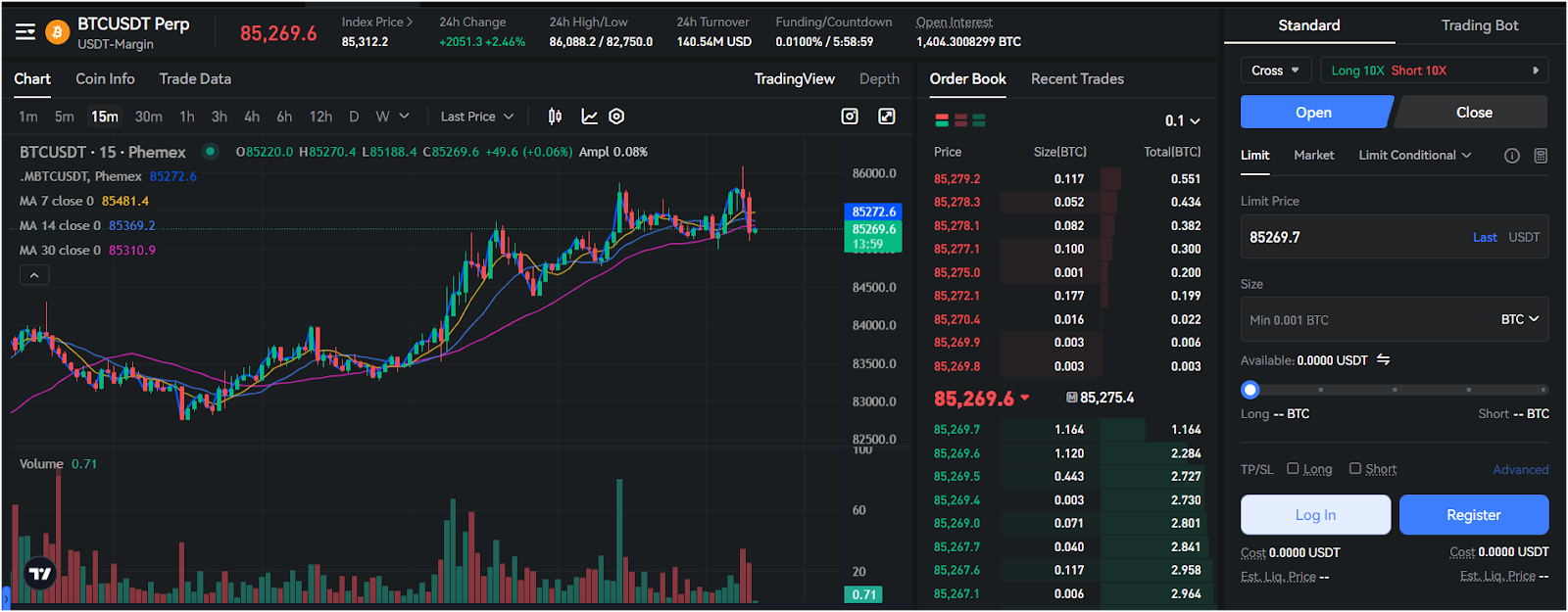

Phemex Derivatives Trading

Phemex offers the best platform for derivatives trading. You can trade both USD-margined and coin-margined contracts. These contracts are also called futures contracts. You do not need to own the asset to trade it. Phemex supports popular perpetual contracts like BTC/USDT, ETH/USDT, and many others, and you can trade with up to 100x leverage.

There are two types of contracts on Phemex:

- USD-Margined Contracts (Linear Contracts): These are settled in USDT. You need to deposit USDT in your contract trading account. These are easier to use and understand.

- Coin-Margined Contracts (Inverse Contracts): These are settled in the base coin like BTC or ETH. You need to deposit the same coin to trade. These are better if you want to grow your crypto holdings.

You can use different order types like limit, market, conditional, and stop orders. This helps you manage risk. Phemex also offers tools like take-profit, stop-loss, and trailing stop features. These tools help you control your losses. The platform uses Isolated and Cross Margin modes. Isolated margin limits risk to one trade, and cross margin uses all your funds to prevent liquidation. As discussed above, Phemex also gives a demo account for practicing futures trading with leverage. You can test your strategies without using real money.

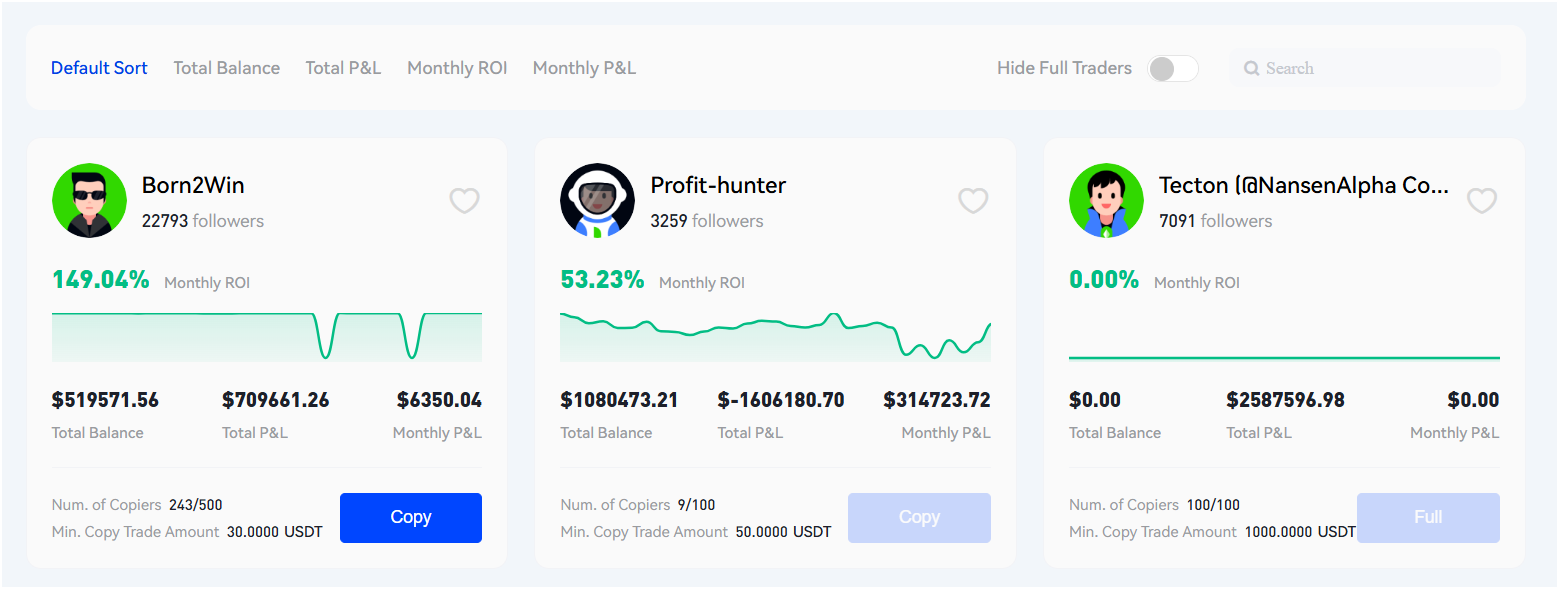

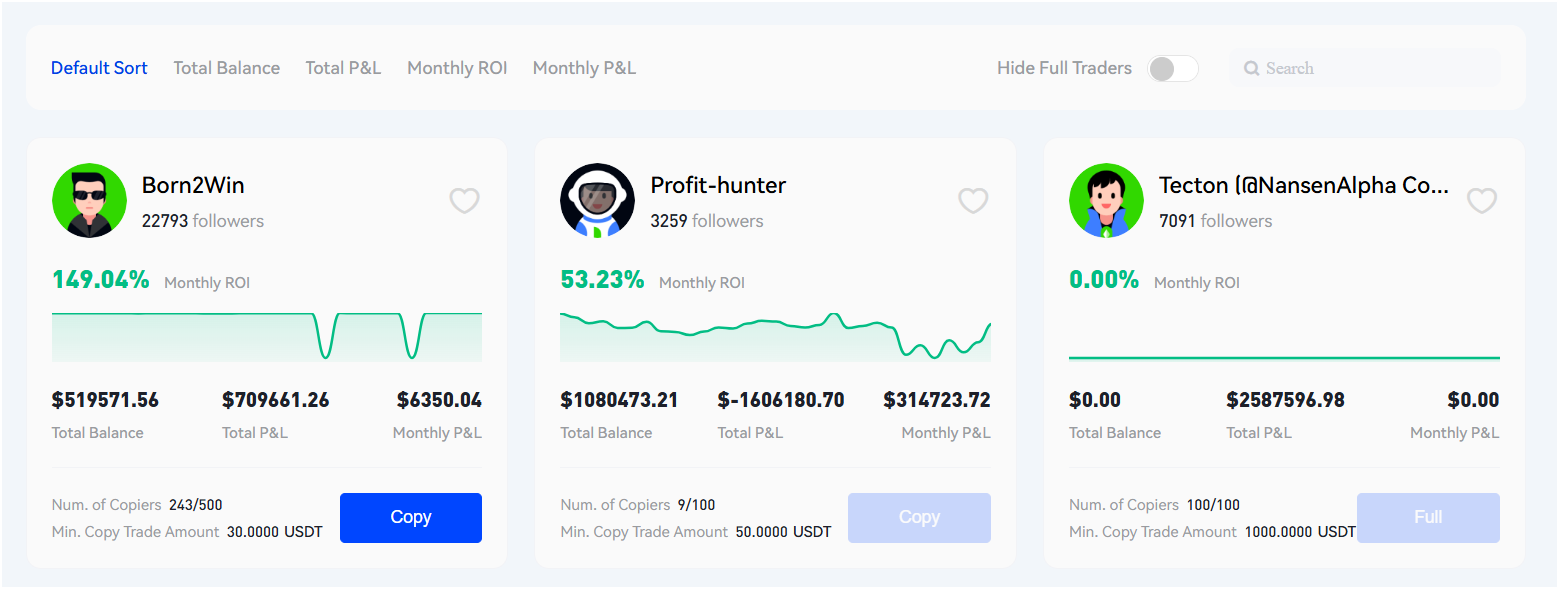

Phemex Copy Trading

Phemex offers a feature called Copy Trading in the futures contracts market. This allows you to automatically copy the trades of experienced traders, known as Top Traders. It is useful if you are new to trading or want to follow the strategies of skilled traders.

Phemex supports copy trading for over 70 USDT-margined perpetual contracts, including major coins like Bitcoin, Ethereum, and altcoins like DOGE and SOL. No extra transaction fees apply beyond standard trading fees. Top Traders earn a profit share, typically up to 20%, calculated periodically based on copiers’ net profits.

The platform displays each trader’s credentials, including their profit and loss (PNL), return on investment (ROI), and winning rate over periods like 30 or 90 days. You can choose to follow a trader for notifications on their moves or copy their trades directly. Copying requires setting parameters like trading pairs (e.g., BTC/USDT), maximum investment, and leverage, with a minimum copy amount of 50 USDT. Funds must be deposited into a dedicated copy trading account.

Sub-Accounts and API

Phemex sub-accounts enable you to have individual accounts under your primary account for structured trading. You can handle various strategies, portfolios, or risk levels without combining funds. Every sub-account has its own wallet and trading authority, but the primary account governs funding.

Phemex offers API access for automated trading and account management. You can generate API keys to programatically interact with your account. For instance, you can use popular crypto trading bots such as 3Commas and Cryptohopper to trade on Phemex via API.

The API uses REST and WebSocket protocols for real-time market data, order sending, and account management. Spot and contract trading APIs can support up to 5,000 requests per minute, with greater limits for VIP or institutional users, and no additional fees are charged for API usage, only regular trading fees.

Phemex Launchpad

The Phemex Launchpad offers you a chance to buy new cryptocurrencies at a set price before they hit the spot market. You can invest in promising projects early, potentially benefiting from future price increases. The process involves holding PT (Phemex native token) in your spot wallet.

The Launchpad operates in different stages. First, the Calculation Period tracks your daily average PT balance in your spot wallet and investment account over a set time. The Allocation Period follows, where Phemex calculates token distribution based on your committed PT, capped by each project’s maximum allocation.

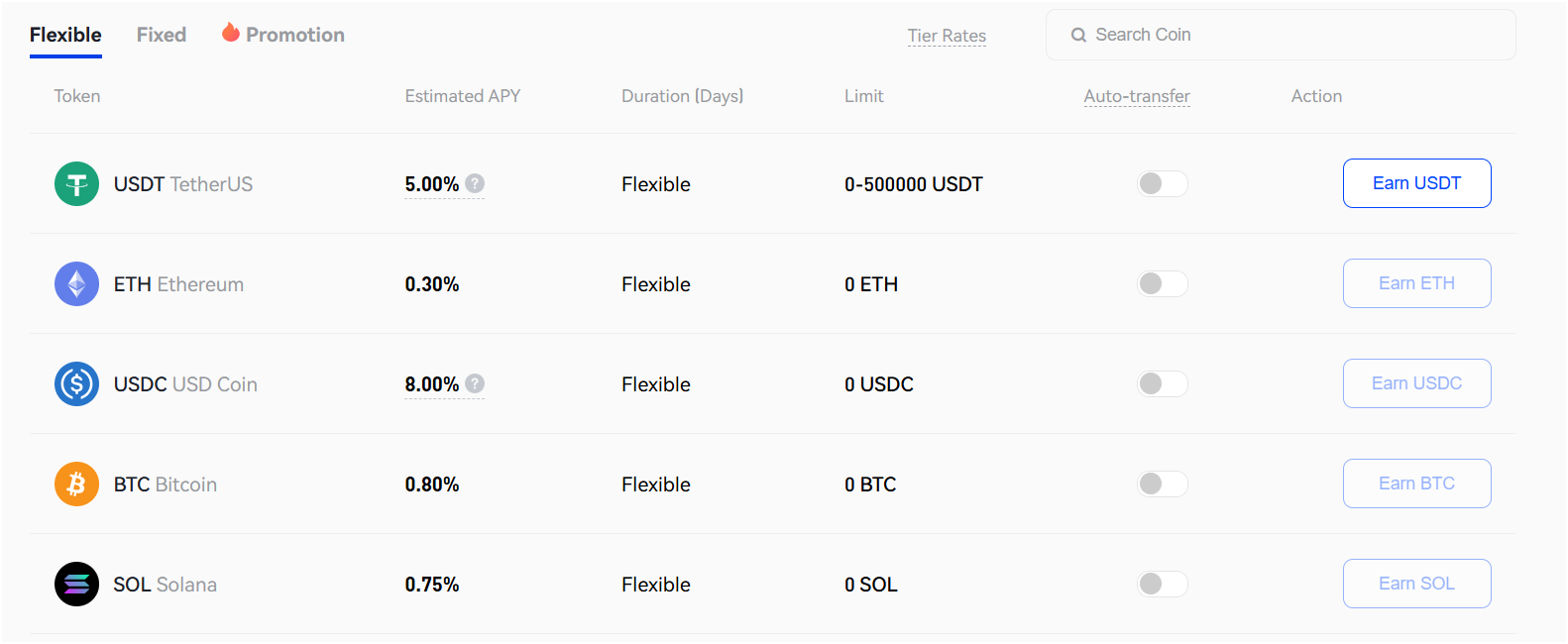

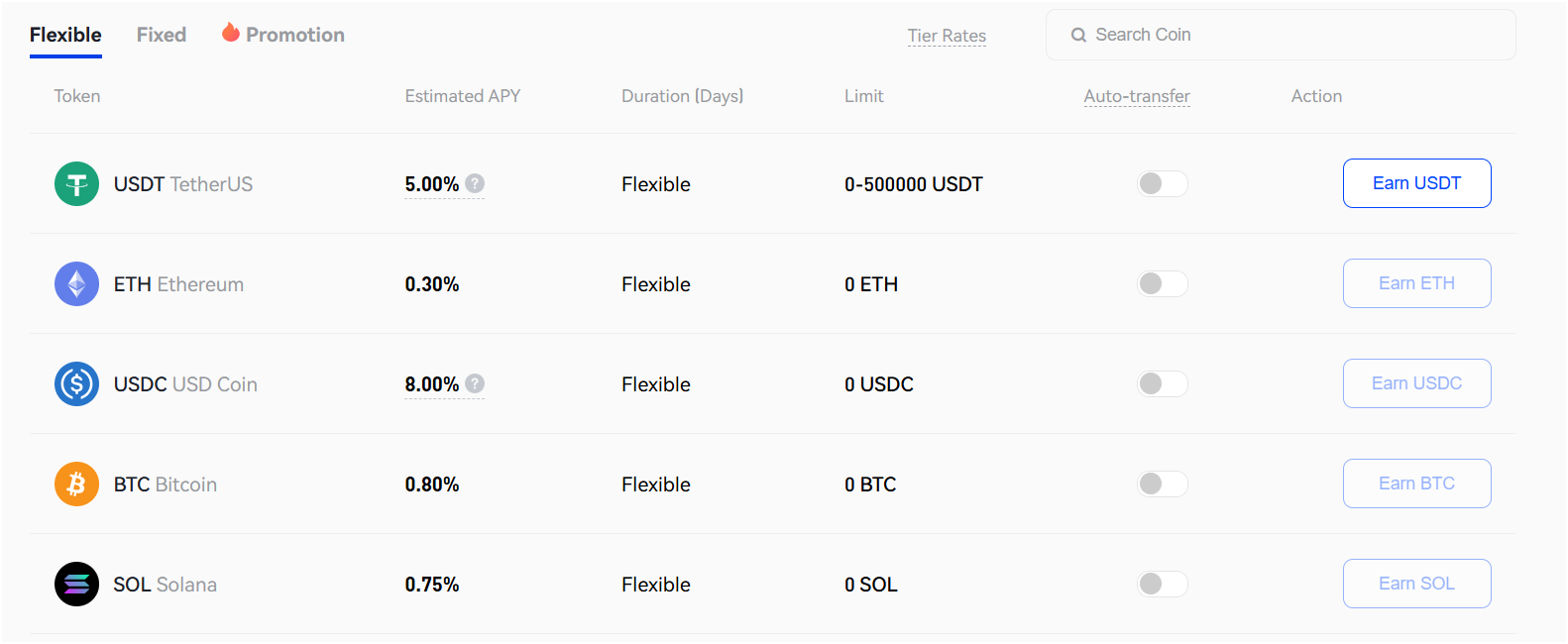

Phemex Earn

Phemex Earn provides a way for you to generate passive income by depositing cryptocurrencies into savings accounts. You can deposit assets like USDT, BTC, ETH, and SOL into two types of savings accounts: Flexible Savings and Fixed Savings.

- Flexible Savings lets you withdraw your funds anytime, offering daily profit distribution and immediate access to your assets. It has a lower APY compared to fixed-term staking.

- Fixed Savings requires you to lock your funds for a set period, either 7 or 14 days, with profits distributed at the end of the term.

For Flexible Savings, you earn daily interest credited to your account, which you can reinvest or withdraw. For Fixed Savings, you receive the principal and interest upon maturity, with no early withdrawal option.

Phemex Earn works like a lending and borrowing market. When you supply your crypto, Phemex adds it to a shared pool. Other users can borrow from this pool. In return, they pay interest. That interest is shared among all lenders based on their share in the pool.

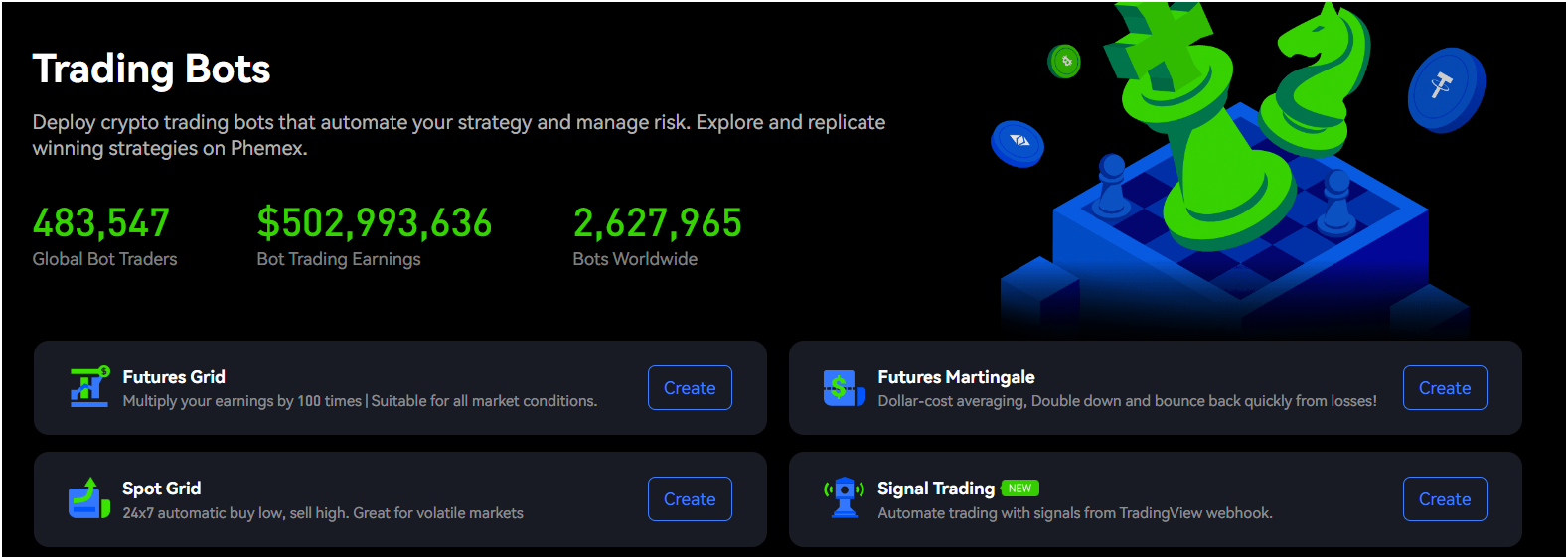

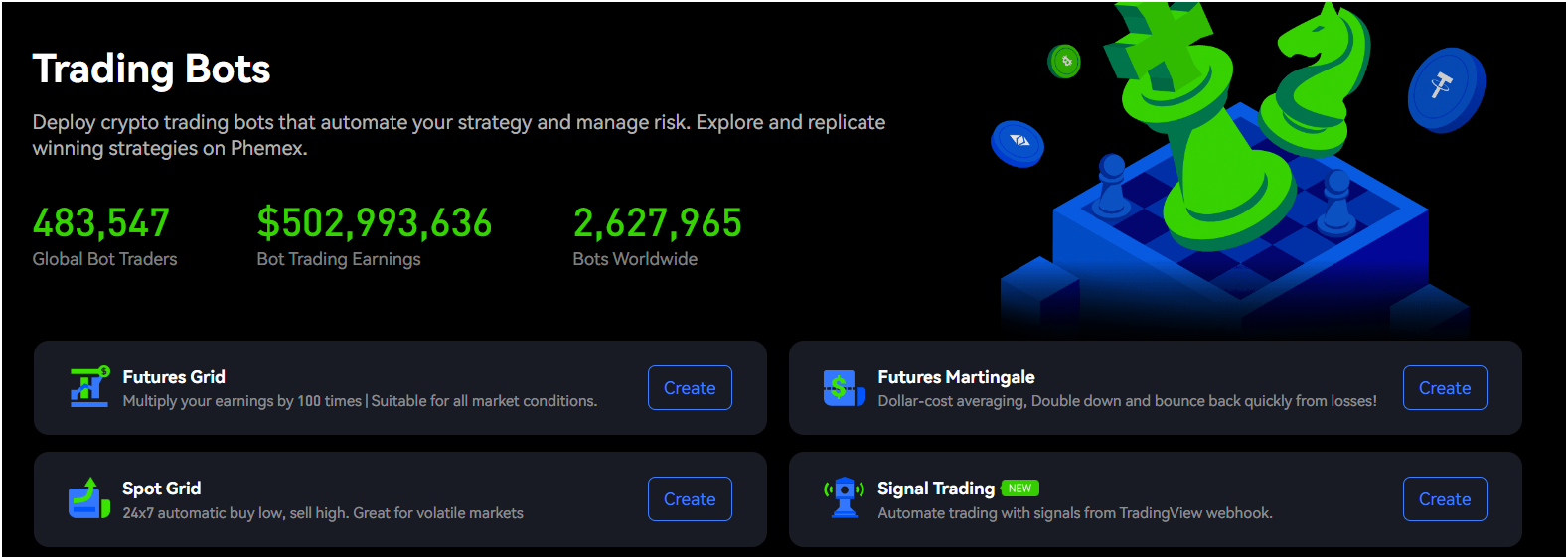

Trading Bots

Phemex Trading Bots are automated tools that help you trade without manual effort. These bots follow preset strategies to buy and sell crypto based on market conditions. Phemex offers three types of bot trading: spot and futures grid trading, futures martingale, and signal trading.

- Spot and Futures Grid Trading: Phemex’s Grid Trading Bots automate buying and selling at preset price intervals within a defined range. This strategy is effective in sideways markets. For futures, it supports USDT-margined perpetual contracts with up to 20x leverage, requiring at least 50 USDT, and you can choose long, short, or neutral strategies.

- Martingale Strategy: The Martingale bot on Phemex is designed to manage risk by adjusting trade sizes. When a trade results in a loss, the bot increases the position size in the next trade, aiming to recover losses and gain profit when the market reverses.

- Signal Trading: Signal Trading on Phemex lets you automate trades using TradingView webhook signals for precise execution. You connect your Phemex account to TradingView, set triggers like buy or sell based on technical indicators, and the bot executes them on spot or futures markets.

Phemex Web3 Ecosystem

The Phemex Web3 Ecosystem, known as Phemexia, blends centralized and decentralized finance to create a transparent, community-driven platform. You can participate by minting a Phemex Soul Pass (PSP).

Phemexia includes PhemexPulse, a SocialFi platform, where you can share trading insights, engage with others, and earn up to 270 points daily (convertible to PT) through activities like messaging, trading, or referrals. Phemex Lending Protocol, another key feature, lets you supply liquidity or borrow assets like USDT, with vePT holders enjoying a 30% discount on borrowing rates.

Phemex P2P

Phemex’s Peer-to-Peer (P2P) trading service enables you to buy and sell cryptocurrencies directly with other users using local fiat currencies.

- Fiat Currencies Supported: Over 30 fiat currencies, including USD, EUR, BRL, and RUB, depending on Ascertain availability by country or region.

- Trading Fee: 0% for P2P transactions, though payment providers may charge external fees.

- Multiple Payment Methods: The platform supports over 15 payment methods, such as PayPal, Apple Pay, and various bank transfers.

- Transaction Time Limit: You must complete payments within the seller’s specified time, often 15–30 minutes.

- Supported Cryptocurrencies: Includes major coins like BTC, ETH, USDT, and others, with no fixed limit on pairs.

Phemex Learn & Earn

The Phemex Learn & Earn program rewards you for learning about cryptocurrencies and blockchain through engaging educational content.

You need to watch short videos or read lessons on topics like fiat vs. cryptocurrency, trading basics, and platform features, then complete quizzes to test your understanding. Upon passing, you earn trading bonuses, typically $2 per lesson, credited as USD to your Phemex account for investing in any cryptocurrency.

Phemex Fees

Phemex Trading Fees

For spot trading, Phemex charges both makers and takers a base fee of 0.1%. However, users can benefit from reduced fees through the VIP program, which is determined by the user’s 30-day trading volume or asset balance. You can also get a 20% discount with PT tokens.

The fee structure is as follows:

| VIP Level | Last 30d spot trading vol. (USD) | Maker Fee | Taker Fee |

| VIP 0 | [0.0000,800.00K) | 0.1000% | 0.1000% |

| VIP 1 | [800.00K,1.80M) & API ≤ 20% | 0.0900% | 0.1000% |

| VIP 2 | [1.80M,2.50M) & API ≤ 20% | 0.0500% | 0.0700% |

| VIP 3 | [2.50M,4.50M) & API ≤ 20% | 0.0450% | 0.0650% |

| VIP 4 | [4.50M,8.00M) & API ≤ 20% | 0.0400% | 0.0600% |

| VIP 5 | [8.00M,15.00M) & API ≤ 20% | 0.0350% | 0.0550% |

In contract trading, Phemex distinguishes between market makers and takers. Makers, who add liquidity to the order book, are charged a lower fee compared to takers, who remove liquidity. The base contract trading fee is 0.01% for the maker and 0.06% for the taker. You can also get a 10% fee discount when paying with PT.

Phemex Deposit and Withdrawal Fees

Depositing cryptocurrencies into your Phemex account is free of charge. However, when withdrawing cryptocurrencies, fees are applied based on the specific asset and the network used. For example:

- Bitcoin (BTC): The Withdrawal fee is 0.00004 BTC with a minimum withdrawal amount of 0.0002 BTC

- Ethereum (ETH): The Withdrawal fee is 0.005 ETH with a minimum withdrawal amount of 0.002 ETH

- Tether (USDT): On the ERC-20 network, the withdrawal fee is 10 USDT with a minimum withdrawal of 20 USDT; on the TRC-20 network, the fee is 1 USDT with a minimum withdrawal of 10 USDT.

Phemex supports fiat transactions through various methods, including SWIFT, SEPA, and FPS, in currencies such as USD, EUR, GBP, CHF, AUD, and JPY. Fiat deposits are free of charge.

For fiat withdrawals, fees are calculated based on the withdrawal amount and method. For instance, withdrawing $50–$499 via SWIFT incurs a 2% fee plus a $30 flat fee. SEPA and FPS withdrawals have similar fee structures, with additional flat fees in EUR or GBP, respectively.

Phemex Supported Cryptocurrencies

Phemex supports over 470 cryptocurrencies for trading, covering major coins and altcoins. You can trade popular assets like Bitcoin (BTC), Ethereum (ETH), Tether (USDT), and Solana (SOL) alongside emerging tokens such as Dogecoin (DOGE) and Chainlink (LINK).

The platform offers more than 500 trading pairs, including spot pairs with up to 5x leverage and 140+ USDT-margined perpetual contracts. New coins are added regularly based on market demand and project credibility.

Phemex Native Token (PT)

The Phemex Token (PT) is an ERC-20 utility token with a total supply of 1 billion. You can stake PT to earn vePT, granting voting rights in the Phemex DAO for platform governance.

PT offers trading fee discounts, staking yields up to 1,000% APR, and access to Launchpad and Launchpool. You acquire PT through trading rewards, pre-mining as xPT with a Soul Pass, or open market purchases.

Fiat Currency Support

Phemex supports over 30 fiat currencies for buying crypto, including USD, EUR, BRL, RUB, and INR. You can deposit fiat via credit/debit cards, bank transfers, SEPA, Apple Pay, or Google Pay through third-party providers like Banxa or MoonPay.

Phemex Payment Method

Phemex supports 15+ payment methods for buying and selling cryptocurrencies. You can use over 30 fiat currencies and multiple local payment options, depending on your country. These include credit and debit cards, bank transfers, and various third-party providers.

Phemex also offers P2P trading, which allows you to buy crypto directly from other users using popular local payment channels like PayPal, Apple Pay, Wise, and more. The platform partners with trusted fiat gateways such as Banxa, Mercuryo, and Simplex to process card payments securely. Payment processing times depend on the method you choose. Card payments are usually instant, while bank transfers may take longer.

Is Phemex Regulated?

No, Phemex is not regulated by major financial authorities such as the U.S. Securities and Exchange Commission (SEC), the UK’s Financial Conduct Authority (FCA), or the European Securities and Markets Authority (ESMA).

In fact, the FCA has explicitly warned that Phemex is not authorized to offer financial services in the UK and advises consumers to avoid dealing with the platform. Similarly, Phemex lacks regulatory approval in the United States.

However, Phemex holds a license in Lithuania under Phemex Lithuania UAB, regulated by the Lithuanian Securities Commission for certain services. However, it is not fully licensed by major authorities like the U.S. SEC, EU’s ESMA, or Singapore’s MAS, leading to restrictions in some regions.

Phemex Restricted Countries

Phemex restricts access in several countries due to local regulations and compliance requirements. Prohibited jurisdictions include the United States, the United Kingdom, Canada, Afghanistan, China, Iran, North Korea, Palestine, Russia, Yemen, and more.

Security Measures: How Secure Is Phemex?

Phemex employs multiple security measures to protect user accounts and funds. These include Two-Factor Authentication (2FA), Passkeys, Anti-Phishing Codes, Withdrawal Address Whitelisting, Cold Wallet Storage, a Risk Control System, a Secure Trading Engine, and Proof of Reserves.

- Two-factor authentication (2FA): Phemex requires 2FA for all critical actions like login, withdrawals, and password changes.

- Passkeys: Passkeys allow for password-free logins using biometric authentication, such as fingerprints or facial recognition. This method enhances security by eliminating the need for passwords, which, of course, can be compromised.

- Anti-Phishing Codes: Phemex lets you set a custom anti-phishing code that appears in all legitimate emails from the platform. This helps you verify the authenticity of emails and avoid phishing scams.

- Withdrawal Address Whitelisting: You can whitelist specific wallet addresses for withdrawals, ensuring that funds can only be sent to these approved addresses. This feature prevents unauthorized withdrawals to unknown addresses. Additionally, a time lock can be set by you for newly added addresses to delay withdrawals.

- Cold Wallet Storage: The majority of user funds are stored in cold wallets, which are not connected to the internet. This reduces the risk of online hacks. Cold wallets are secured with multi-signature protocols.

- Risk Control System: Phemex employs a risk control system that monitors accounts for suspicious activities, such as unusual withdrawal patterns or high-risk asset transfers. If an account is flagged, actions like freezing withdrawals or requiring additional verification may be taken to protect user funds.

- Secure Trading Engine: The platform’s trading engine is built with high-performance technology to handle large volumes of transactions efficiently. It includes real-time risk checks to ensure the integrity of trades and account balances.

- Proof of Reserves: Phemex provides Proof of Reserves to demonstrate that user funds are fully backed and available. This transparency allows users to verify that the platform holds sufficient assets to cover all customer balances. Regular audits are conducted to maintain trust and accountability.

Phemex KYC and Account Verification

Phemex requires all users to complete Know Your Customer (KYC) verification to access its services. The process involves submitting a government-issued ID and a selfie for identity confirmation. Phemex partners with Jumio, a reputable identity verification platform, to ensure the security of user information.

The withdrawal limits on Phemex are determined by the user’s KYC level. Users who complete Basic KYC verification have a daily withdrawal limit of USD 2,000. Those who complete Advanced KYC verification benefit from a significant increase in their daily withdrawal limit to USD 2 million.

Phemex User Interface & Experience

The Phemex trading interface is designed for simplicity and efficiency, catering to both beginners and advanced traders with seamless trading experience. You navigate a clean layout with dark-themed visuals, featuring white text on a black background for easy reading.

Real-time price charts powered by TradingView offer customizable indicators like Moving Averages and RSI, supporting technical analysis. You can access spot, futures, and copy trading seamlessly, with sub-accounts for flexible strategies. The platform handles 300,000 transactions per second, ensuring no lag during volatile markets.

However, some advanced trading tools may feel complex for novices, and the interface lacks extensive beginner guides.

Phemex Mobile App

The Phemex mobile app, available on iOS and Android, delivers a streamlined trading experience with a 4.5/5 rating on App Store and 4.6/5 on Google Play.

You can trade over 470 cryptocurrencies, monitor portfolios, and set price alerts using a user-friendly interface with TradingView charts. The app supports spot and futures trading, though it lacks some desktop features like Pivot Point indicators.

Phemex vs Other Crypto Exchanges

The best alternatives to the Phemex crypto exchange are Bybit, Coinbase, and Binance. Here is a quick comparison:

| Phemex | Bybit | Coinbase | Binance | |

| Founded | 2019 | 2018 | 2012 | 2017 |

| Trading Products | Spot, Futures, Copy Trading | Spot, Futures, Options, Copy Trading, NFTs | Spot, Derivatives (limited only) | Spot, Futures, Options, Leveraged Tokens, NFTs, Margin Trading |

| Supported Cryptocurrencies | 470+ | 1600+ | 250+ | 400+ |

| Maximum Leverage | Up to 100x | Up to 100x | Up to 10X | Up to 125x |

| Spot Trading Fees | Maker: 0.1%, Taker: 0.1% | Maker: 0.1%, Taker: 0.1% | Maker: 0.4%, Taker: 0.6% | Maker: 0.1%, Taker: 0.1% (discounts with BNB) |

| Mobile App | Yes | Yes | Yes | Yes |

| User Interface | Simple and user-friendly | Advanced features with a user-friendly interface | Beginner-friendly | Advanced features with a user-friendly interface |

How to Trade Crypto & Bitcoin on Phemex?

- Create a Phemex Account: To start trading on Phemex, you first need to create an account. Go to the official website and sign up using your email address. Once registered, complete the KYC verification by uploading a government-issued ID and a selfie.

- Deposit Funds: After your account is verified, you need to deposit funds. You can do this by going to the “Wallets” section and selecting “Deposit”. You can deposit either cryptocurrency or fiat money by following the steps shown on the screen.

- Choose Trading Market: Next, go to the “Markets” page and choose the trading pair you want to trade. You can select between spot trading, which involves buying and selling crypto directly, or contract trading, which allows you to trade with leverage.

- Place an Order: To place a trade, select the trading pair, choose the order type (like market or limit), enter the amount, and then click to confirm your trade. Once placed, you can see your active trades and manage them from the “Orders” section. You can use stop-loss and take-profit settings to manage your risks.

How to Deposit and Withdraw on Phemex?

To deposit funds into your Phemex account, first log in and go to the “Wallets” section. Click on the “Deposit” button to start. Choose the currency you want to deposit. For crypto, copy the wallet address given by Phemex and paste it into the withdrawal field of your external wallet. For fiat currency, follow the bank transfer steps provided on the screen.

To withdraw, go back to the same section and click on “Withdraw”. Select the asset you want to withdraw. If you are withdrawing crypto, enter the recipient’s wallet address and choose the network. For fiat withdrawals, you need to fill in your bank account details.

Phemex Customer Support

Phemex provides customer support through multiple channels to assist you with trading, account issues, and technical queries. You can access 24/7 live chat on their website for real-time help, with typical response times under 5 minutes.

Email support is available, addressing complex issues like deposits or withdrawals within 24–48 hours. The Help Center offers guides and FAQs on topics like KYC verification and futures trading, though it lacks phone support.

Conclusion: Is Phemex the Right Exchange for You?

To conclude our Phemex review, it stands as a robust cryptocurrency exchange, launched in 2019 in Singapore, serving over 5 million users globally. You can trade more than 470 cryptocurrencies with low fees and across spot, futures, and P2P markets.

The platform excels with fast execution, processing 300,000 transactions per second, and offers features like copy trading, staking, and a Web3 ecosystem with the Phemex Token (PT). However, it’s unregulated in many regions and restricted in countries like the US, requiring you to check local laws. Overall, Phemex balances speed, variety, and innovation, but you should weigh its regulatory status before diving in.

FAQs

Is Phemex Legal in the US?

Phemex is not legal for use in the United States. The platform restricts U.S. residents due to stringent regulations on cryptocurrency exchanges, particularly for derivatives trading. Phemex operates without a U.S. license and isn’t authorized by bodies like the SEC or CFTC.

Does Phemex Require KYC?

Phemex requires KYC for certain features but not for basic trading. You must complete KYC to deposit fiat, buy crypto via third-party services, or withdraw over $2M daily. Basic trading and crypto deposits don’t need verification, appealing to privacy-focused users.

Can You Withdraw From Phemex?

You can withdraw cryptocurrencies from Phemex, but fiat withdrawals are limited in certain regions. The platform supports withdrawals of over 470 coins, like BTC and USDT, with fees varying by network. KYC-verified users enjoy higher limits (up to $2 million daily).

Is Phemex Legit?

Phemex is a legitimate cryptocurrency exchange with a strong reputation. Founded in 2019, it serves over 5 million users globally, offering secure trading with cold wallet storage and proof of reserves. It offers a range of trading options, including spot and futures trading. However, its unregulated status in some regions requires caution.

Where Is Phemex Located?

Phemex is headquartered in Singapore. The exchange, officially operated by Phemex Technology Pte. Ltd., leverages Singapore’s fintech-friendly environment for low-latency trading.