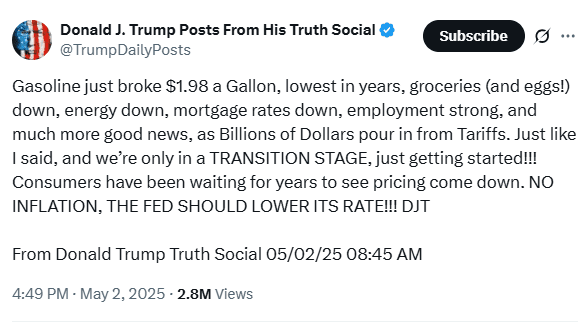

On May 2, 2025, President Donald Trump again asked the Federal Reserve to cut interest rates. His comments followed the latest US jobs report, which showed nonfarm payroll employment increased by 177,000. Unemployment stayed unchanged, and wages rose modestly.

Trump cited strong job growth and lower consumer prices. He argued that rate cuts would help boost the US economy. He made similar requests earlier during economic updates, especially when data looked positive.

Despite Trump’s push, the Federal Reserve has not changed its stance. Fed Chair Jerome Powell has stated that rate decisions must reflect long-term risks. He warned that early rate cuts may reduce the Fed’s ability to act if real problems emerge later.

Powell Keeps Interest Rates Unchanged Over Inflation Risks

Jerome Powell and other members of the Federal Reserve are still focused on controlling inflation and watching global trade risks. A key issue for them is the uncertainty caused by U.S. tariffs. Powell has said that these tariffs make it hard to predict future economic conditions and could hurt the country’s financial stability if not handled carefully.

Because of this uncertainty, the Fed believes that cutting interest rates too soon—especially after a strong jobs report—could be risky. Lowering rates now would reduce the tools available to respond if a real economic crisis happens later. That’s why Powell has stressed the need to wait until long-term risks are more visible before making any changes.

Trump previously threatened to remove Powell over policy differences. However, federal law prevents the President from firing the Fed Chair without cause. When Trump first made the threat, it caused brief market volatility, but he later stepped back.

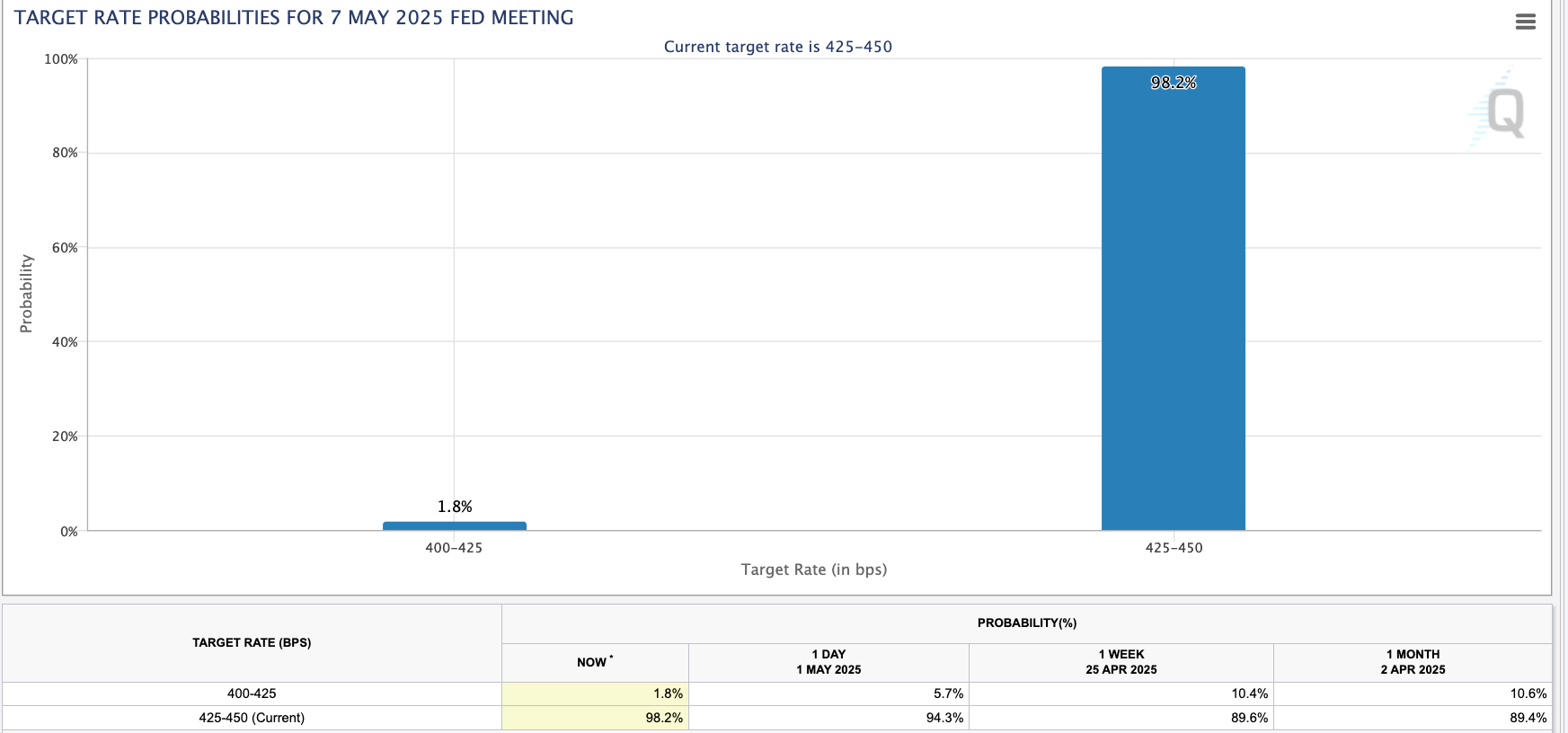

Market data from the CME Group shows almost no chance of a rate cut during the next Fed meeting. According to the CME rate prediction tool, traders expect the Fed to keep rates steady, especially after the labor market report.

Crypto Market Reacts to Trump Rate Cut Pressure

The crypto market often reacts to shifts in interest rate expectations. When interest rates are low, assets like Bitcoin and Ethereum may see increased demand because investors tend to move money away from traditional savings into higher-risk options that offer better potential returns.

President Trump’s call for rate cuts has added to speculation in the crypto space. Still, the Federal Reserve does not base its decisions on how crypto markets behave. Instead, it focuses on indicators like employment data, inflation trends, and overall economic stability when deciding whether to adjust interest rates.

In past months, Bitcoin rate impact stories emerged after false reports about policy shifts. This has created uncertainty for short-term crypto investors. Still, the current data points to no immediate changes in Powell interest rates.

Analysts Say Fed Unlikely to Cut Rates Soon

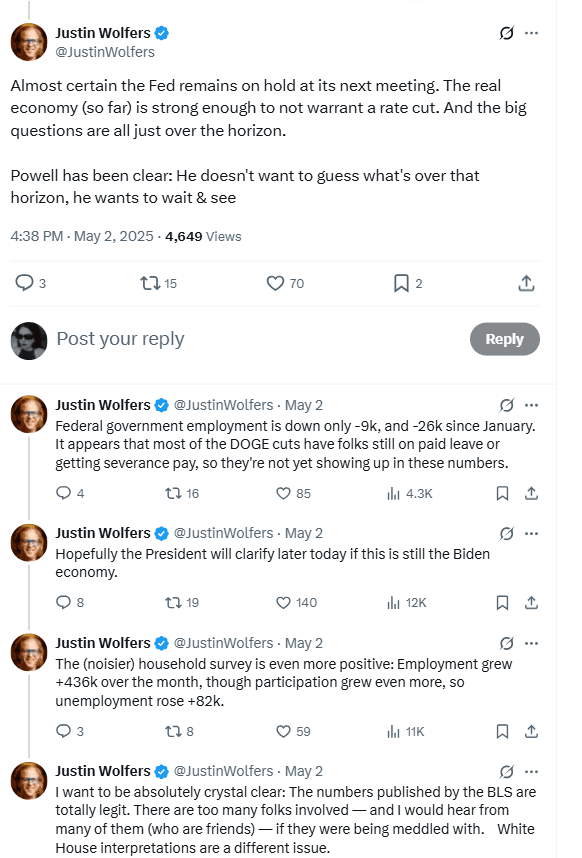

Justin Wolfers, an economist at the University of Michigan, explained the Fed’s likely response to the April jobs data. He said:

“I’m almost certain that the Fed remains on hold at its next meeting. The real economy (so far) is strong enough to not warrant a rate cut. And the big questions are all just over the horizon. Powell has been clear: He doesn’t want to guess what’s over that horizon, he wants to wait & see. The report is absolutely legit. White House interpretations are a different issue.”

His remarks align with current CME rate prediction figures. The platform shows traders shifting away from expecting a cut in the near term.

The Federal Reserve appears to be holding its line. The current strength of the US labor market gives officials confidence to delay further changes. While Trump rate cut calls continue, they have not yet influenced Fed decisions.

Meanwhile, crypto investors remain focused on future updates, watching closely how the US economy and Fed decisions could affect digital asset prices. The Bitcoin rate impact remains tied to broader financial trends rather than individual comments.