The XRP Ledger is showing signs of weakening user engagement despite growing optimism around the approval of a spot XRP ETF. The number of daily active addresses has declined sharply from a high of over 110,000 in January 2025 to fewer than 30,000 in June — a 75% drop over five months.

XRP Network Activity Returns to Pre-Rally Levels

Back in January, XRP’s active address count surged to its highest level in years. At the time, the asset had just crossed $1.50 and was riding a wave of optimism following Ripple’s regulatory victories and speculation about broader institutional adoption. But five months later, the hype on-chain has faded.

Daily address activity is now back to levels seen in early 2023—when XRP was still trading under $0.40. Yet, as of press time, the token continues to hover above $2

While overall activity is cooling, large holders appear to be positioning for what could come next. Santiment data shows that wallets holding between 10 million and 100 million XRP have quietly increased their share of the total supply—from 10.4% in December to 12.2% today.

In contrast, wallets in the 1M–10M range have reduced their holdings by over 3% during the same period. This suggests retail and mid-sized players are stepping back, while whales—often more risk-tolerant and longer-term focused—are leaning in.

XRP ETF Hype Driving Price, Not Participation?

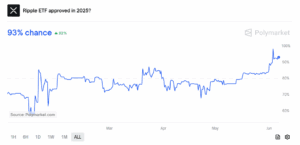

One reason XRP’s price has remained resilient despite weaker on-chain signals is growing confidence in the approval of a U.S.-listed spot XRP ETF. According to Polymarket, odds of an ETF approval by the end of 2025 have jumped to 92%, up from 70% just last month.

The surge in optimism follows a string of developments. Asset managers including Bitwise, Grayscale, Franklin Templeton, and 21Shares have filed for XRP ETFs. CME’s launch of XRP futures in mid-May added to the narrative, and Ripple’s regulatory progress—particularly the licensing of RLUSD in Dubai—has helped shape the perception of legitimacy.

But sentiment and usage aren’t the same thing. While ETF speculation is fueling headlines, it hasn’t translated to increased on-chain demand. The drop in active addresses shows that. And with price currently standing on sentiment rather than utility, any delays or setbacks in the ETF process could expose structural weakness.

Exchange Activity Remains Stable

Exchange flow data provides more evidence of cooling market engagement. Binance’s XRP inflows and outflows have both declined since March. That slowdown in activity aligns with the drop in network usage and suggests fewer retail participants are actively trading or moving XRP—at least for now.

During XRP’s brief rally above $3 earlier this year, both inflow and outflow spikes hinted at profit-taking and repositioning. Today, those flows have stabilized, indicating a wait-and-watch stance across the board.

XRP is trading around $2.14, stuck below key moving averages including the 20, 50, 100, and 200 EMA.

The Relative Strength Index (RSI) remains near 41, hovering just above oversold territory. Price action has flattened, volume has thinned, and momentum indicators aren’t signaling a strong breakout—yet.

That doesn’t necessarily point to a breakdown. But in the absence of new buyers or a fundamental uptick in activity, holding ground becomes harder to justify, especially if ETF-related expectations cool off.