YEREVAN (CoinChapter.com) — Caroline Crenshaw, Commissioner at the U.S. Securities and Exchange Commission (SEC), criticized the agency’s latest stance on stablecoins. She said the SEC stablecoin guidance contains legal and factual mistakes. Crenshaw accused the agency of creating a “distorted picture” of the USD stablecoin market.

The SEC recently stated that some USD stablecoins are not securities. It also said those coins may be exempt from transaction reporting. Crenshaw objected to these claims in a statement dated April 4. She argued that the stablecoin market has serious risks, and the agency’s new approach fails to reflect that.

She pushed back on the SEC’s claim that issuer actions — like keeping the token stable or ensuring redemptions — reduce risk. Crenshaw stated that the agency’s view overlooks how these mechanisms actually work in practice.

The SEC said some USD stablecoins are available to retail users only through intermediaries. Crenshaw said this is misleading. She argued that most USD stablecoins are sold this way, not just a few.

She said,

“It is the general rule, not the exception, that these coins are available to the retail public only through intermediaries who sell them on the secondary market, such as crypto trading platforms.”

Crenshaw added that over 90% of USD stablecoins in circulation are distributed in this way.

This point shows a major difference between Crenshaw’s assessment and the SEC stablecoin guidance. She emphasized that the market structure is different from what the public may assume based on the SEC’s wording.

Industry Responds to SEC Stablecoin Guidance

Parts of the crypto industry responded to the SEC’s update. While Caroline Crenshaw expressed concerns, some industry leaders welcomed the clarification.

Ian Ballina, founder of Token Metrics, said the guidance shifts focus to important matters. Tan Tran, CEO of Vemanti Group, said he had hoped to see this change earlier. Ian Kane of Midnight Network said it helps those following the rules.

Despite positive reactions from some sectors, Crenshaw warned that the guidance does not reflect real stablecoin risks. She said the new approach may give a false sense of security to the public.

Crenshaw also disputed the SEC’s assurance that full reserve backing reduces risk. The SEC said that if a USD stablecoin issuer holds reserves equal to the token supply, it could handle unlimited redemptions.

Crenshaw disagreed. She said,

“The issuer’s overall financial health and solvency cannot be judged by the value of its reserve.”

Crenshaw explained that reserve levels do not show the issuer’s liabilities or other financial risks.

She added that stablecoin risks include insolvency, exposure from other financial activities, and stress during market downturns. According to Crenshaw, these issues remain even if the stablecoin appears fully backed.

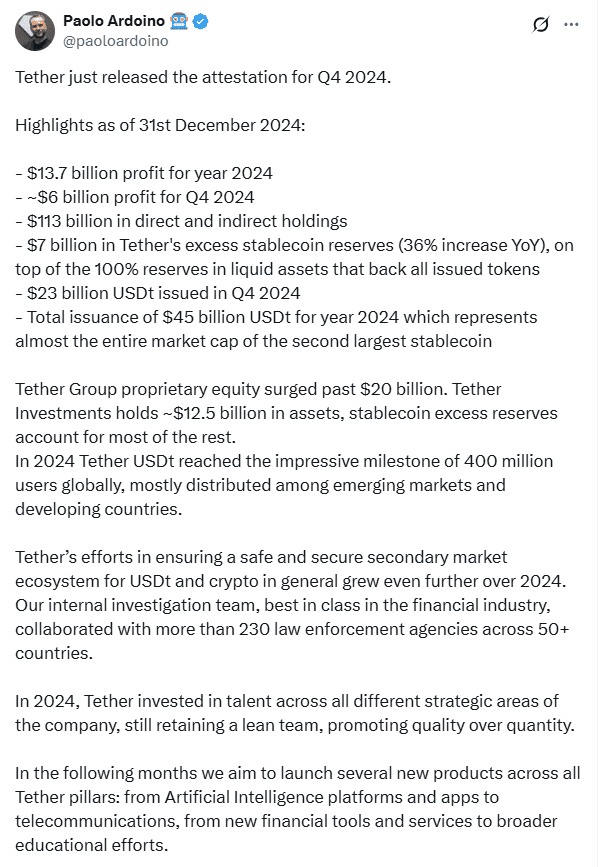

Tether Audit Highlights Broader Stablecoin Market Concerns

The stablecoin debate comes weeks after Tether began working with a Big Four accounting firm. The goal is to audit its reserves and confirm its USDT stablecoin is fully backed.

On March 22 Tether CEO Paolo Ardoino said this process could move faster if Donald Trump returned as U.S. President. Trump is seen as more supportive of crypto.

The Tether audit raises new questions about how USD stablecoins are backed and how transparent issuers really are. Crenshaw’s comments connect to these broader concerns about stablecoin risks and the structure of the stablecoin market.