Coinspeaker

Stablecoins Transfer Volume Surpasses Visa, Mastercard Combined in 2024

Stablecoins took center stage in 2024, with their transfer volumes eclipsing those of Visa and Mastercard combined. According to a report from crypto exchange CEX.io on January 31, stablecoin transfers reached a staggering $27.6 trillion, marking a 7.7% lead over the traditional payment giants.

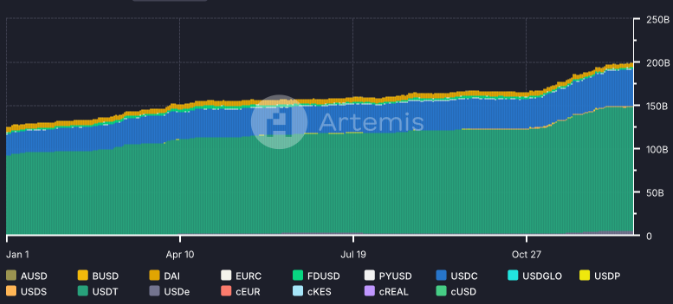

That massive volume highlights stablecoins’ growing role in global finance. The supply of stablecoins also saw explosive growth, rising by over 59% throughout the year and peaking at $200 billion in September. By year-end, stablecoins accounted for 1% of the total US dollar supply, up from just 0.63% at the start of the year.

-

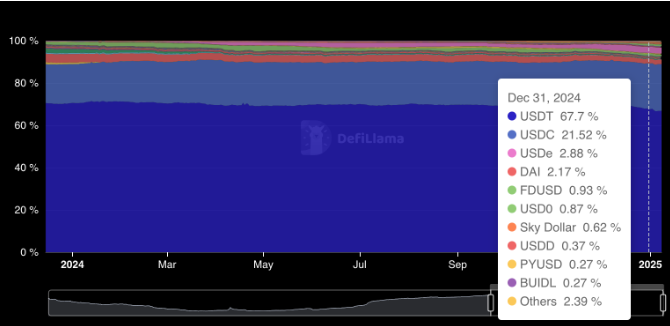

Tether’s USDT retained its lead but saw market share decline from 70.5% to 67.7%. In contrast, Circle’s USDC strengthened its position, rising from 18.4% to 21.5%, primarily due to wider adoption of decentralized finance (DeFi). Ethena’s USDe emerged as a standout, multiplying 40 times in supply and capturing a 2.88% market share, securing the rank of the third-largest stablecoin.

Source: DeFiLlama

USDe’s Surged 6,300%, While Yield-Bearing Stablecoins Skyrocket 583% in 2024

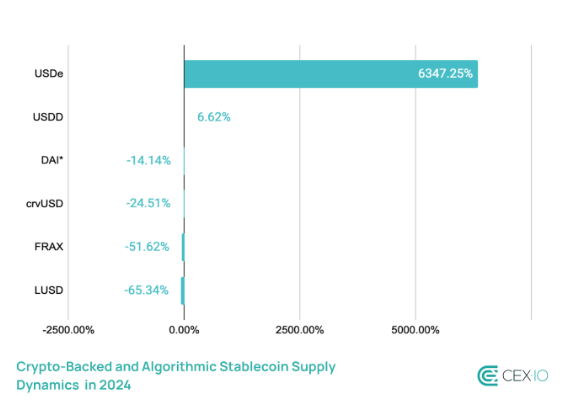

Algorithmic and crypto-backed stablecoins witnessed remarkable expansion in 2024, with supply surging by 92%. USDe played a dominant role in this surge, recording an unprecedented 6,347.25% increase. By December, USDe overtook DAI, capturing 37% of the crypto-backed stablecoin market.

Source: CEX.io

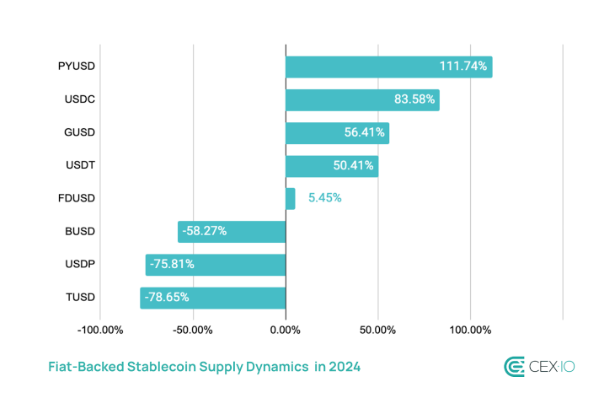

Fiat-backed stablecoins also experienced growth, expanding by 54.8%. However, their overall market dominance slipped from 93.62% to 92.2%. PayPal’s PYUSD significantly contributed to this sector’s expansion, leveraging integration with the Solana blockchain. In contrast, TUSD plummeted by 78% after Binance delisted it due to regulatory challenges.

Source: CEX.io

Yield-bearing stablecoins recorded extraordinary gains, with market capitalization soaring 583% over the year. sUSDe led the segment with a staggering 5,800% rise. Tokenized US Treasuries followed a similar trajectory, climbing 414% as USD0’s supply multiplied 39 times, reaching $1.7 billion. By year-end, USYC emerged as the largest holder of tokenized Treasuries.

Ethereum & Tron’s Dominance Drops from 90% to 83%

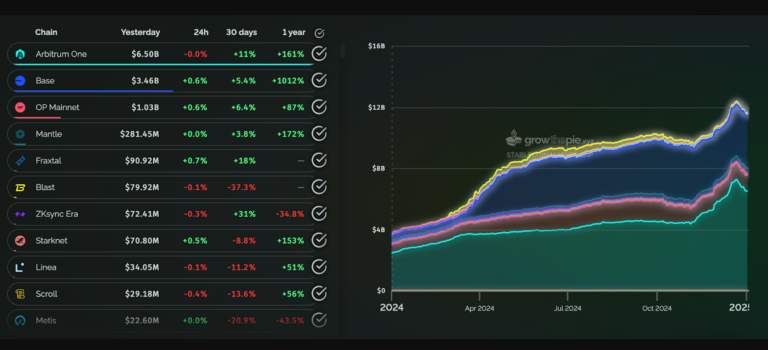

Stablecoins remained heavily concentrated on Ethereum and Tron, which together hosted 83% of the market’s supply by the end of 2024. However, that dominance waned from 90% in January, signaling increased diversification across other networks. Ethereum’s market capitalization grew by 65%, partly thanks to the Dencun upgrade, which significantly reduced transaction fees.

Meanwhile, Tron saw its market share drop from 38% to 29%. The decline was largely attributed to Ethereum’s more competitive fee structure and a sluggish DeFi ecosystem on Tron. On the other hand, Layer 2 (L2) networks gained traction, with their stablecoin market cap surging 218% throughout the year. The Dencun upgrade played a crucial role in that shift, slashing fees by up to 99% and making L2 networks a more attractive option for stablecoin transactions.

Source: CEX.io

Arbitrum remained the dominant Layer 2 network, though its market share declined from 65% to 55% as Base made significant strides. Coinbase’s USDC migration and gasless transactions helped Base gain traction, fueled further by a wave of memecoin trading activity.

-

next

Stablecoins Transfer Volume Surpasses Visa, Mastercard Combined in 2024