Hardware wallets are one of the best ways to protect your digital assets from hackers and theft. These small devices store your private keys offline, making them much safer than online wallets. This guide will explain different types of hardware wallets, how to set them up, key features to look for, top crypto hardware wallet models in 2025, and tips to keep your crypto secure.

What Is a Hardware Wallet?

A hardware wallet is a physical device used to safely store cryptocurrency private keys in an offline setting. Think of it like a super secure USB drive built specifically for your crypto. Unlike software wallets, which are installed on your phone or computer and can be vulnerable to hacks, hardware wallets keep your keys isolated from the internet. They are small, portable, and often look like a flash drive or a tiny gadget with a screen.

The best and popular hardware wallet brands like Ledger and Trezor. The main idea is that it protects your crypto assets from online threats like malware, phishing, or exchange hacks.

How Does a Hardware Wallet Work?

A hardware wallet works by storing your private key inside a secure chip. This chip never shares your key with any connected device. When you make a transaction, your computer sends the unsigned transaction to the wallet. The wallet signs the transaction inside the device, then sends the signed version back.

This process means your private key is never exposed. It is used only inside the wallet to sign things. The device needs to be connected to a computer or mobile app to send or receive crypto. But even when connected, it does not trust the computer. It keeps the signing process isolated. You can also review the transaction details on the wallet screen and approve or reject it using physical buttons.

What Is a Hardware Wallet Used For?

Cold Storage

Cold storage means keeping your crypto offline, away from the internet, where hackers can try to steal it. A cold wallet stores your private keys in a secure chip inside the device.

Since it’s not connected to the internet most of the time, it’s nearly impossible for someone to remotely access your funds. It’s like locking your money in a vault instead of leaving it on a website or app that could get hacked.

Managing Multiple Accounts on Multiple Chains

Crypto isn’t just Bitcoin or Ethereum, there are tons of different blockchains, like Solana, Binance Smart Chain, or Polygon, each with its own coins or tokens.

A hardware wallet lets you manage accounts across these different blockchains in one place. For example, you can store Bitcoin, Ethereum, and other coins all on the same device, without needing separate wallets for each.

Signing Transactions Offline

When you want to send crypto or interact with a blockchain (like buying an NFT or swapping tokens), you need to “sign” the transaction with your private key to prove it’s you.

A hardware wallet does this signing process inside the device itself, without exposing your private key to your computer or the internet. You plug it in, confirm the transaction on the wallet’s screen, and it handles the rest securely.

Types of Hardware Wallets

There are different types of hardware wallets like USB hardware wallet, bluetooth hardware wallet, smart-card based wallet and air-gapped cold wallets.

1. USB Hardware Wallets

USB hardware wallets look like small USB drives. You have to plug them into your computer or phone to manage your crypto. They’re easy to use and super secure because they stay offline most of the time.

Popular ones like Ledger Nano S and Trezor One sign transactions inside the device, so your private keys never touch the internet. You just connect, enter a PIN, and confirm transactions on the device’s screen. They’re small, so you can carry them anywhere. But you need to keep them safe, because if you lose them and don’t have a backup seed phrase, your crypto is gone.

2. Bluetooth Hardware Wallets

Bluetooth hardware wallets add wireless connection. They work like USB wallets but use Bluetooth to connect to your phone or computer.

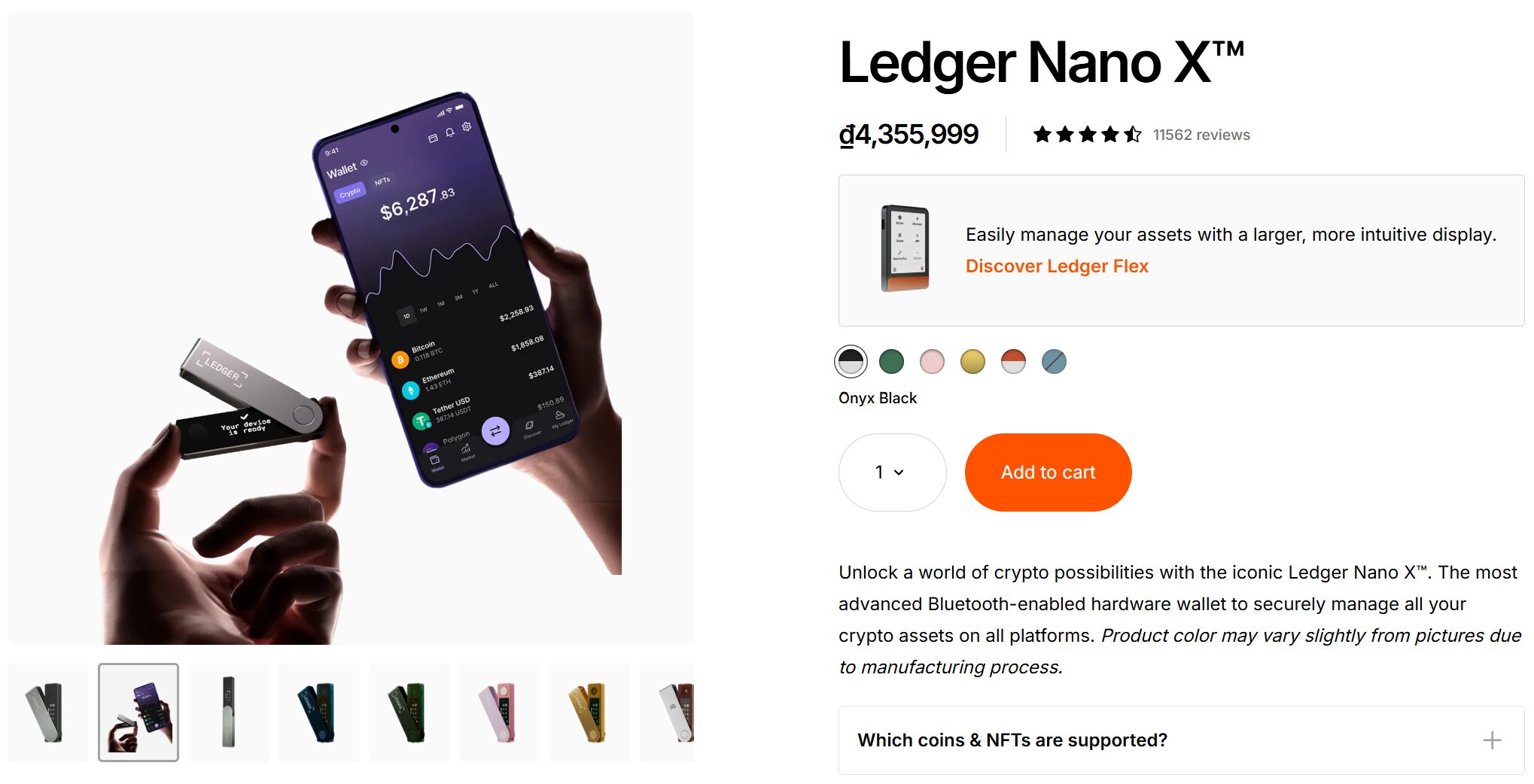

Ledger Nano X is a good example. You don’t need to plug it in, which makes it more convenient, especially for mobile users. You still need a PIN and confirm transactions on the device, so security is strong. The downside is that Bluetooth might worry some people about hacking risks, but these devices use encryption to stay safe. They’re great if you want flexibility without cables.

3. Smartcard-Based Wallets (NFC-Based)

Smartcard-based wallets use technology like credit cards with chips. They’re thin and fit in your wallet like a card. Tangem Wallet is one of these. You can easily connect it to your phone using NFC or Bluetooth, and it works with an app.

These wallets are portable and look cool, but they still keep your keys offline. You just need to tap the card to your phone to sign transactions. They’re not as common as USB or Bluetooth wallets, but they’re good for people who want something small and stylish.

4. Air-Gapped Hardware Wallets (QR Code Based)

Air-gapped hardware wallets never connect to the internet. They’re the most secure because they use QR codes to sign transactions. You need to scan a code with your phone or computer to transfer crypto without any direct connection.

The best air-gapped hardware devices are ELLIPAL Tian 2.0 and Keystone Pro work this way. They’re perfect for people who want maximum security, but they’re slower to use since you need to scan codes back and forth. They’re also a bit harder to set up, but they’re great for storing large amounts of crypto safely.

Benefits of Using a Hardware Wallet

Self-Custody & Ownership

A hardware wallet lets you fully control your cryptocurrency. Unlike keeping your crypto on an exchange or online wallet, where someone else holds your private keys, a hardware wallet gives you the keys. This means you own your assets completely.

Nobody else, like a crypto exchange or third party, can access or freeze your funds. If an exchange gets hacked or shuts down, your crypto is still safe because it’s stored offline in your hardware wallet.

Enhanced Security & PIN Protection

Most hardware wallets, like Ledger or Trezor, use a PIN code that you set up. If someone tries to guess your PIN too many times, the device can lock or even wipe itself to protect your funds.

They also have a recovery phrase that lets you recover your crypto if the device is lost or broken. This combo of offline storage and PIN protection makes hardware wallets one of the safest ways to store crypto.

Multi-Currency Support

Hardware wallets aren’t just for Bitcoin or Ethereum. Most of them, like Ledger Nano or Trezor One, support tons of different cryptocurrencies, sometimes thousands! You can store Bitcoin, Ethereum, altcoins like Cardano or Ripple, and even some stablecoins like USDT, all in one device. This is awesome because you don’t need separate wallets for each coin.

Portability and Accessibility

Hardware wallets are small, like a USB drive, so you can carry them in your pocket or store them safely at home. They’re easy to use on the go, just plug them into a computer or connect to a mobile app to send or receive crypto. Even though they’re portable, they don’t sacrifice security.

You can access your funds anywhere, anytime, as long as you have the device and your PIN or recovery phrase. Plus, they work with the best crypto wallets like MetaMask or Ledger Live, so managing your crypto is simple and user-friendly.

Disadvantages of Hardware Crypto Wallets

Initial Cost

A hardware wallet is not free. You need to buy it, and it can be a bit expensive. Most good hardware wallets cost between $50 to $150. Some models can even go higher. If you are just starting with crypto or if you don’t have much money in your wallet, spending that much may not feel worth it.

Many people prefer using free software wallets or apps, even if they are less safe. So, the first big problem is the cost. It is a one-time payment, but still, for some people, it feels too much.

Complexity

Using a hardware wallet is not as easy as using a phone app or website. You have to connect it to your computer or phone, install apps, and write down a long backup phrase. If you make a mistake during setup, you can lose access to your coins.

For people who are new to crypto or not good with tech, it may feel confusing. Some instructions are also not clear or are only in English, which makes it harder for non-native speakers. If you lose your backup words or type them wrong, you could lose all your money.

Single Point of Failure

If your hardware wallet gets damaged, lost, or stolen, that’s a big problem. The device holds your private keys. Without it, you can’t use your coins. Yes, there is a recovery process using your seed phrase (a set of 12–24 words), but many people lose that too or never save it correctly.

This makes your hardware wallet a “single point of failure.” Everything depends on that one device and the backup words. If both are gone, your crypto is gone forever. So, you must store your backup safely, and that adds more stress.

Limited Functionality

Most hardware wallets only support sending, receiving, and storing coins. Some models can connect to DeFi apps or staking platforms, but not all of them. Even then, it is harder and slower than using a phone or computer directly.

How a Hardware Wallet Processes A Blockchain Transaction

Here is how a hardware wallet processes a blockchain transaction:

- Creating the Transaction: To begin, you have to start by using a software wallet, like Ledger Live or MetaMask, on your computer or phone, which is connected to the internet. You need to enter the transaction details: the recipient’s blockchain address, the amount of crypto you want to send, and the transaction fee. The software then creates an unsigned transaction. At this point, your private key isn’t used, so the transaction isn’t ready for the blockchain.

- Sending to Hardware Wallet: Next, you have to send the unsigned transaction to your hardware wallet, a physical device like Ledger or Trezor, connected via USB or Bluetooth. This device has a secure element, a tamper-resistant chip that keeps your private keys offline.

- Verifying and Signing: Now, you need to verify the transaction details (amount and recipient address) shown on the hardware wallet’s screen. This ensures everything is correct. Then, you have to confirm the transaction by entering a PIN code or pressing buttons on the device to prevent unauthorized actions. Once confirmed, the secure element uses your private key to generate a digital signature, a cryptographic code proving you authorized the transaction.

- Broadcasting to the Blockchain: After signing, you have to send the signed transaction back to the software wallet, which broadcasts it to the blockchain network (like Bitcoin or Ethereum). Nodes verify the digital signature using your public key to confirm the transaction is valid and you have enough funds. The transaction goes into the mempool, and miners or validators then include it in the next block.

- Completion: Once included in a block, you’ll see the transaction get block confirmation, meaning it’s permanently recorded on the blockchain. The recipient receives the funds, and the process is done.

Hardware Wallet vs. Software Wallet: Key Differences

| Feature | Hardware Wallet | Software Wallet |

| Security | Very strong. Keeps private keys offline. Needs PIN and button press to confirm. | Medium level. Keys stay on a device with internet. More risk from viruses. |

| Ease of Use | Not very easy. Needs setup and learning. You must use the physical device each time. | Very easy. Just install the app and start using it. No extra tools needed. |

| Cost | Not free. Devices like Ledger or Trezor cost $50 to $200. | Free to use. Wallets like MetaMask or Trust Wallet don’t cost anything. |

| Accessibility | Less quick. You must have the device to make any transfer. | Very quick. You can open the app anytime from your phone or computer. |

| Backup | Uses a 12 or 24-word phrase. You must write it and keep it safe. | Also uses a backup phrase. Some apps offer online backup, but less secure. |

How to Use a Hardware Wallet?

Step 1: Set up the wallet

First, you set up the hardware wallet. When you get a device like a Ledger Nano X or Trezor Safe 5, open the box and check that it’s sealed to ensure no tampering. Connect it to your computer or phone using a USB cable or Bluetooth, depending on the model.

Now, download the official app, like Ledger Live or Trezor Suite, from the manufacturer’s website. Follow the app’s instructions to initialize the device. You’ll create a PIN code (usually 4–8 digits) to unlock the wallet. The device will generate a seed phrase, which is a list of 12–24 words. Write this down on paper and store it somewhere safe, like a locked drawer. Never save it online. This phrase recovers your funds if the device is lost.

Step 2: Add accounts

Next, you need to add accounts. Open the app and select the cryptocurrencies you want to store, like Bitcoin or Ethereum. The app links each coin to a unique account on your wallet. The hardware wallet creates a public address for each account, which you can share to receive crypto.

You don’t need to add every coin at once; you can add more later. Each account stays tied to your seed phrase, so you only need one phrase for all accounts.

Step 3: Connect and interact

Then, you connect and interact with the wallet. To manage your crypto, plug in or pair the device with the app. Enter your PIN to unlock it. The app shows your balances and lets you send or receive crypto. For some actions, like sending funds, you confirm directly on the device’s screen to ensure security.

You can also connect the wallet to other apps, like MetaMask, for things like DeFi or NFT trading, but the hardware wallet signs transactions offline to keep keys safe.

Step 4: Secure your wallet

Securing your wallet is crucial. Always store the device in a safe place, like a secure box, when not in use. Never share your seed phrase or PIN with anyone. Enable extra security features, like a passphrase, if your device supports it. This adds another layer of protection.

Regularly check the device for physical damage or tampering. Update the device’s firmware through the official app to fix security bugs. Avoid using public computers or Wi-Fi to reduce risks.

Step 5: Transfer your assets

Finally, you can transfer your assets. To receive crypto, copy your wallet’s public address from the app and share it with the sender. To send crypto, open the app, select the account, and enter the recipient’s address and amount. Confirm the transaction on the device’s screen. The wallet signs it offline, keeping your keys safe. Check the blockchain or app to ensure the transfer completes.

How To Choose A Hardware Wallet?

- Security Features: Look for strong security in a hardware wallet. Devices like Ledger Nano or Trezor use a secure chip to protect your private keys. They require a PIN and often have a screen to confirm transactions, keeping keys offline. Check if the wallet offers extra features like a passphrase for added protection.

- Supported Cryptocurrencies: Make sure the wallet supports the coins you own. Some wallets, like Ledger, handle thousands of cryptocurrencies, including Bitcoin, Ethereum, and altcoins. Others, like older models, might only support a few major coins.

- Ease of Use: Choose a wallet that’s simple to set up and use. Devices like Trezor One have clear screens, and apps like Ledger Live make managing crypto easy. Bluetooth wallets, like Ledger Nano X, connect wirelessly for convenience. If you’re new to crypto, pick a wallet with a user-friendly app. Complex wallets can confuse beginners and lead to mistakes.

- Cost: Hardware wallets cost money, usually between $50 and $200. Ledger Nano S is cheaper, while premium models like Ledger Nano X cost more for extra features like Bluetooth. Compare prices to fit your budget, but don’t compromise on security for a lower price.

- Brand Reputation: Buy from trusted brands with a good history. Ledger and Trezor are well-known for being reliable devices and receiving regular updates. Check user reviews and news to see if the company has had security issues. A strong brand responds quickly to problems and offers good customer support.

Best Crypto Hardware Wallets In 2025

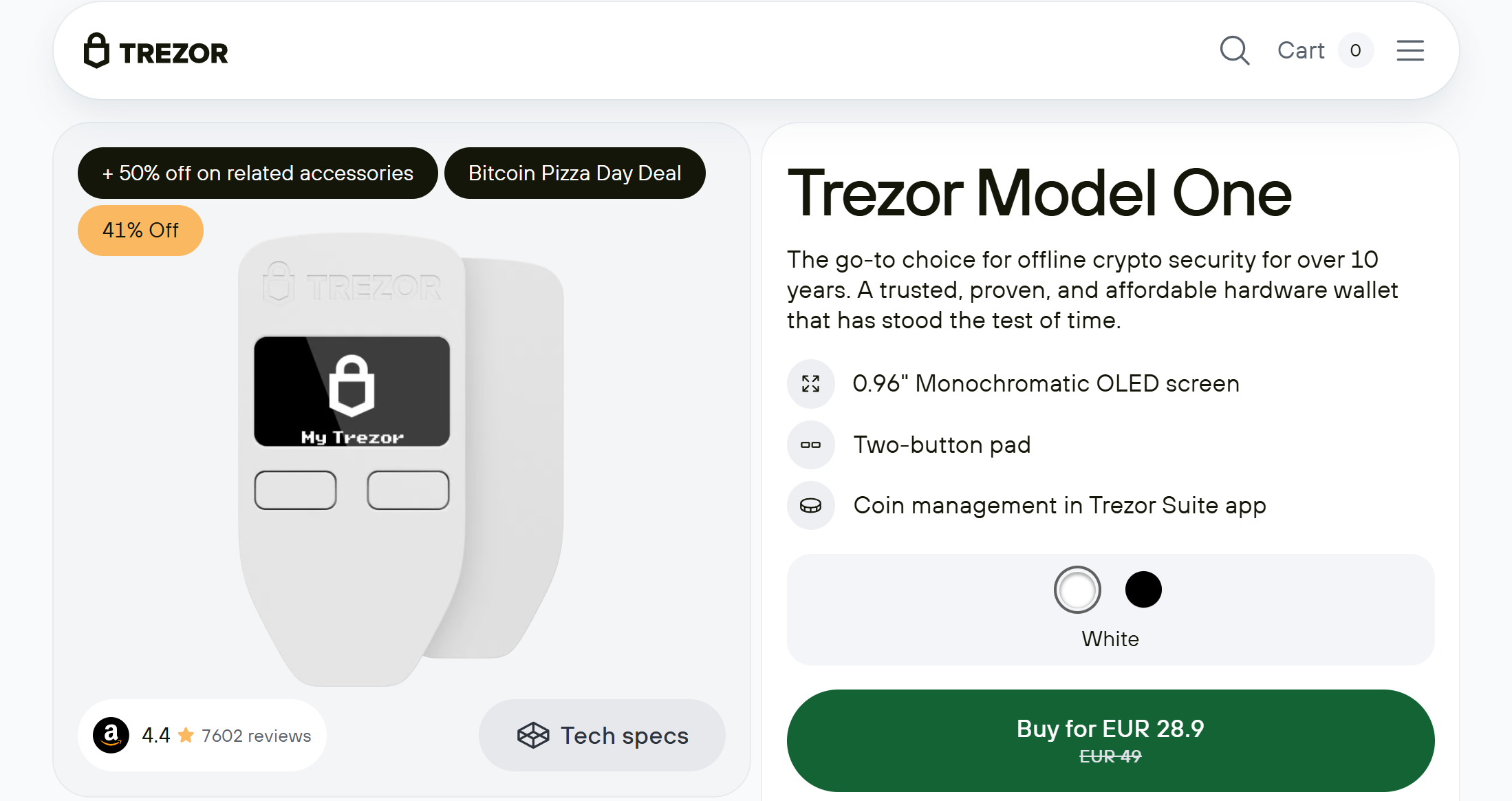

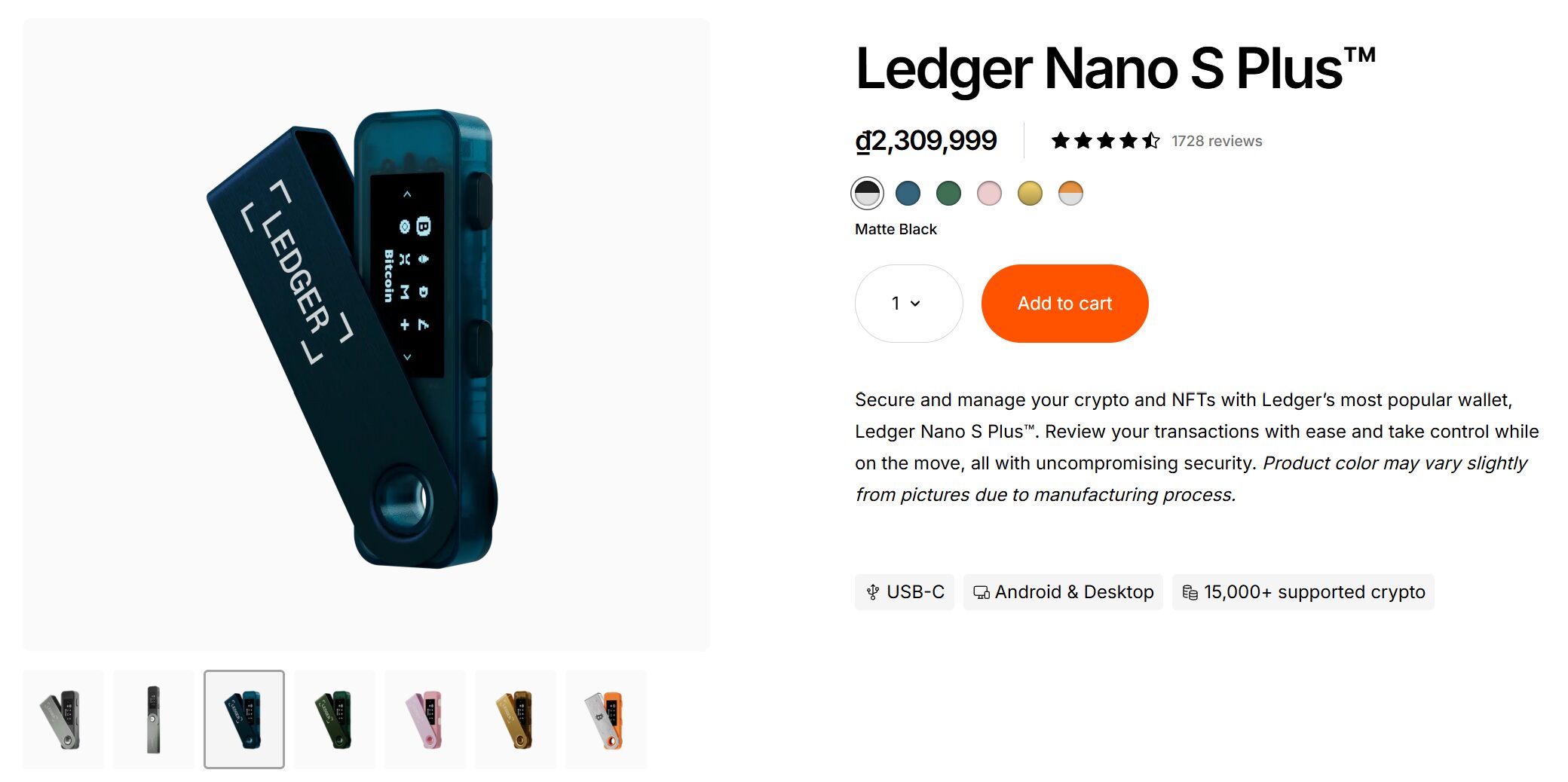

1. Ledger Nano S Plus

The Ledger Nano S Plus offers strong security at an affordable price of around $79. It supports over 5,500 cryptocurrencies, including Bitcoin, Ethereum, and NFTs, making it versatile for diverse portfolios. Its secure element chip (CC EAL5+) keeps private keys offline, protecting against hacks.

The device connects via USB-C and works with the user-friendly Ledger Live app for managing assets. While it lacks Bluetooth, its larger memory allows multiple apps to run simultaneously. This wallet suits beginners and budget-conscious users who want reliable security without complex features.

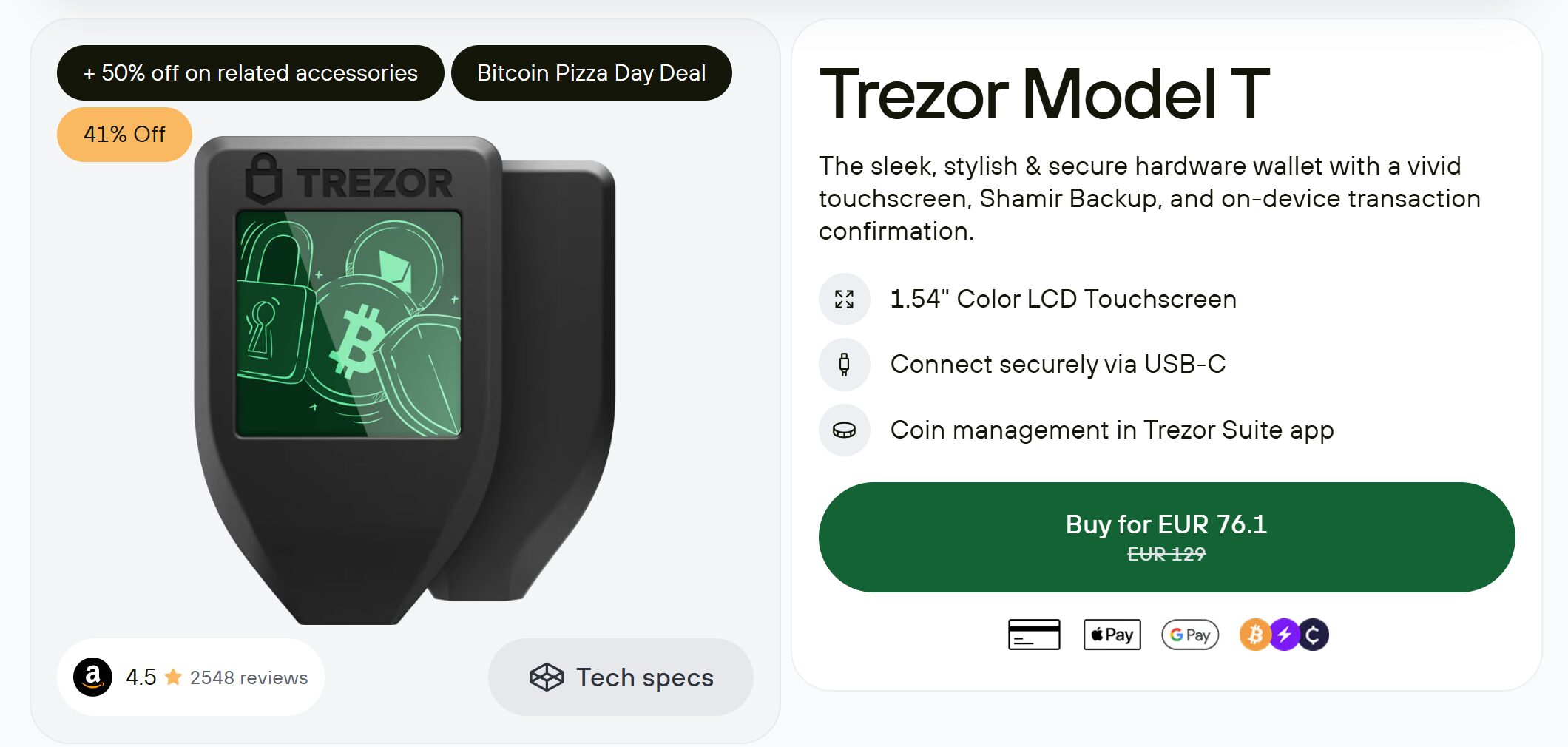

2. Trezor Model T

The Trezor Model T, priced at about $179, is a premium wallet known for its open-source firmware and robust security. It supports over 8,000 cryptocurrencies, including major coins and ERC-20 tokens, and integrates with Trezor Suite for easy management.

It’s 1.54-inch color touchscreen simplifies transaction verification and PIN entry, reducing keylogging risks. Features like Shamir Backup and passphrase protection add extra security layers. This wallet is ideal for experienced users who prioritize transparency and advanced security, though its higher cost and lack of iOS app support may deter some.

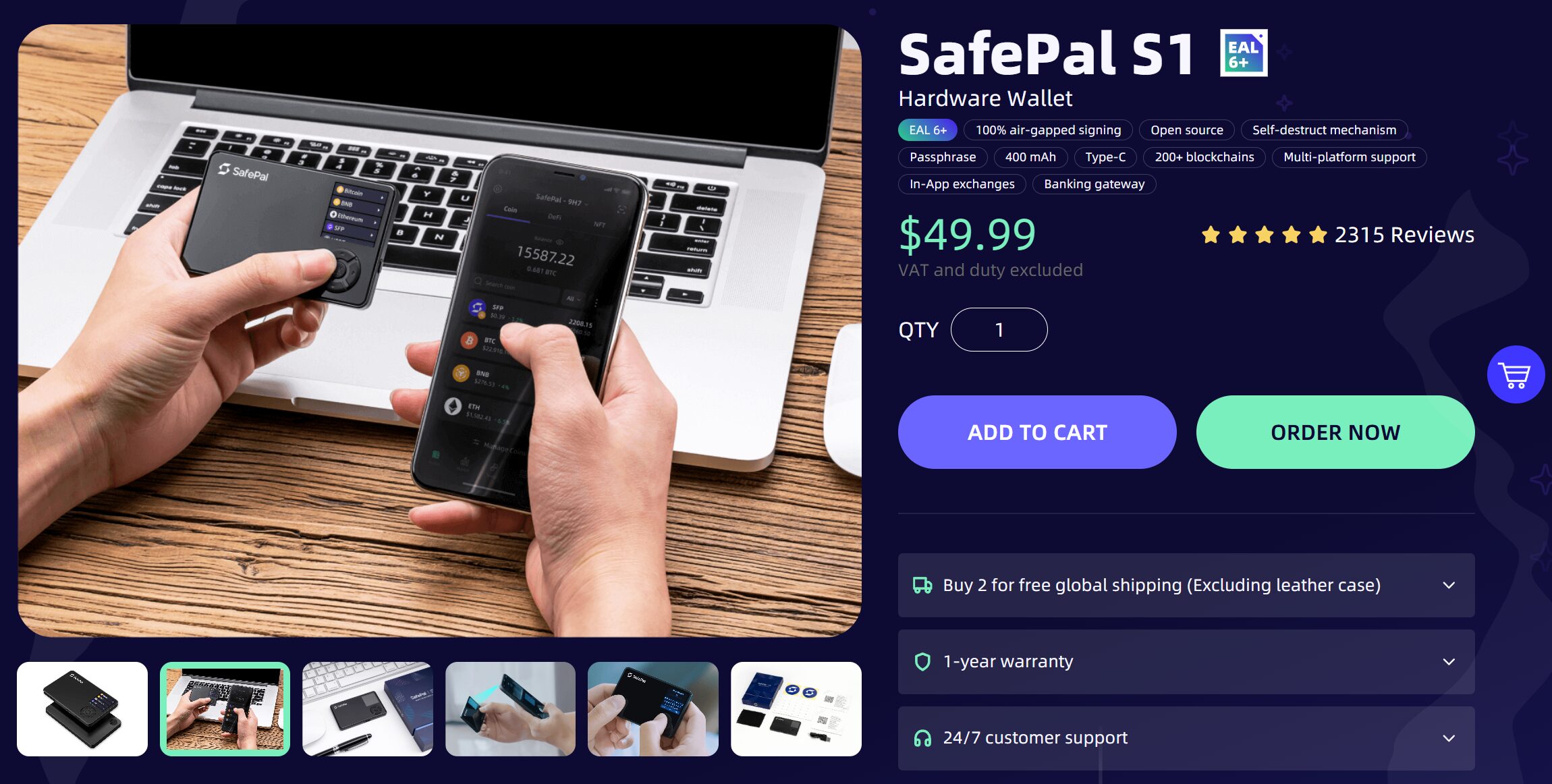

3. SafePal S1

SafePal S1, priced at $49.99, is a budget-friendly, air-gapped wallet backed by Binance. It supports over 10,000 tokens across 58+ blockchains, perfect for diverse portfolios. It’s 1.3-inch color display and QR code-based transactions ensure offline security, with an EAL5+ chip and self-destruct mechanism for tamper protection. The SafePal app allows trading and DeFi access, enhancing versatility.

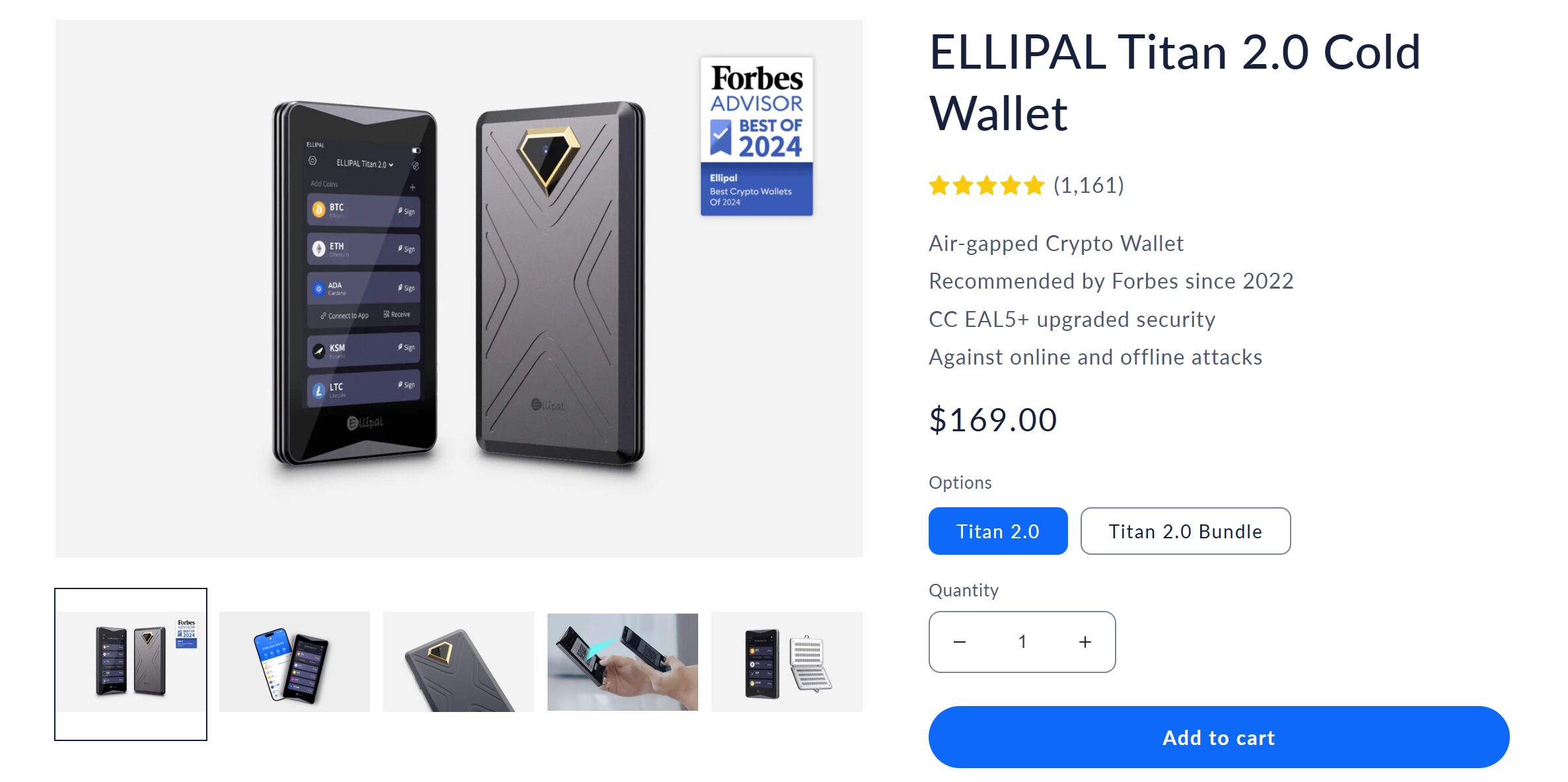

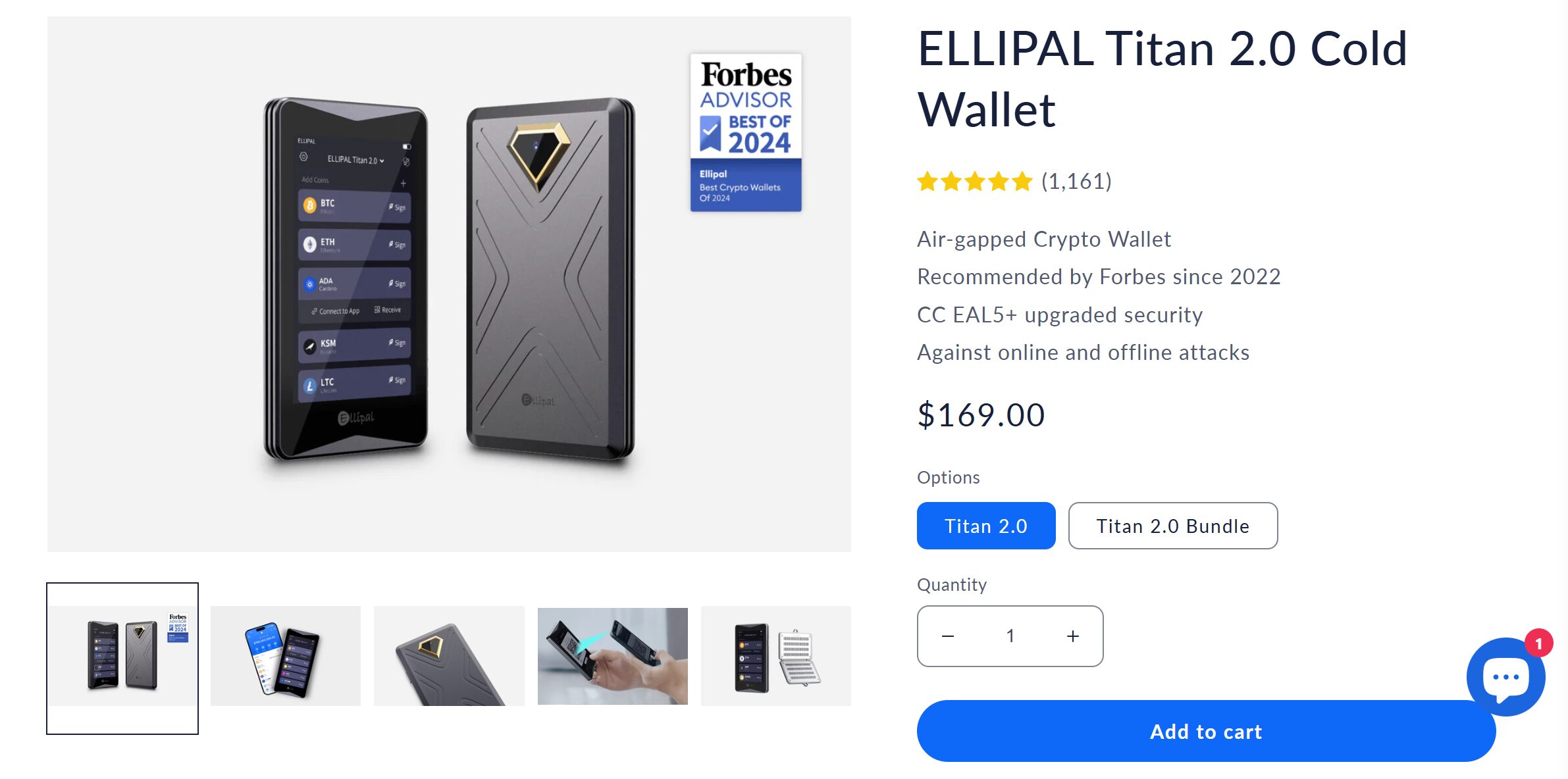

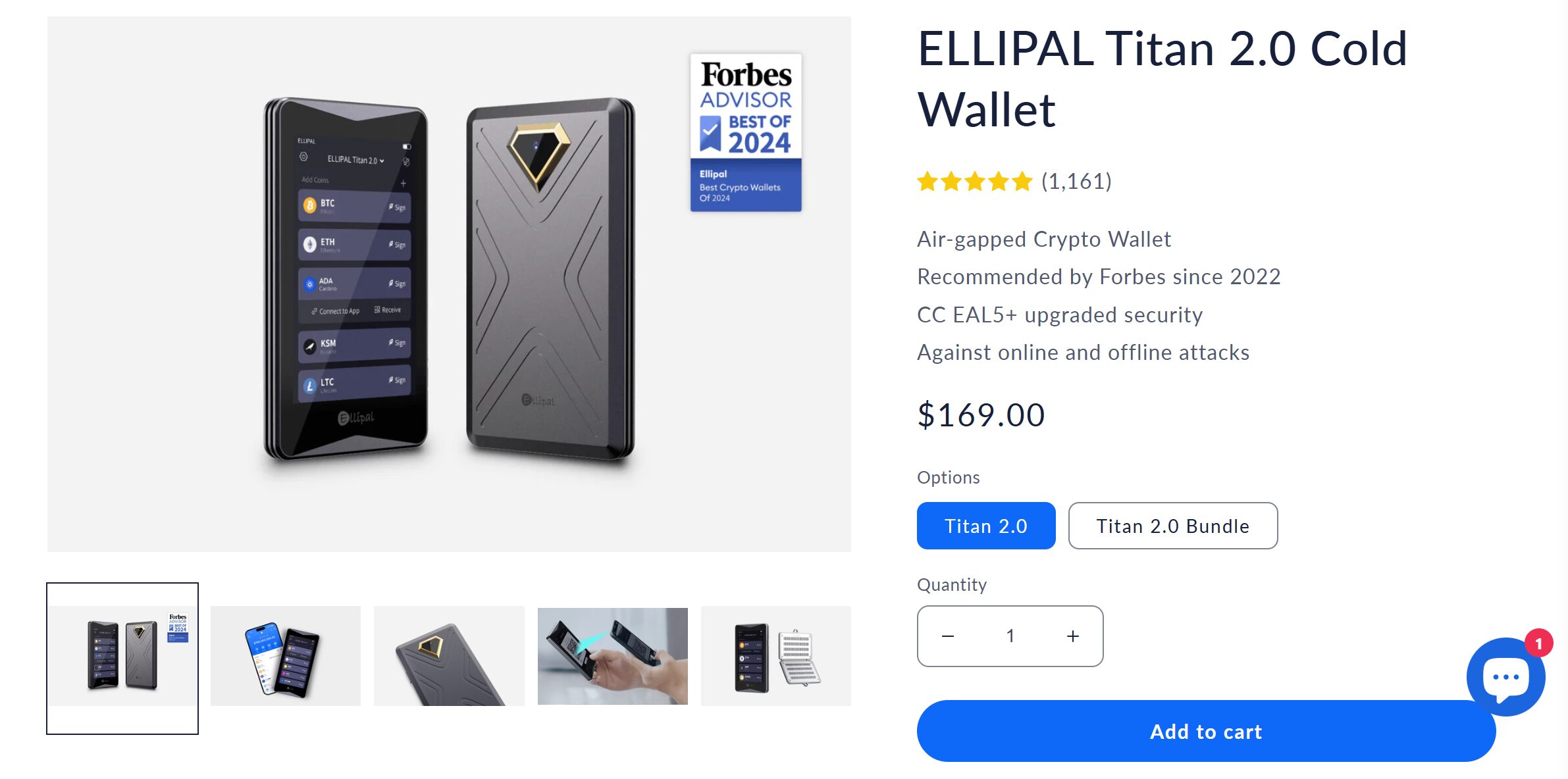

4. Ellipal Titan 2.0

The Ellipal Titan 2.0, costing $169, is a fully air-gapped wallet with a 4-inch touchscreen for easy navigation. It supports over 10,000 tokens across 46 blockchains, ideal for mobile users and DeFi enthusiasts.

Using QR codes for transactions, it avoids USB, Bluetooth, or Wi-Fi, ensuring top security with an EAL5+ chip and anti-tamper design. Its metal build protects against physical attacks. This wallet suits users who value maximum security and a phone-like interface, but its bulkier size and higher price may not appeal to everyone.

Best Practices for Hardware Wallet Security

Here is how you can secure your crypto hardware wallet with some best practices:

- Store the backup words safely: You have to write down the 12-24 words you get when setting up your hardware wallet and keep them in a safe place, like a locked box or a bank vault. You should never tell anyone these words, even if they say they’re from the wallet company. It’s also smart to have a couple of copies in different safe spots in case something like a fire happens.

- Choose a strong PIN: You need to set a tough PIN, ideally 6-8 digits long, when you first set up your wallet to protect it from being used by others. You have to avoid easy combinations like 1111 or 1234 because those are simple to guess.

- Update the wallet’s software regularly: You have to check for and install updates for your wallet’s software using the official app. These updates fix problems that could let hackers get into your wallet.

- Connect only to trusted devices: You need to plug your wallet into a computer or phone you know is safe and free from viruses. A hacked or untrusted device could mess with your transactions or try to steal your money. You have to keep your computer’s antivirus software updated and avoid using public or shared computers.

- Keep your wallet in a secure place: You have to store your hardware wallet somewhere safe, like a locked drawer or a safe, when you’re not using it. This prevents it from being stolen or damaged. You should avoid carrying it around unnecessarily to reduce the risk of losing it. If you travel, you need to keep it hidden and secure, like in a safe pocket. A safe wallet means your money stays protected. You can also read our guide on how to avoid crypto scams to stay safe in the crypto market.

Conclusion

In conclusion, a hardware wallet is one of the safest tools for storing cryptocurrency. It keeps your private keys offline, which protects your funds from hackers and online threats. While it costs money and needs some setup, the extra safety is worth it for long-term holders or those with large amounts. You just need to keep your recovery phrase in a safe place.

FAQs

Are hardware wallets 100% safe?

No wallet is 100% safe, but hardware wallets are very secure. Private keys are saved offline, protecting against online hacks. Devices like Ledger or Trezor use secure chips and PINs to prevent unauthorized access.

However, risks like physical theft, losing your seed phrase, or scams can still cause problems. Always store your seed phrase safely and buy from trusted sellers to avoid tampered devices. Regular firmware updates also keep security strong.

Are hardware wallets worth it?

Hardware wallets are worth it if you own a lot of crypto or want strong security. They cost $50–$200 but protect against hacks better than software wallets. They’re great for long-term storage or valuable assets. If you only hold small amounts or trade often, a hot wallet might be enough. Consider your budget and how much crypto you need to protect.

What happens if my hardware wallet breaks?

If your hardware wallet breaks, you can still recover your crypto. Use your seed phrase, a 12–24-word code you wrote down during setup. Enter it into a new compatible wallet or software to access your funds. Keep your seed phrase safe and never share it online. Without it, you lose your crypto if the device fails.

What is the difference between a digital wallet and a hardware wallet?

A digital wallet, like MetaMask, is software on your phone or computer, storing keys online for quick access. A hardware wallet, like Trezor, is a physical device keeping keys offline for better security. Digital wallets are free and convenient, but riskier due to internet exposure. Hardware wallets cost money and need setup, but protect against hacks.

Does my crypto still grow in a hardware wallet?

Crypto in a hardware wallet doesn’t grow on its own. Hardware wallets, like Ellipal or Ledger, only store your private keys securely. They don’t earn interest or increase value unless the crypto’s market price rises. To grow your crypto, use staking or DeFi platforms through compatible apps, but this requires connecting the wallet.