Cryptocurrency markets are experiencing a broad-based rally today, Bitcoin is currently trading around $109,413, up 3.76% on the day, while Ethereum hovers near $2,675, posting a strong 7.6% daily gain. Altcoins like Solana ($158, +5.3%) and XRP ($0.64, +2.3%) are also climbing steadily, signaling broad participation across the digital asset space.

As Bitcoin breaks above key resistance levels, analysts suggest the market may be entering a new bullish phase – one shaped by growing institutional participation and shifting global sentiment.

Institutional Capital Returns

One of the clearest catalysts behind today’s gains is the resurgence of institutional capital into crypto markets.

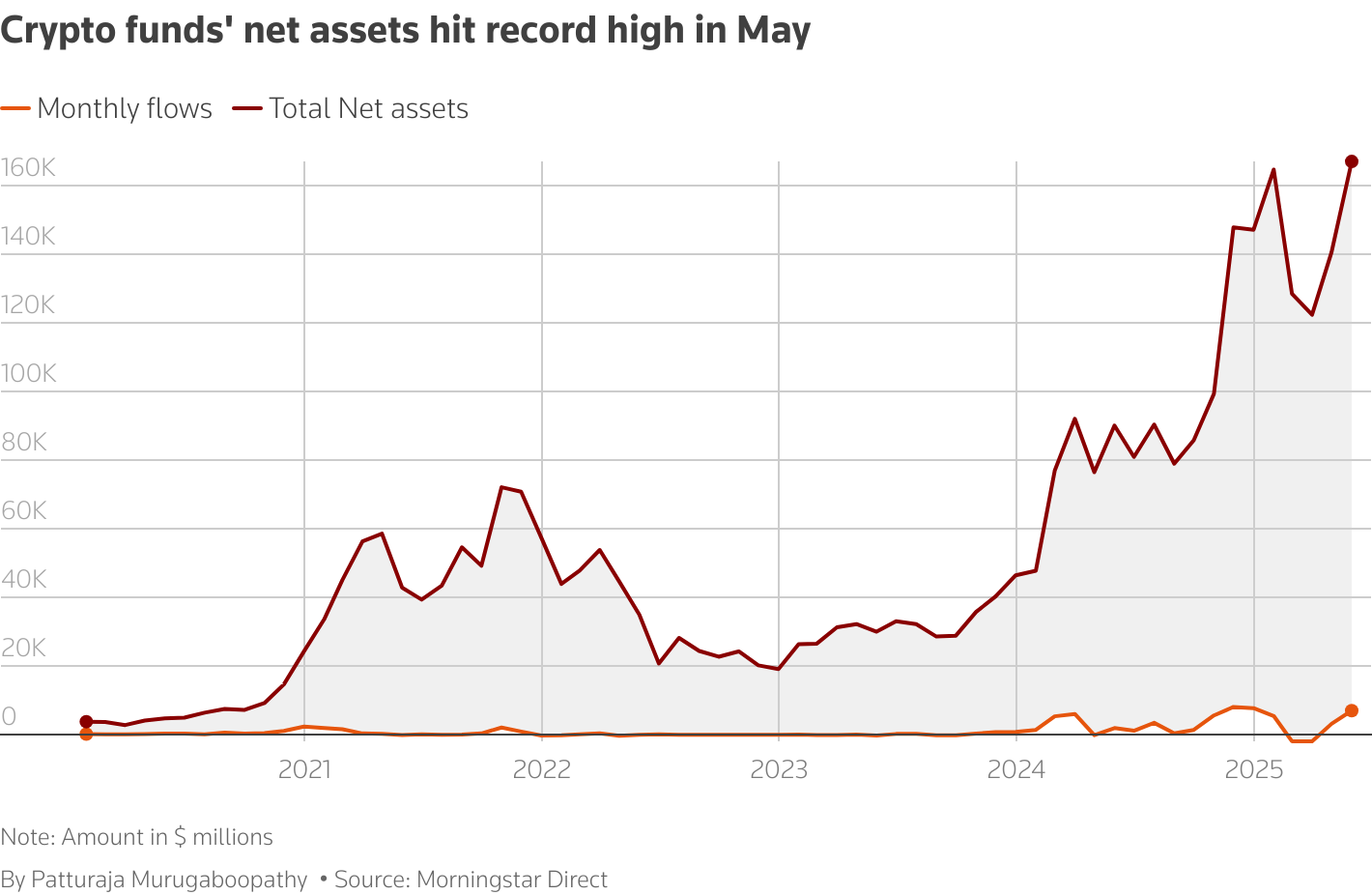

According to Reuters, assets under management in crypto funds surged to a record high of $167 billion in May 2025, driven by $7.05 billion in net inflows – the strongest monthly inflow since late 2023.

Bitcoin-focused funds led the charge with $5.5 billion in inflows, while Ethereum-based funds attracted $890 million. These inflows are largely attributed to the increasing acceptance of spot Bitcoin and Ethereum ETFs in the United States, offering regulated vehicles for traditional institutions to gain exposure to crypto.

Capital locked into ETFs and institutional-grade funds is generally more stable, reducing volatility and supporting price resilience. The re-engagement of large capital allocators has helped lift sentiment and price floors across major crypto assets.

Technical Signals Confirm Bullish Momentum

Bitcoin has climbed decisively above $108,000, marking a technical breakout that has analysts turning bullish. Following a brief correction to the $100,000 range, BTC reclaimed key moving averages, including its 10-, 21-, and 50-day exponential moving averages (EMAs).

Mudrex analysts pointed to “high-volume confirmations and liquidation-driven volatility” as signs of a structurally sound rally. The $106,500 level held firm support before BTC rebounded sharply.

Meanwhile, noted that negative funding rates, increased spot market demand, and bottoming price patterns suggest high conviction among buyers.

A breakout from consolidation zones often sets off momentum-driven buying. With leverage flushed out from earlier corrections, the path appears clearer for further gains, particularly if macro conditions remain favorable.

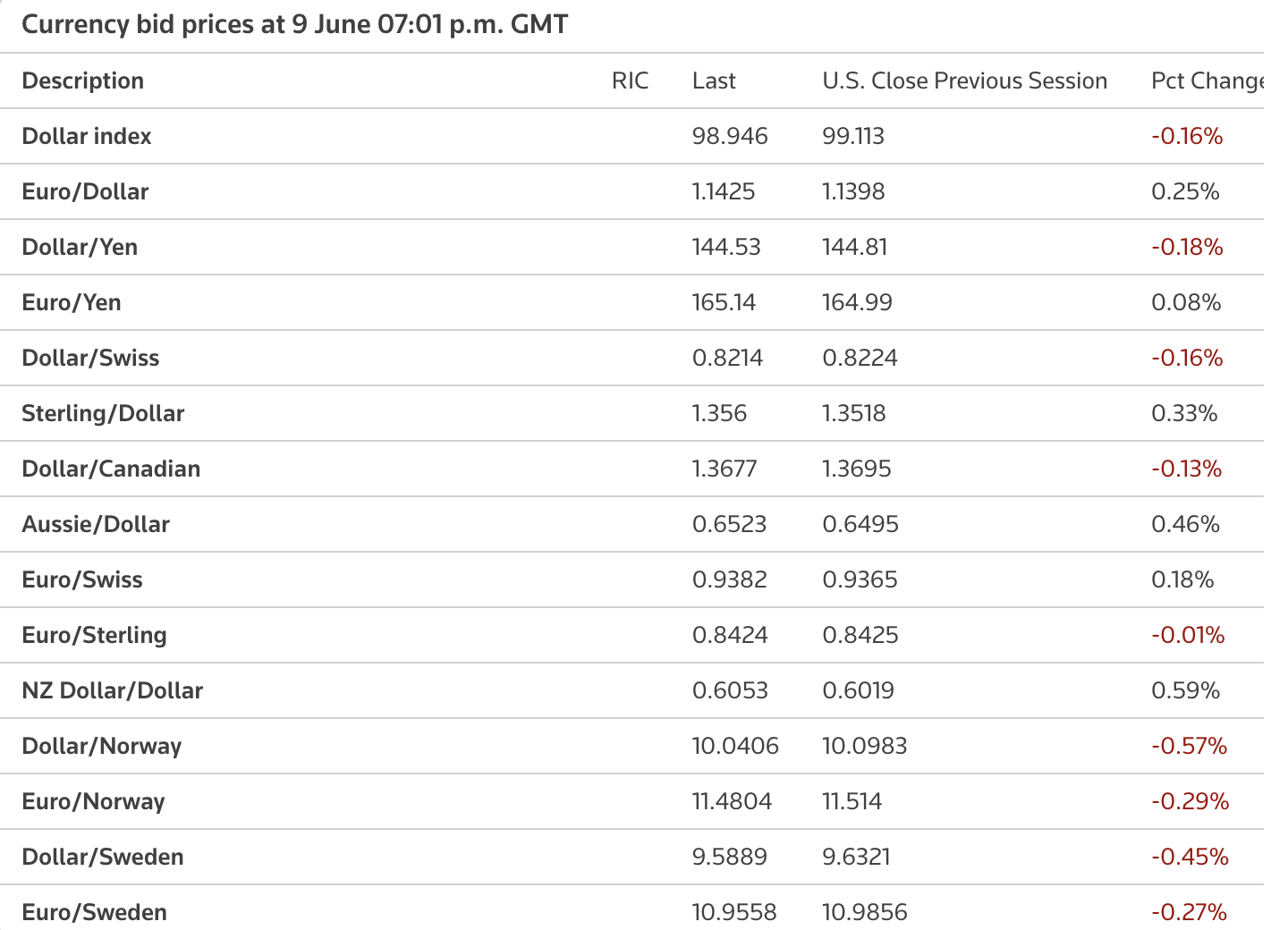

Easing Trade Tensions & Softer Inflation

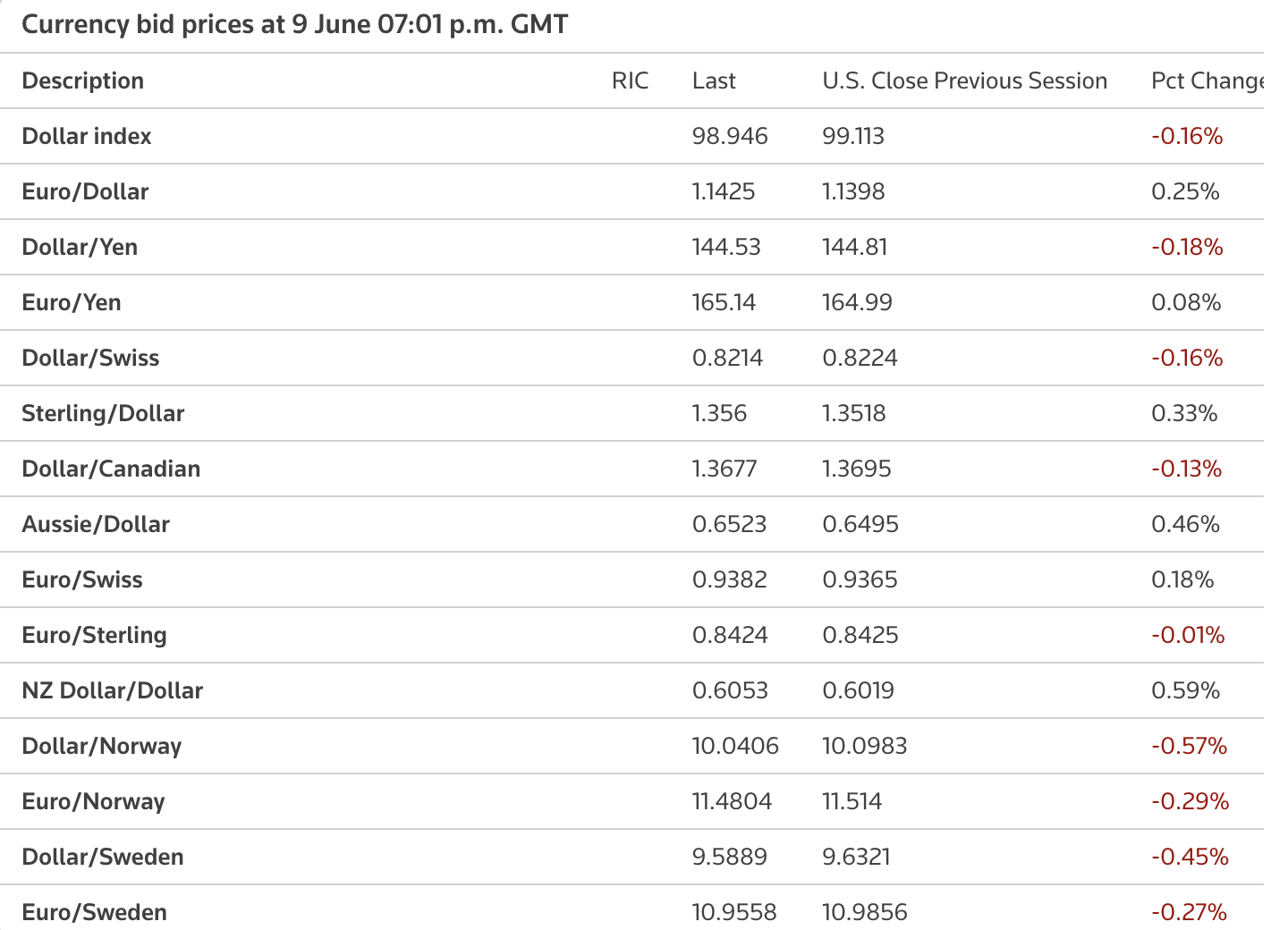

Today’s market strength also coincides with improving global macro conditions. U.S.–China trade talks have taken a positive turn, reducing risk-off sentiment across financial markets. Additionally, cooling inflation data has alleviated concerns about aggressive monetary tightening.

These conditions support risk-on assets, including crypto, by encouraging investor appetite for higher-yield, higher-volatility instruments.

Several major crypto infrastructure players are making headlines. Circle, the issuer of USDC, saw its NYSE debut triple in value, underscoring investor enthusiasm. Meanwhile, Gemini filed confidentially for its IPO, signaling ongoing corporate confidence.

In the UK, the Financial Conduct Authority (FCA) is reportedly reviewing its ban on crypto-linked ETNs for retail investors.

These developments reflect a broader trend toward the institutionalization of crypto and its integration into legacy financial systems.

Regulatory recognition, infrastructure growth, and successful public listings help legitimize crypto, encouraging more conservative capital to participate.

Gold has also rallied strongly this year – up over 25% year-to-date and currently trading near $3,330. This reinforces Bitcoin’s store-of-value narrative, particularly as rolling correlations between the two assets have tightened. While gold attracts institutional capital seeking safety, its rise has also historically coincided with renewed crypto inflows, especially into Bitcoin and high-cap altcoins.

Geopolitical tensions continue to cast a shadow over global markets, with the Israel–Palestine conflict and the ongoing Russia–Ukraine war fueling intermittent risk aversion.

These combined developments – from macro tailwinds to institutional momentum, signal growing legitimacy and resilience across the crypto ecosystem, even amid occasional political and market volatility.

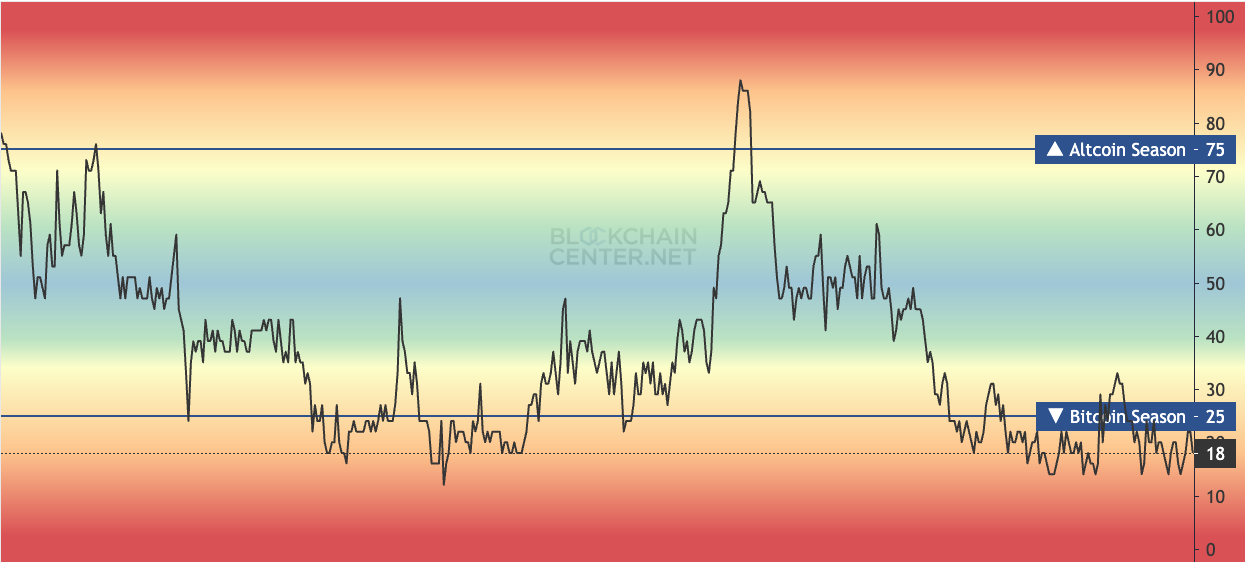

Altcoin Strength and the Return of “Altseason”

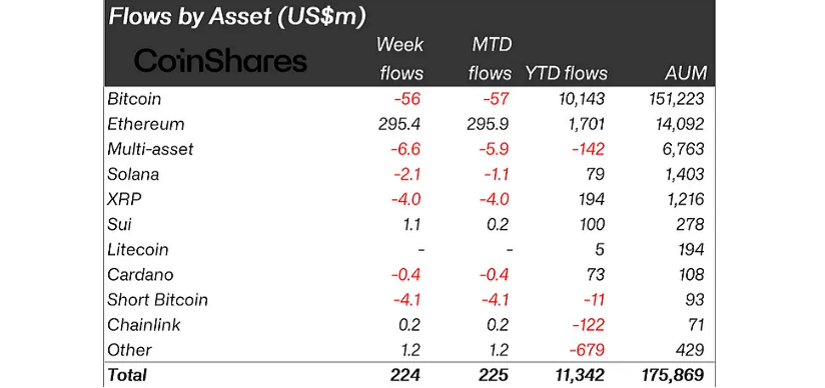

While Bitcoin commands the headlines, altcoins are gaining momentum as well. Solana rose by over 5% today, with Ethereum and XRP also recording strong gains.

Historically, when Bitcoin stabilizes after major moves, liquidity tends to flow into altcoins – a phenomenon commonly dubbed “altseason.”

Notably, the Total Crypto Market Cap excluding Bitcoin and Ethereum is currently forming a base near multi-month lows, suggesting that altcoins may be at the early stage of a new upward cycle.

This “bottoming” structure, combined with fading BTC dominance and improving sentiment, strengthens the case for a potential Altseason in the weeks ahead, especially as capital begins rotating into mid- and low-cap tokens.

Source: TradingView

That said, while current signs such as growing inflows to altcoins and rising retail participation are encouraging, the rally remains largely Bitcoin-led. A full-fledged altseason would typically see altcoins outperforming BTC across the board for an extended period.

Source: Blockscholes

Driving this rotation are broader themes: inflation hedging, institutional diversification, and investor rotation into high-beta assets.

These factors are creating early momentum, but confirmation of a sustained altcoin cycle will require broader breakout behavior among mid- and small-cap tokens.

For now, strong altcoin performance serves as a signal of improving sentiment and speculative appetite, but investors remain cautious about declaring an official altseason too early.

A key storyline emerging from today’s rally is the shift in how investors perceive crypto. It is increasingly being viewed not just as a high-risk bet, but as a portfolio component for diversification, inflation protection, and long-term growth.

- ETFs and regulatory clarity are providing safer entry points.

- IPOs of infrastructure providers offer exposure without direct token risk.

- Corporate treasury adoption of Bitcoin and stablecoins continues to rise.

These changes signal a shift from hype to structured capital flows, shaping the next market cycle.

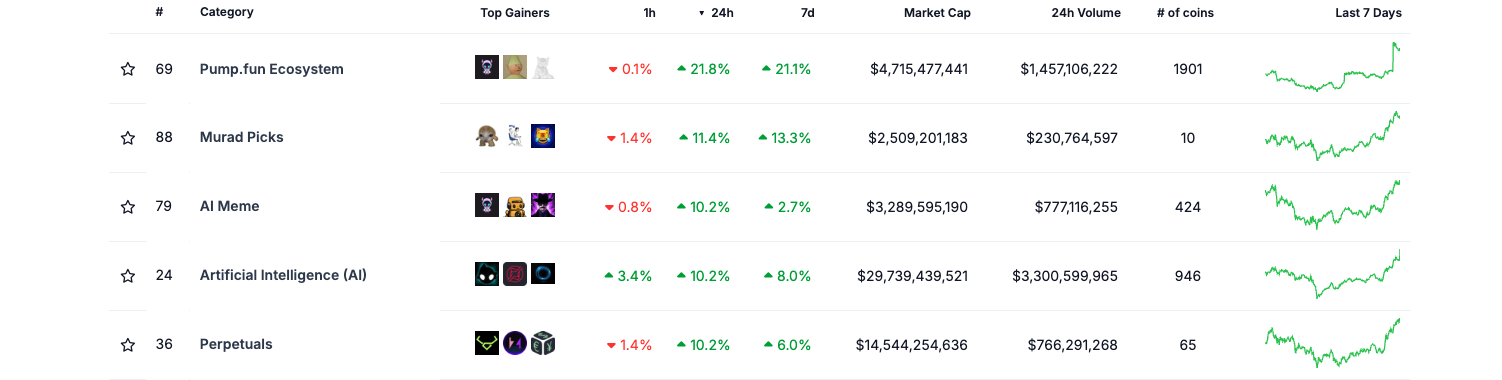

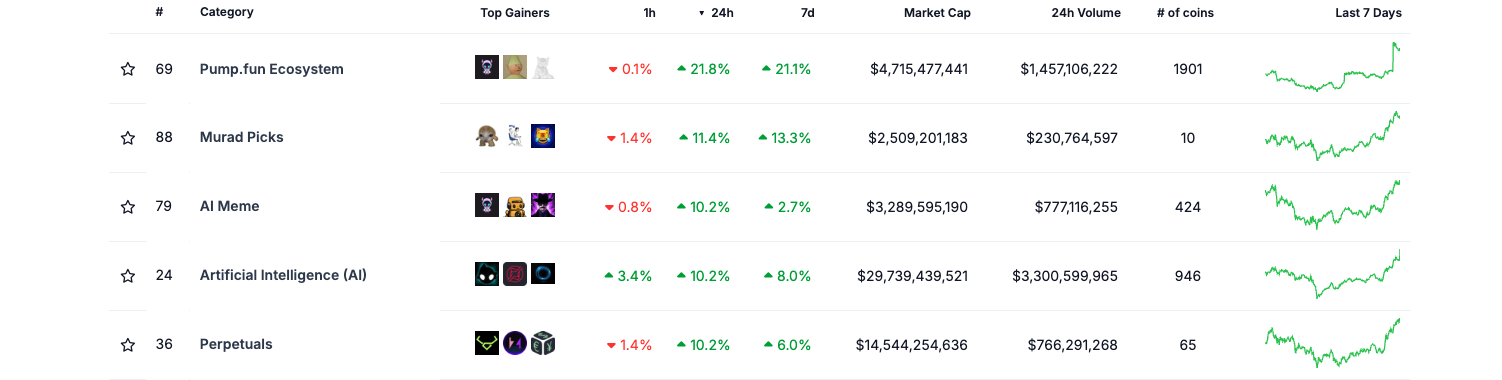

Narratives in Focus: Meme Coins Dominate, Perpetuals Gain Steam

A standout narrative in today’s rally is the resurgence of meme coins. Across the board, meme-themed tokens are posting double-digit gains over 24 hours, with strong trading volumes and clear momentum. This performance reflects renewed appetite for high-volatility, community-driven assets – fueled by social media hype and viral trends.

Source: CoinGecko

Despite their speculative nature, meme coins continue to serve as early indicators of retail risk appetite. Their strong rebound this week suggests that retail investors are re-entering the market in search of quick upside opportunities.

Meanwhile, the Perpetuals narrative – centered around decentralized derivatives platforms, is also showing signs of strength.

While less explosive than meme coins, tokens in this sector are benefiting from sustained trader activity, improved liquidity, and increased attention from DeFi-native users.

This contrast highlights a market balancing speculative fervor with infrastructure adoption, offering both short-term volatility plays and more grounded, long-term DeFi exposure.

Read more: The Rise of Yield-Bearing Stablecoins: Earning Passive Income