As May draws to a close, the crypto market continues to exhibit mixed signals, with several top tokens—BNB, WLD, SHIB, TRUMP, TAO, NEAR, and TRX – hovering near critical technical levels. While some are attempting breakouts after weeks of consolidation, others are approaching key resistance or support zones that could define their short-term trajectories.

BNB Price Prediction

BNB is currently facing strong resistance at $696.47. A daily close above this level is needed to sustain the uptrend. Further resistance lies at $720.14 and $742.63.

If a daily candle wicks above these zones and RSI forms lower highs while price forms higher highs, this would signal a bearish divergence and potential trend reversal. Should the price fail to break above $696.47, BNB could drop to test support at $637.2.

A daily close below this support may lead to a further decline toward the previous bottom at $531.66, passing through intermediate levels at $619.24, $585.16, and $554.75.

Source: TradingView

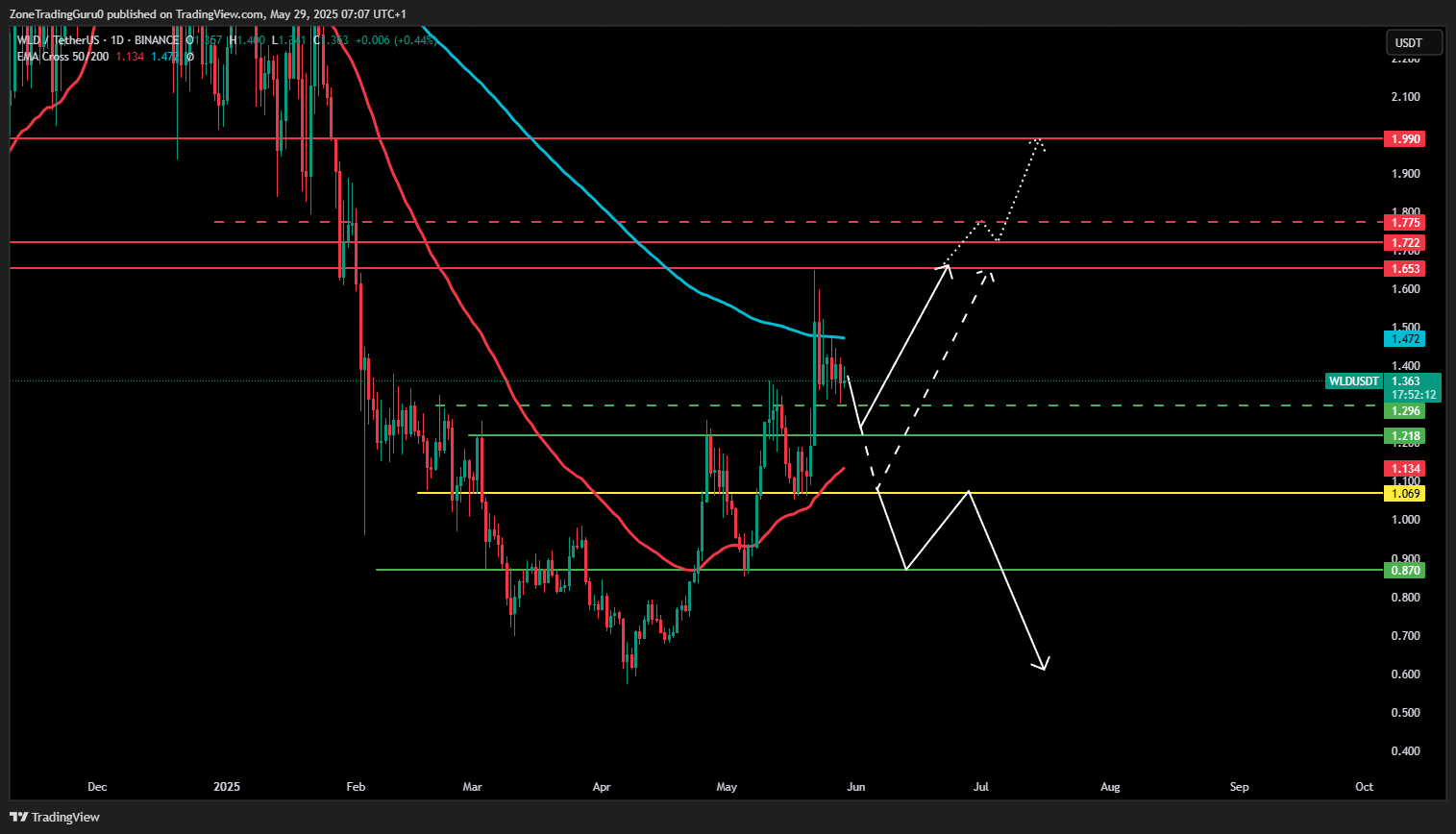

WLD Price Predicion

WLD has reacted strongly to the resistance at $1.653, triggering a corrective wave and testing minor support at $1.296. If the price continues to fall, the next supports are at $1.218 and $1.069.

The key level is $1.069, if breached on a daily close, the uptrend would likely be invalidated and the asset may revisit previous lows.

Conversely, a breakout above $1.653 would lead to the next resistance at $1.99. Notable intermediate resistances to watch are $1.722 and $1.775. A backtest of $1.653 could provide a swing long opportunity.

SHIB Price Predicion

SHIB is currently consolidating in a tight range between $0.00001478 and $0.00001384, also constrained by a descending trendline formed by two previous highs. A breakdown below this range could send the price to the strong support at $0.00001267, which may trigger a bounce back toward the resistance at $0.00001708.

A daily close below $0.00001267 would open the path to the previous low at $0.00001054. On the other hand, a breakout above the range top could send SHIB to $0.00001585, followed by a backtest and potential continuation toward $0.00001708.

If SHIB closes above $0.00001708, it could rally toward the next major resistance at $0.00002222–$0.0000228.

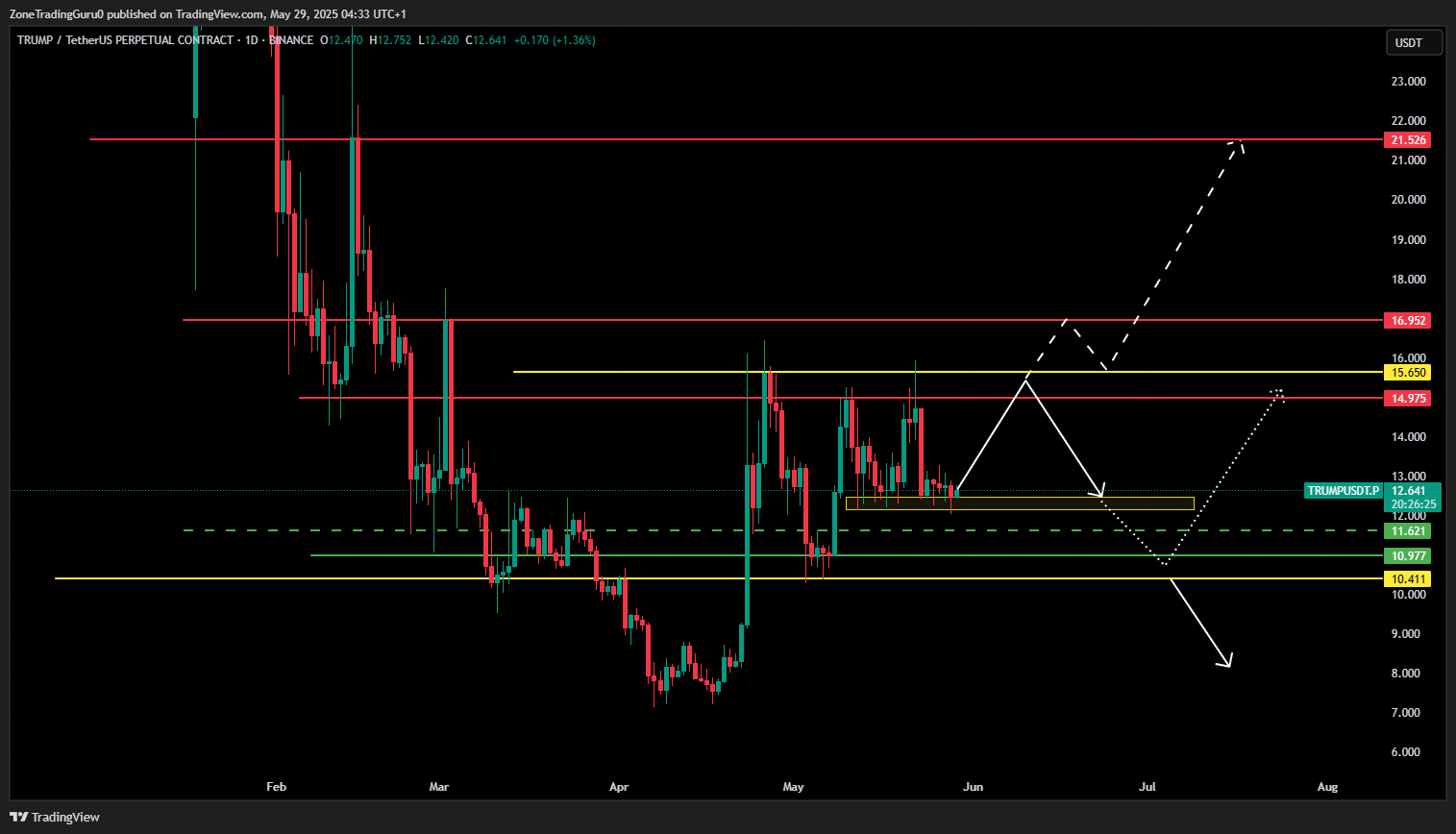

TRUMP Price Prediction

TRUMP is in a strong upward phase, but a breakout toward a potential 2x gain requires a confirmed move above the resistance zone of $14.975–$15.650. The key level is $15.65, and a daily candle closing above this threshold would confirm a long-term bullish trend with targets at $16.952, $21.526, $24.537, and $26.023.

Currently, TRUMP is consolidating near the minor support zone of $12.469–$12.151, which could be a temporary entry point. DCA zones lie at $11.621, $10.977, and $10.411.

The key support at $10.411 must hold; a daily close below this level would invalidate the bullish setup and could lead to a retest of the previous low.

TAO Price Prediction

TAO is currently trading sideways in a range between $490 and $389.3, with an intermediate support at $435. If the price breaks above $490, the next resistance is at $565, and the asset may range between $490 and $565 until a daily close above $565 confirms a move toward $713.

Conversely, if the price breaks below $389.3, it is likely to test $356.4. A confirmed breakdown may lead to deeper targets at $317.1, $272.3, and $230.2. The $230.2–$272.3 zone is considered a strong support, making it a favorable area for spot entries.

NEAR Price Predicion

NEAR is attempting a breakout from its long-term downtrend. However, a corrective move toward $2.285 is needed to establish a new higher low. Immediate support lies at $2.652.

A daily candle close above $3.355 would confirm the bullish reversal and open up upside potential to $3.568, $3.67, and possibly $4.033. A backtest of $3.355 could offer a long swing setup.

TRX Price Prediction

TRX has already rallied strongly to $0.45, making further steep upside moves less likely in the short term. After ranging between $0.2103 and $0.2611 for 140 days, TRX has broken above the upper boundary and is targeting resistance at $0.2971.

A potential wick above $0.3188 could trigger a sharp correction. If price closes below $0.2103, it could invalidate the breakout and trigger a decline to the next supports at $0.1667 and $0.1431.

A short swing position may be considered on a confirmed breakdown.

Conclusion

Most of the analyzed assets are in a consolidation or early breakout phase, indicating a period of indecision before potentially larger moves. Traders should remain vigilant for confirmations at key levels, particularly daily candle closes above or below major support and resistance zones.

Read more: Trading with Free Crypto Signals in Evening Trader Channel

The post Price Prediction 5/30: TRUMP, TAO, NEAR, TRX, BNB, WLD & SHIB appeared first on NFT Evening.