Earnings season is about to kick off again with 4Q24 earnings reports starting to trickle out. While the numbers are not yet officially released, there has been enough sector-level data that I think the market has a pretty good idea of where 4Q24 earnings will come in for the majority of REITs. The 4th quarter report, however, is a special report because it often comes with 2025 guidance and that is where the surprises will be.

Expectations versus valuation

There are some sectors that are rather obviously going to have strong 2025 guidance. Data centers are still growing rapidly with AI expansion, and senior housing is still rebounding off the ugly trough of a few years ago. The likely strong guidance for these sectors, however, seems to already be priced into the stocks, with those sectors trading at premiums to net asset value (NAV).

S&P Global Market Intelligence

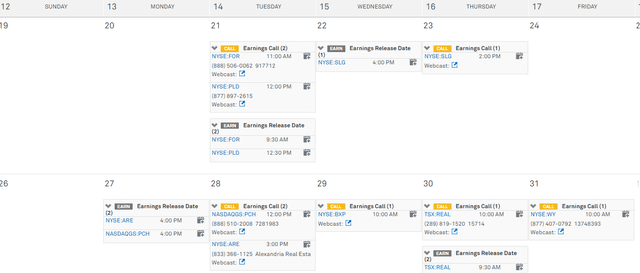

REIT earnings season kicked off with Prologis, Inc. (PLD) on January 21st, followed by SL Green Realty Corp. (SLG), Alexandria Real Estate Equities, Inc. (ARE), PotlatchDeltic Corporation (PCH), and Weyerhaeuser Company (WY).

S&P Global Market Intelligence

These large caps typically report early in the season and serve as bellwethers for industrial, office, labs, and timber, respectively.

Just as data center valuations demand high-growth guidance, industrial REITs are expected to cool significantly from the white-hot, post-pandemic growth with the sector trading at a 27% discount to NAV. We anticipate guidance will indeed show a slowing of same-store NOI growth but remain strongly positive due to existing mark-to-market spreads.

Similarly, timber is likely to have tepid guidance, with still low lumber prices and mortgage rates over 7% keeping the housing market cool. That said, timber REITs are priced at a 28% discount to NAV. Notably, this discount is unique to publicly traded stocks, as timberland itself has been increasing in transaction prices.

So the way I’m looking at guidance issuance as an opportunity for investment is not just about what sectors are hot, but rather which sectors I believe will come in significantly better than what is priced in.

Here are the 3 sectors that, I think, will have the biggest delta between valuation implied expectations and the soon-to-be issued 2025 guidance.

Guidance opportunity #1 Triple net acquisition pipelines reopening

Over the last 2 years, triple net REIT investors have been disappointed by a lack of AFFO/share growth and almost no activity with acquisition pipelines shut down.

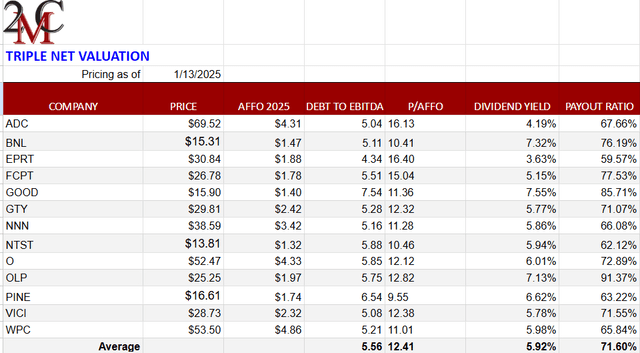

The REITs are priced accordingly with triple nets trading at about 12.4X AFFO.

2MC Portfolio Income Solutions

We believe the guidance will come in well ahead of expectations on both acquisitions and AFFO/share.

Triple net REITs used the high inflation environment to build significant escalators into their leases, with most triple nets somewhere between 2% and 3% annual escalators. With short-term interest rates having stabilized or declining slightly, and long-term debt locked in at fixed rates, interest expense has stopped increasing, which allows the escalators to flow through to AFFO/share growth.

Additionally, cap rates have come up a fair amount. Single tenant properties are available in high 7 cap rates and even higher in some subsectors available for purchase, which has re-opened spreads, allowing triple nets to turn their acquisition pipelines back on. This should be nicely accretive to AFFO/share as well.

Thus, we are long triple net and anticipate a favorable response as guidance comes in ahead of expectations.

Guidance opportunity #2 Utilities – updated pipelines with massive changes in load

2024 was obviously a massive year for AI and data center growth. The build-out will, of course, require vast amounts of electricity and I think this concept has been widely publicized.

So while I think there is tacit awareness of load growth as a driver for utilities I think people are underestimating the capital investment opportunity due to guidance being woefully outdated across much of the sector.

Utilities as a sector seem to only update capital investment guidance once a year. Most of them put out long-dated pathways suggesting X number of gigawatts of new production by 2030 or certain billions of dollars of investment on transmission/generation by 2029.

The numbers in their long-range guidance are fairly large, but these forecasts were put into place with 4Q23 earnings reports. They are a full year outdated at this point which means they are reflecting the load growth assumptions of early 2024.

In January 2024, data center development from AI was still somewhat speculative. It has since transformed into verified demand for hundreds of billions of dollars of new data centers.

Essentially, the load demand now is clearly much larger than people were estimating back at the start of ’24. As such, I think electric utility guidance will be reset substantially higher on the capital investment front, which should pull up long-range annual earnings growth estimates as well.

Utilities have remained quite cheap, so I don’t think higher guidance is priced into the stocks.

Guidance Opportunity #3: Apartments calling for supply-driven disruption

Apartment REITs will likely guide light due to remaining 2025 deliveries and uncertain impact on discounting/promotions.

As we discussed more thoroughly in our apartment sector report, existing developments are continuing to be delivered in substantial volume through at least the first half of 2025. We believe this will be well absorbed by strong demand, such that net absorption roughly offsets net new supply.

However, most companies tend to be conservative in their guidance and there is a disparity in certainty between supply and demand for the apartment sector. The supply is very tangible and a known quantity. You can see the skeletons of buildings under construction and read documents as to when they are likely to be delivered.

Demand, while likely strong, is a bit more of a forecast. There is quite a bit more wiggle room in net absorption for 2025.

So faced with certain high supply and uncertain demand, I suspect most of the apartment REITs are going to guide toward the weak side – probably calling for slightly negative rent rolls and a bit of a hit to occupancy.

A similar thing happened in 2024 where apartments REITs guided for a terrible year given the supply known to hit in 2024. As it turned out, demand came in very strong, keeping earnings healthy, and the majority of apartment REITs materially beat their 2024 guides.

Unlike the other opportunities, this one is potentially more applicable as a post-hoc purchase. We already own some apartment REITs and are limping in to get longer due to the combination of long-term growth and cheap valuation.

If apartment REIT sentiment does take a hit on guidance as we anticipate, we would see it as an opportunity to increase allocation to the sector. Conservative guidance could mark the trough for sentiment on the apartment sector, just as it did in early 2024.

Wrapping it up

This should be a high-impact earnings season. Reports along with guidance provide ample new information for the market to digest. Don’t just trade the numbers, but rather how the data differs from what is implied by valuation.