Bitcoin critic Peter Schiff has acknowledged what he described as the “first real use case” for Bitcoin. Known for supporting gold over digital assets, Peter Schiff has repeatedly said that Bitcoin has no utility.

However, in a recent post on X, he pointed to a situation involving investment manager Jim Chanos as an example where Bitcoin may serve a practical role.

Peter Schiff Critiques Michael Saylor Bitcoin Buying Strategy

According to an X post, Bitcoin critic Peter Schiff remarked that Bitcoin might finally have a use — though not the one Bitcoin advocates promote. He referred to investor Jim Chanos, who recently disclosed that he purchased Bitcoin to hedge against his short position in MicroStrategy stock (MSTR).

Strategy, led by Executive Chairman Michael Saylor, has continued to increase its Bitcoin holdings. The company now owns nearly 570,000 BTC. This has led some market watchers to view MSTR as a proxy for Bitcoin with added corporate risk. Schiff mocked this strategy, stating that Saylor has “accidentally created a real use case for Bitcoin,” where investors use BTC to protect themselves from the risks tied to Saylor’s own firm.

Investment manager Chanos is known for shorting stocks of companies he considers to be overvalued or structurally weak. Like Peter Schiff, he reportedly sees MSTR as overleveraged due to its Bitcoin strategy. By owning Bitcoin while shorting MSTR, Chanos aims to limit his losses in case Bitcoin prices surge.

Chanos Bets Against MicroStrategy Valuation

In an X post, Chanos explained that investors are paying too much for each dollar of Bitcoin exposure through Strategy. According to his statement, MSTR stock is trading at a premium that far exceeds the actual value of its Bitcoin holdings. He argued,

“Investors are paying $3 of stock price to gain $1 of Bitcoin exposure.”

Chanos’s hedge strategy implies that while MSTR’s stock may fall due to overvaluation, the Bitcoin he holds could cushion those losses.

Strategy has also faced criticism for borrowing funds to buy Bitcoin. The company recently added 13,390 BTC for approximately $1.34 billion. Bitcoin critic Peter Schiff has echoed these concerns, saying that large BTC price drops could turn paper profits into real financial stress for Strategy.

Schiff argued that Strategy is no longer operating as a software company but as a Bitcoin-holding entity. He questioned the logic behind buying shares of a company whose main business activity is acquiring Bitcoin, rather than investing directly in Bitcoin or in companies with actual operating revenues. He said,

“If you want to buy Bitcoin, then buy Bitcoin. If you want to invest in the stock market, buy a company with an actual business.”

Despite this backlash, Pro-XRP lawyer John Deaton has praised Michael Saylor comparing his long-term Bitcoin strategy to that of Warren Buffett’s investment approach with Berkshire Hathaway. He stated that Saylor may be aiming to control up to 5% of the total Bitcoin supply in circulation despite the mockery.

MicroStrategy (MSTR) Stock Performance

MicroStrategy (MSTR) stock has gained nearly 40% in 2025, reflecting Bitcoin’s upward trend. However, Peter Schiff argues that this growth is tied more to Bitcoin price movement than to the company’s core business performance. This has led to concerns about sustainability if Bitcoin enters a correction phase.

However, the recent buys by firms like Metaplanet and Tether-backed company Twenty One Shares have boosted the optimism for Bitcoin price to breach the resistance to a new all-time high.

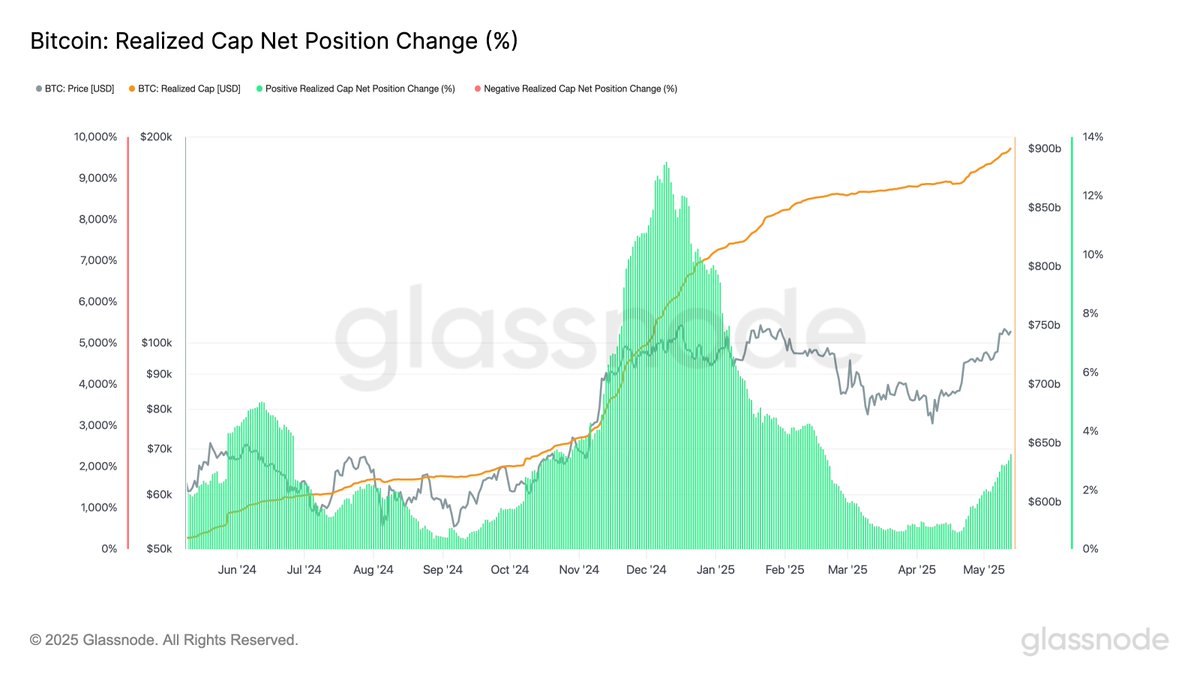

The broader Bitcoin market is currently in a price consolidation range between $100,678 and $105,700. Analysts forecast a potential breakout if the BTC price holds above key levels. Glassnode data shows Bitcoin’s realized cap has increased by $30 billion since April 20, suggesting new capital is entering the market which is a precursor to a bullish breakout.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

✓ Share: