Uniswap (UNI) enters June 2025 with renewed momentum, fueled by strong whale accumulation, protocol upgrades via v4, and growing developer activity across its expanding ecosystem.

Fundamental Developments

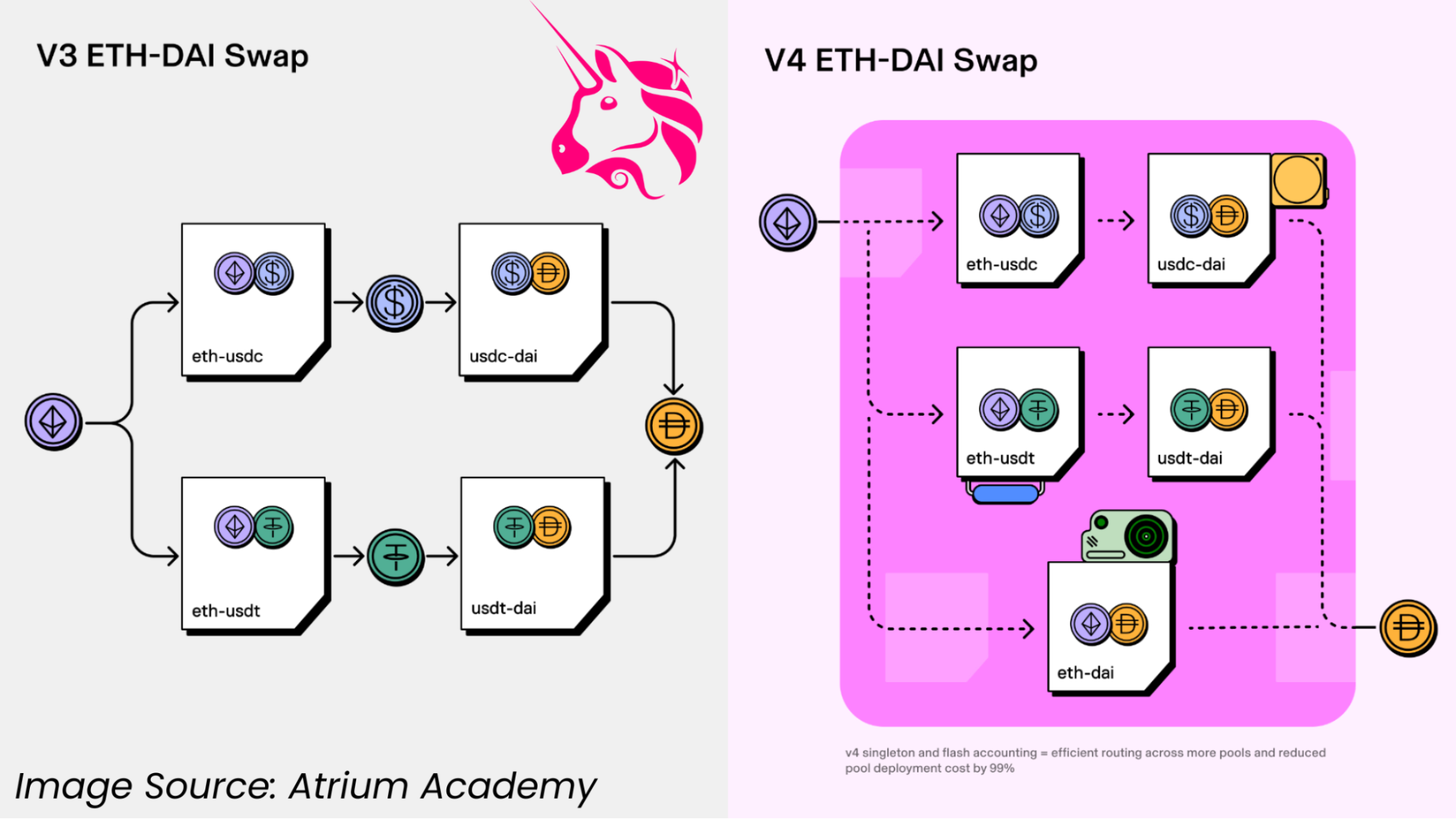

Uniswap’s core protocol continues evolving. Most recently, Uniswap v4 launched with a major architectural overhaul. Key among its features is a new “Hooks” mechanism allowing developers to run custom code before/after swaps.

This enables advanced functionality (built-in limit orders, custom price oracles, dynamic fee management, automated liquidity strategies, etc.). Other v4 improvements include dynamic fees, gas optimizations (e.g. “flash accounting”), native ETH support (no wrapped-ETH needed), and multiple pool types.

These upgrades aim to boost capital efficiency and user flexibility, potentially attracting more traders and liquidity to Uniswap.

Several new projects are already building on v4’s hooks (e.g. Bunni for dynamic liquidity management, Flaunch for structured memecoin launches), suggesting growing developer interest in the platform’s latest tools. In short, v4’s rollout has been smooth, and its advanced features may reinforce UNI’s long-term value by improving Uniswap’s competitiveness.

Source: Atrium Academy

In addition to protocol logic, Uniswap Labs has broadened its network reach. In Feb 2025 it officially launched Unichain, a native Layer-2 rollup built on the Optimism OP Stack. Over 100 applications/protocols (including Uniswap itself, Coinbase, Circle, Lido, etc.) are already deploying on Unichain.

Importantly, Circle (issuer of USDC) is actively integrating on Unichain, enabling native USDC usage and yield features (discussed below). This Layer-2 expansion should enhance Uniswap’s scalability and accessibility.

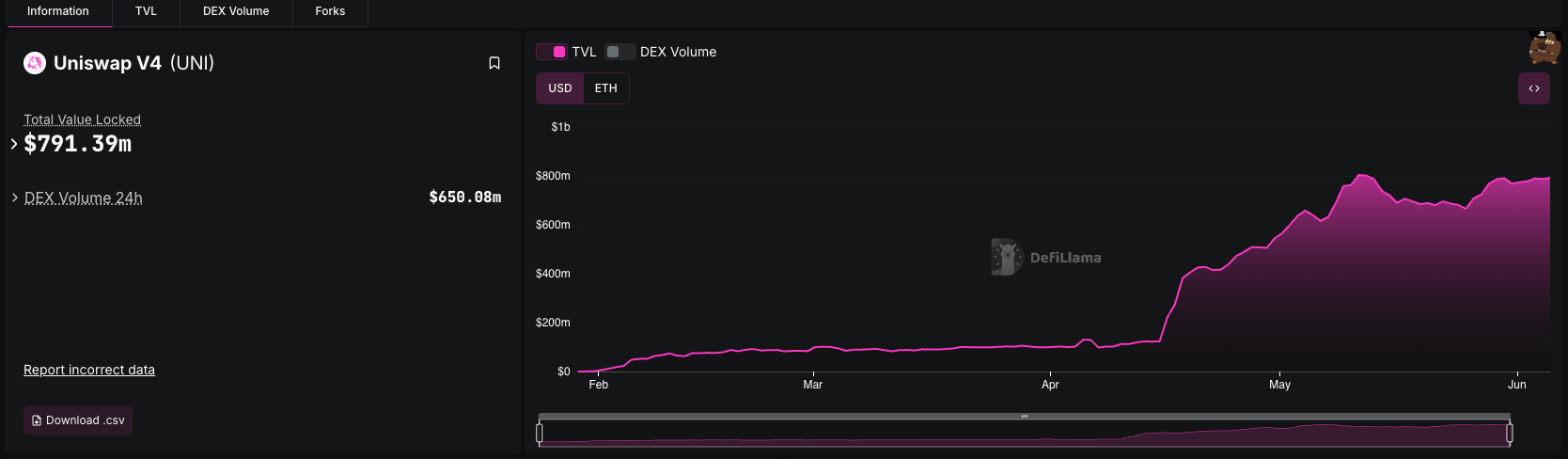

Uniswap already spans many chains – DefiLlama shows ~$4.96B TVL split across Ethereum L1 and numerous L2s: $3.335B on Ethereum, $511M on Unichain, $445M on Base, $293M on Arbitrum.

Tokenomics & On-chain Metrics

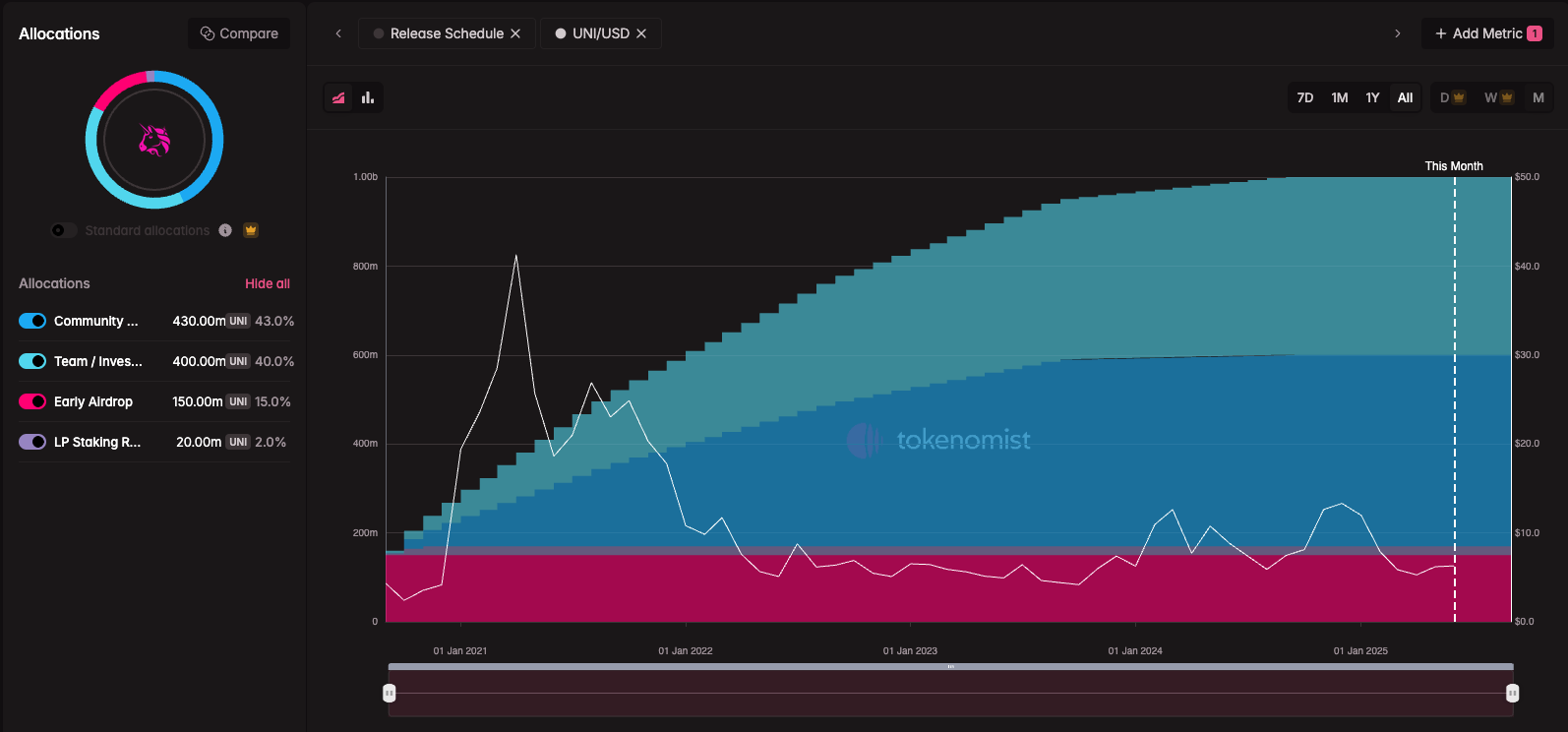

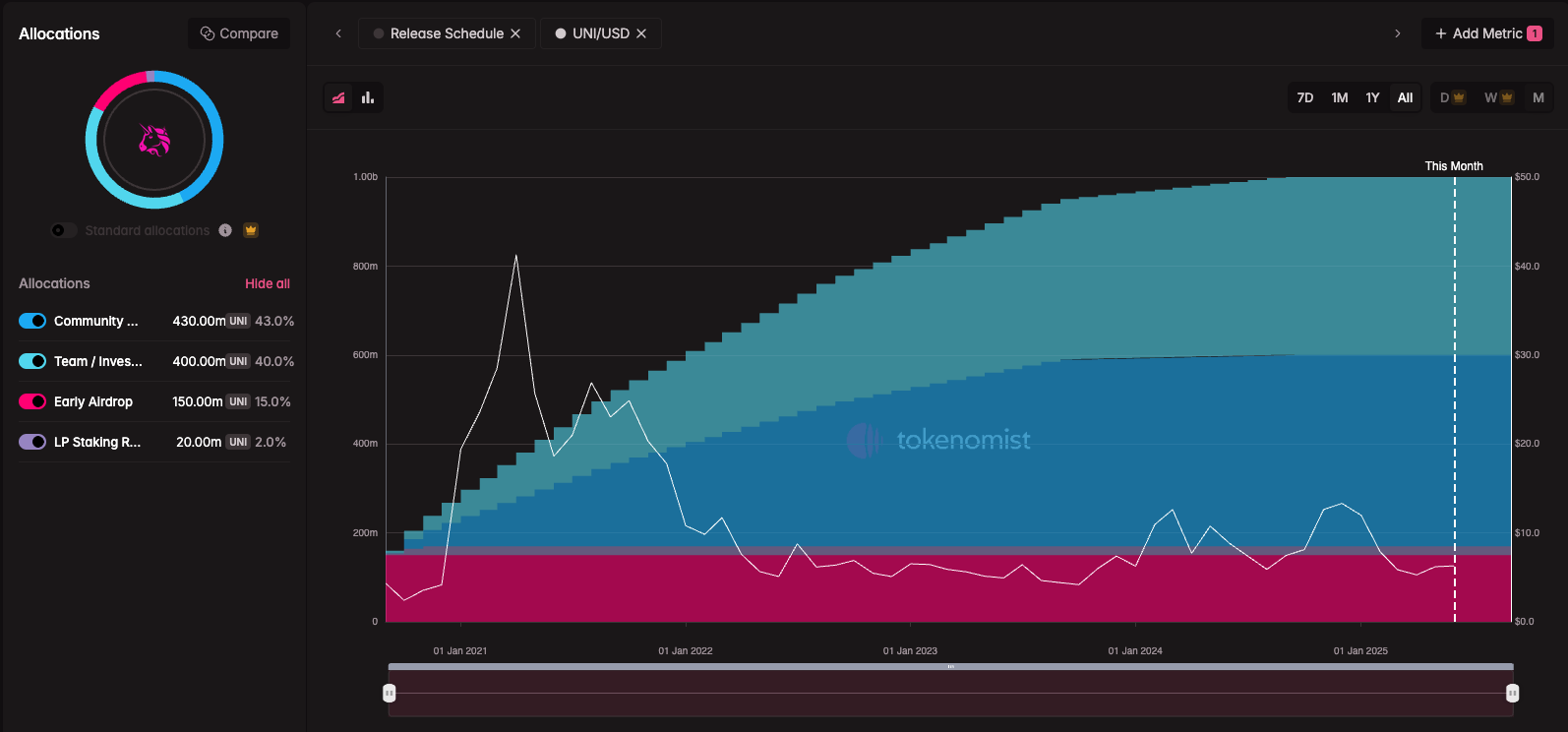

The UNI token itself has a fully unlocked supply of ~1.00 billion. According to Tokenomist data, UNI’s “Total Unlock Progress” is 100%, meaning no major vesting remains. Thus, UNI has no imminent unlock-related inflation to pressure the price. The token’s market capitalization is around $3.9–4.0B (price ~$6.4–6.8).

Source: Token Unlocks

The on-chain treasury is minimal (DefiLlama lists only ~$167K in UNI), so there is little counter-cyclical sell pressure from protocol reserves is distributed to liquidity providers, not directly to token holders, so UNI itself has no scheduled token burns or direct yield.

Overall, the tokenomics are neutral: no new inflation, but also no inherent token sink besides platform growth.

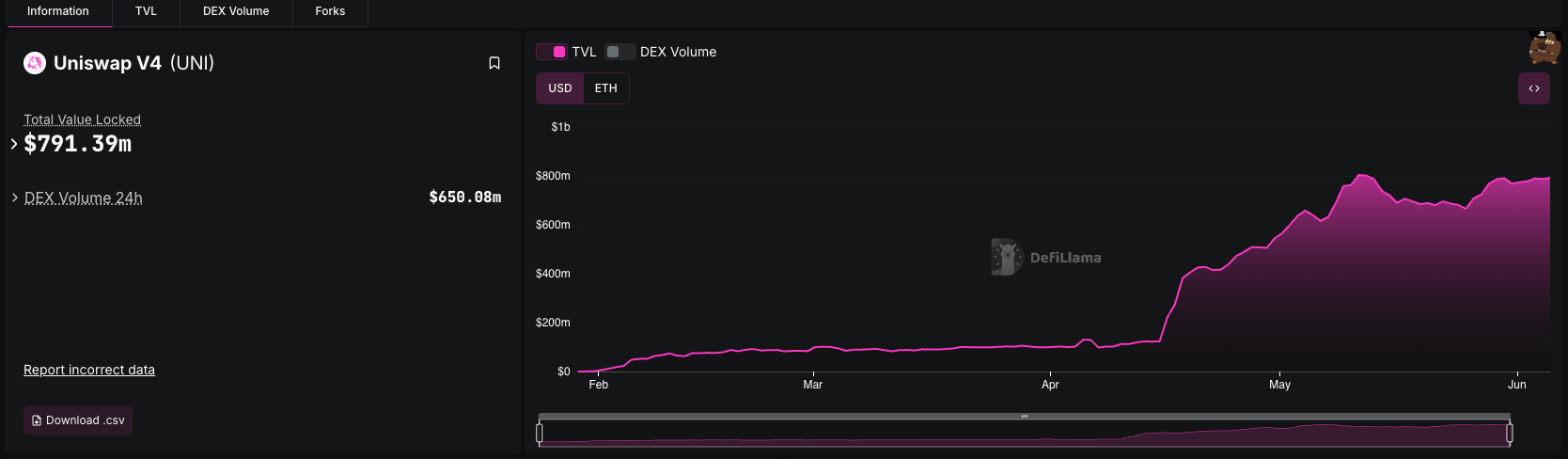

Uniswap’s Total Value Locked is roughly $4.92B, spread over multiple chains. This TVL is down from its 2021 peak (when it briefly hit ~$10–12B), but it remains healthy.

Source: DeFiLlama

Much of the older liquidity (v2/v3 on L1) has been stable; TVL only slowly declined from 2021 peaks as LPs withdrew some funds when yields dropped. That said, new liquidity is flowing in on rollups and v4 pools; Uniswap v4 launched with incentives; but still, enthusiastic users can expect higher yields and new pool designs.

Around 7,261 unique addresses used Uniswap in 24h, showing strong daily activity from traders and LPs.

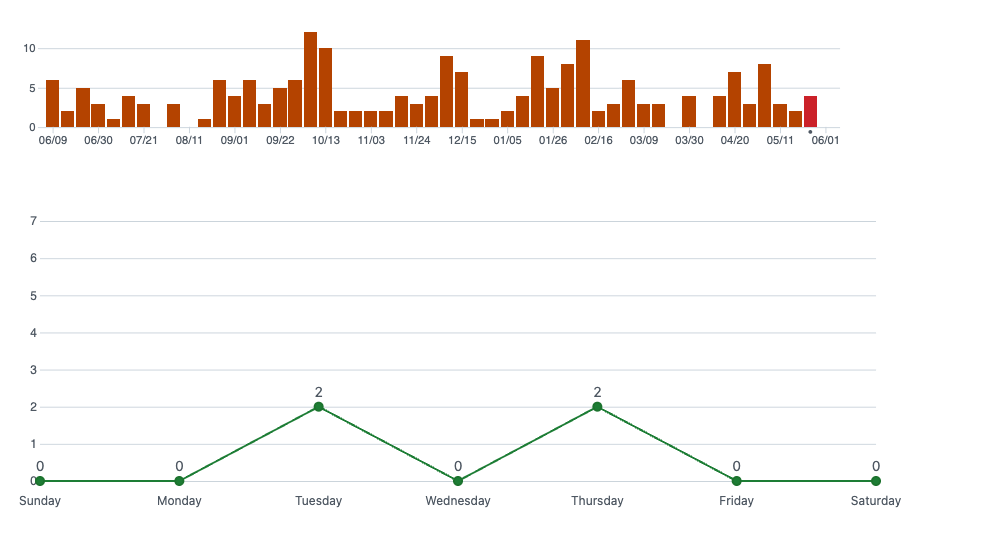

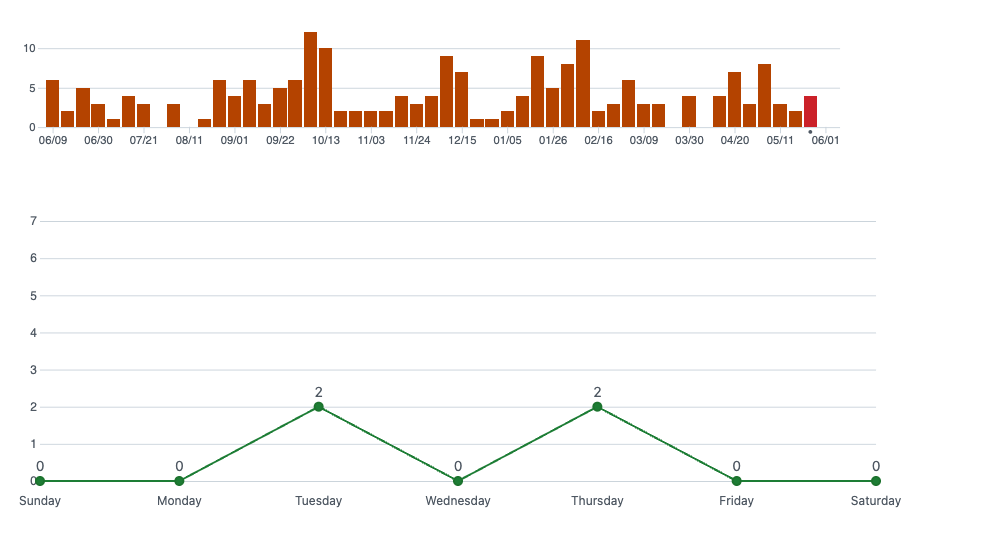

The number of new addresses is likely a fraction of that, but continued high address counts show steady usage. Uniswap’s GitHub is active, with 8 weekly commits by 3 developers as of early June 2025.

Source: GitHub

This suggests ongoing maintenance and feature work. By contrast, many smaller projects hardly see any commits. Active devs and frequent updates signal that Uniswap Labs is continually iterating, which supports confidence in the protocol’s future.

This highlights Uniswap’s resilience even amid the crypto boom – it captured roughly one-quarter of all DEX trades in 2024. The implication is that any growth in the DeFi market will largely benefit Uniswap as the incumbent DEX.

Conversely, serious competition could chip away at market share, but no significant challenger has emerged yet. For now, Uniswap remains the flagship DEX on Ethereum, giving UNI a strong fundamental backing.

Market Sentiment and Trading Behavior

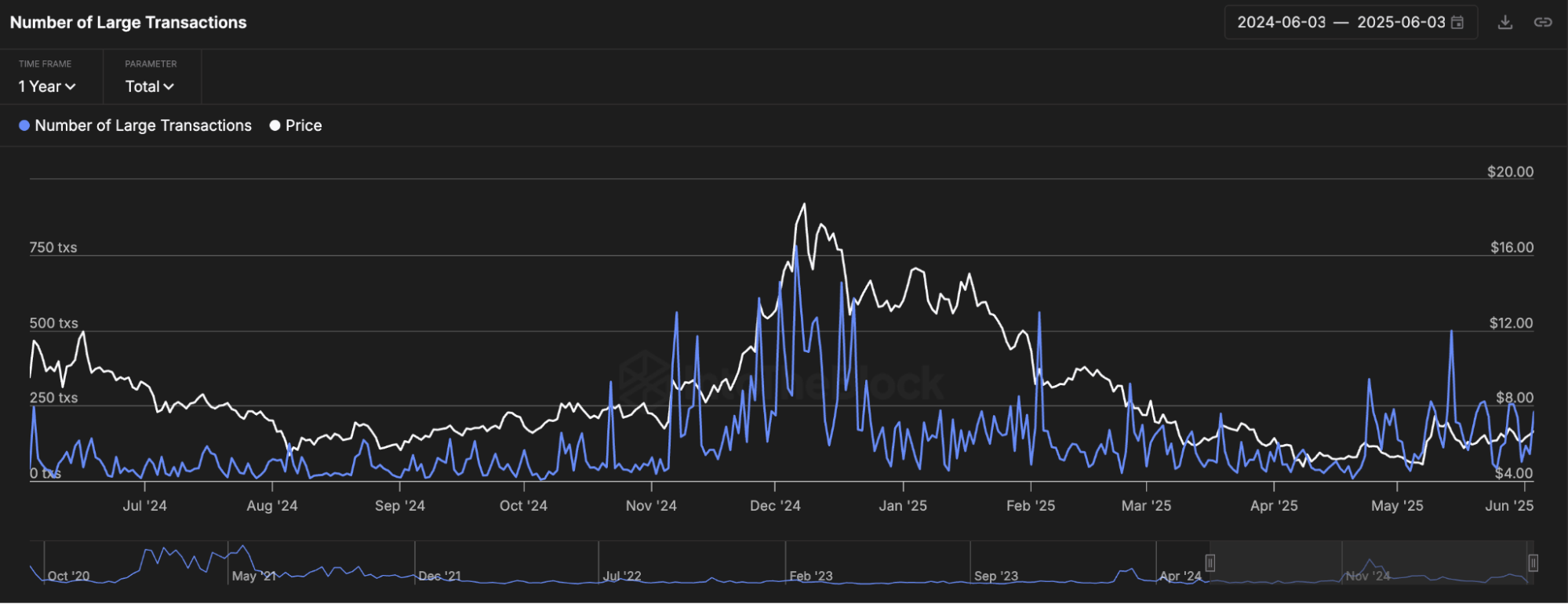

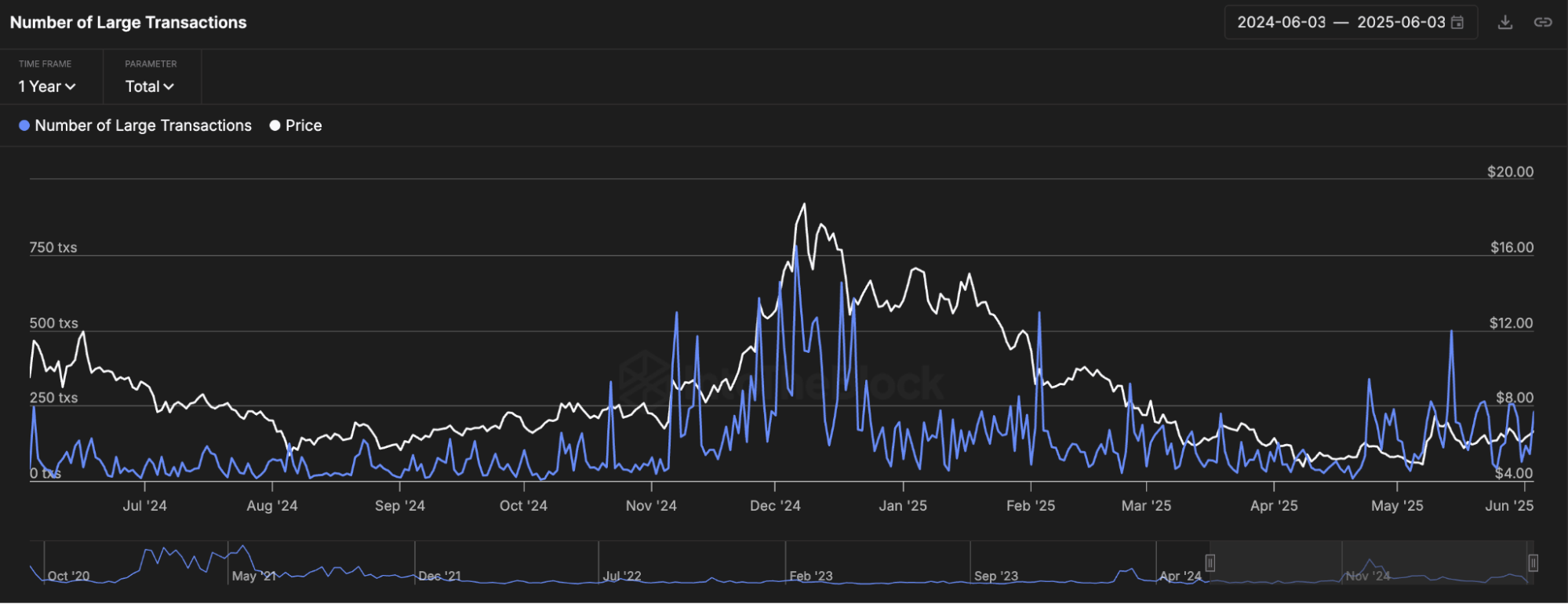

A striking recent trend is growing whale interest. Crypto research reports have noted a sharp uptick in large UNI transactions and accumulations. IntoTheBlock’s data shows that the count of transactions >$100K has risen significantly in late May/early June.

Such surges are often interpreted as institutional or large-wallet accumulation. For example, on June 3 a whale-driven breakout drove UNI from ~$6.45 to $7.00 (a 7% intraday jump).

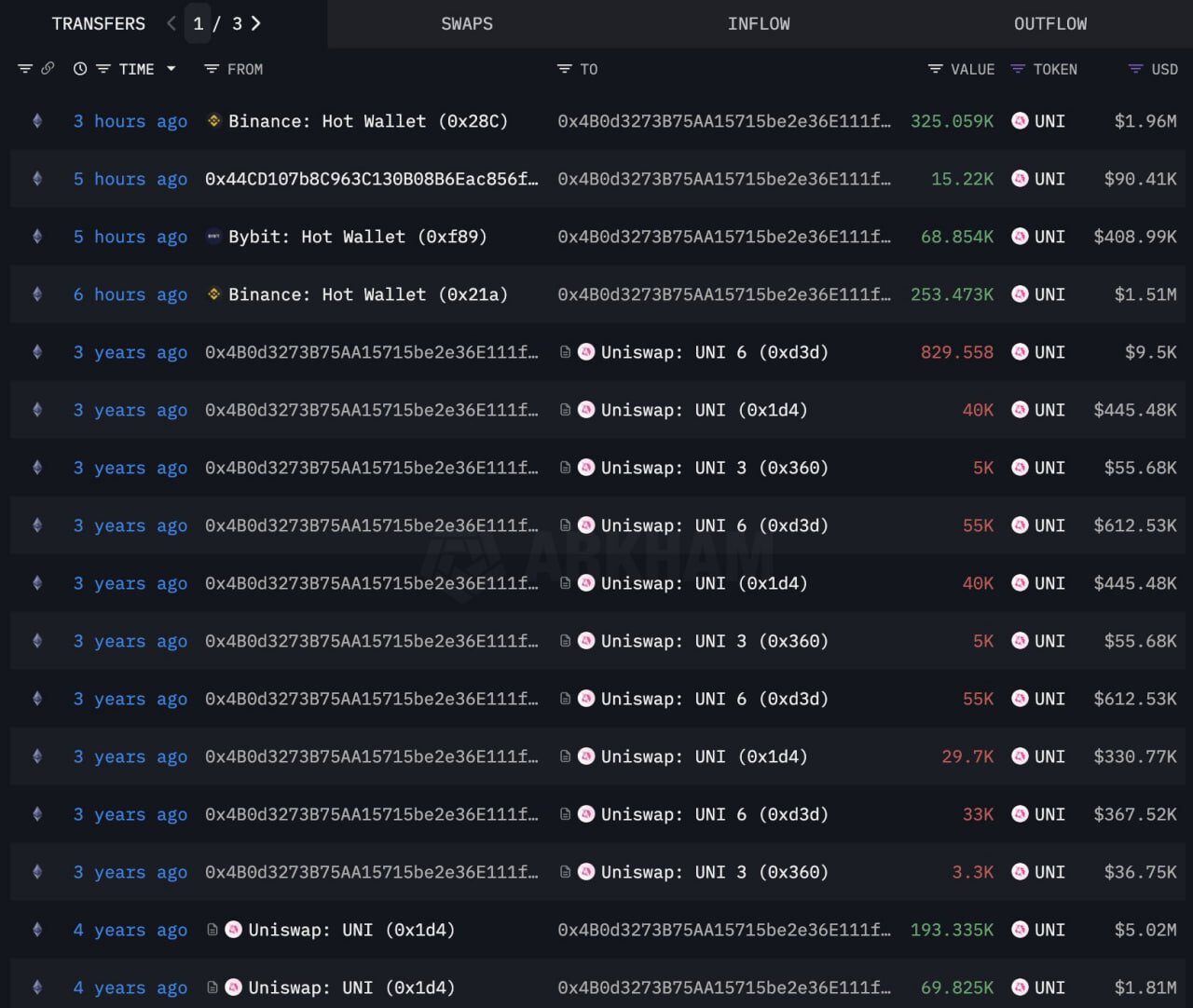

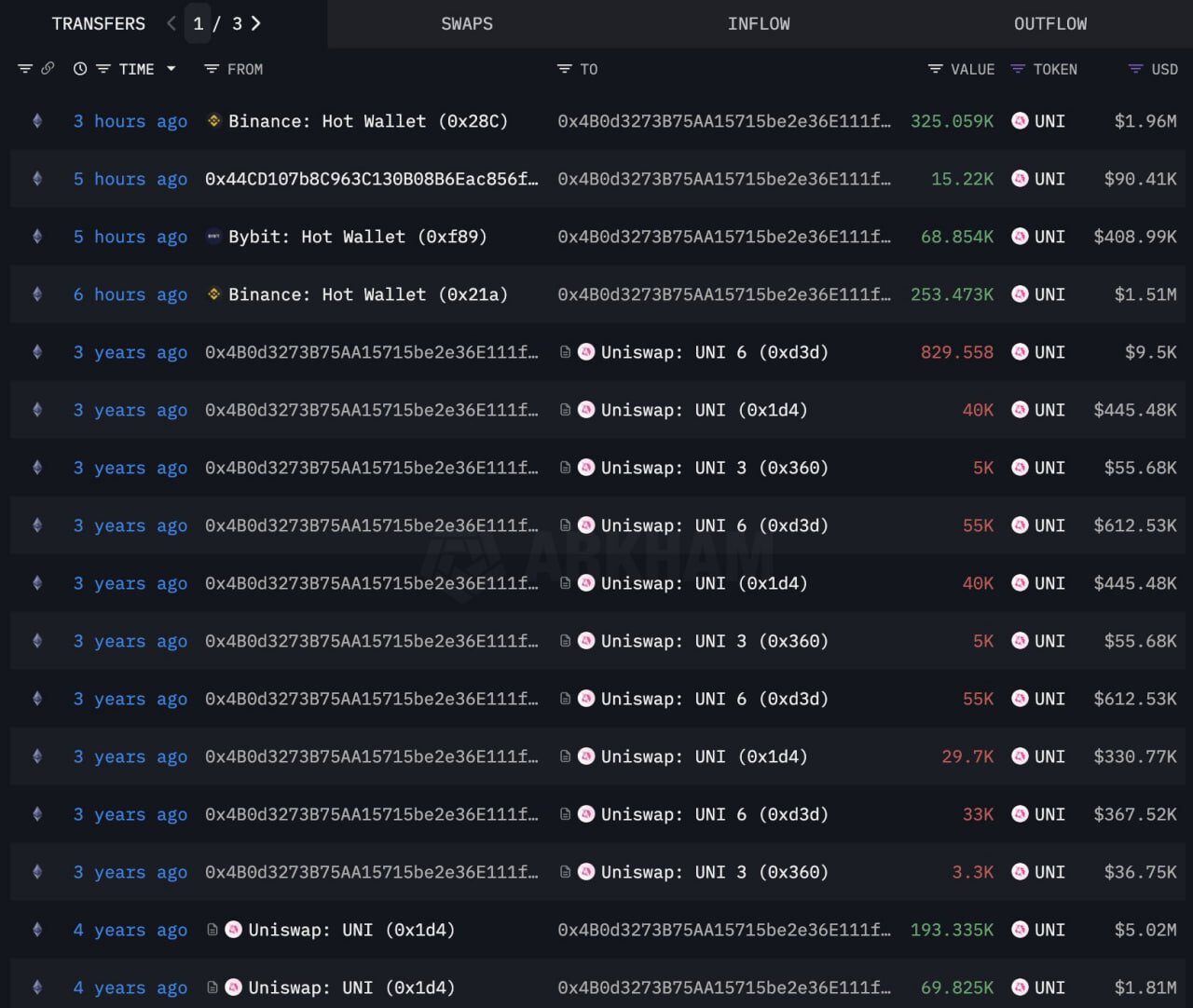

On May 21 a known “UNI whale” purchased 662,606 UNI ($3.97M) and on June 1 another whale withdrew 401,573 UNI ($2.46M) from Binance.

Source: Arkham

These are clear signals that large investors are positioning into UNI. Such activity tends to influence price: withdrawals from exchanges reduce immediate sell pressure (suggesting holding or protocol staking), while large buys can drive the market up.

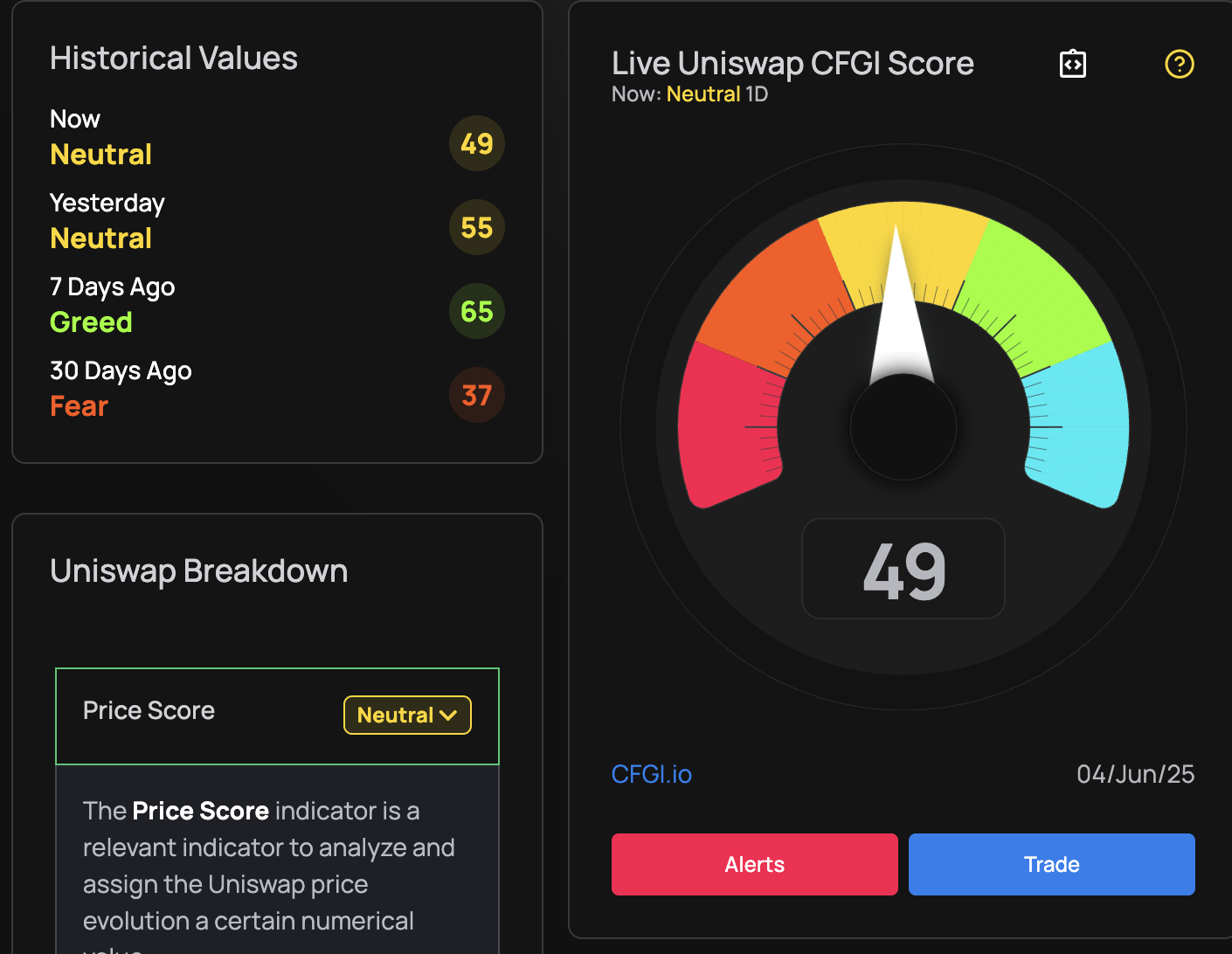

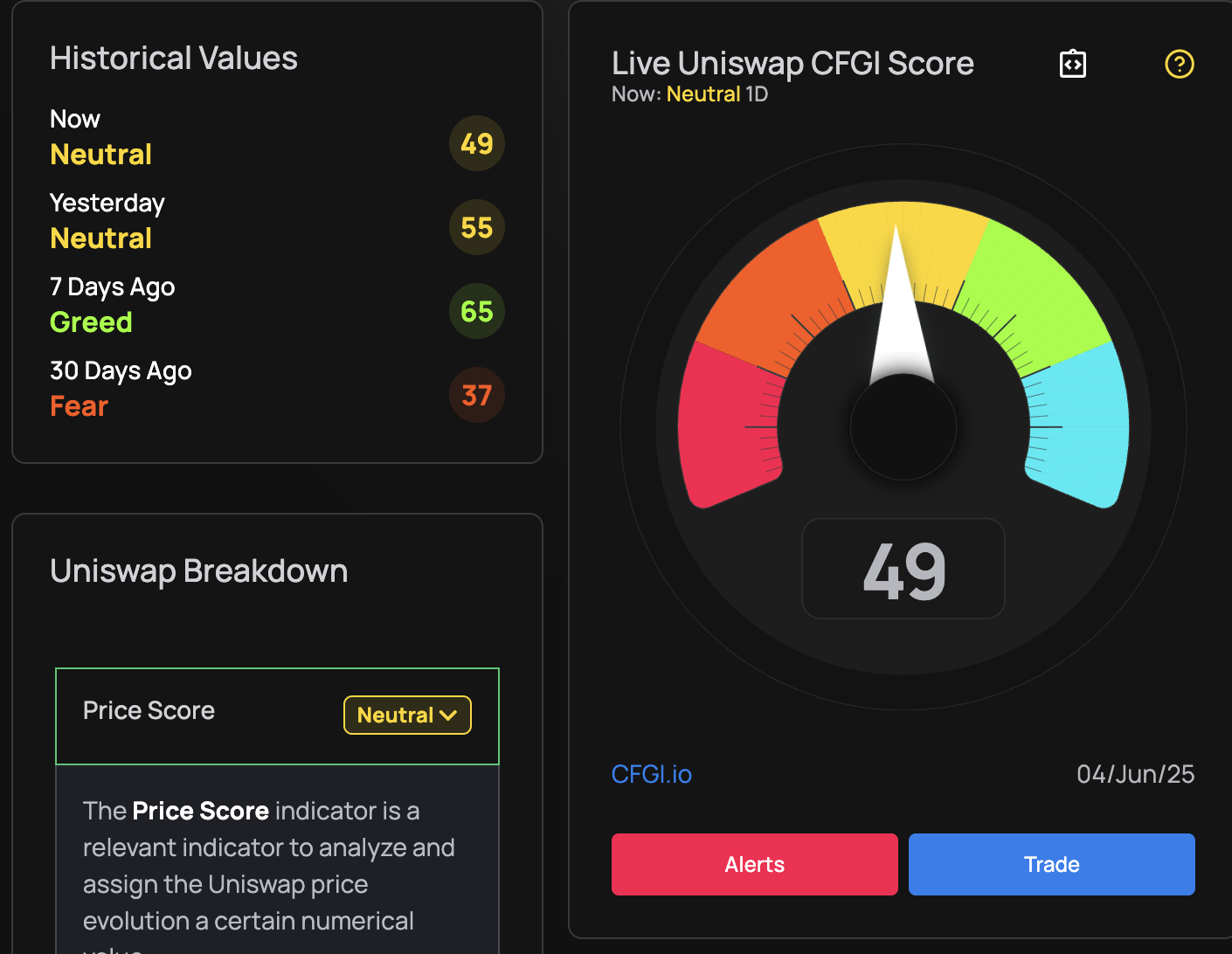

Social sentiment and on-chain appetite have lifted recently. Crypto fear-and-greed measures for Uniswap (UNI Fear & Greed index) rose from “fear” levels (~37) about a month ago to a moderately bullish “greed” (65) one week ago, before settling at ~49 (neutral) as of June 4.

This swing suggests that community optimism has returned after the May dip. On X and Telegram, UNI discussions have been picking up with positive news. Market buzz can be self-reinforcing; the recent steep rally moved UNI from $5.65 (early May lows) to ~$6.94 (June 4 peak), which naturally increased visibility.

Meanwhile, “Fear & Greed” shows enough room for more excitement (RSI < 70, Fear & Greed ~56 is not extreme). In summary, crowd sentiment appears cautiously bullish, aligned with on-chain whale moves.

Technical Analysis: Key Levels to Watch for UNI in June

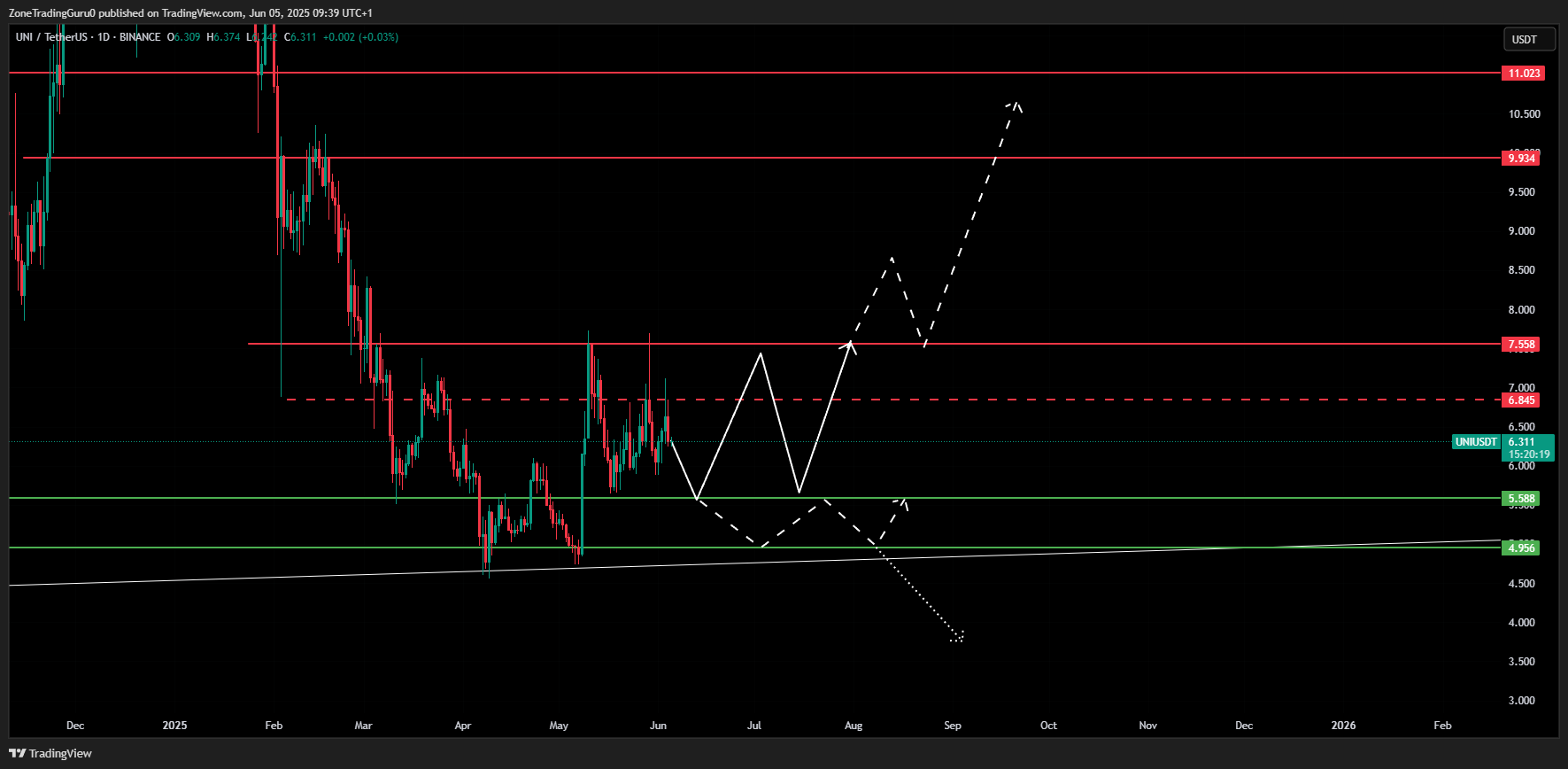

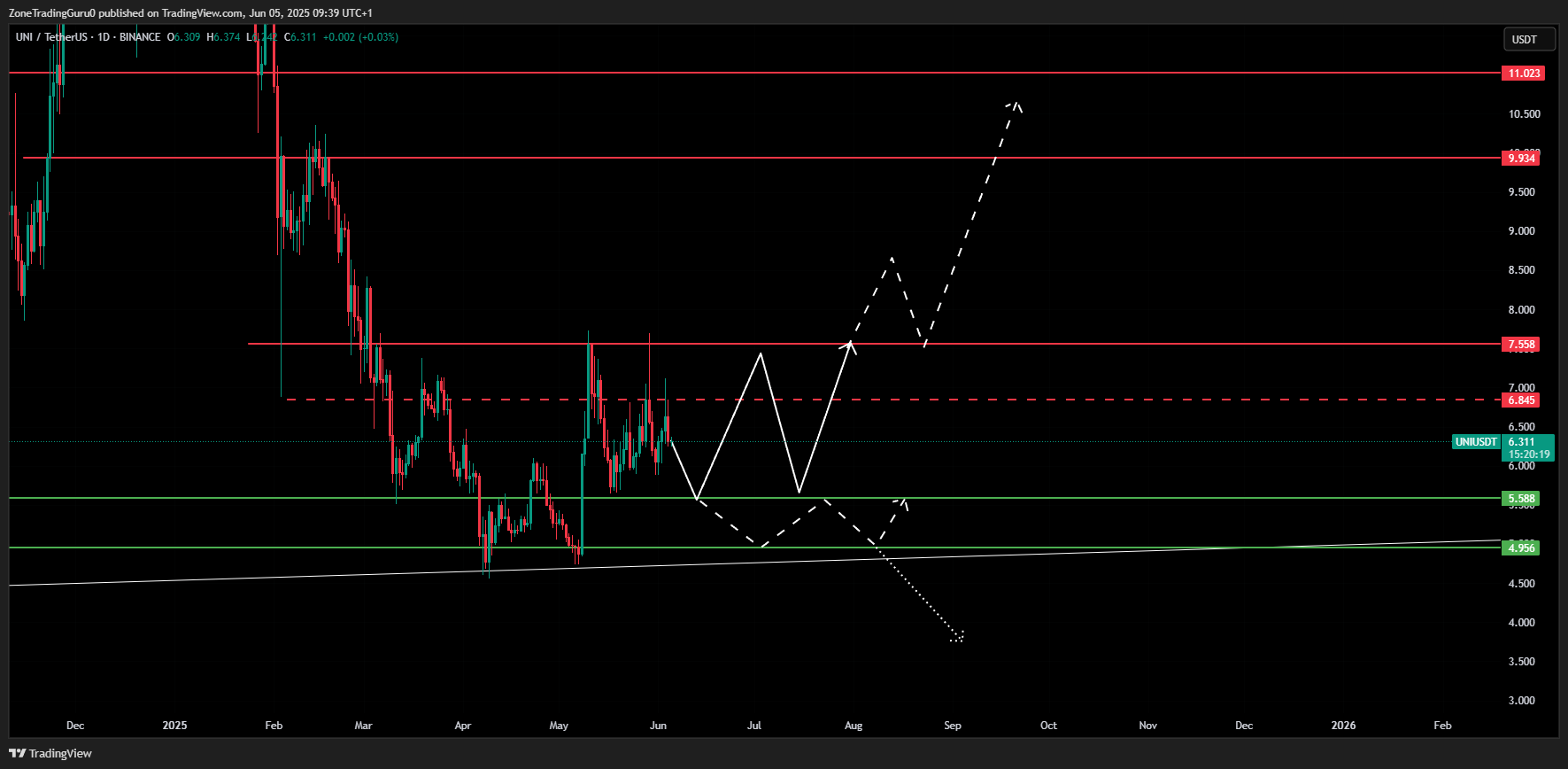

A daily (D1) close above $7.558 would be a critical technical confirmation that UNI has transitioned from a corrective phase to a new bullish impulse.

Should this breakout materialize, upside targets extend toward the next resistance band at $9.934–$11.023, which coincides with historical supply zones and Fibonacci extensions from previous swing highs.

Conversely, failure to hold above $5.588 opens the door to a retest of deeper support at $4.956, where a rising trendline intersects – a structure that has historically provided strong buying interest. A weekly (W1) close below $4.956 would invalidate this support and potentially trigger a sharp decline, as it would confirm a break of long-term trend support.

Traders should also monitor the Relative Strength Index (RSI) and moving averages, particularly the 50-day and 100-day EMAs. UNI is currently hovering near the 100-day EMA (~$7.00), which acts as a pivot zone. A sustained close above this dynamic resistance, with expanding volume and positive market breadth, would strengthen the bull case.

Uniswap Price Prediction

If Uniswap’s momentum continues – supported by whale accumulation, strong liquidity, and the latest fundamental upgrades – UNI could steadily climb through June. In this case we might see UNI reclaim $7.00–7.30 by mid-June.

Importantly, this level coincides with the 100-day EMA, which many short-term traders view as a pivot line between bullish and bearish momentum. A clean daily close above $7.00 – ideally accompanied by rising volume and strong market breadth – would likely trigger follow-up buying from trend-following algorithms, market makers, and even sidelined retail participants waiting for confirmation of a breakout.

In that case, bullish momentum could accelerate, particularly if broader market sentiment (including Bitcoin stability and DeFi capital flows) remains favorable.

All forecasts remain subject to rapid change given crypto’s volatility. Traders should watch the $6.70–6.90 zone: a clean break above there, on high volume and supported by positive macro cues, would confirm a bull breakout.

However, traders should remain cautious of false breakouts, particularly if the move above $6.90 lacks follow-through or occurs on low volume.

In such cases, UNI could be vulnerable to a rejection wick and a pullback toward $6.30–$6.10 support. Still, the presence of strong whale support, growing developer traction on Uniswap v4, and integrations like Spark and Unichain provide a firm fundamental foundation that could help absorb downside volatility.

Read more: Trading with Free Crypto Signals in Evening Trader Channel