TL;DR

- Tether dominates the CeFi lending market with a 70% share, up from 20% before the sector’s collapse in 2022.

- Together with Galaxy Digital and Ledn, it controls $10 billion in loans, accounting for 89% of the centralized market.

- Although criticized for the opacity of its reserves, Tether claims its loans are overcollateralized in Bitcoin and that it has never failed to process a redemption.

Tether became one of the main sources of financing in the crypto market after the collapse of the centralized lending sector in 2022.

While companies like BlockFi, Celsius, and Genesis filed for bankruptcy due to a combination of poor risk management and the sharp market downturn, Tether began to expand its share until it became the leading player. By the end of 2024, the company held nearly 70% of all CeFi loans, a significant increase from the 20% it had in 2021.

A recent report from Galaxy Digital shows that Tether, along with Ledn and Galaxy itself, controlled nearly $10 billion in centralized loans in the fourth quarter of 2024. These three firms represent 89% of the CeFi market, where loans are granted directly between parties without relying on automated contracts, as is common in decentralized finance.

Tether Claims Its Assets Are Fully Backed

Tether has faced heavy criticism for a lack of transparency regarding its reserves. Although it claims its USDT token is fully backed by assets, analysts point out that part of those reserves include loans and investments that could affect liquidity during periods of stress. The company maintains that all loans are overcollateralized in Bitcoin and that it has never failed to process a verified customer’s redemption request. Cantor Fitzgerald, acting as custodian, has publicly confirmed that the firm holds the funds it claims.

In addition to its role as a lender, the USDT issuer has expanded into new industries and sectors. In October 2024, it completed the financing of its first crude oil transaction in the Middle East. It is also in talks with commodity traders and with Cantor to build a loan program backed by Bitcoin.

The CeFi Market Shrinks

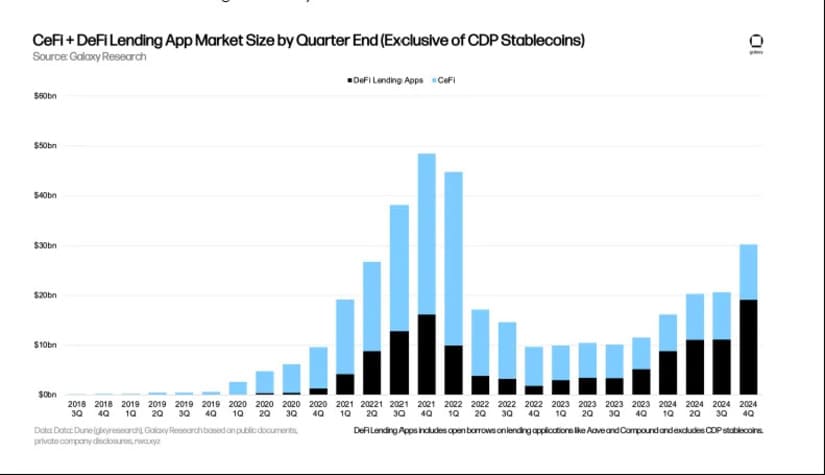

Tether’s growth contrasts with the contraction of the CeFi market, which closed 2024 with a total loan volume of $11.2 billion, down 68% from its peak. However, DeFi lending continues to gain ground. The total size of the crypto lending market, including CeFi, DeFi, and collateralized stablecoins, reached $36.5 billion, far below the $64.4 billion recorded in 2021.