In the fast-paced and often chaotic world of decentralized finance, Pump.fun has rapidly carved out a unique niche, becoming the de facto “ground zero” for meme coin launches on the Solana blockchain.

Since its inception in January 2024, this platform has democratized token creation, allowing virtually anyone to mint and trade a new cryptocurrency with unprecedented ease and minimal cost. Its innovative approach has generated enormous revenue and ignited a speculative frenzy, yet it also operates amidst a storm of controversy regarding pervasive fraud and escalating regulatory scrutiny.

Pump.fun Protocol and The Pump.fun Coin (PUMP)

Historical Context and Key Milestones

Pump.fun launched in January 2024 to simplify meme coins creation and trading on Solana. Operating with a pseudonymous “Alon” team, it quickly saw explosive growth, surpassing $50 million in revenue by July 2024. The platform’s history includes controversies: its live streaming feature was temporarily deactivated in late 2024 due to problematic content, and its X account was hacked in February 2025, promoting a fake token.

In February 2025, Pump.fun strategically replaced Raydium with its own PumpSwap AMM, consolidating liquidity. Despite earlier denials from its co-founder, reports in June 2025 revealed plans for Pump.fun’s own $1 billion token sale at a $4 billion FDV, raising transparency concerns. A Creator Revenue Sharing program, launched in May 2025, now incentivizes token creation by allocating 50% of PumpSwap revenue to creators.

The platform primarily targets crypto enthusiasts, meme lovers, and high-risk investors. Its user-friendly interface and low token creation fee (0.05-0.1 SOL) make it highly accessible, even for those without coding skills. Pump.fun fosters a “meme coins casino” environment, prioritizing speculative trading driven by hype over fundamental value. This attracts users seeking rapid profits, but also exposes them to significant risks inherent in the platform’s high-volume, low-vetting model.

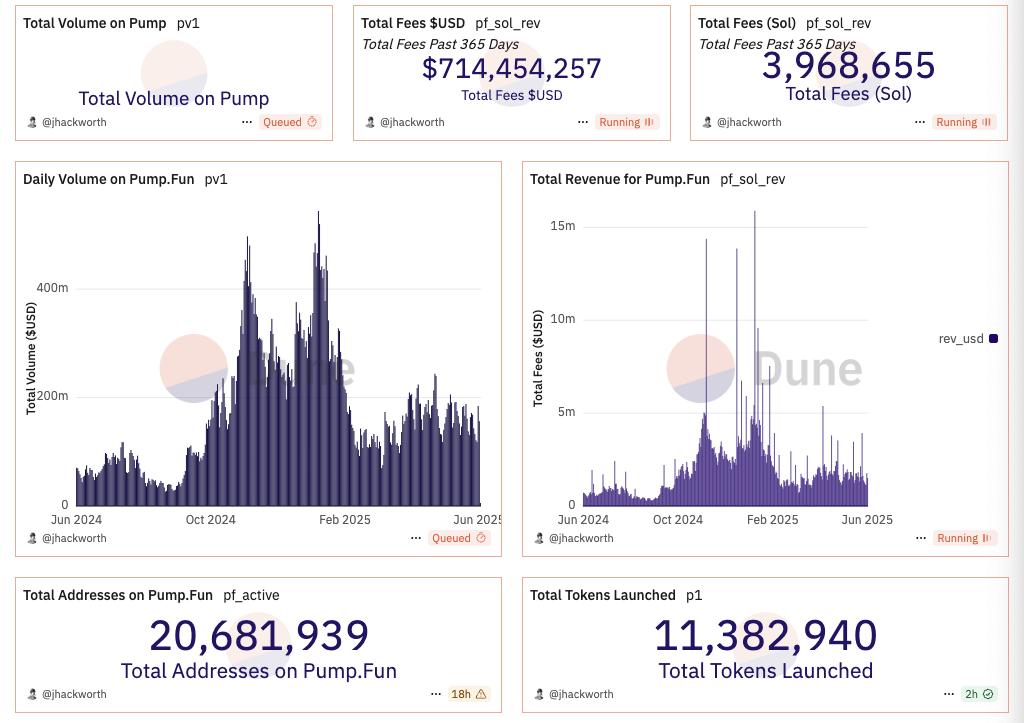

| Metric | Value |

| Launch Date | January 2024 |

| Total Tokens Minted | Over 11 million |

| Cumulative Market Cap | Exceeding $4.5 billion |

| Total Revenue Generated | Over $700 million |

| Daily Transaction Volume (typical) | Frequently exceeding $100 million |

| Percentage of Daily Solana Token Launches | Up to 71% |

| Token Creation Fee | 0.05-0.1 SOL (previously 0.02 SOL) |

| Trading Fee | 1-2% |

For more: What is Pump.fun? A Gateway to Meme Coin Creation and Trading

The Pump.fun Token – PUMP Coin

Pump.fun is reportedly planning its own token launch, widely speculated to be named PUMP. While co-founder Alon Cohen initially denied these rumors in February 2025, reports from June 2025 indicate a planned $1 billion token sale at a $4 billion fully diluted valuation (FDV).

The token is expected to be offered to both public and private investors, potentially within weeks, though official details on its name, ticker, exact launch date, and utility remain unconfirmed. There are also discussions about a potential 10% airdrop to community members. This proposed token launch has generated controversy, with some in the crypto community expressing skepticism due to past inconsistent statements and concerns about its impact on existing Solana meme coins liquidity.

For more: Pump.fun Token Debut: Can It Surpass a $4 Billion FDV?

Pump.fun Technical Architecture and Operational Mechanics

Pump.fun Token Creation Process: From Concept to Launch

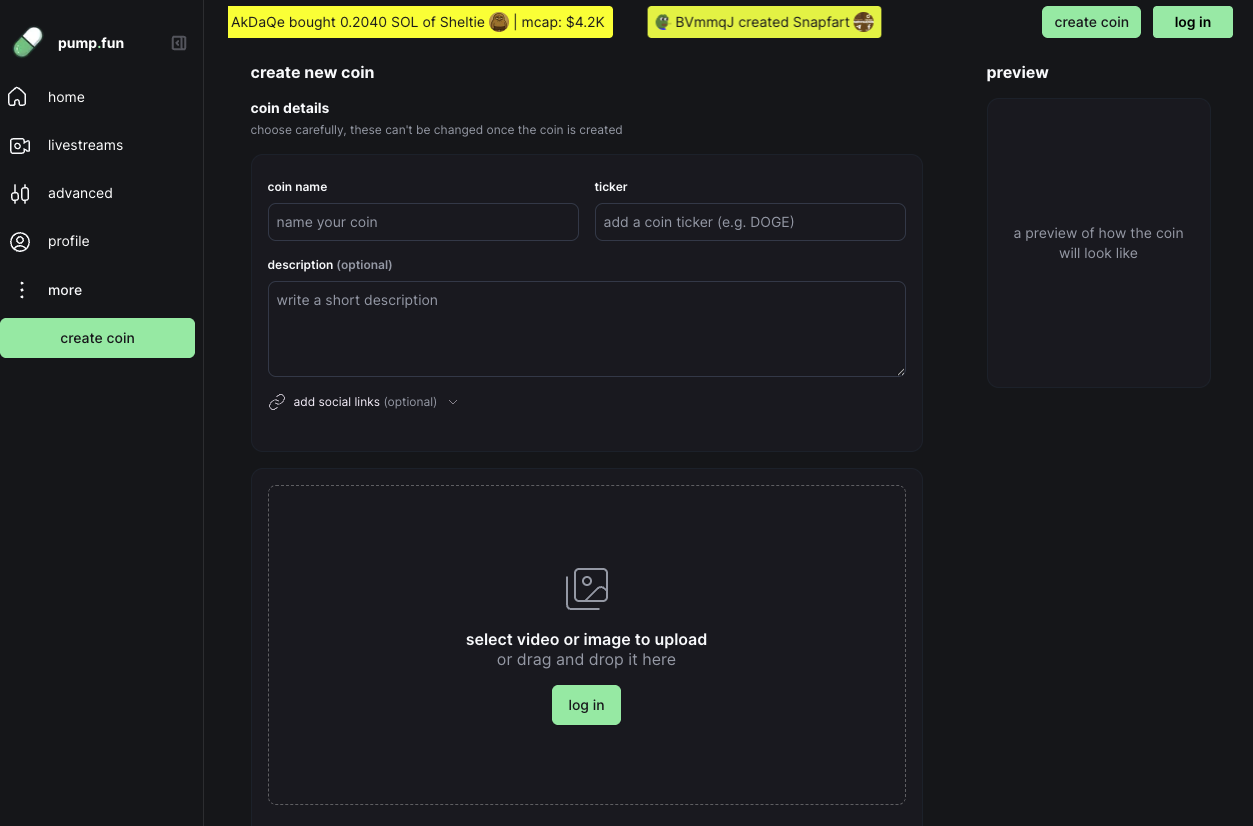

Pump.fun’s token creation process is designed for unparalleled simplicity and speed. Users connect a Solana-compatible wallet, typically requiring around 0.1 SOL for fees. The user-friendly interface eliminates coding skills, broadening accessibility. To create a token, users simply define its Name, Symbol, Image, and Description.

The platform then automates liquidity management and initial pricing. Upon approval, the token’s smart contract is deployed on Solana. Each new token has a 1 billion supply: 80% to the bonding curve for trading, and 20% directly to the creator’s wallet.

The entire process, from input to tradability, takes under five minutes, making it a rapid launchpad. While this democratizes access, the 20% creator allocation combined with minimal vetting facilitates pump-and-dump schemes, incentivizing speculative assets over genuine utility.

Source: Pump.fun

The Bonding Curve: Pricing and Liquidity Mechanism

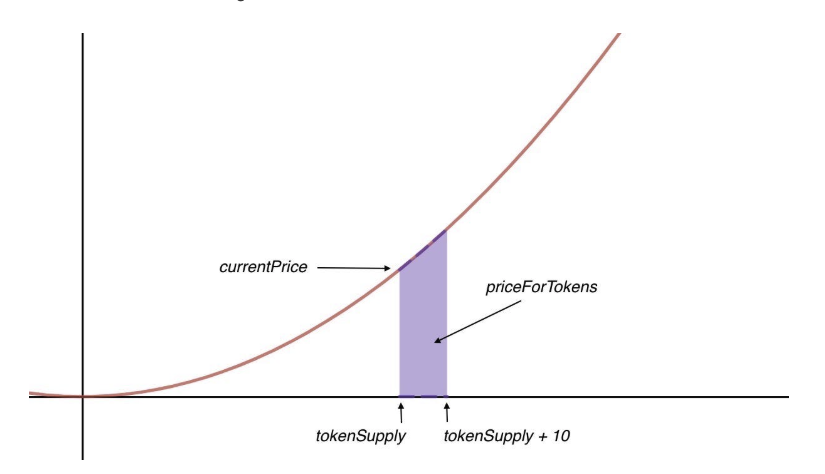

Central to Pump.fun’s operations is its bonding curve system, a mathematical formula that dynamically sets token prices based on supply and demand. As tokens are bought, their price increases, and vice versa. This mechanism provides instant liquidity, eliminating the need for external market makers by building liquidity directly into the smart contract.

Its primary advantage is incentivizing early buyers, who acquire tokens at lower prices, fostering a “first-mover advantage” and a competitive, viral environment. However, this system, while offering predictability within its closed loop, results in extreme volatility. Prices directly reflect collective speculation rather than intrinsic value, fueling Fear Of Missing Out (FOMO) and reinforcing the “meme coins casino” environment where prices can surge and crash dramatically.

Source: Yos Riady

Pump.fun Token “Graduation” to Decentralized Exchanges (DEXs)

A key phase in a Pump.fun token’s life cycle is its “graduation” to external decentralized exchanges. This automatic process triggers when a token reaches a market capitalization of around $69,000. Upon reaching this threshold, a significant portion of the SOL accumulated in the bonding curve is automatically used to create a liquidity pool. This pool is then established on PumpSwap (Pump.fun’s own AMM) or another Solana DEX like Raydium.

Trading then shifts from Pump.fun’s internal bonding curve to the external DEX. While intended for wider market exposure, this transition introduces risks, particularly “post-graduation rug pulls.” Unlike Pump.fun’s internal locked liquidity, creators may regain control of LP tokens on external DEXs, enabling them to withdraw funds and cause a price collapse.

Pump.fun Features and User Interface

Pump.fun offers a comprehensive, user-friendly interface for meme coins creation and trading. Key features include real-time price charts, intuitive buy/sell functions, and a “Discussion Area.”

Competitive elements are prominent: the “King of the Hill” mechanism promotes tokens reaching a ~$30,000-$35,000 market value, offering significant marketing. A “Holder Distribution” visualizes token concentration, and the “Market Dynamic Mechanism” gives exposure for purchases over 0.01 SOL.

Hey @pumpdotfun there is currently someone using your livestreams to threaten to hang themselves if the coin does not reach a set marketcap.

Absolutely heinous and It needs to come down + see if you can get them help.

Shut down the livestream feature. This is out of control.

— Beau (@beausecurity) November 25, 2024

The platform also includes “PUMP.FUN Live (Stages)”, a multi-user live streaming function for project presentations, which was temporarily deactivated in late 2024 due to controversies but later reintroduced with stricter moderation. These features gamify the trading experience, incentivizing hype and rapid price increases, often prioritizing superficial metrics over fundamental value, potentially encouraging reckless behavior among users.

Revenue Model and Fee Structure

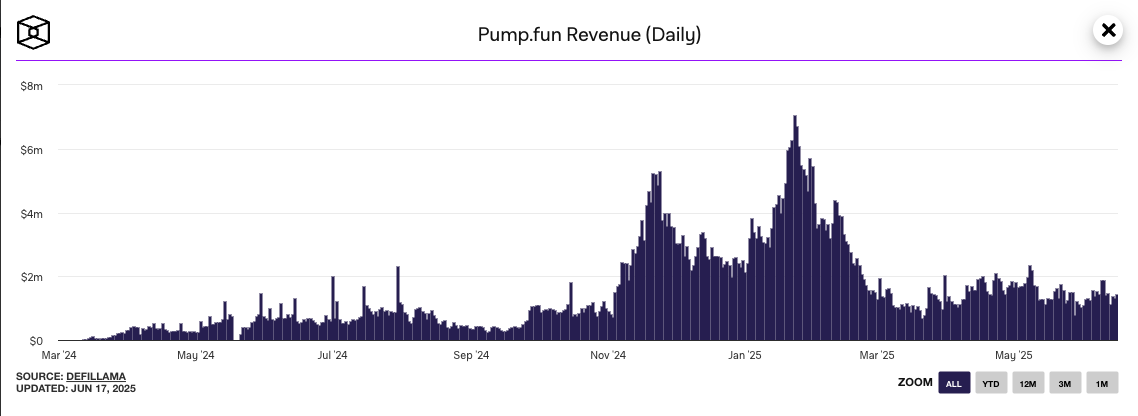

Pump.fun generates substantial revenue through a multi-faceted fee structure. It charges a “Creation Fee” (0.05-0.1 SOL) for each new token, a “Trading Fee” (1-2%) on bonding curve trades, and “Graduation Fees” (e.g., 1.5 SOL) when tokens move to external DEXs. Since its inception, Pump.fun has generated over $700 million in cumulative revenue, becoming the second-largest DeFi protocol after Uniswap in May 2024 and the highest revenue-generating launchpad by November 2024.

Crucially, given that approximately 98.6% of tokens launched are scams or pump-and-dump schemes, a significant portion of Pump.fun’s substantial revenue is derived from activities that ultimately result in widespread financial losses for its users. This creates a strong financial incentive for the platform to maintain high levels of speculative activity, regardless of the ethical implications.

Market Impact and Ecosystem Dynamics

Growth Metrics and Market Dominance on Solana

Since its launch in January 2024, Pump.fun has experienced explosive growth, rapidly establishing itself as a dominant force within the Solana ecosystem. The platform has facilitated the minting of over 11 million tokens, accumulating a cumulative market capitalization exceeding $4.5 billion.

Daily transaction volumes on Pump.fun frequently surpass $100 million, and the platform is responsible for an astonishing 71% of all daily token launches on the Solana blockchain. By November 2024, it had solidified its position as the highest revenue-generating launchpad in the decentralized finance (DeFi) sector.

Source: Dune Analytics

Influence on the Broader Meme Coin Market

Pump.fun has profoundly reshaped the meme coins landscape on Solana by dramatically lowering the barrier to entry for creators. Its user-friendly interface and innovative bonding curve model have inspired similar platforms. Pump.fun’s self-proclaimed “fair launch” mechanism, designed to prevent presales and initial team allocations, has redefined expectations for new meme coins projects, promoting an idea of equal opportunity.

However, this perceived fairness is significantly undermined by the stark reality that approximately 98.6% of tokens launched on the platform are classified as scams or pump-and-dumps. This immense discrepancy means that a “fair launch” on Pump.fun explicitly does not equate to a “safe investment.”

This situation influences overall market sentiment, fostering a cynical view of new projects and reinforcing a pervasive focus on short-term speculation driven by hype, rather than genuine long-term development or intrinsic value. The platform’s operational model therefore shapes market behavior, emphasizing rapid entry and exit strategies over sustainable growth, contributing to a volatile and high-risk environment.

Impact on Solana’s DeFi Liquidity and Innovation

Pump.fun’s escalating dominance in meme coin issuance presents a complex, double-edged sword for the Solana DeFi ecosystem and its innovative potential.

During its peak, Pump.fun’s substantial DEX volume likely funneled significant capital into the Solana network, contributing to SOL and other Solana ecosystem tokens achieving new all-time highs. However, this success comes with inherent risks. The platform’s migration to its own PumpSwap AMM concentrates liquidity, potentially destabilizing other Solana DEXs and centralizing speculative capital. Furthermore, while its “Graduated Token Mechanism” reportedly removes SOL from circulation, this “scarcity” is built upon highly speculative and often fraudulent assets.

The alarming statistic that 98.6% of tokens launched are scams or rug pulls poses immense reputational risks to the entire Solana network, undermining its credibility for legitimate innovation and endangering retail investors. This overwhelming focus on meme coins and prevalence of fraud also diverts developer talent and capital from projects building real utility towards purely speculative ventures.

Consequently, when Pump.fun experiences a downturn or its volume recedes, it can lead to stronger selling pressure on SOL, contributing to price drops. Ultimately, this creates a systemic risk to Solana’s ecosystem health, hindering its long-term growth as a serious blockchain platform, a concern explicitly echoed by Ethereum co-founder Vitalik Buterin.

Case Studies of Notable Pump.fun Tokens

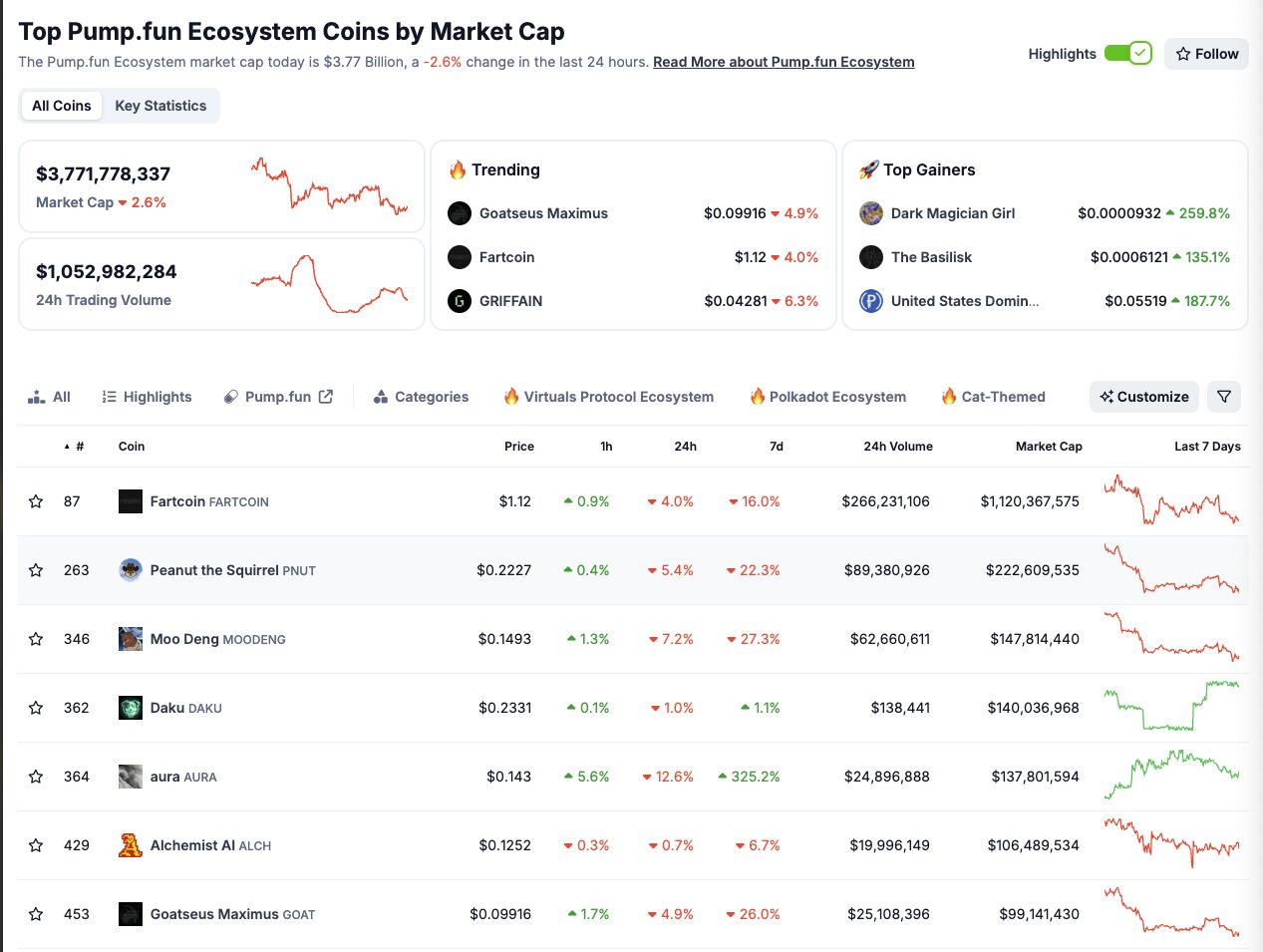

While the vast majority of tokens launched on Pump.fun fail to gain significant traction, a few have achieved notable, albeit often ephemeral, success, highlighting the platform’s potential for rapid wealth creation and extreme volatility.

- MOODENG: This token, inspired by a viral baby pygmy hippopotamus, reportedly reached a market capitalization of $170 million within just three days of its creation.

- Fartcoin: At one point, Fartcoin momentarily achieved a $1 billion valuation during a surge in meme coins popularity.

- GOAT: This token distinguished itself by becoming the first Pump.fun token to reach a $1 billion market capitalization.

Source: Coingecko

These examples, while impressive, represent a tiny fraction of the millions of tokens created on the platform. Solidus Labs reported that only 97,000 out of over 7 million tokens launched on Pump.fun managed to maintain liquidity above $1,000. This means that over 99% of tokens never reach the “graduation” threshold, and many experience a complete loss of value within days of creation.

The focus on these outliers creates a significant survivorship bias, masking the overwhelming reality of widespread token failure. This perpetuates the speculative “casino” narrative, encouraging more participants to chase improbable gains, often at their own financial detriment.

Pump.fun’s Competitors in the Meme Launchpad Narrative

While Pump.fun maintains a dominant position, it faces growing competition from other launchpad platforms within the surging Solana meme coin ecosystem. Key rivals in the “meme launchpad” narrative focus on simplifying token creation and initial liquidity provision, similar to Pump.fun’s core offering.

Some Pump.fun notable competitors across various blockchains:

- Tron: SunPump – First fair launch platform for meme coins on TRON, low-cost.

- Base: Clanker, Flaunch, Zora, WOW – Base is a hotbed. Clanker is a Farcaster-integrated bot; Flaunch is developer-centric with an SDK; Zora, primarily an NFT platform, indirectly facilitates meme coin mints; WOW focuses on user-generated pools with no presales. Ape.store also aims for revolutionary fair launch.

- Solana: Raydium, LetsBonk, Believe, Moonshot, Make Now – Pump.fun’s direct rivals. Raydium (LaunchLab) and LetsBonk leverage existing DEX infrastructure. Believe offers innovative “tweet-to-token” launches and a strong community. Moonshot (from DEX Screener) claims enhanced security/audits.

- BNB: four.meme, Moonshot – four.meme directly competes with Pump.fun’s model on BNB Chain, emphasizing fair launches and low costs.

Overall, Pump.fun’s market share has reportedly decreased from over 98% to approximately 57.5% by mid-May 2025, indicating that competition is genuinely eroding its previously near-monopolistic position. These competitors often strive to offer faster listings, improved user interaction, and more attractive incentive mechanisms for developers.

Rumored Token Launch: A “Profit-Taking” Move or Long-Term Strategy?

Speculation surrounding Pump.fun’s rumored native token launch, targeting $1 billion in fundraising at a $4 billion valuation, has sparked considerable debate. Some argue this represents a “profit-taking” move by the development team, especially given the platform’s enormous revenue (over $700 million) from a model where a vast majority of tokens are scams or pump-and-dumps.

Considering the team’s pseudonymous nature and increasing regulatory and reputational pressures, a large-scale token offering could be viewed as a way to “cash out” on the platform’s short-term success, transferring inherent risks to new investors of the PUMP token.

However, an alternative perspective suggests this could be a strategic move for Pump.fun’s long-term sustainability and development. Launching a token might aim to raise capital for investing in infrastructure, developing new features such as token locking or decentralized governance, or expanding to other blockchains. A token could also distribute ownership and governance, although its actual decentralization remains contentious.

Furthermore, a native token could enhance Pump.fun’s competitiveness by enabling new user and creator incentives (like the already launched revenue-sharing program). Nevertheless, the platform’s past transparency issues and the nature of projects it facilitates continue to fuel skepticism regarding the true motivations behind this rumored token launch.

Risks, Controversies, and Regulatory Landscape

Pump.fun’s Operational Challenges and Risks

Pump.fun faces significant challenges from its operational environment. Indeed, a Solidus Labs report highlights pervasive fraud. It indicates that 98.6% of tokens launched are pump-and-dump schemes or rug pulls. Consequently, only 97,000 out of over 7 million tokens maintained over $1,000 in liquidity. The largest scam, MToken, caused $1.9 million in losses. Moreover, a median rug pull cost $2,832. This widespread fraud raises serious ethical questions about the platform’s sustainability.

Security Vulnerabilities

Pump.fun implements measures like open-source contracts and locked liquidity during the bonding curve phase. Nevertheless, its smart contracts still pose risks. Post-graduation rug pulls remain a concern. Creators can, for instance, manipulate liquidity on external DEXs like PumpSwap. The platform’s permissionless nature and minimal vetting, furthermore, increase impersonation scam risks. Technical audits do not address human-driven exploitation or hype-based fraud. Thus, this highlights a gap in security.

Ethical and Content Moderation Issues

Ethical concerns are prominent, especially regarding content moderation. Pump.fun’s livestreaming feature was temporarily deactivated in late 2024. This followed “degrading on-air stunts” and a faked suicide attempt. However, it was reintroduced in June 2025 with stricter policies. Legal entities like Burwick Law accuse the platform of displaying illicit content. Similarly, the “Gen Z Quant Incident” involving a 13-year-old creator further underscored ethical dilemmas. The need for moderation, therefore, contradicts the platform’s decentralized ethos, creating an accountability vacuum.

Escalating Regulatory Scrutiny

Pump.fun faces escalating regulatory scrutiny. Specifically, a $500 million class-action lawsuit was filed in the U.S. on January 30, 2025. It alleges the sale of unregistered securities and “Ponzi-like” schemes. Internationally, moreover, the UK’s Financial Conduct Authority (FCA) issued a warning in December 2024. This led to geo-blocking for UK users. These actions, alongside potential SEC involvement, could set crucial precedents. Ultimately, they signal an end to the “wild west” era of meme coin launches.

Industry Criticism and Future Outlook

Industry experts widely criticize Pump.fun’s fundamental business model. Concerns include its perceived centralization due to PumpSwap. This could destabilize Solana’s DeFi by concentrating liquidity. Critics often label it a “meme coin casino” and “extraction machine.” They argue retail investors consistently lose while Pump.fun profits from fees.

In addition, Ethereum co-founder Vitalik Buterin has criticized platforms like Pump.fun for promoting speculation. The questioned $4 billion valuation for its proposed token sale, combined with negative sentiment and regulatory pressure, poses an existential threat to Pump.fun’s future.

Navigating Pump.fun’s Future: Challenges and Adaptations

Pump.fun confronts intense regulatory and reputational pressures. This forces a strategic pivot for the platform. Its future may involve adding features like token locking, robust governance, cross-chain expansion, and comprehensive compliance. Such additions aim for greater legitimacy.

Strategic Ambitions and Critical Choices

The planned $1 billion token sale at a $4 billion valuation suggests ambitions for broader market competition. This might include a dedicated exchange. The company faces a critical choice: either legitimize operations or specialize in high-risk assets. Choosing the latter would mean operating within less regulated jurisdictions. This decision will define its long-term viability.

Permissionless Innovation Versus Consumer Protection

The platform highlights crypto’s core tension: permissionless innovation versus consumer protection. Pump.fun’s alarming 98.6% scam rate will likely hasten stricter industry regulations. This fosters calls for greater self-discipline. The situation represents a critical juncture. It exposes the inherent risks of low-barrier, truly permissionless environments.

Market maturation will compel such platforms to meet higher compliance and utility standards. Otherwise, they face significant legal and reputational consequences. This will shape how future decentralized finance applications balance innovation with user safety and market integrity.

User and Developer Responsibilities

Given the exceptionally high scam rate, the burden of risk management falls on individual users. Investors must exercise extreme caution. They should conduct rigorous due diligence, verifying addresses and maintaining skepticism towards promises. Robust risk management is also essential, including stop-loss orders and diversification. Furthermore, critically engaging with community information is crucial.

Developers also bear responsibility. They should prioritize genuine utility and sustainability. Cultivating transparency is vital. Developers must secure post-graduation liquidity to prevent rug pulls and uphold ethical responsibility.

Pump.fun’s Enduring Impact and Necessary Evolution

Pump.fun’s impact on meme coin creation is undeniable. However, its ethical and financial costs, marked by systemic fraud and escalating regulatory action, will force adaptation. This adaptation will move towards greater compliance and utility, or confine it to a constrained niche. Ultimately, this shapes DeFi’s evolution.

For more: 15+ Best Crypto Signals Telegram Groups in 2025