YEREVAN (CoinChapter.com) — The Utah Senate passed the HB230 Blockchain and Digital Innovation Amendments bill after removing a key provision that would have allowed the state to invest in Bitcoin. Lawmakers voted 19-7-3 on March 7, sending the bill to Governor Spencer Cox for final approval.

The bill still protects Utah residents’ rights to mine Bitcoin, run nodes, stake cryptocurrencies, and hold digital assets. However, the Bitcoin reserve bill provision was removed, meaning Utah will not hold state Bitcoin holdings.

Bitcoin Reserve Clause Removed Before Final Vote

The bill originally proposed that Utah’s state treasurer invest up to 5% of certain funds in digital assets with a market cap exceeding $500 billion over the past year. Bitcoin is the only cryptocurrency that currently meets this requirement.

The provision passed a second reading but was later removed in the third. The Utah House approved this amendment with a 52-19-4 vote.

Senator Kirk A. Cullimore, a sponsor of the bill, explained the decision to remove the Bitcoin reserve bill provision.

“There was a lot of concern with those provisions and the early adoption of these types of policies,”

Cullimore said on March 7.

Arizona and Texas Now Lead State Bitcoin Reserve Efforts

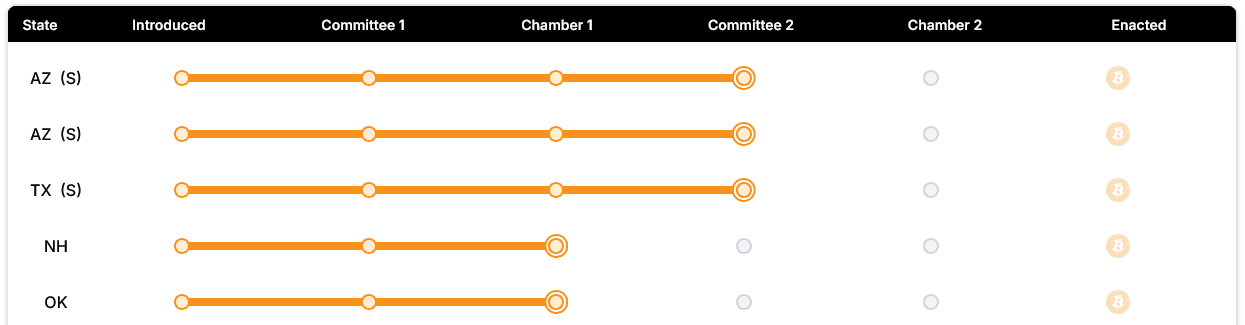

With Utah’s Bitcoin reserve bill failing, Arizona and Texas are now leading the push to establish state Bitcoin holdings. According to Bitcoin state law updates, both states have Bitcoin reserve bills that have passed committee votes and are now awaiting final Senate approval.

A total of 31 Bitcoin reserve bills have been introduced across multiple states. 25 remain active, including proposals in Illinois, Iowa, Kentucky, Maryland, Massachusetts, New Hampshire, New Mexico, North Dakota, Ohio, and Oklahoma. Some states, such as Pennsylvania, Montana, Kentucky, and North Dakota, have rejected similar measures.

Trump Signs Order for Strategic Bitcoin Reserve

On March 7, U.S. President Donald Trump signed an executive order to create a Strategic Bitcoin Reserve at the federal level.

The reserve will be funded using Bitcoin seized in criminal cases, while the Treasury and Commerce departments will develop budget-neutral strategies for acquiring more.

With multiple Bitcoin state law updates and federal Bitcoin initiatives moving forward, government involvement in cryptocurrency continues to expand.