Newton Protocol (NEWT), a project within the Sui ecosystem, has been officially announced as part of the Binance HODLer Airdrops Program and is expected to launch in the near future.

Currently, the NEWT token has already been listed on the perpetual markets of several major exchanges. So, what is the price prediction for NEWT once it officially debuts on the spot market? Let’s explore further in this article.

Newton Protocol (NEWT): Powering the Era of Verifiable On-Chain Automation

Newton Protocol (NEWT) is a cutting-edge decentralized infrastructure layer transforming how automation operates in Web3. Its core mission is to establish the verifiable automation layer for on-chain finance, enabling users to safely delegate complex, cross-chain financial actions to AI agents while maintaining full cryptographic control and transparency.

Traditional on-chain automation often relies on centralized bots, which suffer from critical flaws: lack of transparency, trust issues, and single points of failure. Newton Protocol directly addresses these by bringing the entire automation process on-chain and making it cryptographically verifiable.

Learn more: Newton Protocol (NEWT) will be Listed on Binance HODLer Airdrops

Newton Core Features and Technological Highlights

The project stands out by building a verifiable automation layer for on-chain finance, fundamentally changing how AI agents operate in Web3. Unlike traditional methods that rely on centralized bots, Newton brings the entire automation process on-chain with cryptographic guarantees.

Its core features include:

- Verifiable Automation through TEEs and ZKPs: AI agents execute tasks within secure hardware enclaves (Trusted Execution Environments). For every action, a Zero-Knowledge Proof is generated and posted on-chain, proving the action’s correctness without revealing sensitive data. This eliminates the need for blind trust.

- zkPermissions: Users define precise, programmable rules using ZKPs, ensuring agents only act within pre-approved parameters like price limits or risk thresholds, maintaining user sovereignty.

- Keystore Rollup: This multi-chain validity rollup securely manages cross-chain session keys, allowing agents to operate seamlessly across various blockchains (e.g., Ethereum, BNB Chain) while users retain full asset control.

- Modular Agent Architecture: The protocol supports an open marketplace for developers, operators, users, and validators, fostering innovation in AI-driven financial strategies and dApps.

Newton Protocol ensures automation is transparent, secure, and fully verifiable, driving a new era of trust-minimized agentic finance.

NEWT Tokenomics

The NEWT token is the native utility and governance token powering the Newton Protocol ecosystem. Its design emphasizes protocol security, decentralized operation, and long-term sustainability.

- Token Standard: NEWT is an ERC-20 token, launched on both Ethereum and BNB Chain.

- Total Supply: fixed at 1,000,000,000 tokens. Crucially, there are no inflationary mechanisms (no new tokens minted) post-launch, ensuring a stable supply.

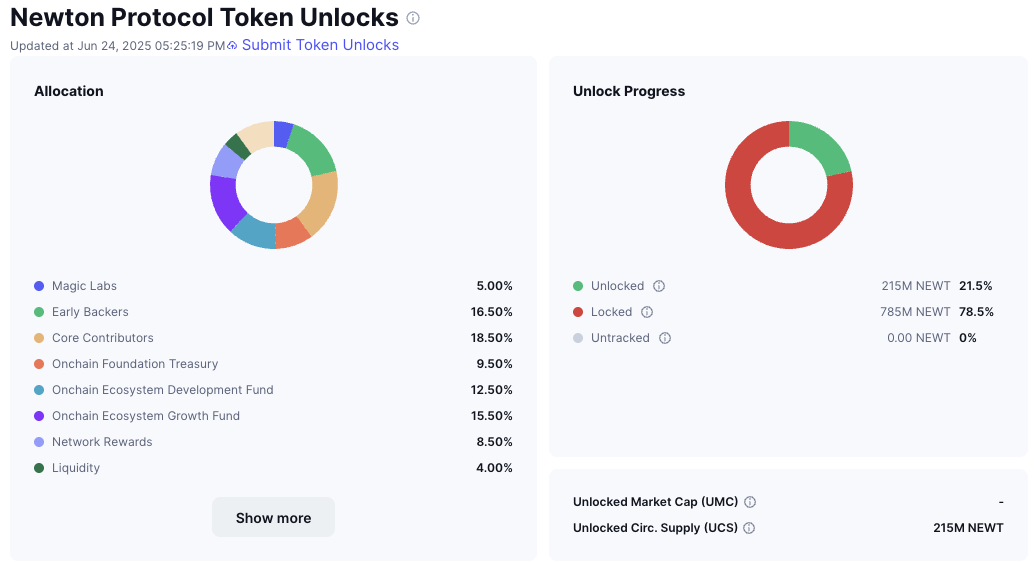

- Circulating Supply: At its listing on major exchanges like Binance (June 24, 2025), the initial circulating supply was 215,000,000 NEWT (21.5% of the total supply).

- Utility & Functions:

- Protocol Security (Staking): NEWT enables network participants to secure the Newton Keystore Rollup through a delegated Proof-of-Stake (DPoS) consensus mechanism. Token holders can delegate their NEWT to validators who execute and verify agent tasks, finalize cross-chain state changes, and earn protocol rewards.

- Transaction Fees & Permission Management: NEWT is used to pay fees to operators and validators for executing and verifying automation tasks. It also facilitates the management of on-chain permissions.

- Agent Model Registry & Service Collateral: Developers or operators seeking to offer automation agents on the marketplace may need to stake NEWT as collateral, ensuring good behavior and service reliability.

- Governance: NEWT holders have governance rights, allowing them to vote on proposals that shape the protocol’s future direction, upgrades, and parameters, fostering a decentralized and community-driven ecosystem.

- Airdrop and Community Rewards: Approximately 10% of the total supply (100 million NEWT) was allocated for initial airdrops and community rewards, fully unlocked at launch to foster early adoption and distribution. Additional tokens (e.g., 12.5 million NEWT) were also earmarked for marketing campaigns post-listing.

Source: Coinmarketcap

NEWT Price Prediction

At the time of writing, NEWT is trading at approximately 0.4506. Upon its official listing on 2025-06-24 at 14:00 (UTC), the token may experience a rapid decline to the range of 0.32–0.35, primarily due to selling pressure from the Binance Alpha Airdrop program. In a more severe scenario, its price could drop further to around 0.26.

Subsequently, the price may rebound to retest its previous peak in the range of 0.475–0.49 before potentially entering a new phase of significant downward correction.