Solana is trading at $154.00, down 1.29% in the last 24 hours, with a volume of $2.2 billion. This drop comes after a $161 million whale transfer and $323 million in net realized losses, indicating pressure from large holders. Whale Alert reported a transfer of nearly 1 million SOL tokens, indicating cautious sentiment amid ongoing macro volatility.

On-chain data confirms the trend: SOL broke below critical support, including the 34-day EMA at $163.20. Volume has spiked, and selling is intense. However, SOL is still in a key support zone between $150 and $156, supported by the 50-day and 100-day moving averages.

- Whale transfer: $161 million SOL moved

- Realized losses: $323 million at the $156 level

- Critical support: $150-$156, major moving averages

Chainlink CCIP and Solana App Kit Bring Optimism

Despite the sell-off, Solana’s fundamentals are strong. The chain has integrated Chainlink’s Cross-Chain Interoperability Protocol (CCIP), the first time Chainlink has deployed outside of the Ethereum Virtual Machine (EVM). This is a significant development for Solana’s cross-chain DeFi capabilities, as DeFi activity surges.

And the Solana App Kit—a React Native toolkit—makes mobile dApp development a breeze. With support for over 18 protocols, this kit enables developers to build mobile apps on Solana’s fast blockchain in minutes, thereby boosting adoption in wallets, NFT platforms, and DeFi markets.

- Chainlink CCIP: Cross-chain DeFi potential

- Solana App Kit: Mobile dApp development for 18+ protocols

- Ecosystem growth: Solana is ready for wider adoption

Technical Outlook: Solana at $154 in a Key Zone

The Solana price prediction remains bearish, given the downward channel that limits SOL’s upward movement. On the 2-hour chart, Solana’s price is stuck in a descending channel, characterized by lower highs and lows, indicating clear selling pressure.

The 50-period EMA at $160.79, once support, is now resistance. The MACD is bearish, MACD line below signal line and red histogram bars.

Price is approaching the $150.66 support zone, the lower boundary of the channel. If a bullish reversal candle, such as a Hammer or Bullish Engulfing, forms here with MACD convergence, we could see a move to $158.33 or $160.79. But a clean break below $150.66 could take SOL to $142.14 or $134.01.

Key Technical Levels:

- Support: $150.66, $142.14, $134.01

- Resistance: $158.33, $160.79, $165.59

For traders, wait for confirmation—rising volume and a bullish candle—before going long. Without that, SOL is bearish, but a textbook rebound at $150 could be a good entry.

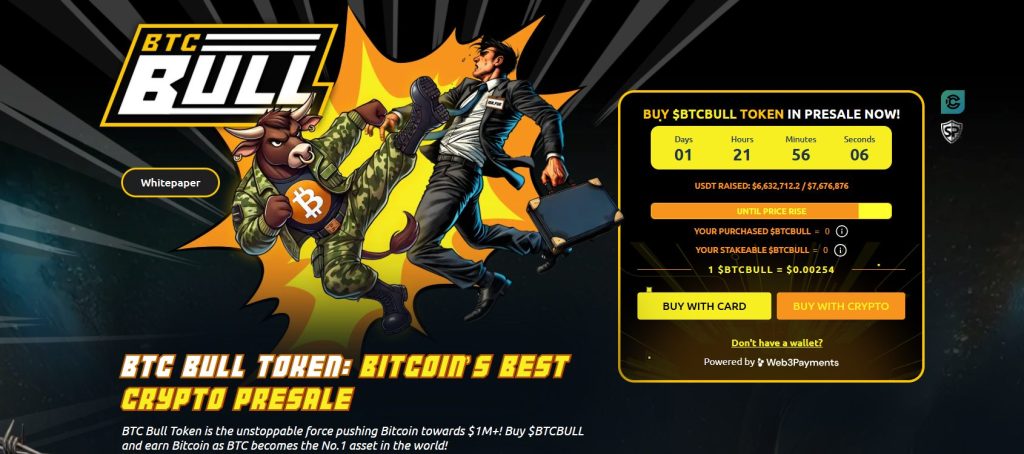

BTC Bull Token Presale Approaches $7.67M Mark as 62% APY Staking Draws Interest

With SOL/USD dipping below $160, attention is shifting to altcoins like BTC Bull Token ($BTCBULL). So far, $6.38 million has been raised, with the next price jump approaching quickly.

Bitcoin Rewards and Supply Reductions

BTC Bull Token operates with a built-in system: the higher BTC’s price, the more BTC airdrops are distributed to token holders. Notably, presale participants receive priority. The system also features:

- Token burns every $ 50,000 BTC increase, reducing the supply.

- The current token price is at $0.00254 before the next bump.

This approach aligns token value with BTC/USD’s price moves while maintaining scarcity through programmed burns.

Staking Terms for Passive Returns – BTCBULL’s staking pool holds 1.62 billion tokens offering 65% APY, with:

- No lockup periods or fees.

- Full access to funds at any time.

This structure appeals to investors seeking yield without complex requirements or the risk of illiquidity.

Momentum Before the Cap Fills

With just over $1 million remaining in the presale, buyers are positioning early. The token’s mechanics of BTC-tied rewards, supply adjustments, and staking options are driving participation.

Key figures:

- USDT raised: $6,632,712/ $7,676,876

- Token price: $0.00254

BTCBULL offers a whopping ~62% APY on its Ethereum-based staking pool (currently holding 1.61B BTCBULL), with no lockups or withdrawal fees. That means passive yield, with full liquidity.

The post Solana Price Prediction: With SOL at $154.00 and Pressure Building, Is a Breakout Past Key Resistance Levels on the Horizon? appeared first on Cryptonews.

(@PinnacleCrypt)

(@PinnacleCrypt)