The world of cryptocurrency is constantly evolving. Bitcoin introduced decentralized money, Ethereum brought smart contracts, and DeFi (Decentralized Finance) opened up a universe of financial activities without involving traditional banks. Within this sector of crypto, stablecoins emerged as a crucial bridge, offering the benefits of crypto – speed, low cost, global access – without the wild price swings often seen with assets like Bitcoin or Ether.

However, even with stablecoins, challenges remain. While US dollar-pegged stablecoins like USDC and USDT dominate the market, accessing and trading stablecoins pegged to other global currencies (like the Euro, Japanese Yen, or Brazilian Real) or tokenized real-world assets (RWAs) like gold has been difficult and inefficient. The massive global Foreign Exchange (FX) market, worth trillions of dollars daily, barely registers on the blockchain, especially for non-USD pairs.

This is where Stabull Finance enters the picture.

Stabull isn’t just another cryptocurrency exchange. It’s a specialized, next-generation Decentralized Exchange (DEX) built from the ground up with one clear mission: to become the central source of liquidity for all local stablecoins and tokenized Real World Assets (RWAs) on the blockchain.

Think of it as building the essential financial plumbing that the rapidly growing world of stablecoins and digital commodities desperately needs. This article will dive deep into what Stabull is, the problems it solves, how its unique technology works, what you can do on the platform, and why it represents a significant step forward for DeFi and the tokenization of real-world value.

The Problem: A Gap in the Crypto Market

Before understanding Stabull’s solution, let’s look at the problems it addresses:

The USD Shadow: While stablecoins are meant to bring stability, the market is overwhelmingly dominated by those pegged to the US dollar. If you hold Euros, Yen, or Singapore Dollars and want to use them in DeFi, finding efficient ways to swap them directly for their stablecoin equivalents (like EURS, GYEN, or XSGD) or other non-USD stablecoins is often cumbersome and expensive. Liquidity (the ease of buying or selling without affecting the price) is often fragmented across different platforms or simply non-existent. The traditional FX market sees massive non-USD volume (around 40%!), yet on-chain, this figure plummets to less than 1%. There’s a huge disconnect and opportunity.

Traditional FX Inefficiencies: The existing global FX market, while massive, runs on what many consider outdated systems. Transactions involve multiple intermediaries (such as banks and/or clearing houses), leading to higher fees, slower settlement times (often taking days), and limited operating hours (typically closed on weekends and bank or national holidays for their home markets). Stablecoins, being digital and blockchain-based, offer a way around this, enabling near-instant, 24/7 peer-to-peer transfers across borders with significantly lower costs.

RWA Trading Barriers: Tokenizing real-world assets like gold (PAXG), precious metals, or even traditional financial products brings them onto the blockchain, unlocking new possibilities for trading, lending, and integration into DeFi. However, specialized venues are needed to trade these efficiently against various currencies, reflecting their real-world market prices accurately.

AMM Limitations: Existing Decentralized Exchanges often use Automated Market Maker (AMM) models that aren’t perfectly suited for swapping assets that should have a relatively stable (but not pegged 1:1) relationship, like two different fiat-backed stablecoins (e.g., EURS/USDC) or a stablecoin and a commodity (e.g., USDC/PAXG). Early AMMs spread liquidity too thin, causing high slippage (the price moving against you during a trade). Later versions improved capital efficiency but still struggled to accurately track dynamic real-world FX rates without relying heavily on arbitrageurs, which can lead to potential losses for liquidity providers.

Stabull was born out of these challenges, directly from discussions within the non-USD stablecoin issuer community. Issuers needed a reliable, liquid, and efficient place for their users to access and utilize their stablecoins. Existing solutions weren’t cutting it.

What is a DEX and How Does Stabull Fit In?

To grasp Stabull, you need to understand what a DEX is.

Centralized Exchanges (CEXs): Think of platforms like Coinbase, Binance, or Kraken. You create an account and complete a KYC and AML process with your identity documents, deposit your funds into their control (custody), and they match buyers and sellers using a traditional order book. They are the central authority.

Decentralized Exchanges (DEXs): Platforms like Uniswap, Curve, and now Stabull operate differently. There’s no central company holding your funds. You connect your own crypto wallet (like MetaMask) directly to the platform. Trades happen directly between the wallet and the pool, facilitated by smart contracts – self-executing code on the blockchain that defines the rules. You always remain in control of your private keys and, therefore, your assets. This is called being non-custodial.

Most modern DEXs, including Stabull, use an Automated Market Maker (AMM) system instead of a traditional order book.

What is an AMM?

Imagine a simple vending machine for tokens. Instead of matching buyers and sellers, an AMM uses pools of assets provided by users (called Liquidity Providers or LPs). Prices are determined automatically by a mathematical formula (an algorithm or “bonding curve”) based on the ratio of assets in the pool.

When someone buys Token A using Token B, the supply of Token A in the pool decreases, and its price automatically goes up according to the formula.

When someone sells Token A for Token B, the supply of Token A increases, and its price goes down.

LPs who deposit assets into these pools earn fees from the trades that occur. AMMs ensure there’s always some liquidity, even for less common pairs, although the price might become unfavorable if the pool is small or imbalanced.

Stabull’s Innovation: The 4th Generation AMM

Stabull isn’t just using any AMM; it employs what it calls a 4th Generation AMM, specifically designed for the nuances of stablecoin and RWA swaps. This builds upon the lessons learned from previous generations:

Gen 1 (e.g., Curve v1): Focused on 1:1 pegged assets (like USDC/DAI). Used a hybrid curve combining constant-sum (flat price) and constant-product (like Uniswap) to offer low slippage near the peg.

Gen 2 (e.g., Curve v2, DFX): Adapted for assets without a fixed 1:1 peg (like different fiat stablecoins or volatile assets). Introduced dynamic “repegging” based on internal calculations or external price feeds (oracles) to keep the efficient trading zone aligned with market prices.

Gen 3 (e.g., Uniswap v3): Introduced “concentrated liquidity,” allowing LPs to provide liquidity within specific price ranges, making capital much more efficient but increasing complexity for LPs.

Stabull takes the best elements and refines them. Its core innovation lies in how it dynamically concentrates liquidity around an off-chain FX or commodity oracle price.

Why Off-Chain Oracles are Key for Stabull:

Blockchains are self-contained systems; they don’t inherently know the prevailing real-world price of the Euro against the US Dollar or the current market price of gold. Oracles are services that securely feed this external data onto the blockchain. Stabull utilizes trusted oracle providers like Chainlink.

Here’s why this is a game-changer for Stabull’s focus:

Real-World Accuracy: For FX stablecoins and RWAs, the true price discovery happens in massive, traditional off-chain markets. Stabull’s AMM uses the oracle price as its primary reference point. This means the exchange rate offered on Stabull closely tracks and adjusts to the real-world market rate.

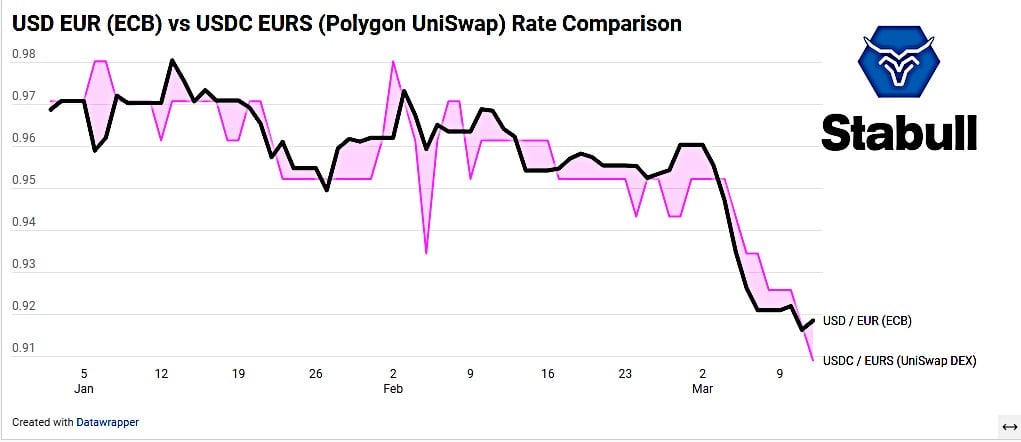

A comparison of the ECB’s daily USD/EUR rate compared to UniSwaps USDC/EURS rate on Polygon, showing the divergence in pricing.

Lower Slippage for Traders: By actively centering liquidity around the current, accurate oracle price, Stabull can offer very low slippage for trades, especially larger ones. Slippage is the difference between the price you expect when you initiate a trade and the price you actually get when it executes. High slippage means you lose value. Stabull’s protocol aims to minimize this.

Reduced Impermanent Loss (IL) for LPs: Impermanent Loss is a risk LPs face. It’s the potential loss in value compared to simply holding the assets, caused by the price ratio of the assets in the pool changing after deposit. Because Stabull’s AMM automatically adjusts its liquidity concentration based on the oracle price (without waiting for arbitrageurs to do it), it significantly reduces the divergence that causes IL for LPs providing liquidity for pairs like EURS/USDC, whose exchange rate naturally fluctuates day to day.

Peg Stability Support for Issuers: By facilitating swaps at rates very close to the real-world FX peg, Stabull helps stablecoin issuers better maintain their peg integrity. It relieves pressure on the peg by providing an efficient venue for users to enter or exit positions near the target value.

Capital Efficiency: Like modern AMMs, Stabull focuses liquidity where it’s most needed (around the current market price), rather than spreading it thinly across all possible prices. This means LPs’ capital is used more effectively to facilitate trades and generate fees. Stabull’s specific approach is tailored for the unique behavior of FX and commodity prices.

Stabull’s AMM is described as “proactive”. Instead of passively waiting for arbitrage traders to correct price differences between Stabull and other markets (which drains value from LPs), Stabull actively uses the oracle feed to keep its internal pricing aligned, providing better rates for traders and protecting LPs simultaneously. It strikes a balance, avoiding the pitfalls of a purely flat curve (vulnerable to oracle manipulation or draining if the peg breaks) while still offering much better pricing than general-purpose AMMs for its target assets.

Core Features: What Can You Do on Stabull?

Stabull is designed to “do one thing and do it well: low slippage stablecoin swaps and capital efficient liquidity pools”. Here’s a breakdown of its main features:

Swapping Stablecoins and RWAs:

How: Connect your compatible wallet (currently MetaMask, including connections via Brave browser and hardware wallets like Ledger and Trezor; with a broader range of wallet supported to be added before the end of Q3). Select the input token you have and the output token you want. Enter the amount. The interface will show you the expected exchange rate, potential price impact (how much your trade might move the price), and estimated blockchain fees. You’ll need to approve the Stabull smart contract to spend your input token (a one-time action per token, requiring gas), and then confirm the swap transaction (also requiring gas).

Supported Assets: Trade a growing list of non-USD stablecoins (like EURS, GYEN, TRYB, NZDS, BRZ, XSGD, PHPC, COPM) and RWAs (like PAXG gold) primarily against USDC.

Multihop Swaps: Even if a direct pool doesn’t exist (e.g., TRYB to EURS directly), Stabull’s router can automatically perform the swap through intermediate pools (e.g., TRYB -> USDC -> EURS) in a single user transaction.

Programmatic Access: Sophisticated users and arbitrage bots can interact directly with Stabull’s smart contracts to execute trades programmatically. This activity helps keep Stabull’s prices aligned with other markets and generates fee revenue for LPs. Aggregator support (like 1inch) is also planned for Q3, making Stabull’s liquidity accessible through other DeFi interfaces.

Fees: When you swap, you pay two types of fees:

- Gas Fee: Paid to the blockchain network (Ethereum or Polygon) validators for processing your transaction. This fee varies based on network congestion and is not collected by Stabull.

- Stabull Protocol Fee: A small fee charged by Stabull on the swap itself. According to the latest information, this is 0.15% of the trade value per pool utilized, paid in the output token. This fee is crucial for the ecosystem’s sustainability.

Providing Liquidity (Becoming an LP):

How: If you hold both assets in a trading pair (e.g., USDC and EURS), you can deposit them into the corresponding Stabull liquidity pool. Deposits must generally be made in proportion to the current reserves in the pool.

LP Tokens: In return for your deposit, you receive LP tokens. These tokens represent your share of that specific liquidity pool. They are standard ERC-20 tokens themselves and can be transferred or potentially used in other DeFi applications.

Earning Fees: As an LP, you earn a share of the trading fees generated by swaps in your pool. As of April 2025, 70% of the 0.15% protocol fee (so, effectively 0.105% of each swap volume) is distributed proportionally to the LPs in that pool. You claim these earned fees when you withdraw your liquidity.

Withdrawing: You can withdraw your liquidity at any time (no lock-up period). You return your LP tokens to the pool contract, which burns them and sends you back your proportional share of the pool’s current assets, including accumulated fees. Remember, the proportion of the two assets might have changed due to trading activity since you deposited.

Liquidity Mining & Staking (Boosting Yield):

The $STABUL Token: Stabull has its own governance token, $STABUL. A significant portion of the total supply is dedicated to incentivizing liquidity providers.

Earning $STABUL: LPs can optionally take their LP tokens and stake them in corresponding “Vaults” (also referred to as LP Staking Pools). By doing this, LPs earn additional rewards in the form of $STABUL tokens on top of their trading fees.

Program Details: 30% of the total $STABUL supply (3,000,000 tokens out of 10,000,000 total) is allocated to this liquidity mining program, distributed over 10 years via a gradually decreasing emission schedule. This encourages early participation while ensuring long-term sustainability. There’s no minimum lock-up period for staked LP tokens in these vaults.

Replenishment: A portion of the protocol’s overall swap fee revenue (potentially the remaining 30% after LP distribution, though specifics might evolve with governance) is planned to be used to buy back $STABUL from the market and replenish the liquidity mining reward pool, creating a sustainable loop.

Supported Assets and Blockchains

Stabull aims to be the premier venue for eligible non-USD stablecoins and RWAs.

Blockchains:

Stabull is currently live on:

Ethereum: The original smart contract platform, known for its security and vast ecosystem, but often higher gas fees.

Polygon (Matic): A popular Layer 2 scaling solution for Ethereum, offering much lower gas fees and faster transactions.

Base: A Layer 2 incubated by Coinbase, integration is planned for Q3 2025.

Stabull plans to expand to other relevant blockchains based on liquidity and demand, aiming to support stable assets wherever they are most active.

Supported Stablecoins:

The list is constantly growing. Key examples include:

Ethereum: EURS (Euro), GYEN (Japanese Yen), TRYB (Turkish Lira), NZDS (New Zealand Dollar). Note: USDC is the pairing asset.

Polygon: EURS, TRYB, NZDS, BRZ (Brazilian Real), XSGD (Singapore Dollar), PHPC (Philippine Peso), COPM (Colombian Peso), DAI (USD Stablecoin), USDT (USD Stablecoin). Again, paired with USDC.

You can always find the current, definitive list on the Stabull DEX interface.

Supported Real-World Assets (RWAs):

PAX Gold (PAXG): Currently live on Polygon, representing ownership of one troy ounce of physical gold stored in secure vaults.

Future Plans: Stabull is actively working on integrating other precious metals and exploring tokenized commodities listed on major exchanges like the Chicago Mercantile Exchange (CME) throughout 2025.

What Makes an Asset Eligible for Listing on Stabull?

Stabull aims to list high-quality, reliable assets. The criteria for eligibility generally include:

- Audited & Transparent Reserves: For stablecoins, proof of the underlying fiat currency reserves, regularly audited by reputable firms and publicly accessible, is crucial. For RWAs, proof of the underlying physical asset and its secure storage.

- Known Team: A reputable and identifiable team behind the asset issuer.

- Supported Chain: The asset must exist on a blockchain network supported by Stabull (Ethereum, Polygon, etc.).

- Technical Standards: Typically, adherence to common token standards like ERC-20 on Ethereum-compatible chains.

- Market Presence: The underlying fiat currency or commodity should be actively traded on established FX or commodity markets.

Stablecoin and RWA issuers can apply to have their assets listed on Stabull. Holding $STABUL tokens may offer a fast-track option for this process, aligning incentives between the platform and asset issuers.

Stabull’s Unique Selling Points (USPs) – Why Choose Stabull?

Let’s summarize what makes Stabull stand out:

- Specialist Focus: It’s the dedicated venue for non-USD stablecoins and tokenized RWAs. This focus allows it to tailor its technology and liquidity programs specifically for these assets’ needs.

- Launchpad for Stablecoins: Provides essential infrastructure and visibility for non-USD stablecoins to gain traction, utility, and users beyond their initial issuing platform or region.

- Oracle-Driven Accuracy: The use of off-chain oracles ensures efficient swaps at real-world prices, benefiting traders (low slippage), LPs (reduced IL), and issuers (peg stability).

- Capital Efficiency: The 4th Gen AMM maximizes the use of LP capital, leading to better returns for LPs and deeper liquidity for traders.

- Competitive & Sustainable Fees: The fee structure aims to be attractive for traders while adequately rewarding LPs and funding platform development and security (like the Insurance Fund).

- Security & Transparency: Operates as a non-custodial DEX, undergoes regular third-party security audits, and allocates a portion of Protocol fees to an Insurance Fund for user protection.

- Community & Consortium Roots: Originated from the needs of stablecoin issuers, with plans for progressive decentralization and governance driven by $STABUL token holders.

- Accessibility: Permissionless (anyone with a wallet can use it), operates 24/7/365, and contributes to financial inclusion by making diverse currencies and assets accessible globally.

Stabull Today and the Road Ahead

Stabull isn’t just a concept; it’s a live platform making waves.

Live and Trading: The Stabull DEX launched and has been operational, facilitating significant volume. Since late 2024, it has processed over $3.7 million in swap volume across tens of thousands of transactions. This demonstrates real-world usage and validation of its model.

$STABUL Token Public Sale: After initial phases, Stabull is now launching its governance token, $STABUL, to the public. An Initial Exchange Offering (IEO) is taking place on the ProBit Global exchange, starting April 16th, 2025, and running through May. The first round of the public sale’s tokens will be priced at $3.00 per $STABUL token. The total supply is capped at 10 million tokens.

Listing & TGE: Following the conclusion of the sale, the $STABUL token is confirmed to be listed for trading on ProBit Global. The Token Generation Event (TGE), will occur when the token is listed. This marks a significant milestone, allowing wider participation in the Stabull ecosystem and its governance.

Future Roadmap:

Stabull has ambitious plans:

- Progressive Decentralization: Gradually handing over control and decision-making (like fee structures, reward allocations, new listings) to $STABUL token holders via a DAO (Decentralized Autonomous Organization).

- Multi-Chain Expansion: Integrating more blockchains like Base and others where stablecoin and RWA activity flourishes.

- More Assets: Continuously adding new eligible stablecoins and RWAs, including diverse commodities and financial products.

- Feature Enhancements: Exploring advanced features like limit orders, RFQ (Request for Quote) systems for large trades, and deeper integrations with DeFi aggregators.

- LVR Implementation: Further refining the AMM using concepts like LVR (Loss Versus Rebalancing) to enhance LP protection and platform efficiency.

Building the Future of On-Chain FX and Commodities

Stabull Finance addresses a critical, underserved niche within the rapidly expanding DeFi landscape. By providing a specialized, efficient, and secure platform for swapping non-USD stablecoins and tokenized real-world assets, it unlocks significant value for multiple participants:

Traders: Get access to diverse global currencies and commodities on-chain with low slippage and competitive fees, mirroring real-world prices.

Liquidity Providers: Can earn attractive yields from trading fees and $STABUL rewards on assets previously difficult to utilize efficiently in DeFi, with reduced risk of impermanent loss thanks to the oracle-driven AMM.

Stablecoin & RWA Issuers: Gain a vital liquidity venue and launchpad to increase the adoption, utility, and stability of their assets.

The Broader DeFi Ecosystem: Benefits from robust infrastructure that bridges the gap between traditional finance (FX, commodities) and the blockchain, fostering greater interoperability and innovation.

Born from a clear need identified by industry players and built on cutting-edge AMM technology, Stabull is more than just a DEX. It’s a foundational piece of infrastructure aiming to democratize access to global financial markets on the blockchain. With a live platform already demonstrating traction and the upcoming public launch of its $STABUL token, Stabull is poised to play a pivotal role in the next chapter of decentralized finance. Whether you’re looking to trade diverse stablecoins, earn yield on your assets, or simply explore the future of on-chain finance, Stabull Finance is a project worth watching closely.