YEREVAN (CoinChapter.com) — The United States has officially established a strategic crypto reserve that will hold five digital assets: Bitcoin, Ethereum, XRP, Solana, and Cardano. On March 6, 2025, President Donald Trump signed an executive order to formalize the decision. The move came after his public statement on March 2, where he first announced the government’s plan to create a national Bitcoin reserve.

The executive order was published in the Federal Register on March 11, 2025, making it active and enforceable. According to the order, the Strategic Bitcoin Reserve will be funded using Bitcoin already held by the federal government, primarily acquired through asset forfeiture in criminal and civil cases. In addition to Bitcoin, the government also created a U.S. Digital Asset Stockpile to include Ethereum, XRP, Solana, and Cardano under Treasury management.

The strategic crypto reserve will use cryptocurrencies already in the government’s control. These were seized in asset forfeiture cases linked to criminal or civil proceedings.

What a Strategic Crypto Reserve Means

A strategic crypto reserve is a collection of digital currencies, such as Bitcoin or Ethereum, held by a government. The goal is to have a financial backup that can be used during economic crises, market instability, or currency devaluation. Similar to traditional foreign exchange reserves, these digital assets can help stabilize a nation’s currency and protect against inflation.

For instance, instead of relying solely on reserves of U.S. dollars or euros, a country might include cryptocurrencies like Bitcoin and Ethereum. This diversification provides additional tools to support the economy during global financial stress. Additionally, holding digital assets can offer alternatives when facing international sanctions or restrictions.

The concept of a strategic crypto reserve is relatively new and still developing. While the potential benefits are recognized, the exact mechanisms and regulations governing such reserves are not yet fully established.

Trump’s Order and the Role of Bitcoin

The Trump Bitcoin order gives permission to use Bitcoin as part of a national strategic reserve. The executive order introduced a plan to store Bitcoin and other digital assets under federal management. While the order refers to a “Bitcoin reserve,” it also includes Ethereum (ETH), XRP, Solana (SOL), and Cardano (ADA).

The decision follows a directive to use cryptocurrencies already held by the U.S. government through asset seizures during criminal or civil investigations. According to a fact sheet from the White House, these digital assets will not be bought immediately but sourced from forfeited crypto funds already in government control. The Strategic Bitcoin Reserve will specifically hold Bitcoin, and the additional four assets will fall under what the administration calls the U.S. Digital Asset Stockpile.

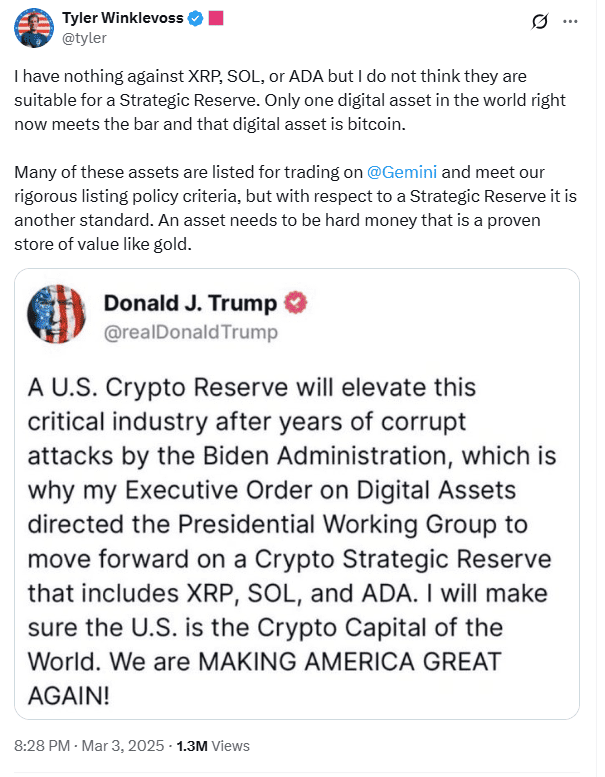

While the government has confirmed its intent to use five cryptocurrencies, not everyone agrees with this multi-asset approach. Tyler Winklevoss, co-founder of Gemini, posted on X that only Bitcoin meets the necessary standard for a national reserve. In his words, “Only one digital asset in the world right now meets the bar and that digital asset is Bitcoin.” He added that XRP, Solana, and Cardano are not suitable for a strategic crypto reserve, despite being tradable on regulated platforms.

Winklevoss further explained that while many cryptocurrencies meet listing rules for trading, a reserve asset must act like “hard money” and have proven long-term value, similar to gold. He suggested that Bitcoin is the only digital asset with the required traits for such a role in national finance.

Additional concerns were echoed by others in the crypto industry. Some pointed out that XRP and SOL are often involved in legal disputes or lack the same level of decentralization. Others questioned the economic logic of adding multiple assets that are more volatile or less adopted on a global scale.

Still, the administration has not made any changes to the list. The plan includes all five tokens. The U.S. Digital Asset Stockpile will fall under the supervision of the Secretary of the Treasury, who will have the authority to decide how to store, manage, or even sell assets if needed. In contrast, Bitcoin placed in the Strategic Bitcoin Reserve will not be sold, according to the executive order. It is to be preserved as a store of value.

Whether or not the five-token plan succeeds, the Trump Bitcoin order has already changed how national governments may approach cryptocurrency. The reserve is the first of its kind for a large economy, and more developments are expected as agencies finalize the reserve’s structure.

How the Crypto Reserve Could Be Used

A strategic crypto reserve could help support the national currency. Many countries already use foreign exchange reserves to control the value of their currency. For instance, Japan spent nearly $62.2 billion between April 26 and May 29, 2024, and another $35 billion in July 2024 to protect the yen from falling too low. This money came from Japan’s FX reserves.

With a crypto reserve, a similar tactic might be possible. A government could sell some crypto to buy its own currency and reduce pressure during hard times. This would only work if the reserve had enough value to make a difference.

The U.S. reserve may also offer a backup during debt repayment. The country issues sovereign bonds when it needs to borrow. Usually, the money to repay them comes from taxes. But in the future, the U.S. crypto reserve might add to this repayment pool, especially if asset prices grow over time.

That said, the entire crypto market is still small. Its total value is below $4 trillion, while the U.S. national debt exceeds $34 trillion. So, even a large reserve would only help a little in covering deficits.

Reactions to the Strategic Crypto Reserve

Reactions to the strategic crypto reserve have been mixed. Some financial experts, like Geoff Kendrick from Standard Chartered, believe it could help Bitcoin become more accepted in large institutions. Others are not convinced. They say that until the rules are clear, the plan cannot be trusted.

Crypto investors responded quickly to Trump’s speech. Bitcoin saw a sharp rise but could not hold the peak. The same happened with XRP, ADA, and other tokens. Prices dropped again when people realized that the reserve’s full plan is still unknown.

On March 7, 2025, Bitcoin stood at $87,700, down from its recent high. Market watchers expect more price changes as more information becomes available.

Strategic Crypto Reserve vs Traditional Reserves

Governments usually hold strategic reserves of things like oil, gold, or food. These are used when there’s a shortage or emergency. A crypto reserve works in a similar way, but it uses digital tokens.

There’s also a difference between a stockpile, a sovereign wealth fund, and a strategic reserve. A stockpile is a large amount of goods saved for future use. A sovereign wealth fund is an investment tool used by the government. A strategic reserve, however, is meant for crisis support and financial defense.

In this case, the strategic crypto reserve is closer to a mix between a stockpile and a defense fund. The White House has not yet said whether it will invest, hold, or use the assets as emergency support. This makes the project harder to define using old financial terms.

Examples From Other Countries

Some countries are already using crypto as part of their national plans. Each country uses it in a different way depending on its goals, economy, or international situation.

El Salvador and Bitcoin

El Salvador made Bitcoin legal money in 2021. This means people could use it to buy things like they use the U.S. dollar. The government gave citizens a free Bitcoin bonus through a mobile app called Chivo Wallet. It also made Bitcoin payments mandatory for businesses.

The goal was to attract new investment and help people without access to banks. The country also bought more than 2,800 BTC for its national reserve. But many people in El Salvador did not trust Bitcoin. It was too complicated for some, and Bitcoin prices changed too often. Shops and customers often refused to use it. Later, the International Monetary Fund (IMF) warned that Bitcoin was risky for the country’s economy. In early 2025, the government quietly stopped using Bitcoin as legal tender. It is no longer required in daily payments. However, the government still holds Bitcoin in its national reserves.

China and the Digital Yuan

China does not allow Bitcoin to be used for payments. Instead, it made its own digital money called the digital yuan or e-CNY. This money is controlled by China’s central bank. It works like a normal currency, but in digital form. People can use the digital yuan to buy things in stores or online, just like with a bank card or mobile app. China tested the digital yuan in cities like Shenzhen, Beijing, and Chengdu. Now, more than 29 cities in China have access to it. The country plans to expand it even more.The digital yuan helps the Chinese government keep control over financial data and track money movements. It also lets China trade internationally without depending on the U.S. dollar. The government hopes the digital yuan will help protect its economy and give it more power in global finance.

Russia and Crypto for Trade

Russia is using crypto in a different way. Because of sanctions from the U.S. and Europe, many Russian banks are blocked from using international systems. This makes it hard for Russia to receive money from exports like oil and gas. To solve this, Russia started using cryptocurrencies such as Tether (USDT), Bitcoin (BTC), and Ethereum (ETH) in some trade deals. These digital coins allow payments between Russia and countries like China and India without using dollars or euros. This helps Russia avoid restrictions and continue selling its energy to foreign buyers. The Russian government is also exploring ways to expand this system, using crypto for more types of trade in the future.

Strategic Crypto Reserve Raises More Questions

Although the U.S. Bitcoin reserve is now official under federal law, many important details are still missing. The executive order confirms that the reserve will exist, but it does not explain how it will work in practice. Government officials still need to decide how much cryptocurrency will be kept, which agency will manage it, how often the value will be checked, and in what situations the crypto can be used or sold.

Right now, the government plans to use only digital assets that it already owns. These assets were taken during criminal and civil cases through court orders. This includes Bitcoin, Ethereum, and other tokens seized from illegal activities. However, this amount is limited and cannot support a large or growing reserve by itself.

If the government wants to buy more cryptocurrency in the future, it must first get approval from Congress. That means Congress needs to pass a law that gives the Treasury permission and budget to buy additional crypto. Without that step, the reserve will stay small and depend only on what the government already has in storage.

Since President Trump first announced the reserve, prices in the crypto market have moved up and down. Bitcoin and other listed tokens jumped in value right after the announcement, but then fell again within a few days. This shows how much uncertainty still surrounds the project.

More detailed updates are needed before the market can react in a stable way. Without clear information about funding, rules, and management, the crypto market will likely continue to shift as more news is released.